Should You Buy Palantir Stock Before May 5th? Wall Street's Surprising Consensus

Table of Contents

Palantir's Q1 2024 Earnings Expectations and Their Impact on Stock Price

Palantir's upcoming Q1 2024 earnings report is poised to significantly impact its stock price. Analyst predictions vary considerably, painting a picture of both optimism and caution.

Analyst Predictions and Price Targets

The range of analyst price targets for Palantir's stock reflects a divergence of opinions. While some analysts maintain a "buy" rating with price targets exceeding $10, others hold a more conservative "hold" or even "sell" rating, with lower price targets.

- Key Metrics: Analysts are closely monitoring revenue growth, earnings per share (EPS), operating margins, and the growth rate of Palantir's customer base.

- Earnings Estimate Revisions: Recent weeks have seen a mix of upward and downward revisions to earnings estimates, reflecting the uncertainty surrounding several key factors influencing Palantir's performance.

Factors Influencing Earnings

Several factors could significantly impact Palantir's Q1 2024 earnings:

- Government Contracts: The size and timing of government contract wins and renewals will play a crucial role. A significant influx of new government contracts could boost revenue and positively impact the stock price. Conversely, delays or losses could negatively affect earnings.

- Commercial Sector Growth: Palantir's progress in expanding its commercial customer base will be a key indicator of its future growth potential. Strong growth in this sector would signal positive momentum.

- Competition: The increasing competition in the data analytics and AI markets could affect Palantir's market share and profitability. The company's ability to differentiate its offerings and maintain a competitive edge is vital.

Historical Earnings Performance and Stock Market Reaction

Analyzing Palantir's past earnings reports and the subsequent market reactions offers valuable context. While past performance is not indicative of future results, it can provide insights into investor sentiment and the market's response to various performance levels. Tracking this historical data can help gauge the potential market reaction to the upcoming Q1 2024 report.

Recent Developments and Future Growth Prospects for Palantir

Beyond the immediate Q1 2024 earnings, recent developments and Palantir's future growth prospects heavily influence its investment appeal.

Significant Contract Wins/Losses

Recent contract wins or losses have significant implications for Palantir's financial outlook. Large government contracts often dominate revenue streams, making news of these deals pivotal in predicting stock performance.

- Key Contracts: Monitoring the size and scope of recent contract awards, including specific details about their value and duration, is critical in assessing Palantir's short-term and long-term financial health.

- Revenue Stream Implications: Analyzing the impact of these contracts on future revenue streams allows for a more accurate prediction of future earnings.

Technological Advancements and Market Position

Palantir's technological innovation is key to maintaining its competitive advantage.

- Key Advancements: The company's investments in AI and data analytics are essential for its future success, so keeping abreast of its progress is crucial. New product releases and advancements in its existing platforms can significantly impact its market position.

- Competitive Landscape: Analyzing Palantir's competitive landscape against industry giants like AWS, Microsoft Azure, and Google Cloud is important to gauge its market share and potential for future growth.

Long-Term Growth Potential and Risks

While Palantir's long-term growth potential is significant, investors need to acknowledge associated risks.

- Growth Challenges: Sustaining high growth rates in a competitive market presents ongoing challenges for the company.

- Economic Downturn: The overall economic climate can impact demand for Palantir's products and services.

Wall Street's Surprising Consensus on Palantir Stock

Wall Street's analysts offer a mixed bag of opinions on Palantir, creating a surprising divergence of viewpoints.

Divergence of Opinions

The range of analyst ratings highlights significant disagreement regarding Palantir's future performance.

- Bullish Predictions: Some analysts maintain a bullish outlook, highlighting the company's potential for growth in both the government and commercial sectors.

- Bearish Predictions: Others remain skeptical, emphasizing the risks associated with competition, economic uncertainty, and the company's high valuation.

The "Surprising" Element

The surprising element lies in the extent of the disagreement. This stark contrast in perspectives, especially given recent company announcements, highlights the considerable uncertainty surrounding Palantir's future.

Considering the Consensus in Your Investment Strategy

Investors need to carefully consider this divided consensus when formulating their investment strategies. A balanced approach, accounting for both the bullish and bearish perspectives, is crucial.

Conclusion: Should You Buy Palantir Stock Before May 5th? A Final Verdict

Palantir's Q1 2024 earnings, recent contract wins, and technological advancements all play a crucial role in determining its future stock performance. While the long-term growth potential is undeniable, significant risks remain. Wall Street's surprising consensus underscores the uncertainty surrounding Palantir's trajectory. Therefore, the decision of whether to buy Palantir stock before May 5th is not a simple yes or no. It hinges on your individual risk tolerance, investment horizon, and thorough due diligence. Conduct your own comprehensive research, considering all the factors discussed above, before making any investment decisions. Continue following Palantir's progress after May 5th to make informed choices about buying Palantir stock, and remember to regularly review your investment strategy.

Featured Posts

-

Municipales Dijon 2026 L Enjeu Ecologique

May 09, 2025

Municipales Dijon 2026 L Enjeu Ecologique

May 09, 2025 -

Open Ais Chat Gpt The Ftc Investigation And Its Potential Impact

May 09, 2025

Open Ais Chat Gpt The Ftc Investigation And Its Potential Impact

May 09, 2025 -

Nhl 2024 25 Key Storylines For The Seasons Finish

May 09, 2025

Nhl 2024 25 Key Storylines For The Seasons Finish

May 09, 2025 -

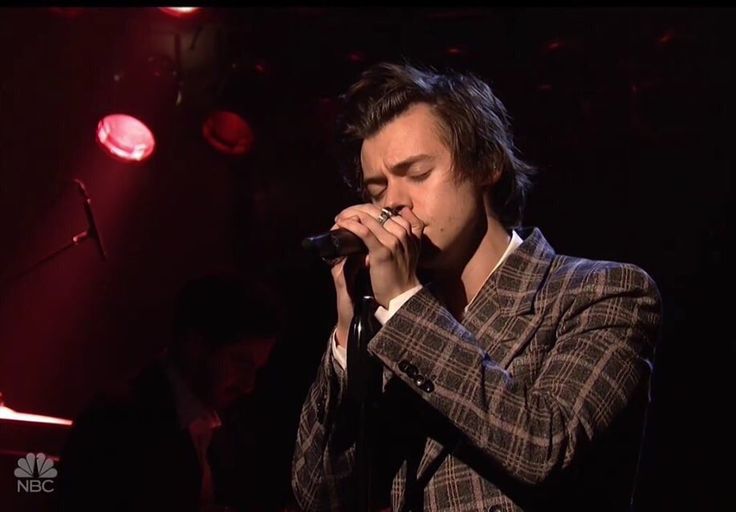

The Snl Impression That Upset Harry Styles

May 09, 2025

The Snl Impression That Upset Harry Styles

May 09, 2025 -

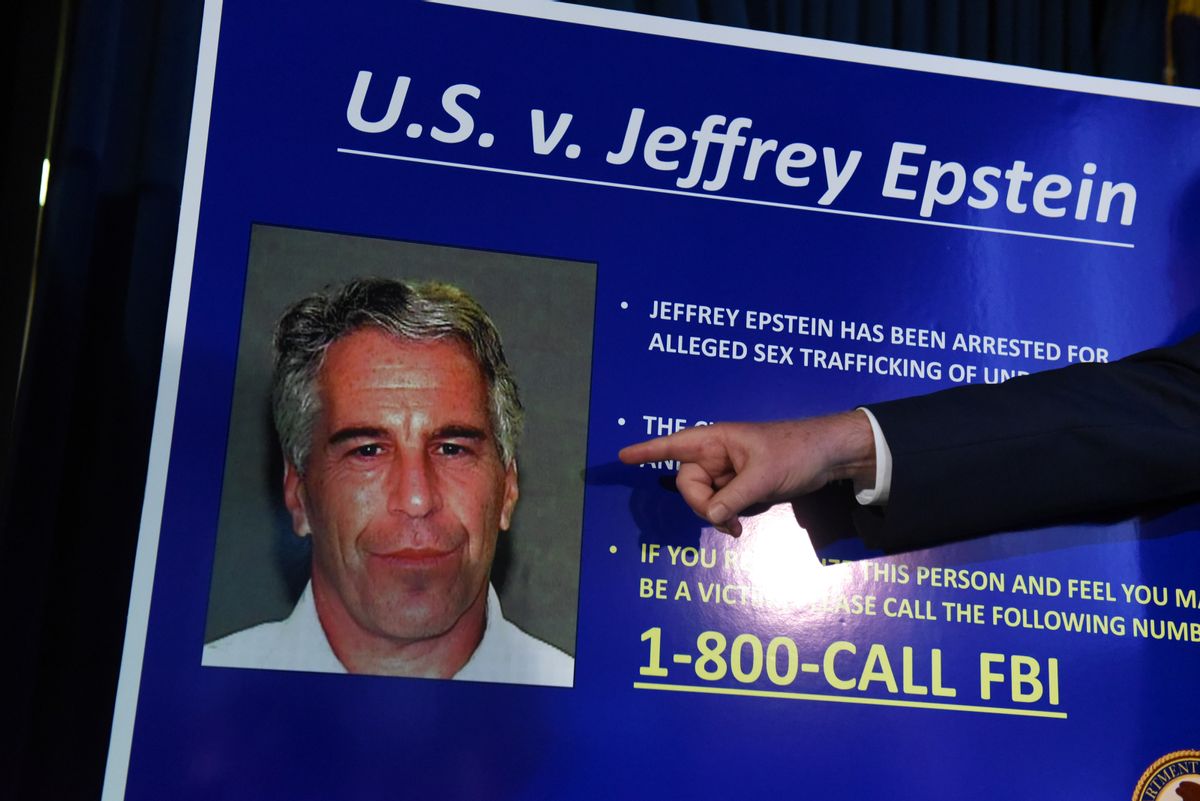

Should We Vote To Release The Jeffrey Epstein Files A Look At Ag Pam Bondis Decision

May 09, 2025

Should We Vote To Release The Jeffrey Epstein Files A Look At Ag Pam Bondis Decision

May 09, 2025