Significant Saudi Regulatory Shift: Transforming The ABS Market

Table of Contents

Easing Restrictions and Fostering Growth

The Saudi Arabian government's recent regulatory overhaul aims to simplify the ABS issuance process, reducing bureaucratic hurdles and encouraging greater participation from both domestic and international players. These reforms are designed to stimulate growth in the Saudi ABS market and diversify funding sources for businesses and infrastructure projects.

- Streamlined application process: The new regulations significantly reduce the time and complexity involved in applying for ABS issuance licenses, making it easier for companies to access capital.

- Reduced documentation requirements: The simplification of documentation requirements minimizes administrative burdens, allowing for faster processing times and a more efficient issuance process.

- Clearer regulatory guidelines: The updated regulatory framework provides clear and concise guidelines, reducing ambiguity and fostering greater transparency and certainty for issuers and investors.

- Increased transparency: Enhanced disclosure requirements provide investors with more comprehensive information, allowing for better informed investment decisions.

- Incentives for foreign investment in Saudi ABS: The reforms include provisions designed to attract foreign investment into the Saudi ABS market, increasing liquidity and promoting international participation.

This streamlining is expected to dramatically increase the volume and diversity of ABS issuance. We can anticipate significant growth in sectors such as real estate, infrastructure, and consumer finance. Furthermore, the regulatory changes specifically support the growth of Islamic finance-compliant ABS, also known as Sukuk, a key area of focus for the Saudi economy.

Enhanced Investor Protection and Market Transparency

The new regulations prioritize enhancing investor protection and market transparency to build confidence and attract international investment. Several key measures have been implemented to achieve this goal.

- Strengthened disclosure requirements for issuers: Issuers are now required to provide more detailed and comprehensive information about their ABS offerings, ensuring greater transparency and reducing information asymmetry.

- Enhanced credit rating agency oversight: Increased regulatory scrutiny of credit rating agencies ensures the accuracy and reliability of credit ratings, protecting investors from misleading assessments.

- Improved investor redress mechanisms: The new regulations establish more robust mechanisms for investors to seek redress in case of disputes or irregularities, strengthening investor protection.

- Increased regulatory scrutiny of ABS offerings: The regulatory authorities are actively monitoring ABS offerings to ensure compliance with regulations and protect investors from fraudulent or misleading practices.

These improvements are expected to significantly increase investor confidence in the Saudi ABS market, attracting more international investors and fostering greater liquidity. The increased transparency also allows for more efficient price discovery and a more robust and resilient market.

The Role of Islamic Finance in the Saudi ABS Market

Islamic finance plays a pivotal role in shaping the Saudi ABS market. The regulatory changes specifically support the growth of Sharia-compliant ABS, also known as Sukuk, further strengthening Saudi Arabia's position as a global leader in Islamic finance.

- Increased issuance of Sukuk (Islamic bonds): The simplified regulatory environment facilitates the issuance of more Sukuk, providing a crucial source of funding for Islamic financial institutions and businesses.

- Development of Sharia-compliant ABS structures: The regulatory framework actively supports the development of innovative Sharia-compliant ABS structures, catering to the specific needs of the Islamic finance sector.

- Regulatory framework supporting Islamic finance principles in ABS: The regulatory changes ensure that Islamic finance principles are fully integrated into the ABS market, providing a solid foundation for sustainable growth.

- Opportunities for growth in the Islamic ABS segment: The reforms present significant opportunities for growth in the Islamic ABS segment, positioning Saudi Arabia as a global hub for Islamic finance-related investments.

Impact on the broader Saudi Economy

The growth of the Saudi ABS market is expected to have a significant positive impact on the broader Saudi economy, contributing to economic diversification and sustainable development.

- Increased capital availability for businesses: The enhanced access to capital through the ABS market will facilitate business growth and expansion, fostering economic development.

- Enhanced funding for infrastructure projects: The ABS market will provide an efficient mechanism for financing large-scale infrastructure projects, contributing to the Kingdom's Vision 2030 goals.

- Stimulation of economic growth: The increased investment and economic activity generated by the ABS market will contribute significantly to the overall growth of the Saudi economy.

- Job creation in the financial sector: The expansion of the ABS market will lead to increased employment opportunities in the financial sector, benefiting the Saudi workforce.

The positive spillover effects will extend to related industries, such as legal, accounting, and consulting services, fostering further economic development and diversification.

Conclusion

The significant Saudi regulatory shift represents a pivotal moment for the Asset-Backed Securities market. The reforms have streamlined the issuance process, enhanced investor protection, increased transparency, and specifically supported the growth of Islamic finance-compliant ABS. These changes are not only fostering market growth but also significantly contributing to the diversification and development of the Saudi economy. The increased confidence in the market, coupled with the incentives for foreign investment, positions Saudi Arabia as a key player in the global ABS landscape. The significant Saudi regulatory shift presents unprecedented opportunities in the Asset-Backed Securities market. Investors and businesses should explore the potential of this dynamic market and capitalize on the streamlined processes and enhanced investor protections now available. Learn more about the evolving landscape of Saudi ABS and discover how you can participate in this exciting growth sector.

Featured Posts

-

Sos From Gaza Bound Aid Ship Drone Attack Reported Near Maltese Waters

May 03, 2025

Sos From Gaza Bound Aid Ship Drone Attack Reported Near Maltese Waters

May 03, 2025 -

Reform Party In Turmoil After Leaked Farage Messages

May 03, 2025

Reform Party In Turmoil After Leaked Farage Messages

May 03, 2025 -

Conservative Party Chairmans Public Dispute With Reform Uk Analysis Of The Conflict

May 03, 2025

Conservative Party Chairmans Public Dispute With Reform Uk Analysis Of The Conflict

May 03, 2025 -

Poleodomiki Diafthora Mia Analysi Kai Protaseis Gia Tin Epanidrysi Toy Kratoys

May 03, 2025

Poleodomiki Diafthora Mia Analysi Kai Protaseis Gia Tin Epanidrysi Toy Kratoys

May 03, 2025 -

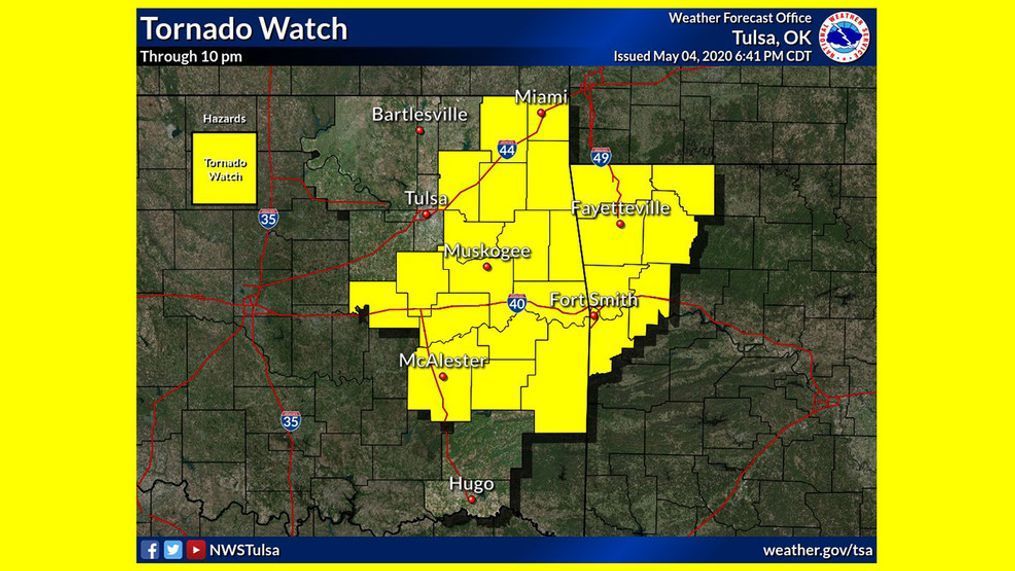

Tulsa Public School District Announces Wednesday Closure For Weather

May 03, 2025

Tulsa Public School District Announces Wednesday Closure For Weather

May 03, 2025

Latest Posts

-

Netherlands Weighs Reintroducing Ow Subsidies To Boost Bidding

May 04, 2025

Netherlands Weighs Reintroducing Ow Subsidies To Boost Bidding

May 04, 2025 -

Lion Storages 1 4 G Wh Battery Energy Storage System In Netherlands Financial Close Achieved

May 04, 2025

Lion Storages 1 4 G Wh Battery Energy Storage System In Netherlands Financial Close Achieved

May 04, 2025 -

Christen Se Impone En La Vuelta Ciclista A La Region De Murcia

May 04, 2025

Christen Se Impone En La Vuelta Ciclista A La Region De Murcia

May 04, 2025 -

Lion Storage Secures Funding For 1 4 G Wh Bess Project In Netherlands

May 04, 2025

Lion Storage Secures Funding For 1 4 G Wh Bess Project In Netherlands

May 04, 2025 -

45 Vuelta Ciclista A La Region De Murcia Victoria Para Fabio Christen

May 04, 2025

45 Vuelta Ciclista A La Region De Murcia Victoria Para Fabio Christen

May 04, 2025