Significant Drop In Indonesia's Reserves: Implications Of The Weakening Rupiah

Table of Contents

Causes of the Weakening Rupiah and Declining Reserves

Several intertwined factors contribute to the current state of Indonesia's foreign exchange reserves and the weakening Rupiah. These can be broadly categorized into global economic factors, domestic economic factors, and the impact of commodity price fluctuations.

Global Economic Factors

The global economic landscape plays a significant role. The strengthening US dollar, driven by aggressive interest rate hikes by the Federal Reserve to combat inflation, exerts considerable pressure on emerging market currencies like the Rupiah.

- Capital Outflows: Higher US interest rates attract capital away from emerging markets, reducing demand for the Rupiah and putting downward pressure on its value.

- Reduced Investment: Uncertainty in the global economy discourages foreign investment in Indonesia, further weakening the Rupiah.

- Increased Import Costs: A stronger dollar makes imports more expensive for Indonesia, impacting the trade balance.

Data from the International Monetary Fund (IMF) shows a clear correlation between US interest rate increases and the depreciation of the Rupiah. For instance, [Insert relevant statistical data here, e.g., "a 1% increase in US interest rates was historically associated with a X% depreciation of the Rupiah"].

Domestic Economic Factors

Internal economic factors also contribute to the Rupiah's weakness.

- Current Account Deficit: A persistent current account deficit, where imports exceed exports, puts pressure on the Rupiah as Indonesia needs to acquire foreign currency to finance the shortfall.

- Inflation: High domestic inflation erodes the purchasing power of the Rupiah, making it less attractive to investors. [Insert relevant data on Indonesian inflation rates].

- Government Spending: Expansionary fiscal policies, while stimulating growth, can also put pressure on the Rupiah if not managed carefully.

- Policy Uncertainty: Changes in government policy or perceived policy instability can also deter investment and lead to capital flight.

Commodity Prices and Trade Balance

Indonesia's reliance on commodity exports, particularly oil and palm oil, makes its economy vulnerable to price fluctuations.

- Low Commodity Prices: Periods of low commodity prices negatively impact export revenues, widening the current account deficit and weakening the Rupiah.

- High Commodity Prices: While high prices boost export earnings, they can also lead to increased import costs if Indonesia relies on imported inputs for its production processes.

[Insert a chart or graph here illustrating the relationship between commodity prices (oil and palm oil) and the Rupiah's exchange rate]. This visual representation will strengthen the argument and improve SEO.

Implications of the Weakening Rupiah and Reduced Reserves

The weakening Rupiah and dwindling foreign exchange reserves have several serious implications for the Indonesian economy.

Inflationary Pressures

A weaker Rupiah makes imports more expensive, directly impacting consumer prices. This leads to increased inflation, particularly for essential goods.

- Increased Import Costs: The higher cost of imported goods translates into higher prices for consumers, reducing their purchasing power.

- Wage-Price Spiral: Rising prices can lead to demands for higher wages, further fueling inflation. [Insert data on inflation rates and the impact on consumer prices].

Debt Servicing Challenges

Indonesia's foreign-denominated debt becomes more expensive to service as the Rupiah weakens. This increases the risk of debt defaults.

- Increased Debt Burden: The cost of repaying foreign debt increases significantly with a weaker Rupiah.

- Risk of Default: Failure to service debt can have severe consequences for Indonesia's credit rating and economic stability. [Insert data on Indonesia's foreign debt and its denomination].

Impact on Foreign Investment

The weakening Rupiah can deter foreign direct investment (FDI) and lead to capital flight.

- Reduced FDI Inflows: Investors may be less inclined to invest in Indonesia if they anticipate further Rupiah depreciation.

- Capital Flight: Existing investors may withdraw their investments to avoid losses, further weakening the Rupiah. [Insert data on FDI inflows and outflows].

Potential Mitigation Strategies

Addressing the challenges requires a multi-pronged approach involving monetary and fiscal policies, and strategic diversification.

Monetary Policy Responses

Bank Indonesia (BI) can employ several tools:

- Interest Rate Hikes: Raising interest rates can attract foreign capital and support the Rupiah, but may also slow economic growth.

- Foreign Exchange Market Intervention: BI can intervene by selling foreign currency reserves to increase the demand for the Rupiah. However, this depletes reserves.

Fiscal Policy Measures

The Indonesian government can implement:

- Government Spending Cuts: Reducing government spending can help control inflation and improve the fiscal balance.

- Tax Reforms: Improving tax collection efficiency can boost government revenue.

Diversification Strategies

Reducing reliance on specific commodities is crucial:

- Export Diversification: Developing a more diverse export base reduces vulnerability to commodity price swings.

- Attracting FDI: Implementing policies to attract higher value-added investments can boost the economy and reduce reliance on commodity exports.

Conclusion

The significant drop in Indonesia's foreign exchange reserves and the weakening Rupiah are a serious concern with far-reaching implications. The underlying causes are a complex interplay of global and domestic factors. The consequences include increased inflationary pressures, challenges in debt servicing, and a potential negative impact on foreign investment. While mitigation strategies involving monetary and fiscal policies, along with diversification efforts, exist, addressing this situation requires a proactive and comprehensive approach. Stay informed about the evolving situation regarding the weakening Rupiah and Indonesia's reserves by following reputable economic news sources and conducting further research. Understanding the long-term implications of this trend is crucial for navigating the future of the Indonesian economy.

Featured Posts

-

Indian Stock Market Today Sensex Nifty Performance And Key Movers

May 10, 2025

Indian Stock Market Today Sensex Nifty Performance And Key Movers

May 10, 2025 -

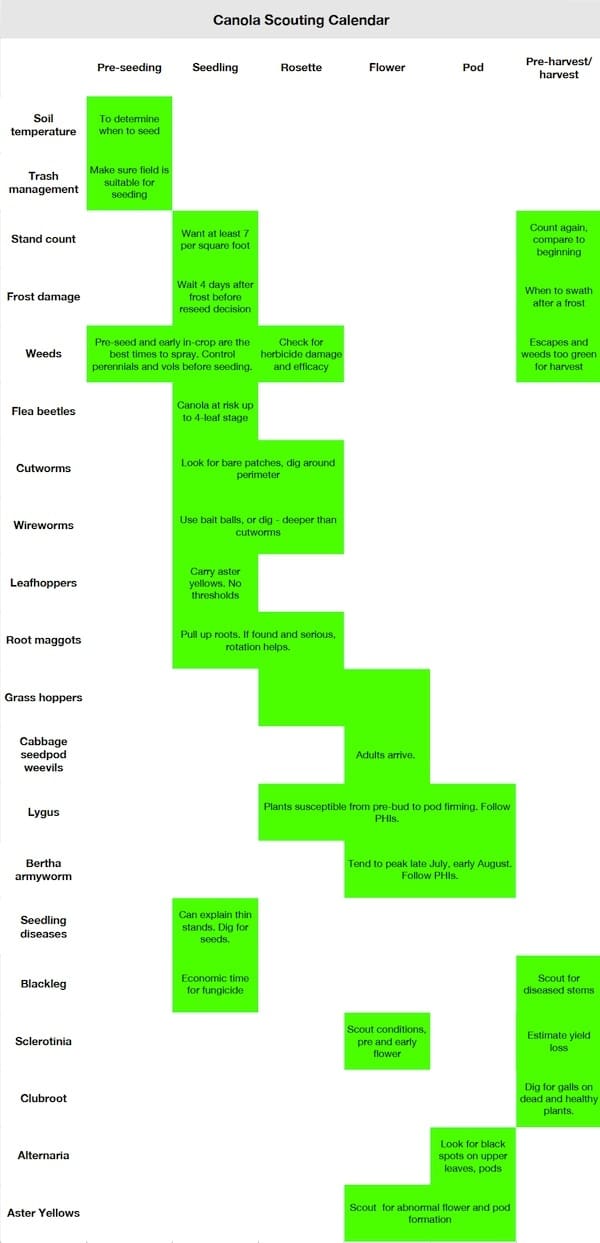

New Canola Suppliers For China A Look At The Post Canada Landscape

May 10, 2025

New Canola Suppliers For China A Look At The Post Canada Landscape

May 10, 2025 -

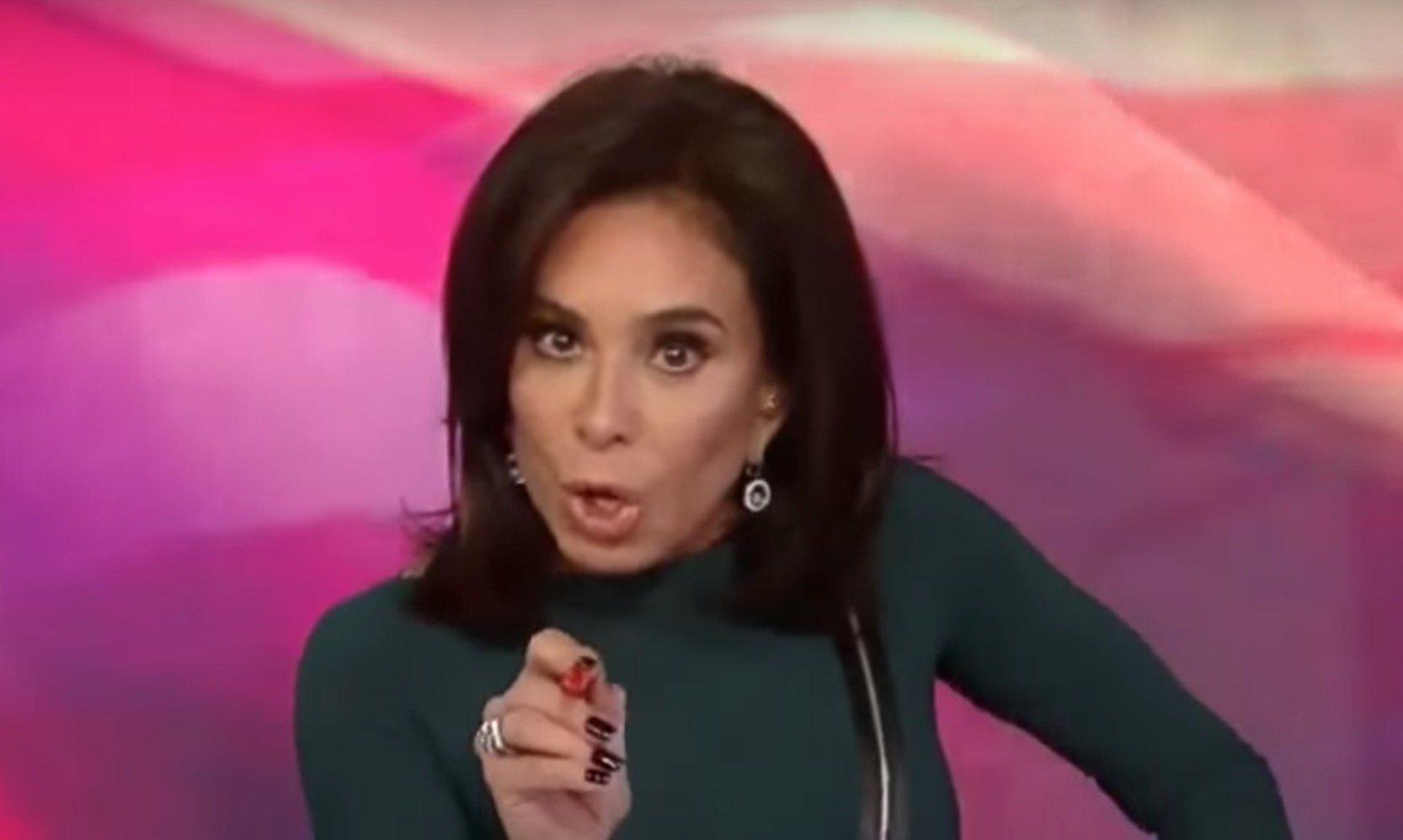

Fox News Jeanine Pirro Insights Into Her Public And Private Life

May 10, 2025

Fox News Jeanine Pirro Insights Into Her Public And Private Life

May 10, 2025 -

X Blocks Jailed Turkish Mayors Facebook Page Opposition Protests Trigger Action

May 10, 2025

X Blocks Jailed Turkish Mayors Facebook Page Opposition Protests Trigger Action

May 10, 2025 -

Young Thugs Vow Of Faithfulness To Mariah The Scientist New Snippet Surfaces

May 10, 2025

Young Thugs Vow Of Faithfulness To Mariah The Scientist New Snippet Surfaces

May 10, 2025