Slow Economic Growth Forecast For Canada: David Dodge's Warning

Table of Contents

David Dodge's Concerns and Predictions

David Dodge, a highly respected economist and former Governor of the Bank of Canada (2001-2008), has voiced serious concerns about Canada's economic trajectory. His extensive experience and deep understanding of the Canadian financial landscape lend significant credibility to his warnings. While precise numerical predictions may vary depending on the source, Dodge's forecast consistently points towards a period of significantly slowed economic growth for Canada. This isn't necessarily a prediction of a full-blown recession, but rather a period of sluggish expansion with potentially significant consequences. His key concerns include:

- High inflation and interest rates: The current inflationary environment, coupled with aggressive interest rate hikes by the Bank of Canada, significantly dampens consumer spending and investment.

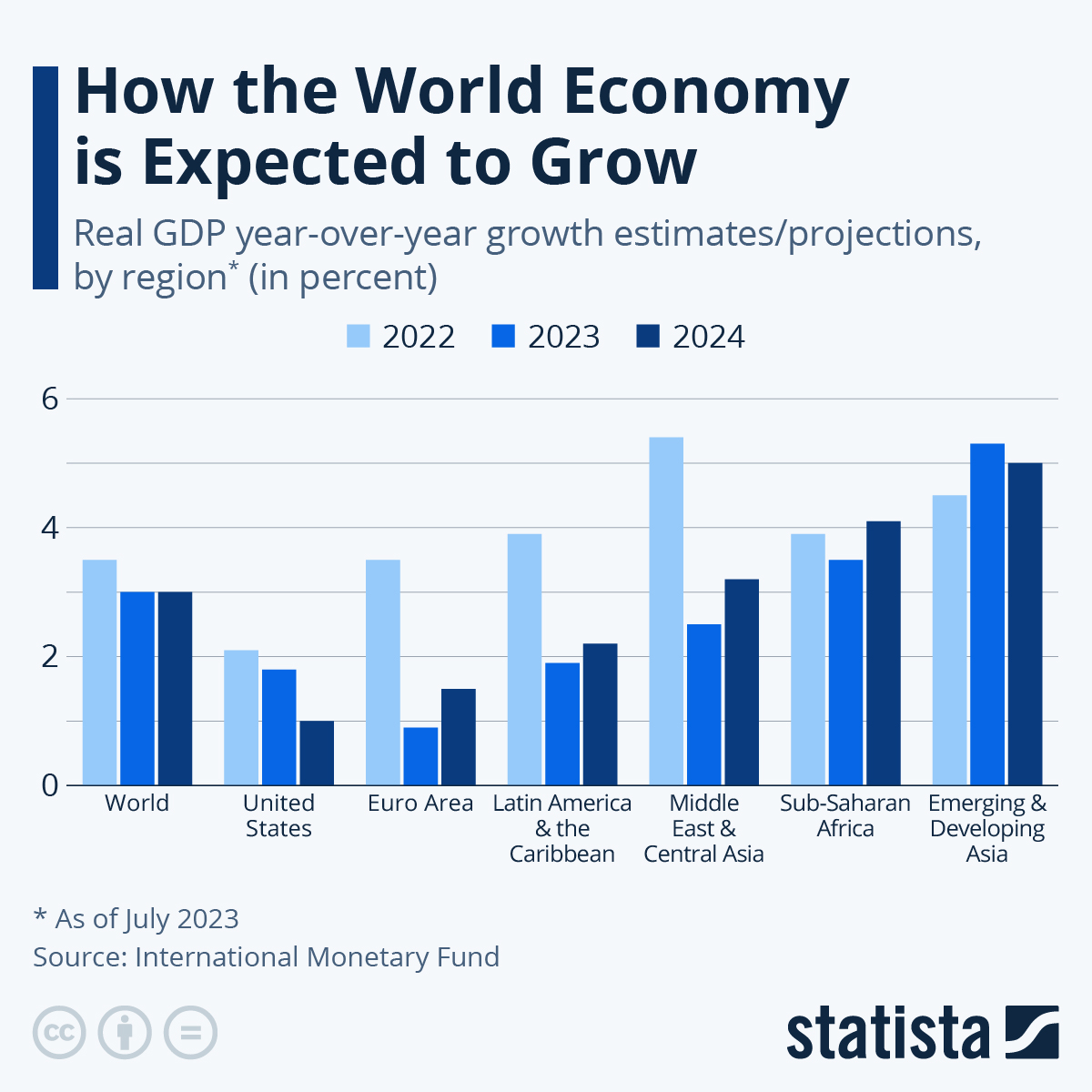

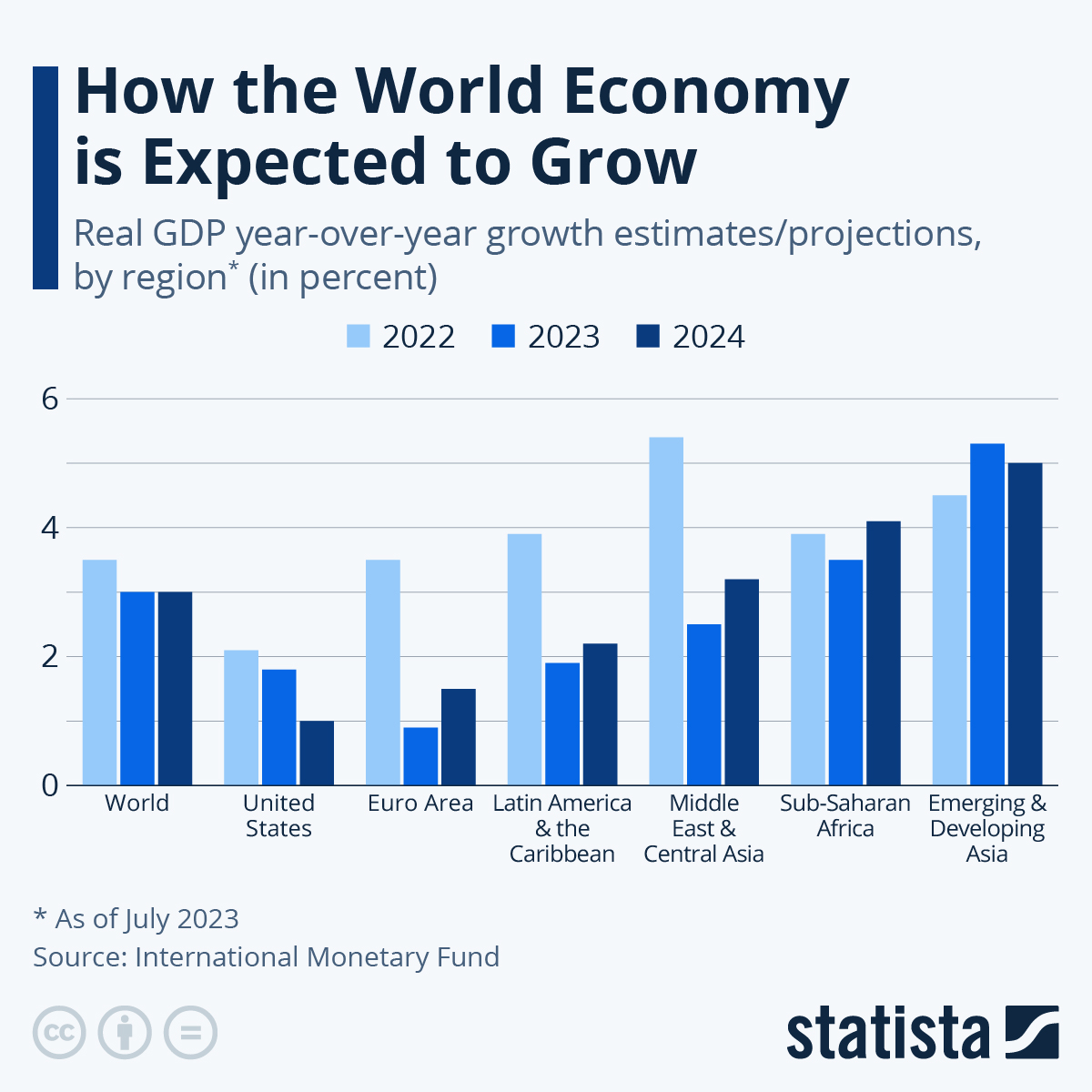

- Global economic uncertainty: The ongoing war in Ukraine, persistent supply chain disruptions, and potential global recessionary pressures all pose considerable risks to the Canadian economy.

- Impact of housing market slowdown: The cooling Canadian housing market, after a period of rapid growth, represents a significant drag on economic activity.

- Potential for a recession: While not explicitly predicting a recession, Dodge's concerns highlight the increased probability of a significant economic downturn if current trends continue.

Factors Contributing to the Slow Growth Forecast

Several interconnected macroeconomic factors contribute to the slow economic growth forecast for Canada. Many of these echo the concerns raised by David Dodge. These include:

- The impact of global events: The ongoing war in Ukraine has disrupted global supply chains and energy markets, contributing to inflation. Supply chain bottlenecks continue to impact various sectors, limiting production and increasing costs.

- Canadian government policies: While government policies aim to stimulate growth, their effectiveness in the face of global headwinds is debated. The balance between fiscal responsibility and stimulus spending remains a key challenge.

- High inflation's impact on consumer spending: Soaring inflation erodes purchasing power, leading to reduced consumer spending, a major driver of economic growth.

- Rising interest rates and their effect on borrowing and investment: Increased borrowing costs discourage investment and reduce consumer spending on big-ticket items like homes and automobiles.

- Weakness in specific sectors of the Canadian economy: The housing market slowdown is a prime example, but other sectors, such as manufacturing and resource extraction, may also experience weakening demand.

- Geopolitical risks and their influence: Global geopolitical instability creates uncertainty that discourages investment and impacts international trade.

Potential Consequences of Slow Economic Growth

A prolonged period of slow economic growth in Canada could have several significant consequences:

- Increased unemployment: A slowdown in economic activity often translates to job losses, particularly in sectors sensitive to economic cycles. This could lead to increased unemployment rates and social unrest.

- Reduced consumer confidence: As people feel less secure about their jobs and incomes, consumer confidence declines, further reducing spending and economic activity.

- Potential strain on government services: Reduced tax revenues due to slower economic growth could strain government budgets, potentially leading to cuts in public services.

- Decreased investment: Uncertainty about the economic outlook discourages both domestic and foreign investment, further hampering growth.

- Impact on the Canadian dollar: A weakening Canadian economy could lead to a depreciation of the Canadian dollar against other major currencies.

Mitigation Strategies and Possible Solutions

Addressing the slow economic growth forecast requires a multi-pronged approach involving government intervention, Bank of Canada policies, and private sector adaptation. Potential solutions include:

- Targeted government spending programs: Investing in infrastructure projects and social programs can stimulate economic activity and create jobs.

- Tax cuts or incentives to stimulate investment: Reducing taxes on businesses and individuals could encourage investment and spending.

- Measures to address inflation: The Bank of Canada's management of interest rates is crucial, but further measures to control inflation may be necessary.

- Support for struggling industries: Providing financial assistance or other support to industries significantly impacted by the economic slowdown can help mitigate job losses and maintain economic stability.

Conclusion: Responding to the Slow Economic Growth Forecast for Canada

David Dodge's warning underscores the serious challenges facing the Canadian economy. The confluence of high inflation, rising interest rates, global uncertainty, and a cooling housing market points towards a period of slow economic growth. The potential consequences, including increased unemployment, reduced consumer confidence, and strained government finances, are significant. However, through proactive government policies, effective Bank of Canada monetary policy, and adaptive strategies within the private sector, Canada can mitigate some of these risks. To stay informed about Canada's economic outlook and the evolving situation regarding the slow economic growth forecast for Canada, follow reputable economic news sources and consider consulting a financial advisor for personalized guidance on navigating this challenging economic climate. Understanding Canada's economic growth forecast is crucial for individuals and businesses alike.

Featured Posts

-

Where To Find Newsround Your Bbc Two Hd Guide

May 03, 2025

Where To Find Newsround Your Bbc Two Hd Guide

May 03, 2025 -

Is Reform Uk The Right Choice For British Farming

May 03, 2025

Is Reform Uk The Right Choice For British Farming

May 03, 2025 -

Gaza Flotilla Attack Arab Media Perspective And Analysis

May 03, 2025

Gaza Flotilla Attack Arab Media Perspective And Analysis

May 03, 2025 -

Rumeurs De Complot Macron Et L Election Du Prochain Pape

May 03, 2025

Rumeurs De Complot Macron Et L Election Du Prochain Pape

May 03, 2025 -

Bullying Allegations Reform Uks Rupert Lowe Reported To Police

May 03, 2025

Bullying Allegations Reform Uks Rupert Lowe Reported To Police

May 03, 2025

Latest Posts

-

Siete Nuevos Vehiculos Para El Sistema Penitenciario Una Mejora En La Seguridad Y Logistica

May 03, 2025

Siete Nuevos Vehiculos Para El Sistema Penitenciario Una Mejora En La Seguridad Y Logistica

May 03, 2025 -

Sydney Harbour Surveillance Heightened Amidst Reports Of Chinese Ships

May 03, 2025

Sydney Harbour Surveillance Heightened Amidst Reports Of Chinese Ships

May 03, 2025 -

Breaking News Attack On Gaza Freedom Flotilla Near Malta Watch Here

May 03, 2025

Breaking News Attack On Gaza Freedom Flotilla Near Malta Watch Here

May 03, 2025 -

Increased Chinese Naval Activity Spotted Off Sydney Coast

May 03, 2025

Increased Chinese Naval Activity Spotted Off Sydney Coast

May 03, 2025 -

Gaza Flotilla Under Attack Video Footage Emerges From Malta

May 03, 2025

Gaza Flotilla Under Attack Video Footage Emerges From Malta

May 03, 2025