Should You Buy Palantir Stock Today? A Detailed Investment Overview

Table of Contents

Palantir Technologies (PLTR) has captured significant attention since its IPO, sparking debates among investors about its potential. This detailed overview delves into the key factors you should consider before deciding whether to buy Palantir stock today. We'll analyze its financial performance, growth prospects, and market position to help you make an informed investment decision regarding your Palantir stock investment strategy.

Palantir's Business Model and Revenue Streams

Palantir's success hinges on its two core platforms: Gotham and Foundry. Understanding their revenue generation is key to a thorough Palantir stock analysis.

Government Contracts

A significant portion of Palantir's revenue stems from government contracts, both domestically (like the US government) and internationally. These contracts offer a degree of stability and often involve recurring revenue streams, contributing to the predictability of Palantir's financial performance.

- Examples of government clients: Various US intelligence agencies, defense departments, and international government bodies.

- Percentage of revenue from government contracts: Historically a substantial portion, although Palantir actively seeks to diversify.

- Long-term contract outlook: Generally positive, although subject to changes in government spending priorities and geopolitical factors. Analyzing the long-term government contract outlook is crucial for any Palantir stock forecast.

Commercial Partnerships

Palantir is increasingly focusing on commercial partnerships, diversifying its revenue streams and reducing its dependence on government contracts. This expansion is crucial for long-term Palantir stock growth.

- Examples of commercial clients: Companies in finance, healthcare, and energy sectors.

- Growth potential in the commercial sector: Considerable, as Palantir's platforms offer valuable data analytics capabilities across various industries.

- Competitive landscape: Intense, with established players and emerging competitors in the data analytics market.

Gotham and Foundry Platforms

Palantir's two core platforms, Gotham and Foundry, are central to its business model. Understanding their unique value propositions is critical for any Palantir investment.

- Key features of Gotham: Designed for government and intelligence agencies, it focuses on large-scale data integration, analysis, and visualization.

- Key features of Foundry: Targets commercial clients, offering a more flexible and scalable platform for data integration and analysis tailored to various business needs.

- Target customer profiles for each platform: Gotham targets government agencies; Foundry targets commercial organizations across diverse sectors.

- Competitive advantages: Palantir's platforms emphasize ease of use, scalability, and advanced data analytics capabilities. These competitive advantages are key factors in evaluating the Palantir share price.

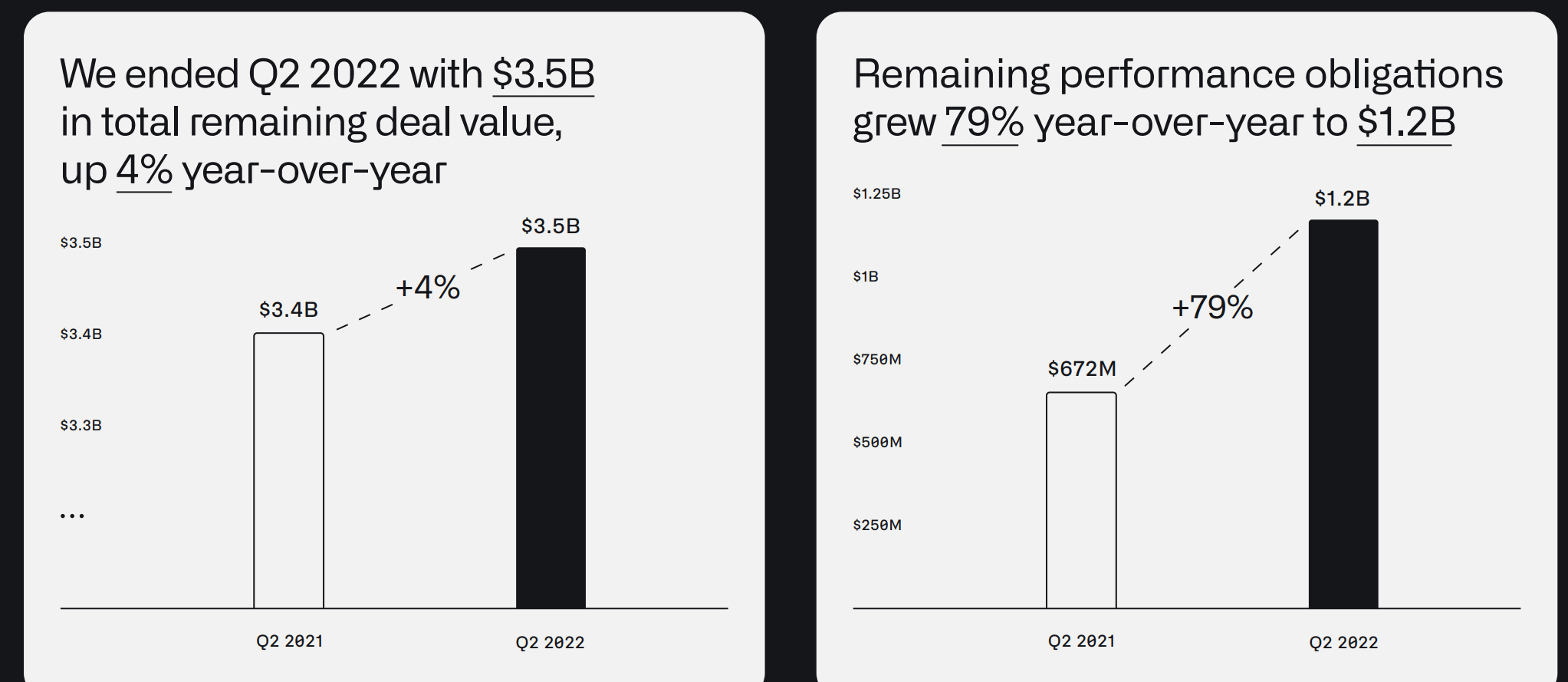

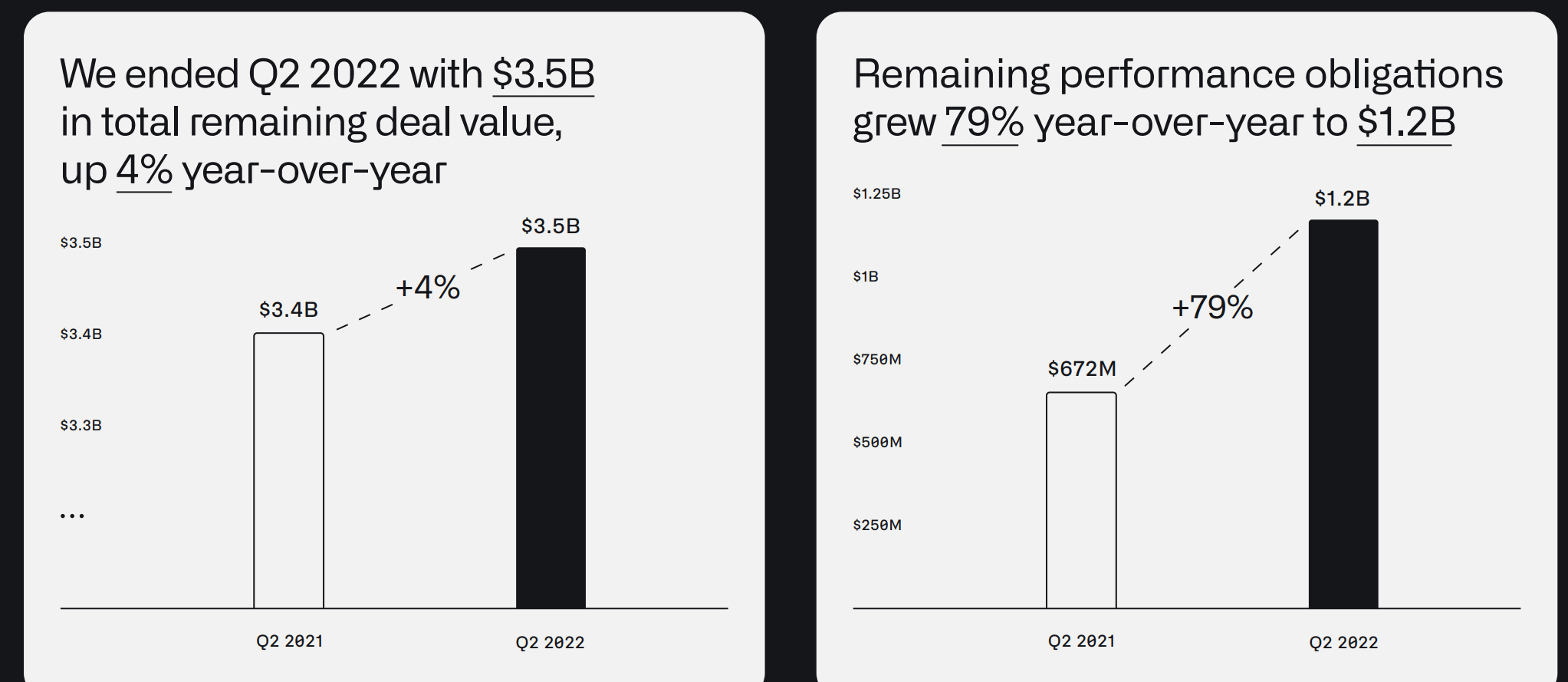

Palantir's Financial Performance and Growth Prospects

Analyzing Palantir's financial performance is critical to understanding the Palantir investment opportunity.

Revenue Growth and Profitability

Palantir has shown significant revenue growth, although profitability has been a focus area. Understanding its path to profitability is vital for any Palantir stock analysis.

- Revenue growth rates (year-over-year): Fluctuate, but generally positive, indicating growth potential.

- Operating margins: Improving, but still under pressure due to high research and development costs.

- Net income: Historically negative, but potentially showing improvements as the company scales its operations.

- Path to profitability: Palantir's strategy includes increasing its commercial client base and optimizing operational efficiency.

Cash Flow and Debt

Evaluating Palantir's cash flow generation and debt levels offers further insight into its financial health and growth prospects.

- Free cash flow: A key indicator of Palantir's ability to fund future growth and operations.

- Debt-to-equity ratio: Indicates the company's leverage and financial risk.

- Capital expenditures: Investment in technology and infrastructure influence long-term growth and the Palantir stock forecast.

Valuation Metrics

Comparing Palantir's valuation to its peers and industry benchmarks provides crucial context for a potential Palantir investment.

- P/S ratio: A common valuation metric for high-growth companies; comparing Palantir's P/S ratio to competitors' offers valuable insight.

- Market capitalization: Reflects the overall market value of Palantir.

- Comparison to competitors' valuations: Provides a benchmark for assessing Palantir's relative valuation and potential future stock price movements.

Risks and Challenges Facing Palantir

Investing in Palantir involves inherent risks. A comprehensive understanding of these challenges is crucial before considering a Palantir stock purchase.

Competition and Market Saturation

Palantir operates in a competitive market with established players and new entrants. Understanding this competitive landscape is essential for any Palantir stock analysis.

- Key competitors: Include other large data analytics companies, cloud providers, and specialized software firms.

- Potential for increased competition: The data analytics market is dynamic, and new competitors could emerge, impacting Palantir's market share.

- Market share vulnerability: Palantir needs to continually innovate and adapt to maintain its competitive edge.

Dependence on Government Contracts

Palantir's reliance on government contracts introduces significant geopolitical and regulatory risks.

- Geopolitical risks: Changes in international relations or government policies could impact contract awards and revenue streams.

- Changes in government spending priorities: Budget cuts or shifts in focus could affect Palantir's government contracts.

Technological Disruption

The technology landscape is constantly evolving, introducing the risk of technological obsolescence.

- Potential for technological obsolescence: Palantir must continuously invest in R&D to stay ahead of the curve and avoid obsolescence.

- R&D spending and innovation: Palantir's commitment to R&D is crucial for maintaining its competitive advantage and long-term growth.

Conclusion

Should you buy Palantir stock today? The decision depends on your risk tolerance and investment strategy. Palantir offers substantial growth potential in the data analytics and AI sectors, but also carries risks related to its business model and competitive landscape. Thoroughly analyze its financial performance, growth prospects, and competitive position. Diversify your portfolio and consult a financial advisor before investing in Palantir stock or any other security. Carefully weigh the potential rewards against the inherent risks before deciding whether to buy Palantir stock today. Remember, thorough due diligence is essential before making any Palantir investment decisions.

Featured Posts

-

Elizabeth Hurley Baring It All A Look At Her Boldest Cleavage Moments

May 09, 2025

Elizabeth Hurley Baring It All A Look At Her Boldest Cleavage Moments

May 09, 2025 -

Arctic Comic Con 2025 Photo Gallery Focus On Characters Connections And The Ectomobile

May 09, 2025

Arctic Comic Con 2025 Photo Gallery Focus On Characters Connections And The Ectomobile

May 09, 2025 -

Daycare Costs Soar After 3 000 Babysitting Expense A Fathers Dilemma

May 09, 2025

Daycare Costs Soar After 3 000 Babysitting Expense A Fathers Dilemma

May 09, 2025 -

Nottingham Stabbing Investigation Into Illegal Access Of Patient Records By Nhs Staff

May 09, 2025

Nottingham Stabbing Investigation Into Illegal Access Of Patient Records By Nhs Staff

May 09, 2025 -

F1 World Mourns Colapinto And Perez Among Those Paying Tribute

May 09, 2025

F1 World Mourns Colapinto And Perez Among Those Paying Tribute

May 09, 2025