Significant Losses For Amsterdam Stocks: 7% Fall On Trade War Anxiety

Table of Contents

The Impact of Trade War Uncertainty on Amsterdam's Stock Market

The interconnectedness of the global economy means that trade wars don't stay localized; their effects are far-reaching. Uncertainty created by escalating trade tensions significantly impacts investor confidence, leading to market volatility. The Amsterdam stock market, like others globally, is feeling the pinch. Specific sectors within the Amsterdam stock market, particularly those heavily reliant on exports and technology, are bearing the brunt of the trade war's fallout. The Netherlands, a significant player in global trade, is particularly vulnerable to disruptions in international supply chains.

- Increased market volatility: The unpredictable nature of trade policies leads to increased market volatility, making it challenging for investors to make informed decisions. This volatility discourages investment and can trigger sell-offs.

- Decreased consumer confidence: Trade wars often lead to increased prices for imported goods, impacting consumer spending and lowering overall domestic demand. This decreased consumer confidence further weakens the economy.

- Supply chain disruptions: Trade restrictions and tariffs disrupt established supply chains, leading to production slowdowns and shortages, impacting businesses' profitability.

- Potential for further Euro devaluation: The uncertainty surrounding the global economy and the European Union's trade relationships could potentially lead to further devaluation of the Euro, impacting the value of Amsterdam stocks denominated in the currency.

Key Players and Their Losses: Analyzing the Biggest Declines in Amsterdam Stocks

Several major companies listed on the Amsterdam Stock Exchange (AEX) have suffered substantial losses in recent days. These declines reflect the broader impact of trade war anxieties on various sectors. Analyzing these losses provides crucial insight into the current market climate. The following are some examples, though the specific companies and percentages will fluctuate:

- Company A (e.g., a technology firm): Experienced a 5% drop, largely attributed to decreased demand for its products in key export markets impacted by tariffs. This highlights the vulnerability of export-oriented businesses.

- Company B (e.g., an industrial manufacturer): Suffered a 3% decline due to disruptions in its supply chain, resulting in production delays and increased costs. This underscores the fragility of global supply chains.

- Company C (e.g., a consumer goods company): Saw a 2% decrease, largely attributed to weakened consumer confidence and decreased domestic spending. This shows the domestic impact of trade tensions.

Investor Sentiment and Future Outlook for Amsterdam Stocks

Current investor sentiment towards Amsterdam stocks is understandably cautious. Many investors are adopting a wait-and-see approach, monitoring the evolving trade situation before making significant investment decisions. However, there is potential for a market rebound depending on how the trade conflict resolves.

- Recent investor behavior: We're currently seeing a trend of increased selling, indicating a flight from risk. However, some investors are viewing this as an opportunity to acquire undervalued stocks.

- Expert opinions: Financial analysts offer mixed outlooks. Some predict further declines in the short term, while others believe the market has already factored in much of the negative news and that a rebound is possible.

- Government intervention: The Dutch government may introduce stimulus packages or policy changes to support the market and boost investor confidence. This is a key variable impacting the future outlook.

Strategies for Navigating the Volatility in Amsterdam Stocks

Navigating the current volatility in Amsterdam stocks requires a cautious yet proactive approach. Risk management and diversification are critical. A long-term investment strategy is paramount during periods of uncertainty.

- Diversify your portfolio: Spread your investments across various sectors and asset classes to reduce the overall risk. Don't put all your eggs in one basket, especially in sectors heavily affected by trade tensions.

- Consider defensive stocks: Invest in companies less susceptible to trade war impacts, such as essential consumer goods providers or utilities.

- Avoid panic selling: Market downturns are temporary. Panic selling often leads to losses. Stick to your investment plan unless your financial circumstances change significantly.

Conclusion: Understanding and Mitigating Risks in the Amsterdam Stock Market

The significant losses experienced by Amsterdam stocks due to trade war anxieties highlight the crucial role of global events in shaping local market performance. The interconnectedness of the global economy is undeniable, meaning that events like trade disputes can have far-reaching and unexpected consequences.

Key Takeaways: Global trade disputes significantly impact even seemingly insulated markets like the Amsterdam stock market. Understanding the interconnectedness of the global economy is crucial for informed investment decisions.

Call to Action: Stay informed about global economic events and develop a sound investment strategy that accounts for market volatility. To learn more about navigating the complexities of the Amsterdam stock market and the impact of global trade, explore resources from reputable financial institutions and economic news outlets. Understanding the dynamics of Amsterdam stocks will better prepare you for future market fluctuations.

Featured Posts

-

Scrutiny Of Thames Water Executive Bonuses And The Public Outcry

May 25, 2025

Scrutiny Of Thames Water Executive Bonuses And The Public Outcry

May 25, 2025 -

Kriza Zasahuje Nemecko Prepustanie V Najvaecsich Spolocnostiach

May 25, 2025

Kriza Zasahuje Nemecko Prepustanie V Najvaecsich Spolocnostiach

May 25, 2025 -

September Gucci Reveal Kering Reports Lower Sales Figures

May 25, 2025

September Gucci Reveal Kering Reports Lower Sales Figures

May 25, 2025 -

Negotiations Heat Up G 7 Discusses De Minimis Tariffs For Chinese Imports

May 25, 2025

Negotiations Heat Up G 7 Discusses De Minimis Tariffs For Chinese Imports

May 25, 2025 -

Sadie Sink And Mia Farrow Broadways John Proctor Is The Villain Photo

May 25, 2025

Sadie Sink And Mia Farrow Broadways John Proctor Is The Villain Photo

May 25, 2025

Latest Posts

-

Nvidia Rtx 5060 Review A Wake Up Call For Gamers

May 25, 2025

Nvidia Rtx 5060 Review A Wake Up Call For Gamers

May 25, 2025 -

Google Vs Open Ai A Deep Dive Into I O And Io

May 25, 2025

Google Vs Open Ai A Deep Dive Into I O And Io

May 25, 2025 -

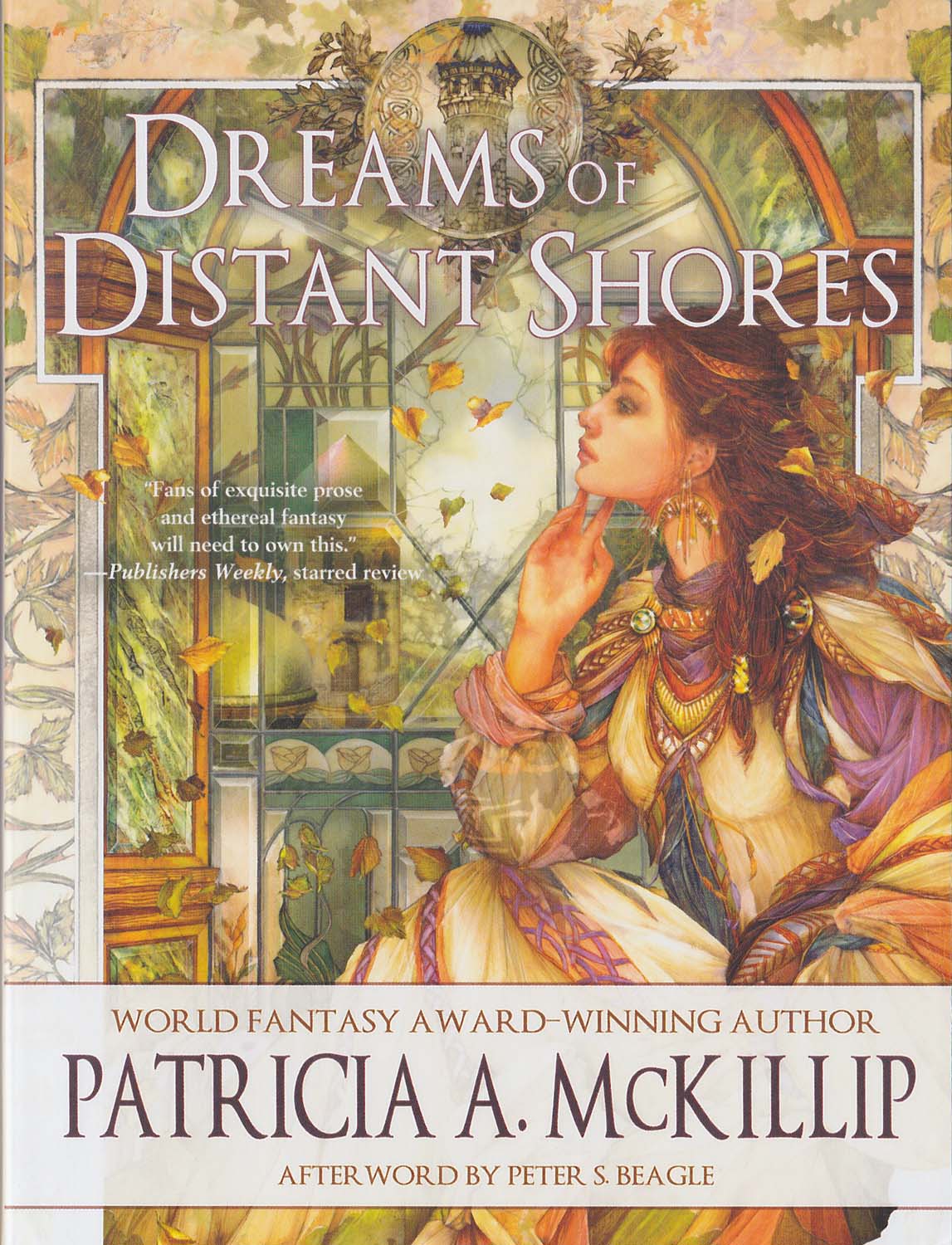

From Distant Shores To Dc A Love Story Cut Short

May 25, 2025

From Distant Shores To Dc A Love Story Cut Short

May 25, 2025 -

Fujifilm X H2 A Hands On Experience Whimsical Refreshing And Fun To Use

May 25, 2025

Fujifilm X H2 A Hands On Experience Whimsical Refreshing And Fun To Use

May 25, 2025 -

I O Vs Io The Ongoing Tech War Between Google And Open Ai

May 25, 2025

I O Vs Io The Ongoing Tech War Between Google And Open Ai

May 25, 2025