Should You Buy XRP (Ripple) Now? Price Analysis Under $3

Table of Contents

XRP Price Analysis: Current Market Conditions and Trends

Understanding the current market dynamics is crucial for any XRP investment strategy. This section will provide a comprehensive XRP price analysis, combining technical and fundamental perspectives.

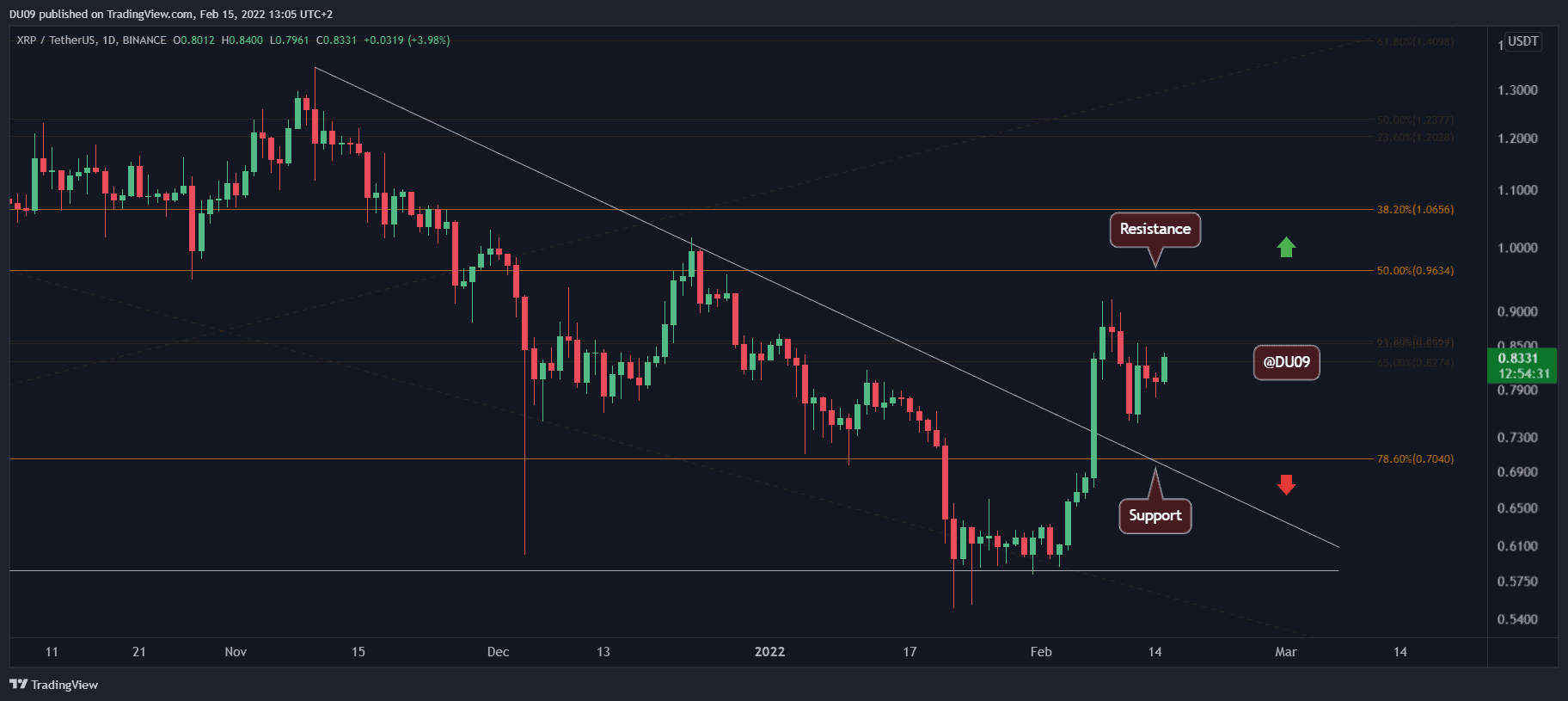

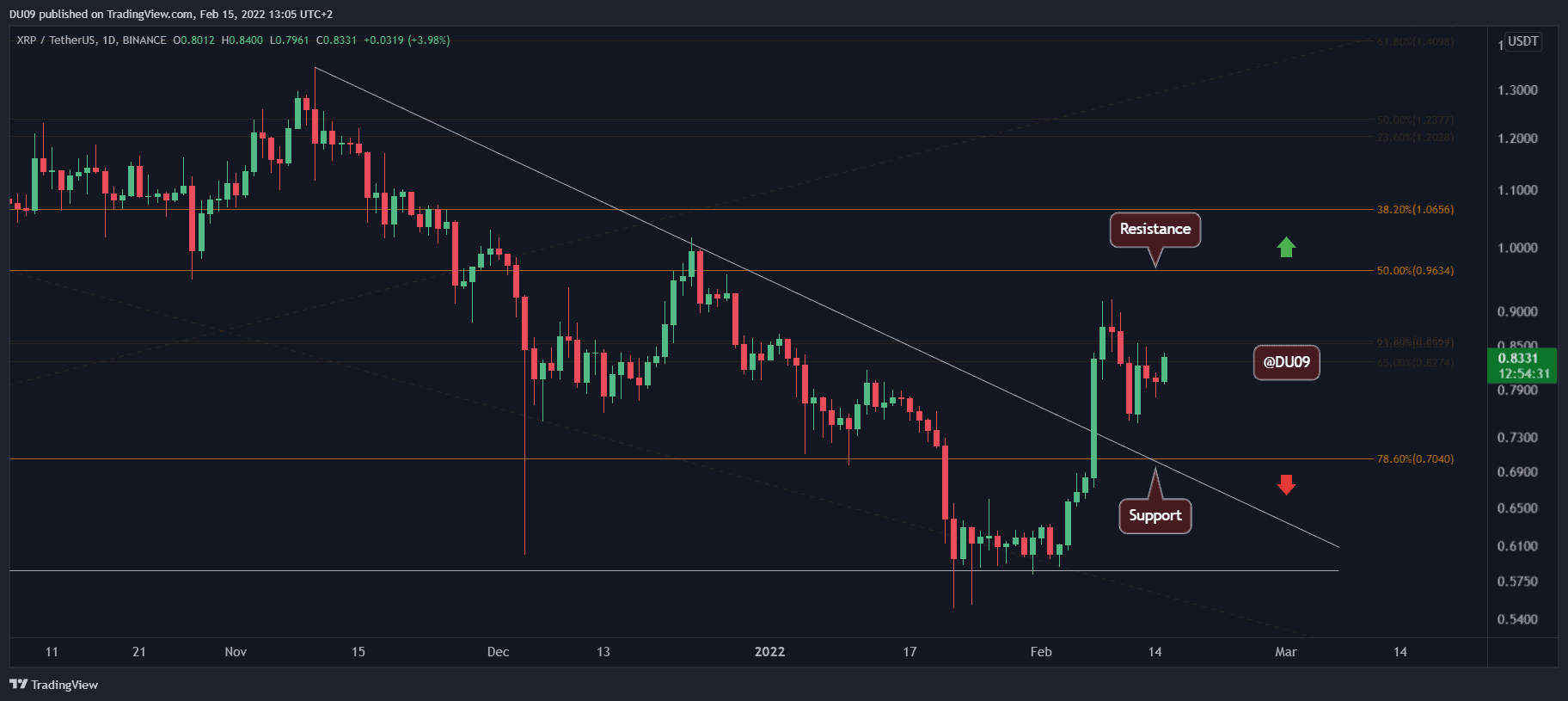

Technical Analysis of XRP: Chart Patterns, Support and Resistance Levels, Trading Volume Analysis

Technical analysis helps predict future price movements based on past market data. For XRP, several key indicators provide insights:

- RSI (Relative Strength Index): Analyzing the RSI can reveal whether XRP is overbought or oversold, suggesting potential price reversals. A reading above 70 often indicates overbought conditions, while a reading below 30 suggests oversold conditions.

- MACD (Moving Average Convergence Divergence): The MACD helps identify momentum changes and potential trend reversals. Bullish crossovers (MACD line crossing above the signal line) often precede price increases, while bearish crossovers suggest potential declines.

- Moving Averages (MA): Analyzing different moving averages (e.g., 50-day MA, 200-day MA) can help identify support and resistance levels and determine the overall trend. A price crossing above a long-term moving average (e.g., 200-day MA) can be a bullish signal.

Based on current technical analysis, short-term price projections suggest potential volatility, while long-term projections depend heavily on the resolution of the SEC lawsuit and broader market sentiment.

Fundamental Analysis of XRP: Ripple's Business Model, Partnerships, and Adoption Rate

Fundamental analysis assesses the intrinsic value of XRP by evaluating Ripple's business model, partnerships, and the adoption rate of its technology.

- Ripple's Partnerships: Ripple has secured numerous partnerships with major financial institutions globally, facilitating cross-border payments using its On-Demand Liquidity (ODL) solution. These partnerships are crucial for XRP's adoption and long-term value.

- On-Demand Liquidity (ODL): ODL leverages XRP to enable faster and cheaper cross-border transactions, reducing reliance on correspondent banks. Increased ODL adoption directly impacts XRP demand.

- XRP Utility: XRP's utility extends beyond just a payment token. Its role in the broader crypto market, particularly in facilitating efficient cross-border transactions, is key to its long-term value proposition.

Regulatory Landscape and its Impact on XRP's Price

The regulatory landscape significantly influences XRP's price volatility. The ongoing legal battle between Ripple and the SEC casts a considerable shadow over investor sentiment.

The SEC Lawsuit and its Potential Outcomes

The SEC lawsuit alleging that XRP is an unregistered security has created uncertainty in the market. Potential outcomes include:

- SEC Victory: A SEC victory could lead to significant price drops and potentially restrict XRP's use.

- Ripple Victory: A Ripple victory could result in a substantial price surge, as it would remove a major regulatory hurdle.

- Settlement: A settlement could lead to a mixed reaction, depending on the terms of the agreement.

Regulatory Uncertainty and its Influence on Investment Decisions

Regulatory uncertainty in different jurisdictions significantly impacts investor confidence and XRP's price. Clear regulatory frameworks in major markets are crucial for XRP's long-term growth.

- Varying Regulations: The regulatory landscape for cryptocurrencies differs significantly across countries. Clarity is needed for a more stable market environment.

- Impact of Regulatory Clarity: Increased regulatory clarity, regardless of the specific rules, would likely reduce volatility and improve investor confidence.

Technological Advancements and Future Potential of XRP

Continuous improvements to the XRP Ledger enhance XRP's utility and scalability.

- XRP Ledger Upgrades: Ongoing improvements to the XRP Ledger's transaction speed, efficiency, and security enhance its appeal to financial institutions and developers.

- New Features and Functionalities: New functionalities further solidify XRP's position in the cross-border payment landscape.

- Cross-Border Payments: XRP's potential to revolutionize cross-border payments remains a significant driver for its future growth.

Comparing XRP to Other Cryptocurrencies

Comparing XRP to other cryptocurrencies in its market cap range reveals its strengths and weaknesses. Assessing risk-reward ratios and diversification strategies is essential before investing.

- Performance Comparison: Analyzing XRP's performance against its competitors helps understand its position within the broader cryptocurrency market.

- Strengths and Weaknesses: Understanding XRP’s strengths (e.g., speed, low transaction fees) and weaknesses (e.g., regulatory uncertainty) is crucial.

- Risk-Reward Analysis: Evaluating the potential gains against potential losses helps determine the suitability of XRP for your investment portfolio.

Conclusion: Should You Buy XRP (Ripple) Now? A Final Verdict

This analysis highlights the complex factors influencing XRP's price. While technological advancements and strategic partnerships position XRP for future growth, the ongoing SEC lawsuit introduces significant regulatory risk.

Weighing the Pros and Cons: The potential rewards are considerable, but the risks are substantial. XRP's price is highly sensitive to legal developments and broader market sentiment.

Investment Recommendation (with Disclaimer): Given the current uncertainty, a cautious approach is advisable. This analysis is not financial advice.

Call to Action: Ultimately, the decision of whether or not to buy XRP rests with you. Conduct thorough research, consider your risk tolerance, and stay informed about the latest developments in the XRP ecosystem before making any investment decisions. Remember to diversify your portfolio and never invest more than you can afford to lose. Continue your due diligence on XRP investment and Ripple price analysis to make informed decisions.

Featured Posts

-

German Spd Faces Youth Backlash During Coalition Formation Talks

May 01, 2025

German Spd Faces Youth Backlash During Coalition Formation Talks

May 01, 2025 -

Pakstan Myn Kshmyr Ykjhty Ka Dn Mzahrwn Awr Tqrybat Ky Rpwrt

May 01, 2025

Pakstan Myn Kshmyr Ykjhty Ka Dn Mzahrwn Awr Tqrybat Ky Rpwrt

May 01, 2025 -

Canadians Prioritize Domestic Travel Airbnb Bookings Soar

May 01, 2025

Canadians Prioritize Domestic Travel Airbnb Bookings Soar

May 01, 2025 -

Harris Criticized For Rambling Speech At Louis Armstrong Musical

May 01, 2025

Harris Criticized For Rambling Speech At Louis Armstrong Musical

May 01, 2025 -

Capital Breakfast Reveals Remember Mondays Eurovision 2025 Song

May 01, 2025

Capital Breakfast Reveals Remember Mondays Eurovision 2025 Song

May 01, 2025