SPAC Stock Surge: Should You Invest In This MicroStrategy Challenger?

Table of Contents

Understanding the SPAC Stock Surge

SPACs, often called "blank-check companies," are shell corporations that raise capital through an initial public offering (SPAC IPO) to acquire a private company. Their recent popularity stems from their ability to take private companies public more quickly and with less regulatory scrutiny than a traditional IPO. This has led to a significant increase in SPAC merger activity and SPAC market capitalization. However, it's crucial to understand both the advantages and disadvantages before diving in.

- The SPAC Merger Process: A SPAC raises capital, then searches for a target company to acquire. If a suitable target is found, a merger is proposed and voted on by SPAC shareholders. The combined entity then typically trades on a major stock exchange.

- Advantages of SPAC Investments: Faster path to market for private companies, potential for high returns, and access to otherwise unavailable investment opportunities.

- Disadvantages of SPAC Investments: Lack of detailed information about the target company before the merger, higher risk due to limited historical data, and potential for management conflicts.

- Regulatory Environment: The regulatory landscape surrounding SPACs is evolving, with increasing scrutiny from the SEC and other regulatory bodies.

Recent data shows a dramatic increase in SPAC IPOs and SPAC market capitalization over the past few years. While precise figures fluctuate, the overall trend points to a considerable surge in activity. For example, [insert relevant statistic on SPAC market growth here, citing source]. This growth, however, hasn't been without its challenges, with some SPACs underperforming significantly after their mergers.

MicroStrategy's Influence on the SPAC Market

MicroStrategy's aggressive investment strategy, particularly its substantial holdings in Bitcoin, has significantly impacted the perception of SPACs. While some see this as a bold and innovative approach, others view it as highly risky. This approach has undoubtedly influenced other companies considering SPAC mergers, prompting some to explore unconventional strategies.

- MicroStrategy's Investment Strategy: MicroStrategy's Bitcoin investments have garnered significant media attention, highlighting both its potential for massive gains and the associated volatility.

- Influence on Other Companies: MicroStrategy's success (or lack thereof) in its investments has undoubtedly influenced the decisions of other companies considering SPAC mergers, particularly those in the tech sector. It demonstrates the potential for both high rewards and substantial risk.

- Controversies and Criticisms: MicroStrategy's investment strategy has faced criticism regarding its high risk and potential for substantial losses. Some critics argue that its Bitcoin holdings expose the company to significant market fluctuations.

Understanding MicroStrategy's successes and failures with its investments, particularly its significant holdings of MicroStrategy Bitcoin, provides a case study for assessing the risks and rewards involved in this investment strategy. Analyzing its MicroStrategy stock performance in relation to its SPAC investments can offer valuable insight for prospective investors.

Evaluating Potential SPAC Investments (Beyond MicroStrategy)

Before investing in any SPAC, thorough due diligence is paramount. A robust framework for evaluation is crucial to mitigating risks and maximizing potential returns. This involves a careful assessment of the target company, the management team, and the broader market conditions.

- Researching the Target Company: Scrutinize the target company's financials, business model, competitive landscape, and growth prospects. Look for strong fundamentals and a sustainable business plan.

- Analyzing the Management Team: Evaluate the experience, track record, and reputation of the management team. A strong and experienced team increases the likelihood of successful execution.

- Considering Market Conditions: Assess the overall economic climate, market trends, and industry dynamics. Understand how these factors could impact the target company's performance. This includes analyzing the SPAC valuation in relation to its projected future performance.

Conducting comprehensive SPAC due diligence and performing a thorough SPAC risk assessment are crucial steps in mitigating potential losses. Developing a well-defined SPAC investment strategy, including diversification, is essential for managing risk.

The Risks of Investing in SPACs

Investing in SPACs comes with inherent risks, and it’s crucial to be fully aware of them before committing your capital. The lack of historical performance data, combined with the inherent volatility of the market, means that significant losses are a possibility.

- Target Company Failure: The target company may fail to meet expectations, leading to a decline in the SPAC's share price.

- Regulatory Scrutiny: SPACs are increasingly subject to regulatory scrutiny, which could lead to delays, increased costs, or even legal challenges.

- Volatility: SPAC stocks are often highly volatile, experiencing significant price swings in response to news and market conditions. This can lead to substantial losses for investors who lack patience or diversification.

Understanding these SPAC risk factors is critical. The high SPAC volatility underlines the importance of risk management and diversification within your overall investment portfolio.

Conclusion: Should You Invest in a SPAC Stock Similar to MicroStrategy's Strategy?

The SPAC stock surge presents both exciting opportunities and significant risks. MicroStrategy's influence, while notable, highlights the potential for both substantial gains and considerable losses. While the prospect of high returns is tempting, the lack of historical data and inherent volatility necessitate a cautious approach.

Remember, before investing in any SPAC stock, conduct thorough research, carefully analyze the target company, assess the management team, and consider the overall market conditions. Carefully consider your SPAC investments and only invest what you can afford to lose. Understanding the SPAC market and its nuances is critical for informed decision-making. Research before investing in SPAC stocks is not just advisable; it's essential. Understand the potential rewards, but also the risks involved, and only invest if it aligns with your risk tolerance and investment goals.

Featured Posts

-

Glen Powells Bulletproof Transformation For The Running Man

May 08, 2025

Glen Powells Bulletproof Transformation For The Running Man

May 08, 2025 -

Grand Theft Auto Vi Second Trailer Deep Dive Bonnie And Clyde Theme Analysis

May 08, 2025

Grand Theft Auto Vi Second Trailer Deep Dive Bonnie And Clyde Theme Analysis

May 08, 2025 -

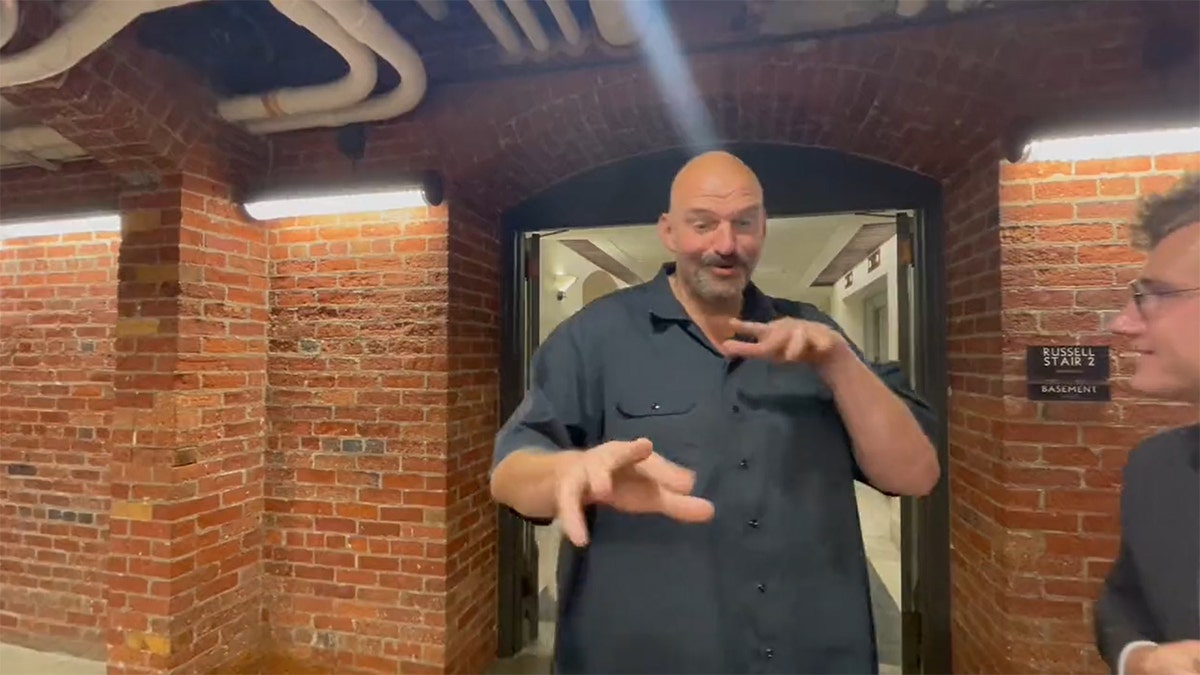

Fettermans Senate Bid Dismissing Fitness Concerns And Vowing To Stay

May 08, 2025

Fettermans Senate Bid Dismissing Fitness Concerns And Vowing To Stay

May 08, 2025 -

El Flamengo Presenta A Sergio Hernandez Como Su Nuevo Entrenador

May 08, 2025

El Flamengo Presenta A Sergio Hernandez Como Su Nuevo Entrenador

May 08, 2025 -

Ukraine Cemetery Corruption The Profiting From Deceased Soldiers Scandal

May 08, 2025

Ukraine Cemetery Corruption The Profiting From Deceased Soldiers Scandal

May 08, 2025