SSE Announces £3 Billion Reduction In Spending Amidst Economic Slowdown

Table of Contents

Reasons Behind SSE's £3 Billion Spending Cut

The decision to slash £3 billion from its capital expenditure wasn't taken lightly. Several key factors contributed to SSE's strategic shift.

Economic Uncertainty and Inflation

The current economic climate is undeniably challenging. High inflation, rising interest rates, and a general sense of economic uncertainty have made large-scale investments considerably riskier. SSE's move reflects a cautious approach to managing financial resources during this period of volatility.

- Increased borrowing costs: Securing funding for large-scale projects has become more expensive, impacting the feasibility of many planned investments. Higher interest rates directly increase the cost of borrowing, making previously viable projects less attractive.

- Reduced consumer demand: Economic pressures are impacting consumer spending, potentially leading to lower energy demand and affecting price forecasts. This uncertainty makes long-term investment planning more complex.

- Heightened investor scrutiny: Investors are paying closer attention to capital expenditure plans, demanding greater transparency and a stronger focus on profitability in the current economic climate. This increased scrutiny necessitates a more cautious approach to investment.

Focus on Core Business and Profitability

The spending reduction allows SSE to prioritize its core business activities and enhance profitability. This strategic shift involves a more targeted approach to investments, concentrating resources on areas with the highest potential for return.

- Renewable energy focus: Investment in renewable energy sources, crucial for long-term sustainability, remains a priority. However, there's a sharper focus on cost-effectiveness and identifying projects with the most promising ROI (Return on Investment). This will involve careful selection and prioritization.

- Reduced spending on less profitable ventures: Less profitable or speculative projects are being cut to free up capital for higher-yield opportunities. This involves a hard look at the portfolio and prioritizing projects that align with core competencies and offer better prospects.

- Strengthening existing infrastructure: Instead of solely focusing on new developments, SSE is strengthening its existing infrastructure to improve efficiency and reduce operational costs. This is a cost-effective way to enhance performance and generate better returns.

Regulatory Changes and Policy Shifts

Changes in government energy policy and regulatory frameworks have undoubtedly influenced SSE's decision. Navigating evolving regulations requires careful resource allocation and a pragmatic approach to investment planning.

- Uncertainty regarding government support: The level of future government support for renewable energy projects remains uncertain. This uncertainty necessitates a more conservative approach to investment in this area.

- Potential changes to licensing and permitting procedures: Changes in licensing and permitting processes can significantly impact project timelines and costs. A more cautious investment strategy mitigates potential delays and cost overruns.

- Review of existing energy market regulations: The ongoing review of energy market regulations adds another layer of complexity, necessitating a careful assessment of the long-term implications for investment decisions.

Implications of the Spending Cuts for SSE and the Energy Sector

The SSE spending cuts have significant implications, both for the company and the broader energy sector.

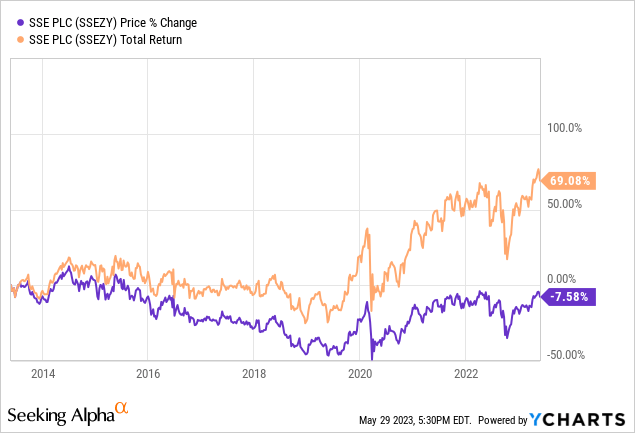

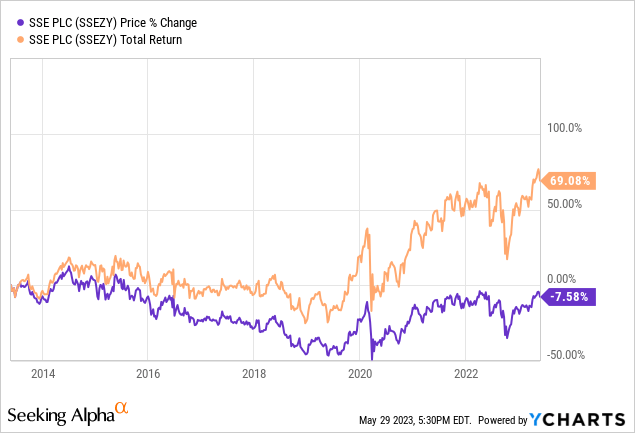

Impact on SSE's Future Growth

The reduced investment could potentially impact SSE's long-term growth trajectory, particularly in renewable energy development. However, it also allows for a more sustainable and financially responsible approach.

- Potential delay in some renewable energy projects: Some renewable energy projects might experience delays as a result of the spending cuts. However, this prioritization ensures a more financially viable approach to long-term investments.

- Increased focus on optimizing existing assets: The company will likely focus more on optimizing existing assets and improving their efficiency, rather than solely on new development.

- Opportunities for strategic acquisitions: The freed-up capital could open up opportunities for strategic acquisitions of smaller, more profitable projects, offering a more targeted growth strategy.

Ripple Effect on the Energy Market

SSE's decision may signal a wider trend within the energy sector, as other companies grapple with economic uncertainty. This could lead to a reassessment of investment strategies across the board.

- Reduced investment in new energy infrastructure: We might see a broader slowdown in investment in new energy infrastructure as companies adopt a more cautious approach.

- Increased competition for funding: Energy companies will face increased competition for funding, making it more challenging to secure capital for new projects.

- Potential impact on job creation: Reduced investment could potentially impact job creation within the energy sector, although this will depend on the nature and scale of projects affected.

SSE's Response and Future Outlook

SSE has publicly stated that the spending cuts are a strategic response to the current economic climate and aim to ensure the long-term financial health and stability of the company. While specific details regarding affected projects haven't been fully disclosed, the company emphasizes its continued commitment to renewable energy and its core business objectives. Analysis suggests that while short-term growth may be impacted, the focus on profitability and efficient resource allocation positions SSE for better long-term sustainability. Their future strategies will likely involve a more rigorous assessment of investment opportunities, a greater emphasis on cost control, and potentially increased partnerships to share risks and resources.

Conclusion

SSE's announcement of a £3 billion reduction in spending underscores the challenges faced by energy companies amidst the current economic downturn. These SSE spending cuts, driven by economic uncertainty, a focus on core profitability, and evolving regulatory landscapes, have significant implications for SSE's future and the broader energy market. While some projects might be delayed, the move towards a more financially responsible and sustainable approach to investment is a crucial strategic response. Understanding the nuances of these SSE spending cuts is vital for anyone tracking the energy sector's future trajectory. Stay informed about further developments concerning SSE spending cuts and their impact on the UK energy landscape.

Featured Posts

-

Burclar Ve Zeka En Yueksek Iq Ya Sahip Burclar

May 23, 2025

Burclar Ve Zeka En Yueksek Iq Ya Sahip Burclar

May 23, 2025 -

Cat Deeleys Stylish Midi Dress From M And S In Stock

May 23, 2025

Cat Deeleys Stylish Midi Dress From M And S In Stock

May 23, 2025 -

Netflixs Siren First Look At Julianne Moore Meghann Fahy And Milly Alcock

May 23, 2025

Netflixs Siren First Look At Julianne Moore Meghann Fahy And Milly Alcock

May 23, 2025 -

Big Rigs Rock 101 Report 3 12 Key Takeaways

May 23, 2025

Big Rigs Rock 101 Report 3 12 Key Takeaways

May 23, 2025 -

Efektivne Gospodaryuvannya Poradi Dlya Tov Z 1 Uchasnikom

May 23, 2025

Efektivne Gospodaryuvannya Poradi Dlya Tov Z 1 Uchasnikom

May 23, 2025

Latest Posts

-

Unmissable Memorial Day Sales And Deals 2025 Shopping Editors Guide

May 23, 2025

Unmissable Memorial Day Sales And Deals 2025 Shopping Editors Guide

May 23, 2025 -

Behind The Scenes Neal Mc Donoughs Bull Riding Video Training

May 23, 2025

Behind The Scenes Neal Mc Donoughs Bull Riding Video Training

May 23, 2025 -

Kevin Pollak Joins Tulsa King Season 3 Trouble For Sylvester Stallone

May 23, 2025

Kevin Pollak Joins Tulsa King Season 3 Trouble For Sylvester Stallone

May 23, 2025 -

2025 Memorial Day Appliance Sales Forbes Vetted Guide

May 23, 2025

2025 Memorial Day Appliance Sales Forbes Vetted Guide

May 23, 2025 -

Memorial Day 2025 Open And Closed Businesses In Michigan

May 23, 2025

Memorial Day 2025 Open And Closed Businesses In Michigan

May 23, 2025