Spotify's Q[Quarter] Subscriber Count Jumps 12%, Outperforming Forecasts (SPOT Stock)

![Spotify's Q[Quarter] Subscriber Count Jumps 12%, Outperforming Forecasts (SPOT Stock) Spotify's Q[Quarter] Subscriber Count Jumps 12%, Outperforming Forecasts (SPOT Stock)](https://hirschfeld-kongress.de/image/spotifys-q-quarter-subscriber-count-jumps-12-outperforming-forecasts-spot-stock.jpeg)

Table of Contents

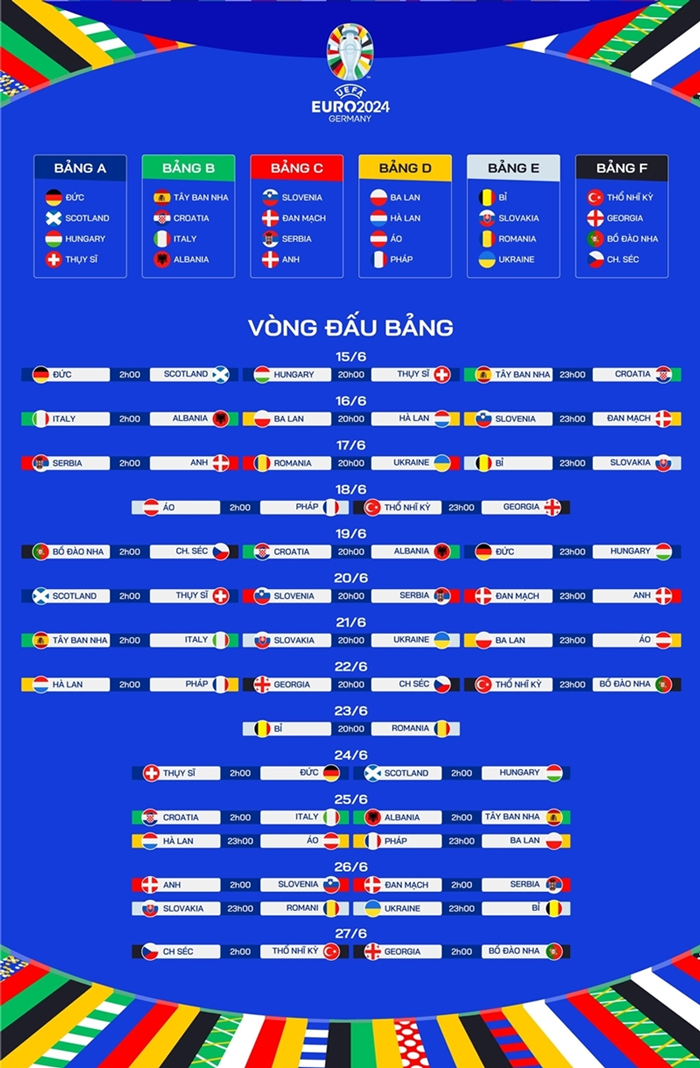

Record Subscriber Growth: Breaking Down the Numbers

Spotify's Q3 results showcased exceptional growth in its premium subscriber base. This key metric is crucial for understanding the company's financial health and future prospects. Let's break down the impressive numbers:

- Premium Subscriber Surge: Spotify added X million premium subscribers in Q3, a substantial increase compared to the previous quarter's Y million. This represents a stunning 12% growth rate.

- Total Premium Subscribers: At the end of Q3, Spotify boasted a total of Z million premium subscribers globally. This demonstrates a significant expansion of its user base and market penetration.

- Monthly Active User (MAU) Growth: The total number of monthly active users (MAUs) also saw a considerable increase, rising by W% to reach A billion users. This signifies a widening reach and engagement with the Spotify platform.

- Geographic Growth Highlights: The strongest growth in premium subscribers was observed in [Region A] and [Region B], indicating successful market penetration strategies in these key areas. This geographic diversification mitigates risk and showcases the global appeal of Spotify's services.

- Growth Initiatives: Several initiatives contributed to this substantial growth. The enhanced user interface (UI), improved recommendation algorithms, and the ongoing expansion of its podcast library were all key factors. The successful integration of new features resulted in enhanced user experience and increased subscriber retention.

Factors Contributing to Spotify's Success

Spotify's Q3 success is not merely a matter of chance; it's a result of several strategic initiatives and favorable market trends. Let's examine the key factors driving this impressive growth:

- Podcast Powerhouse: The growing popularity of podcasts on Spotify continues to be a major driver of user engagement and subscriber acquisition. Exclusive podcast deals and partnerships with high-profile creators have attracted a substantial new audience to the platform.

- Effective Marketing Campaigns: Targeted marketing campaigns and strategic partnerships effectively reached new user demographics and boosted user acquisition. The company's focus on user-centric campaigns has resonated well with target audiences, driving significant growth.

- Competitive Edge: Spotify maintains a clear competitive advantage over rivals like Apple Music and Amazon Music due to its extensive music catalog, compelling podcast offerings, and a user-friendly interface. Continuous improvements in its recommendation system and personalized playlists also enhance user engagement.

- Enhanced User Interface (UI): Improvements in Spotify's user interface and user experience (UX) have contributed significantly to increased user satisfaction and retention. A smoother, more intuitive interface keeps users engaged and encourages them to upgrade to premium plans.

- Exclusive Content: Securing exclusive content deals with artists and podcasters provides a compelling reason for users to choose Spotify over competitors, further fueling subscriber growth.

Impact on SPOT Stock and Investor Sentiment

The impressive Q3 results have had a significant impact on SPOT stock and investor sentiment:

- Stock Price Surge: Following the earnings announcement, SPOT stock experienced a notable price increase, reflecting investor confidence in the company's future growth potential.

- Positive Analyst Reactions: Analysts have largely responded positively to the Q3 earnings report, with several upgrading their ratings and price targets for SPOT stock. This positive sentiment underscores the market's confidence in Spotify's performance.

- Strong Financial Performance: The surge in premium subscribers directly translates to increased subscription revenue and improved profitability, strengthening Spotify's overall financial performance.

- Long-Term Investment Outlook: The consistent growth in subscribers and positive financial indicators suggest a robust long-term outlook for SPOT stock, making it an attractive investment opportunity for many investors. However, investors should also be mindful of potential risks and challenges.

- Potential Risks: While the outlook is positive, investors should acknowledge the competitive nature of the streaming music market. The ongoing need for significant investment in content acquisition and technological innovation poses ongoing challenges for the company.

Conclusion

Spotify's Q3 earnings report showcased exceptional subscriber growth, outperforming expectations and boosting investor confidence. The surge in premium subscribers can be attributed to a confluence of factors, including the platform's expanding podcast library, successful marketing strategies, and a continually improving user experience. This positive momentum has significantly impacted SPOT stock, making it a compelling investment opportunity for many.

Call to Action: Stay informed on Spotify's performance and the ever-evolving streaming music landscape. Keep an eye on future SPOT stock announcements and consider researching further before making any investment decisions related to Spotify and its future growth prospects in the competitive streaming music market. Remember to conduct your own thorough due diligence before investing in SPOT stock or any other security.

![Spotify's Q[Quarter] Subscriber Count Jumps 12%, Outperforming Forecasts (SPOT Stock) Spotify's Q[Quarter] Subscriber Count Jumps 12%, Outperforming Forecasts (SPOT Stock)](https://hirschfeld-kongress.de/image/spotifys-q-quarter-subscriber-count-jumps-12-outperforming-forecasts-spot-stock.jpeg)

Featured Posts

-

Venerdi Santo Riflessioni Sul Messaggio Di Feltri

Apr 30, 2025

Venerdi Santo Riflessioni Sul Messaggio Di Feltri

Apr 30, 2025 -

Xem Lich Thi Dau Vong Chung Ket Thaco Cup 2025 Truc Tiep Tren Kenh Nao

Apr 30, 2025

Xem Lich Thi Dau Vong Chung Ket Thaco Cup 2025 Truc Tiep Tren Kenh Nao

Apr 30, 2025 -

2024 Canadian Election Trumps Views And Their Potential Consequences

Apr 30, 2025

2024 Canadian Election Trumps Views And Their Potential Consequences

Apr 30, 2025 -

Beyonces Absence Blue Ivy And Rumi Shine At The Super Bowl With Jay Z

Apr 30, 2025

Beyonces Absence Blue Ivy And Rumi Shine At The Super Bowl With Jay Z

Apr 30, 2025 -

Trumps First Weeks A Congressional Address

Apr 30, 2025

Trumps First Weeks A Congressional Address

Apr 30, 2025