Slowdown Predicted: David Dodge On Canada's Ultra-Low Growth Outlook For Next Year

Table of Contents

David Dodge's Concerns Regarding Canada's Economic Outlook

David Dodge's concerns about Canada's economic outlook stem from a confluence of factors pointing towards a period of ultra-low growth. His analysis highlights several key challenges that could significantly impact the Canadian economy.

-

High inflation and interest rates: Soaring inflation, fueled by global supply chain disruptions and robust consumer demand, has forced the Bank of Canada to implement aggressive interest rate hikes. These hikes, while intended to curb inflation, also risk dampening economic activity and potentially triggering a recession. The impact of Canadian inflation on borrowing costs is a major factor in Dodge's prediction.

-

Global economic uncertainty: The global economic landscape is fraught with uncertainty. The risk of recession in major economies like the US and Europe poses a significant threat to Canadian exports and overall economic growth. This global recession risk directly impacts Canada's economic health.

-

Geopolitical instability: The ongoing war in Ukraine and the resulting energy crisis have created significant geopolitical instability. These factors contribute to inflationary pressures and disrupt global supply chains, further impacting Canada's economic prospects. Geopolitical risks are a significant factor in the current Canadian economic forecast.

-

Housing market correction: After a period of rapid growth, Canada's housing market is experiencing a correction. Rising interest rates and tighter lending conditions are leading to decreased sales and price adjustments, impacting consumer confidence and overall economic activity. The Canadian real estate market is highly sensitive to interest rate hikes.

-

Impact of rising borrowing costs on businesses and consumers: Higher interest rates increase the cost of borrowing for businesses and consumers, potentially leading to reduced investment, spending, and overall economic activity. Rising borrowing costs are a major contributor to the predicted Canada economic slowdown.

Predicted Impact of Ultra-Low Growth on Key Sectors

The predicted ultra-low growth will disproportionately affect certain sectors of the Canadian economy.

-

Real estate: The Canadian real estate market is expected to experience a significant slowdown, with decreased sales and further price adjustments. This will have ripple effects across related industries.

-

Manufacturing: The manufacturing sector is vulnerable to reduced production and potential job losses due to decreased consumer demand and global economic uncertainty. The manufacturing sector in Canada is particularly sensitive to changes in global demand.

-

Retail: Retail sales are anticipated to decline as consumers cut back on spending in response to higher interest rates and economic uncertainty. Retail sales Canada are expected to reflect the overall economic slowdown.

-

Tourism: The Canadian tourism sector is susceptible to the impact of global economic uncertainty, with potential decreases in both domestic and international tourism. Canadian tourism relies heavily on both domestic and international travel.

Potential Mitigation Strategies and Government Response

The Canadian government has several policy options to mitigate the impact of the predicted slowdown.

-

Fiscal stimulus measures: The government could implement fiscal stimulus measures, such as tax cuts or increased government spending, to boost economic activity. However, the timing and effectiveness of fiscal stimulus are crucial considerations.

-

Monetary policy adjustments by the Bank of Canada: The Bank of Canada may need to adjust its monetary policy in response to the evolving economic situation, potentially by slowing the pace of interest rate hikes or even considering rate cuts if inflation cools significantly. The Bank of Canada monetary policy will play a vital role in navigating the economic slowdown.

-

Support for vulnerable sectors: The government may provide targeted support to sectors particularly vulnerable to the slowdown, such as the manufacturing and tourism sectors. Support for vulnerable sectors can help cushion the blow of the Canada economic slowdown.

Comparing Dodge's Predictions with Other Economic Forecasts

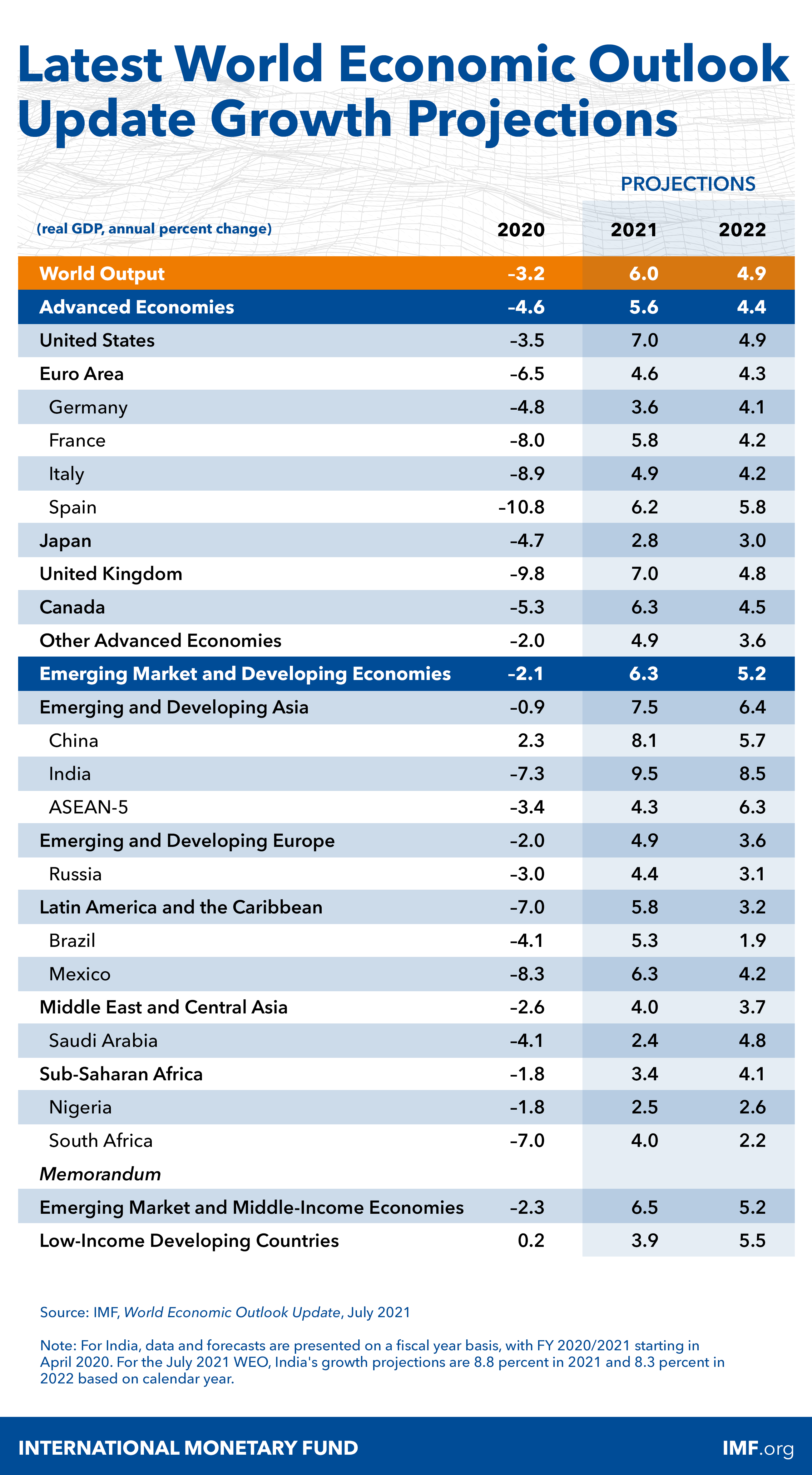

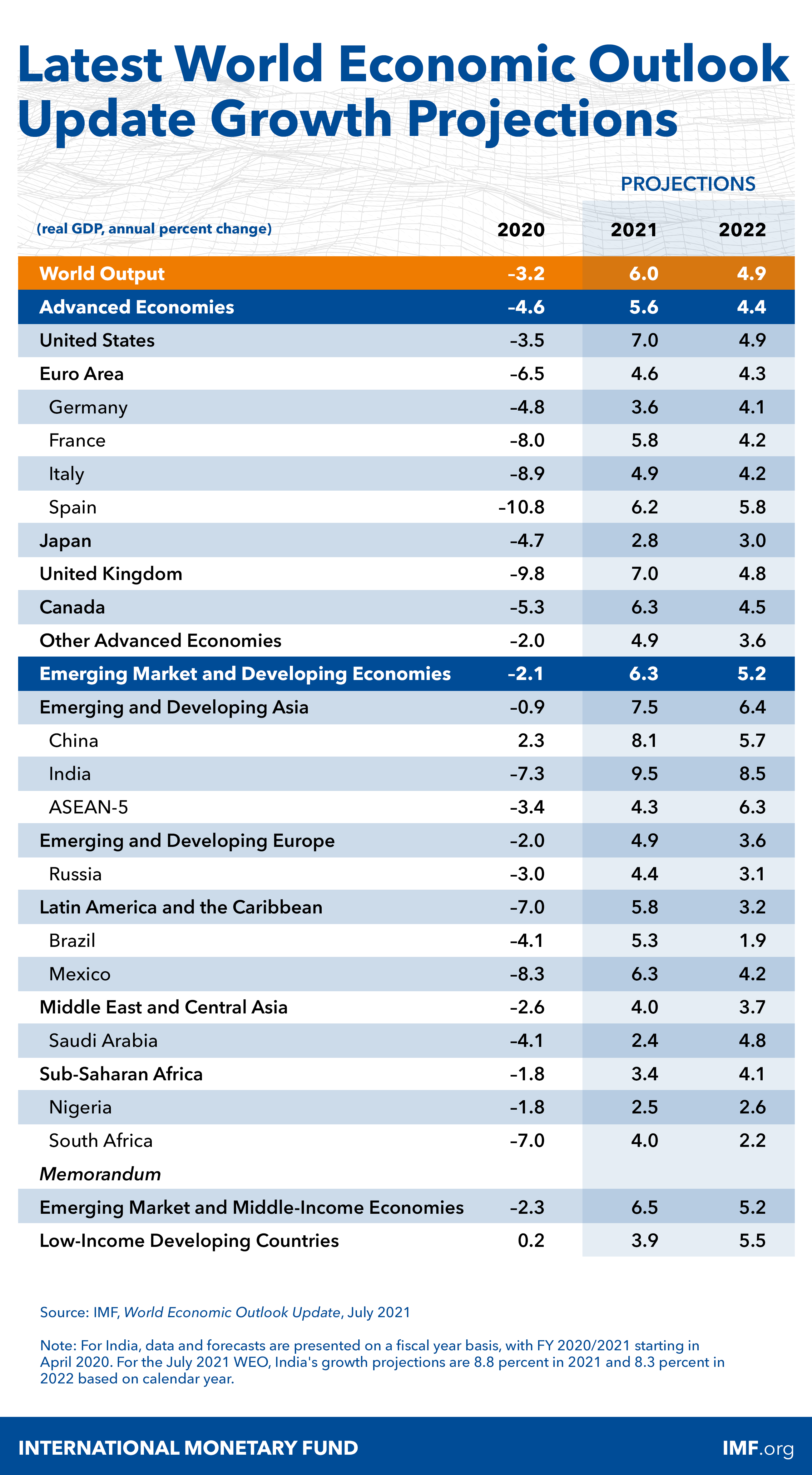

While David Dodge's forecast paints a concerning picture, it's crucial to compare his outlook with other leading economic forecasts. The consensus view on Canada's growth prospects varies, with some economists predicting a milder slowdown than Dodge anticipates. Areas of agreement generally include the impact of high inflation and interest rates, but disagreements exist on the severity and duration of the slowdown. The range of GDP growth forecasts for the next year reflects this divergence of opinion. Careful analysis of these differing economic forecasts Canada is essential for effective planning.

Conclusion: Navigating Canada's Predicted Economic Slowdown

David Dodge's prediction of ultra-low growth for the Canadian economy presents significant challenges. High inflation, rising interest rates, global economic uncertainty, and geopolitical instability are all contributing factors. The predicted slowdown will impact various sectors, requiring both government intervention and proactive adaptation by businesses and individuals. To prepare for Canada's economic slowdown, understanding the predicted ultra-low growth and closely monitoring the Canadian economic forecast is crucial. Stay informed, adapt your strategies, and navigate this period of economic uncertainty effectively. Understanding the nuances of the Canadian economic outlook is key to successful navigation of the predicted slowdown.

Featured Posts

-

Sources Confirm Nikki Burdines Departure From News 2 Morning Show In Nashville

May 02, 2025

Sources Confirm Nikki Burdines Departure From News 2 Morning Show In Nashville

May 02, 2025 -

The Infidelity Proof Smart Ring Hype Or Help

May 02, 2025

The Infidelity Proof Smart Ring Hype Or Help

May 02, 2025 -

Priscilla Pointer Dalla Star Dies At 100

May 02, 2025

Priscilla Pointer Dalla Star Dies At 100

May 02, 2025 -

La Laport

May 02, 2025

La Laport

May 02, 2025 -

Louisiana School Desegregation Order Officially Terminated By Justice Department

May 02, 2025

Louisiana School Desegregation Order Officially Terminated By Justice Department

May 02, 2025