SSE Growth Slowdown Leads To £3 Billion Spending Reduction

Table of Contents

H2: Reasons Behind SSE's Spending Reduction

SSE's decision to slash £3 billion from its five-year investment plan stems from a confluence of factors impacting the energy market. These include a slowdown in growth, regulatory changes, and increasing economic uncertainty.

-

Slower-than-anticipated growth in customer demand for electricity and gas: The post-pandemic economic recovery hasn't translated into the expected surge in energy consumption, impacting SSE's projected revenue streams. This reduced demand, coupled with increased competition, has forced a reassessment of investment priorities.

-

Increased inflationary pressures and rising costs of materials and labour: Soaring inflation has significantly increased the cost of materials and labour, making many energy projects less financially viable. The rising cost of steel, concrete, and skilled workers directly impacts the bottom line of large-scale infrastructure projects like wind farms and power plants.

-

Uncertainty surrounding future government energy policies and regulatory frameworks: The UK government's evolving energy policies and the uncertainty surrounding future regulatory frameworks create an environment of investment risk. Companies like SSE need clear and consistent policies to justify large-scale, long-term investments.

-

Challenges in securing sufficient returns on investment in renewable energy projects: While the transition to renewable energy is crucial, the investment cycle is long, and securing adequate returns in a volatile market presents significant challenges. The complexities of securing planning permissions and grid connections add further delays and cost increases.

-

Volatility in the energy market making long-term investment planning more complex: The unpredictable nature of global energy markets, influenced by geopolitical events and fluctuating energy prices, makes long-term investment planning incredibly difficult. This uncertainty forces energy companies to adopt a more cautious approach to spending.

H2: Impact on SSE's Renewable Energy Investments

The spending reduction will undoubtedly impact SSE's ambitious renewable energy portfolio. This could lead to:

-

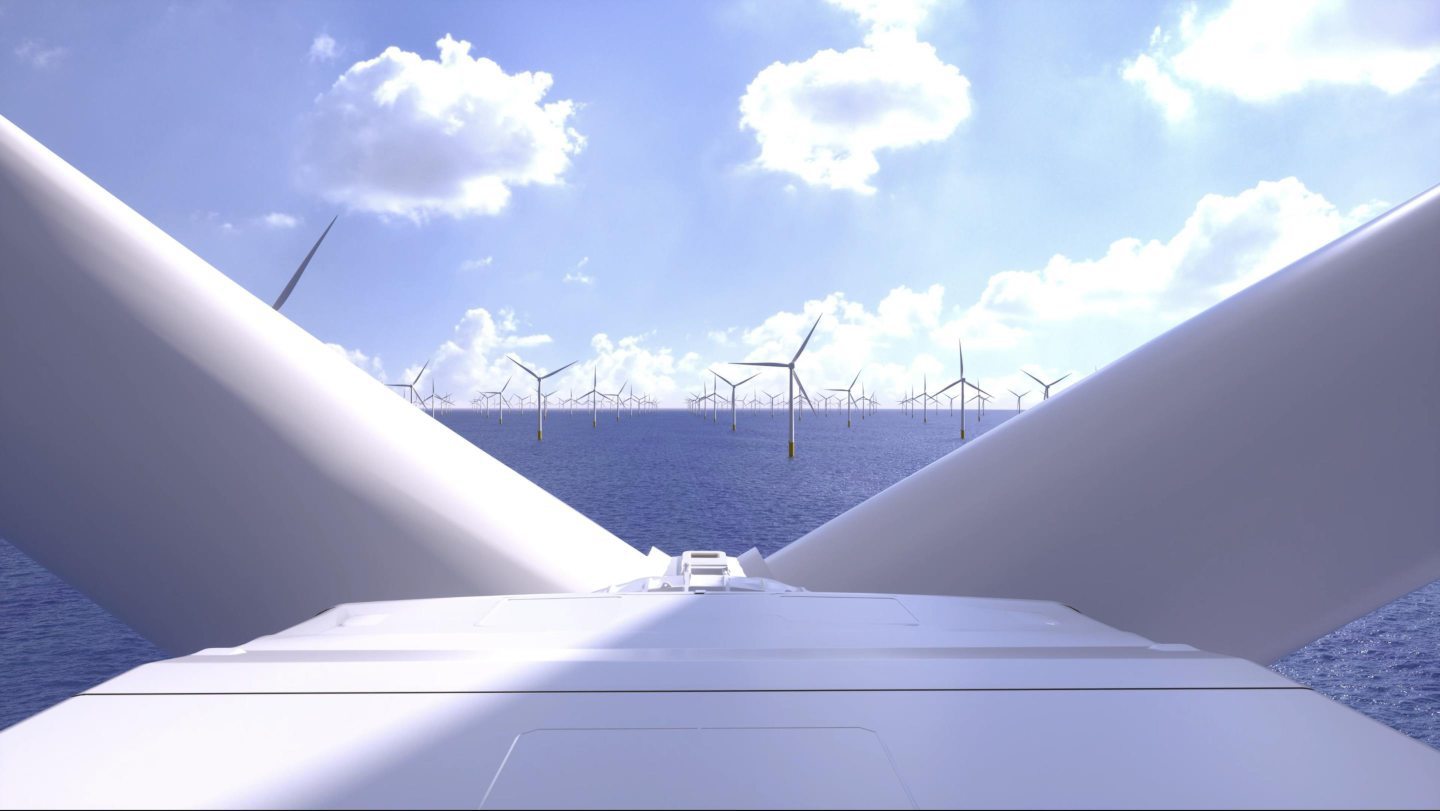

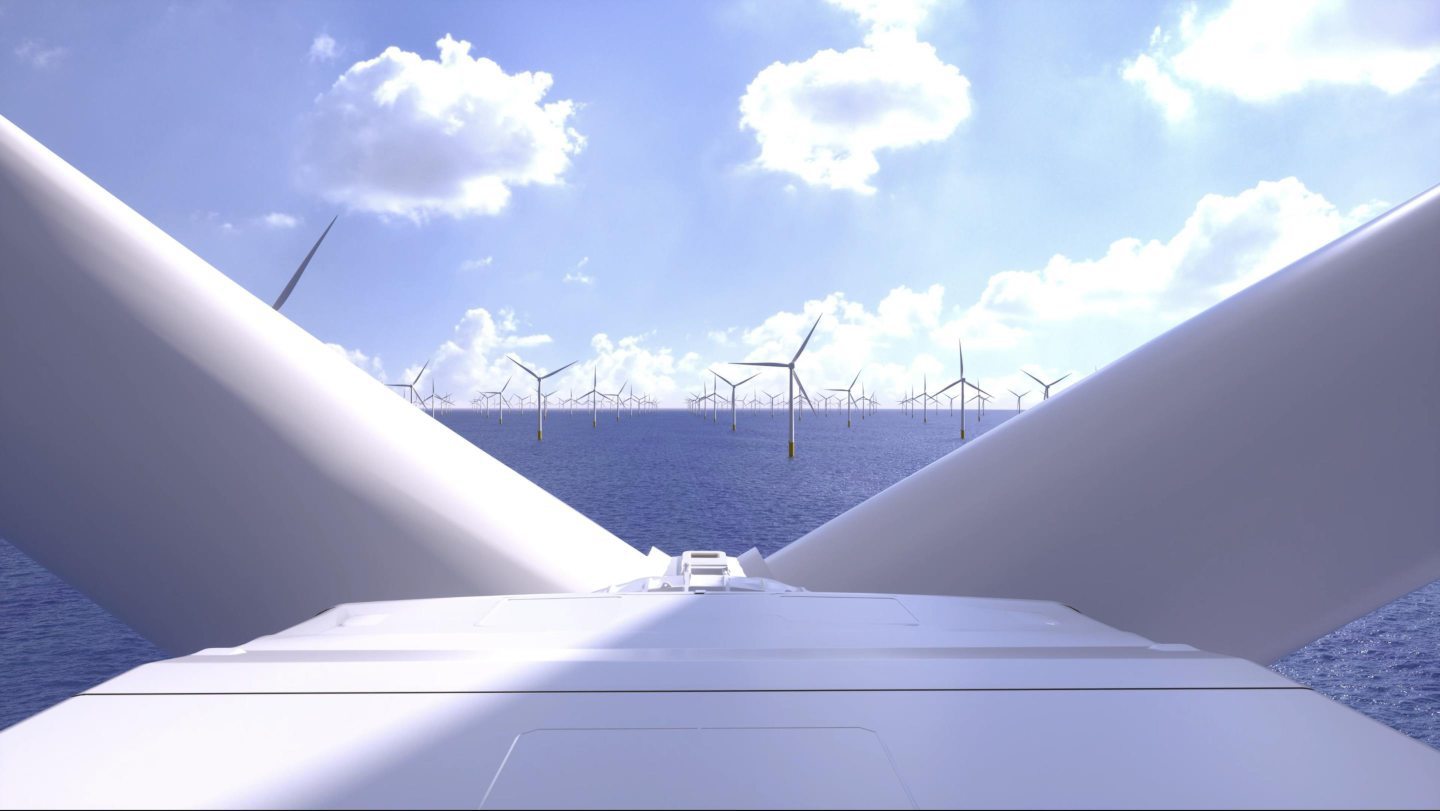

Specific renewable energy projects that may face delays or cancellations: Projects like the planned expansion of offshore wind farms or new solar power initiatives might face delays or even complete cancellation due to the reduced budget. This uncertainty creates ripple effects within the supply chain and for the companies involved in these projects.

-

The potential impact on the UK's renewable energy targets and the transition to a low-carbon economy: SSE's reduced investment could hinder the UK's progress towards its ambitious renewable energy targets. Delayed or cancelled projects mean slower decarbonization and a potential setback in the fight against climate change.

-

Analysis of the financial implications for SSE's renewable energy portfolio: The financial implications are significant. The reduction in spending could result in lower returns for investors and a potential decrease in SSE's market valuation. This reduced investment will impact the long-term financial health of the company and its ability to contribute to the energy transition.

-

Discussion of alternative financing options that SSE might explore: To mitigate the impact, SSE may need to explore alternative financing options, such as attracting private investment or seeking government subsidies. This will depend on the government's willingness to support the energy sector during this period of uncertainty.

H2: Wider Implications for the Energy Sector

SSE's decision has far-reaching consequences for the entire UK energy sector.

-

Potential knock-on effects for other energy companies and their investment plans: SSE's move might trigger a wave of similar decisions by other energy companies, leading to a broad slowdown in investment across the sector. This lack of investment would hinder development in the renewable energy and wider energy infrastructure sector.

-

The impact on competition within the energy market: Reduced investment could lead to less competition, potentially resulting in higher prices for consumers. A less dynamic market could also slow the pace of innovation and improvement within the industry.

-

Potential job losses within SSE and the wider supply chain: The spending cuts are likely to lead to job losses, not only within SSE itself but also within the wider supply chain of companies reliant on SSE's projects. This could have a significant impact on employment in related industries and local economies.

-

Analysis of the potential impact on energy prices for consumers: While the immediate impact on energy prices is difficult to predict, reduced investment in infrastructure and supply could eventually lead to higher energy costs for UK consumers.

H3: Government Response and Future Outlook

The government's response to SSE's announcement will be crucial. It needs to consider implementing policies that encourage investment in the energy sector, such as:

-

Targeted investment incentives: Tax breaks or subsidies for renewable energy projects could encourage companies to invest despite market uncertainties.

-

Regulatory reform: Streamlining the planning process and ensuring a clearer regulatory framework would reduce risk and attract more investment.

-

Long-term energy strategy: A clear and consistent long-term energy strategy that provides long-term vision for the industry would instill investor confidence and encourage much-needed investment.

3. Conclusion

SSE's £3 billion spending reduction reflects a challenging environment for the UK energy sector. A slowdown in growth, rising costs, and policy uncertainty have combined to create a climate of investment hesitancy. This decision will significantly impact renewable energy development, sector competition, and potentially consumer energy prices. The government must act decisively to create a supportive environment that encourages long-term investment in the UK energy sector and ensures a secure and sustainable energy future. Stay informed about the evolving situation and its impact on the UK energy market by regularly visiting our website for updates on SSE's performance and the latest developments in the energy sector.

Featured Posts

-

Porsche 956 Nin Tavan Sergisi Teknik Aciklamalar

May 25, 2025

Porsche 956 Nin Tavan Sergisi Teknik Aciklamalar

May 25, 2025 -

Shooting At Popular Southern Vacation Spot Prompts Safety Review

May 25, 2025

Shooting At Popular Southern Vacation Spot Prompts Safety Review

May 25, 2025 -

Frankfurt Stock Market Update Dax Climbs Record High In Sight

May 25, 2025

Frankfurt Stock Market Update Dax Climbs Record High In Sight

May 25, 2025 -

Annie Kilners Solo Outing After Kyle Walkers Night With Mystery Women

May 25, 2025

Annie Kilners Solo Outing After Kyle Walkers Night With Mystery Women

May 25, 2025 -

Demna At Gucci Analyzing The Creative Director Change

May 25, 2025

Demna At Gucci Analyzing The Creative Director Change

May 25, 2025

Latest Posts

-

Canli Izle Atletico Madrid Barcelona Macinin Heyecani Fanatik Te

May 25, 2025

Canli Izle Atletico Madrid Barcelona Macinin Heyecani Fanatik Te

May 25, 2025 -

Atletico Madrid Barcelona Maci Canli Izle Fanatik Gazetesi Nden Anlik Guencellemeler

May 25, 2025

Atletico Madrid Barcelona Maci Canli Izle Fanatik Gazetesi Nden Anlik Guencellemeler

May 25, 2025 -

Atletico Madrid In Zaferi 3 Maclik Durgunluk Asildi

May 25, 2025

Atletico Madrid In Zaferi 3 Maclik Durgunluk Asildi

May 25, 2025 -

3 Maclik Bekleyis Sonlandi Atletico Madrid Kazandi

May 25, 2025

3 Maclik Bekleyis Sonlandi Atletico Madrid Kazandi

May 25, 2025 -

Atletico Madrid 3 Maclik Korkulu Film Son Buldu

May 25, 2025

Atletico Madrid 3 Maclik Korkulu Film Son Buldu

May 25, 2025