Singapore's DBS Bank: Grace Period For Major Polluters To Transition To Sustainability

Table of Contents

Understanding DBS Bank's Sustainability Initiatives

DBS Bank's commitment to Environmental, Social, and Governance (ESG) investing is deeply ingrained in its overall business strategy. The bank recognizes the interconnectedness of economic prosperity and environmental well-being, actively promoting sustainable development across its operations and investments. This commitment extends beyond mere compliance; it's a proactive effort to drive positive change within the financial sector and beyond. DBS has consistently demonstrated its dedication through various initiatives.

- Examples of previous sustainable financing projects: DBS has been a frontrunner in green financing, providing substantial funding for renewable energy projects, sustainable infrastructure development, and green building initiatives across Southeast Asia.

- Public commitments and targets: The bank has publicly committed to ambitious targets regarding carbon emissions reduction, aiming to achieve net-zero emissions across its operations by a specific date, and supporting its clients in achieving their own sustainability goals.

- Awards and recognitions: DBS has received numerous accolades for its sustainability efforts, reflecting its leadership position in ESG investing and its impact on the region. These awards underscore the bank's dedication and the effectiveness of its initiatives.

The Details of the Grace Period for Major Polluters

The DBS Bank Sustainability Grace Period offers a defined timeframe – (insert specific duration, e.g., three years) – for major polluting industries in Singapore to transition towards more sustainable practices. This initiative specifically targets sectors like manufacturing, energy production, and potentially others significantly contributing to environmental pollution. The grace period isn't simply a period of leniency; it's designed as a supportive framework.

- Conditions for qualification: Businesses must meet specific criteria to qualify, including a demonstrable commitment to developing and implementing a credible transition plan. This plan outlines concrete steps towards reducing their environmental impact.

- Financial incentives and support: DBS provides various forms of support during this period, including access to specialized consulting services to help companies develop their transition plans, financial incentives to invest in cleaner technologies, and potentially favorable loan terms.

- Expected transition plans: Companies receiving support are expected to detail their timelines for emission reduction, investment in sustainable technologies, and improvements in waste management and resource efficiency. These plans are subject to regular review and monitoring by DBS.

Impact and Implications of DBS Bank's Approach

The potential positive impacts of the DBS Bank Sustainability Grace Period are significant. This initiative promises benefits both for the environment and the economy.

- Positive environmental impact: Reduced emissions from participating industries will contribute to improved air and water quality, leading to a healthier environment in Singapore. More sustainable practices will contribute to a reduction in overall pollution levels.

- Economic benefits: Companies adopting sustainable practices are likely to see long-term cost savings through increased efficiency, reduced waste, and access to new markets for eco-friendly products and services. This will create a positive ripple effect across the Singaporean economy, fostering innovation and economic growth within the green sector.

- Global potential: The success of this model in Singapore could encourage other financial institutions globally to adopt similar approaches, significantly accelerating global efforts towards environmental sustainability. This initiative could set a powerful example of how the financial sector can leverage its influence to promote sustainable change.

Challenges and Criticisms of the Grace Period

While the initiative is innovative, potential criticisms must be addressed.

- Greenwashing concerns: There is a risk that some companies might exploit the grace period without genuine commitment to change, using it to improve their public image rather than implementing meaningful improvements.

- Monitoring and enforcement challenges: Ensuring effective monitoring and enforcement of compliance during the grace period is crucial. Robust mechanisms are needed to track progress, verify the accuracy of sustainability reports, and address any non-compliance.

- Accountability: Transparent and accountable reporting mechanisms must be in place to ensure that companies are held responsible for their commitments and that progress is accurately reflected.

Conclusion

DBS Bank's novel approach of offering a DBS Bank Sustainability Grace Period to major polluters represents a significant step towards a more sustainable future. By providing support and resources, DBS aims to facilitate a smoother transition towards greener practices, balancing economic progress with environmental responsibility. The success of this initiative will depend on effective monitoring, transparency, and the genuine commitment of participating companies to implement sustainable changes. The potential for this model to be replicated internationally is substantial, showcasing a potentially effective strategy for encouraging wider adoption of sustainable practices.

Call to Action: Learn more about DBS Bank's commitment to sustainability and their innovative grace period program. Visit the DBS website to explore their sustainability initiatives and understand how you can contribute to a greener future with the DBS Bank Sustainability Grace Period initiative.

Featured Posts

-

Understanding Uber Auto Payment Methods Cash Upi And More

May 08, 2025

Understanding Uber Auto Payment Methods Cash Upi And More

May 08, 2025 -

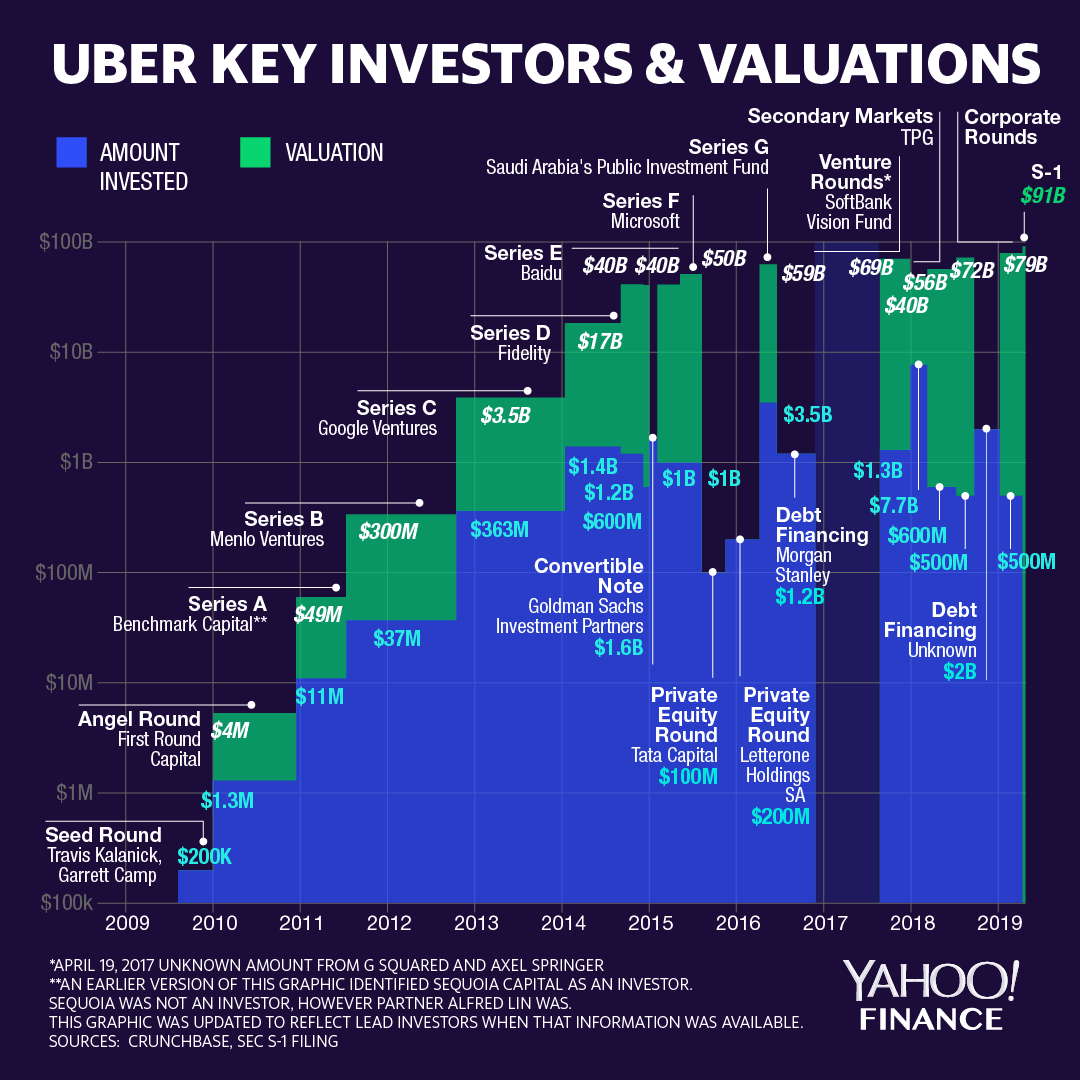

Should You Invest In Uber Technologies Uber

May 08, 2025

Should You Invest In Uber Technologies Uber

May 08, 2025 -

Wall Street Kurumlari Kriptoyu Nasil Kabul Ediyor

May 08, 2025

Wall Street Kurumlari Kriptoyu Nasil Kabul Ediyor

May 08, 2025 -

Xrp Etf Approvals Sec Developments And Ripples Future

May 08, 2025

Xrp Etf Approvals Sec Developments And Ripples Future

May 08, 2025 -

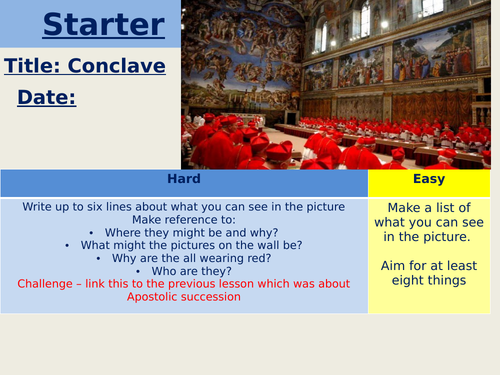

The Conclave Begins Electing The Next Pope

May 08, 2025

The Conclave Begins Electing The Next Pope

May 08, 2025