SSE Cuts Spending: £3 Billion Reduction Amidst Economic Slowdown

Table of Contents

Reasons Behind SSE's Spending Cuts

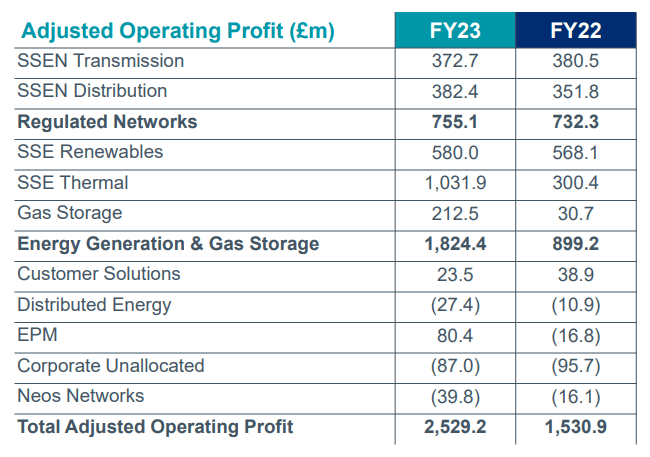

Several interconnected factors have driven SSE's decision to slash its capital expenditure by such a considerable amount.

Economic Slowdown and Inflation

The UK's current economic climate is undeniably a major contributor to the SSE spending cuts. High inflation, coupled with increased interest rates, has squeezed consumer spending, impacting energy demand. This challenging environment has resulted in:

- Increased costs of materials and labor: The rising cost of raw materials and labor significantly increases the cost of energy projects, making them less financially viable.

- Reduced demand from consumers: Higher energy bills and economic uncertainty have led to reduced energy consumption, impacting revenue projections.

- Uncertainty in the energy market: Volatile energy prices and fluctuating demand create significant uncertainty, making long-term investment planning extremely difficult.

- Pressure on profit margins: The combination of rising costs and reduced demand directly impacts profit margins, forcing companies like SSE to re-evaluate their spending plans.

Regulatory Uncertainty and Policy Changes

Beyond the immediate economic pressures, regulatory uncertainty and shifting government policies also play a crucial role in the SSE spending cuts. This uncertainty makes long-term investment planning extremely challenging.

- Shifting government priorities regarding renewable energy investment: Changes in government policy regarding renewable energy subsidies and support schemes can drastically alter the profitability of renewable energy projects.

- Delays in planning permissions for new projects: Lengthy and complex planning processes can significantly delay project timelines, impacting returns on investment.

- Fluctuations in energy prices impacting project viability: Unpredictable energy prices make it difficult to accurately assess the long-term financial viability of energy projects.

Focus on Debt Reduction and Financial Stability

SSE's decision to implement these SSE spending cuts also reflects a strategic focus on strengthening its financial position and reducing debt. This prioritization aims to:

- Maintain investor confidence: Demonstrating a commitment to financial stability is crucial for maintaining investor confidence and attracting future investment.

- Improve credit rating: Reducing debt levels improves the company's credit rating, making it easier to access funding in the future.

- Securing long-term financial stability: The overall goal is to ensure the long-term financial health and sustainability of the company.

Impact of the Spending Cuts on SSE's Future Plans

The £3 billion reduction in capital expenditure will inevitably have far-reaching consequences for SSE's future plans and the wider UK energy landscape.

Renewable Energy Projects

The SSE spending cuts will likely lead to delays or even cancellations of crucial renewable energy projects, potentially hindering the UK's decarbonization goals. This could manifest as:

- Potential delays in wind farm developments: New wind farm projects may experience delays or face outright cancellation.

- Reduced investment in solar and other renewable technologies: Investment in other renewable energy sources, such as solar power, may be scaled back.

- Impact on the UK's renewable energy targets: The reduced investment could make it more difficult for the UK to meet its ambitious renewable energy targets.

Grid Infrastructure Investment

Investments in upgrading and expanding the national grid, crucial for handling increasing renewable energy generation, are also likely to be affected by the SSE spending cuts. This could result in:

- Potential delays in modernizing the electricity network: Essential upgrades to the electricity grid may be postponed.

- Impact on the capacity to handle increasing renewable energy generation: The grid's capacity to handle the influx of renewable energy may be compromised.

- Reduced resilience of the energy system: Delays in grid modernization could negatively impact the overall resilience and stability of the energy system.

Job Security and Employment

The SSE spending cuts could have significant implications for job security within SSE and the wider energy sector. Potential consequences include:

- Potential job losses or hiring freezes: The reduced investment may necessitate job losses or hiring freezes.

- Impacts on the wider supply chain: The reduction in project activity will have knock-on effects throughout the supply chain.

- Potential for reduced investment in training and development: Training and development programs may be scaled back due to budgetary constraints.

Industry-Wide Implications of SSE's Decision

SSE's decision is not an isolated incident; it's likely indicative of a broader trend within the energy sector.

Signaling a Trend

SSE's action may signal a wider trend of reduced spending across the energy sector, creating significant challenges for the UK's energy transition.

- Other energy companies may follow suit, leading to a slowdown in investment: Other energy companies may adopt similar cost-cutting measures, leading to a significant slowdown in much-needed investment.

- Increased pressure on the government to provide support for the energy sector: The industry will likely increase its lobbying efforts to secure government support and financial aid.

- Potential for a wider impact on the UK economy: The reduction in investment will likely have a knock-on effect on the broader UK economy.

Investor Sentiment and Market Reaction

The announcement of the SSE spending cuts will undoubtedly influence investor sentiment and the share prices of SSE and other energy companies.

- Potential for short-term market volatility: The news is likely to cause short-term market volatility as investors react to the announcement.

- Long-term impact on investor confidence in the energy sector: The reduction in investment could negatively impact investor confidence in the long term.

- Potential for increased scrutiny of company finances: Companies will likely face increased scrutiny of their financial performance and future investment plans.

Conclusion

SSE's £3 billion spending cut is a stark response to the challenging economic environment and underscores the pressures facing the UK energy sector. The impact of these SSE spending cuts will be felt across renewable energy projects, grid infrastructure, and employment. This decision could signal a wider industry trend, highlighting the need for a careful review of government support and strategic industry planning. Staying informed about further developments regarding SSE spending cuts and their implications is crucial for understanding the future of the UK's energy landscape. Keep up-to-date on the latest news regarding SSE spending cuts and their impact on the energy market.

Featured Posts

-

Wordle 1358 Answer And Clues For Saturday March 8th

May 22, 2025

Wordle 1358 Answer And Clues For Saturday March 8th

May 22, 2025 -

Liga Natsiy U Ye Fa 2025 Rezultati Ta Rozklad Matchiv Na 20 03 2025

May 22, 2025

Liga Natsiy U Ye Fa 2025 Rezultati Ta Rozklad Matchiv Na 20 03 2025

May 22, 2025 -

Phan Tich Chi Phi Va Loi Ich Xay Dung Cau Ma Da Tai Dong Nai

May 22, 2025

Phan Tich Chi Phi Va Loi Ich Xay Dung Cau Ma Da Tai Dong Nai

May 22, 2025 -

Adam Ramey Dead At 31 Dropout Kings Singer Passes Away

May 22, 2025

Adam Ramey Dead At 31 Dropout Kings Singer Passes Away

May 22, 2025 -

The Swiss Governments Reaction To Chinas Military Exercises

May 22, 2025

The Swiss Governments Reaction To Chinas Military Exercises

May 22, 2025

Latest Posts

-

Crafting Compelling Briefs A Step By Step Process

May 22, 2025

Crafting Compelling Briefs A Step By Step Process

May 22, 2025 -

How To Write Winning Briefs Strategies For Persuasive Communication

May 22, 2025

How To Write Winning Briefs Strategies For Persuasive Communication

May 22, 2025 -

Effective Brief Writing Tips And Techniques For Success

May 22, 2025

Effective Brief Writing Tips And Techniques For Success

May 22, 2025 -

Understanding Different Types Of Briefs A Practical Guide

May 22, 2025

Understanding Different Types Of Briefs A Practical Guide

May 22, 2025 -

How To Buy Tickets For Metallica At Hampden Park Glasgow

May 22, 2025

How To Buy Tickets For Metallica At Hampden Park Glasgow

May 22, 2025