Should You Heed Jeanine Pirro's Stock Market Prediction?

Table of Contents

Evaluating the Credibility of Jeanine Pirro's Market Analysis

Lack of Financial Expertise

Jeanine Pirro's background is primarily in law and television, not finance. This lack of financial expertise is a critical factor to consider when evaluating her stock market predictions. While her opinions on legal matters may be insightful, her understanding of complex financial markets and investment strategies is likely limited. It's crucial to remember that basing investment decisions on the opinions of someone without relevant financial qualifications is risky.

- Pirro's expertise lies in legal commentary, not financial analysis. Her insights are not based on years of studying market trends, economic indicators, or financial modeling.

- Her opinions should not be considered professional investment advice. Financial advice should always come from qualified professionals.

- Always consult a registered financial advisor before making investment decisions. This is paramount to protecting your financial well-being.

The Dangers of Following Non-Expert Opinions

Relying on non-expert opinions for stock market forecasts can lead to significant financial risks. The stock market is inherently volatile, influenced by countless factors that are difficult to predict accurately, even for seasoned professionals. Attempting to time the market based on unsubstantiated predictions is a gamble that often results in losses.

- Emotional decision-making based on opinions can lead to poor investment choices. Fear and greed can cloud judgment, prompting impulsive trades that may not align with your financial goals.

- Market volatility makes predictions unreliable, especially from non-experts. Unforeseen events can dramatically impact market trends, rendering even the most sophisticated forecasts inaccurate.

- Following unsubstantiated advice can result in significant financial losses. Protecting your capital requires careful consideration and professional guidance, not reliance on speculative opinions.

Alternative Sources for Reliable Stock Market Information

Reputable Financial News Outlets

Instead of relying on opinions from non-experts, access credible sources of financial news and analysis. Reputable outlets provide in-depth reporting, market analysis, and expert commentary.

- Bloomberg: Offers real-time market data, in-depth analysis, and news from around the world.

- The Wall Street Journal: Provides comprehensive financial news, analysis, and commentary from experienced journalists.

- Financial Times: A leading global business news source offering insightful analysis and data.

- Reuters: A global news agency providing reliable and timely financial news coverage.

Certified Financial Advisors (CFAs)

Consulting a Certified Financial Advisor (CFA) or other qualified financial professional is crucial for making informed investment decisions. CFAs possess the necessary education, training, and experience to provide tailored advice based on your individual needs and goals.

- CFAs possess the necessary expertise and qualifications. They understand market dynamics, risk management, and various investment strategies.

- They can provide tailored advice based on your individual circumstances and risk tolerance. A personalized strategy is far superior to generic advice.

- Finding a registered financial advisor is crucial for sound investment decisions. This step ensures you have professional guidance throughout your investment journey.

Fundamental and Technical Analysis

Professional investors use various analytical methods to assess market trends. Understanding these can help you interpret information from reputable sources more effectively.

- Fundamental analysis involves evaluating a company’s financial health. This includes examining factors like revenue, earnings, debt, and assets.

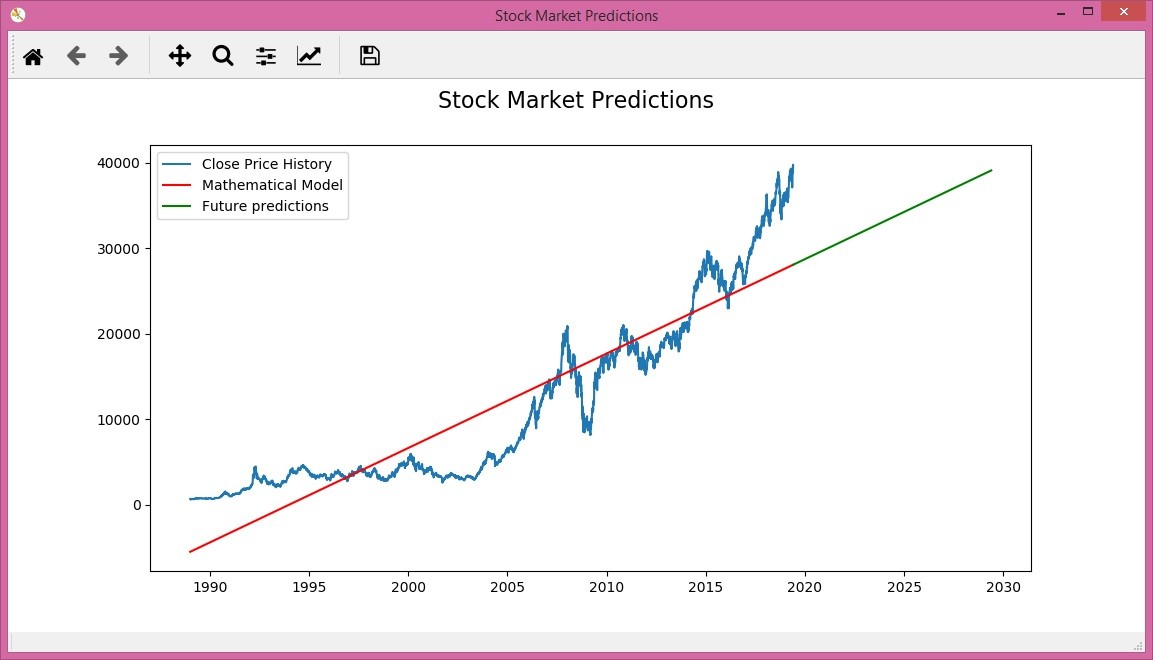

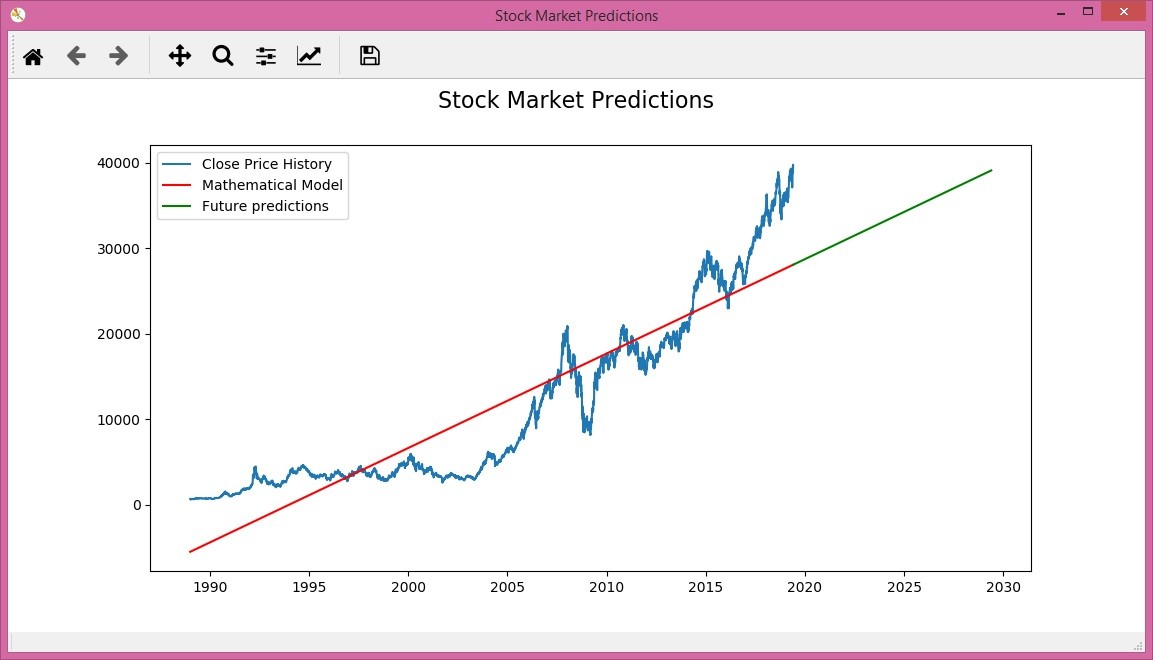

- Technical analysis uses charts and past data to predict future price movements. This method identifies trends and patterns to forecast potential price changes.

Developing a Sound Investment Strategy

Diversification

Diversification is a cornerstone of sound investment strategy. By spreading your investments across different asset classes, you reduce the risk of significant losses.

- Don't put all your eggs in one basket. Diversification mitigates risk and protects your portfolio from market fluctuations.

- Diversify your portfolio across different asset classes (stocks, bonds, real estate, etc.). This approach offers resilience against market downturns.

Risk Tolerance

Understanding your risk tolerance is paramount before making any investment decisions. Your risk profile influences the type of investments suitable for your circumstances.

- Assess your comfort level with potential losses. Are you comfortable with higher risk for potentially higher returns, or do you prefer a more conservative approach?

- Choose investments that align with your risk profile. Don't invest in assets that make you uncomfortable or that you don't fully understand.

Long-Term Perspective

Focusing on long-term growth rather than chasing short-term gains is vital for successful investing. Market fluctuations are inevitable, and short-term predictions are often unreliable.

- Avoid impulsive decisions based on short-term market fluctuations. Market timing is notoriously difficult, even for professionals.

- Focus on long-term growth and wealth building. A well-diversified portfolio, aligned with your risk tolerance and financial goals, will yield better results over time.

Conclusion

While Jeanine Pirro's opinions may be interesting, relying on her or any non-expert for stock market predictions is inherently risky. Investors should prioritize reliable sources of information and always consult qualified financial professionals like CFAs for personalized advice. Building a sound investment strategy involves diversification, understanding your risk tolerance, and maintaining a long-term perspective. Remember, careful planning and professional guidance are essential for navigating the complexities of the financial markets.

Call to Action: Before making any investment decisions based on public figures' opinions, remember to seek professional financial advice. Don't gamble with your future; make informed decisions based on reliable sources and sound investment strategies. Avoid relying on speculative Jeanine Pirro stock market predictions and instead focus on building a robust and diversified portfolio. Consult a CFA today to get started!

Featured Posts

-

Oilers Vs Kings Game 1 Nhl Playoffs Predictions Odds And Betting Picks

May 09, 2025

Oilers Vs Kings Game 1 Nhl Playoffs Predictions Odds And Betting Picks

May 09, 2025 -

Singer Wynne Evans Reveals Details Of Recent Health Scare Hints At Return To Stage

May 09, 2025

Singer Wynne Evans Reveals Details Of Recent Health Scare Hints At Return To Stage

May 09, 2025 -

Daycare And Young Children Weighing The Risks

May 09, 2025

Daycare And Young Children Weighing The Risks

May 09, 2025 -

Recrutement Dijon Postes Disponibles En Restauration Et Sur Le Rooftop Dauphine

May 09, 2025

Recrutement Dijon Postes Disponibles En Restauration Et Sur Le Rooftop Dauphine

May 09, 2025 -

Montoya Speaks Out The Already Made Decision On Doohans F1 Career

May 09, 2025

Montoya Speaks Out The Already Made Decision On Doohans F1 Career

May 09, 2025