SSE's £3 Billion Spending Cut: A Response To Slowing Economic Growth

Table of Contents

H2: The Reasons Behind the £3 Billion Spending Reduction

The £3 billion spending reduction reflects SSE's response to a confluence of significant economic headwinds. The company's decision isn't isolated; it mirrors a wider trend within the energy sector as companies grapple with the economic downturn. Several key factors contributed to this strategic move:

-

Rising Inflation and Interest Rates: Soaring inflation and subsequent interest rate hikes have dramatically increased borrowing costs for large-scale infrastructure projects. This makes financing new renewable energy initiatives and grid upgrades significantly more expensive, impacting the overall financial viability of such ventures. The increased cost of capital directly impacts the return on investment (ROI) calculations, making projects less attractive.

-

Energy Market Volatility: The energy market has experienced unprecedented volatility in recent years, driven by geopolitical instability and fluctuating demand. This uncertainty makes long-term investment planning considerably riskier, prompting companies like SSE to adopt a more cautious approach to capital expenditure. The unpredictability makes it challenging to accurately forecast future energy prices and revenues, hindering sound investment decisions.

-

Regulatory Changes: Shifting government regulations and policies concerning energy production and distribution add another layer of complexity. Changes in environmental regulations, licensing processes, and subsidy schemes create uncertainty and can delay or even derail major projects, further contributing to the need for cost-cutting measures. This necessitates a more thorough and potentially time-consuming regulatory review before commencing any new initiatives.

-

Concerns about Return on Investment: The combination of increased costs, market volatility, and regulatory uncertainty has significantly impacted the perceived return on investment for many large-scale energy projects. SSE's decision to reduce spending reflects a strategic recalibration to focus on projects with a higher probability of success and a quicker return. This prioritization ensures the company's long-term financial stability amidst the current economic climate.

H2: Impact on SSE's Future Investments and Projects

The £3 billion spending cut will inevitably impact SSE's future investment plans and ongoing projects. While the company hasn't specified every project affected, the consequences are likely to be wide-ranging:

-

Delays in Renewable Energy Projects: Several renewable energy projects, including wind and solar farms, are expected to face delays or potential cancellations. This could slow the UK's transition towards cleaner energy sources and potentially impact the country's renewable energy targets.

-

Reduced Investment in Grid Upgrades: The reduction in spending will likely translate into reduced investment in upgrading and modernizing the electricity grid infrastructure. This could potentially lead to increased pressure on the existing network and hinder the integration of new renewable energy sources into the national grid. The lack of sufficient grid capacity could bottleneck renewable energy generation.

-

Potential Job Losses: The scaling back of projects could unfortunately lead to job losses within SSE and in associated industries, impacting employment across the wider economy. This could have a wider economic impact beyond just the energy sector.

H2: Analysis of the Financial Implications for SSE and its Stakeholders

The financial implications of the £3 billion spending cut are multifaceted and will affect various stakeholders:

-

Share Price Impact: The announcement is likely to cause short-term fluctuations in SSE's share price as investors assess the long-term consequences of the cost-cutting measures. Market sentiment will play a crucial role in determining the actual impact.

-

Profit Margins: In the short term, the reduced investment may lead to lower profit margins as revenue streams from new projects are delayed. However, this cost-cutting may enhance long-term profitability by focusing resources on more viable ventures.

-

Dividend Payments: The financial impact may also necessitate a review of dividend payments to shareholders, potentially leading to adjustments in dividend payouts. This will depend on the overall financial performance and strategic priorities of the company.

-

Credit Rating: Credit rating agencies will closely scrutinize the impact of the spending cut on SSE's financial stability, potentially affecting its credit rating. Maintaining a strong credit rating is vital for securing future financing.

-

Investor Confidence: The spending reduction could impact investor confidence, particularly in the short term. However, a well-communicated strategy focused on long-term financial stability can help mitigate negative effects and maintain investor trust.

H2: Comparison with Other Energy Companies' Responses

SSE's response to the economic slowdown is not unique. Many other energy companies are implementing similar cost-cutting measures to navigate the challenging economic landscape. The current trend across the sector suggests a widespread adoption of cost optimization strategies, including:

-

Project Delays and Cancellations: Several energy companies globally are delaying or canceling large-scale energy projects due to increased costs and financial uncertainty.

-

Focus on Core Businesses: Many energy companies are focusing their resources and investments on their core businesses and most profitable assets to ensure financial stability.

-

Operational Efficiency Improvements: There's a greater emphasis on improving operational efficiency and streamlining processes to reduce costs and enhance profitability.

Conclusion:

SSE's £3 billion spending cut represents a significant response to the current economic slowdown and its impact on the energy sector. Rising inflation, interest rates, market volatility, and regulatory changes have collectively contributed to this decision. While the reduction in spending will undoubtedly impact future projects and stakeholders, it also reflects a necessary strategic recalibration to navigate the challenging economic climate and ensure the long-term financial stability of the company. The implications for the energy sector are broad, signaling a more cautious and strategic approach to investments amidst uncertainty. Learn more about the impact of SSE's spending reduction and the future of the energy sector by visiting SSE's official website or following reputable financial news sources for further updates.

Featured Posts

-

Impact Of Sses 3 Billion Spending Cut On Energy Investments And Jobs

May 23, 2025

Impact Of Sses 3 Billion Spending Cut On Energy Investments And Jobs

May 23, 2025 -

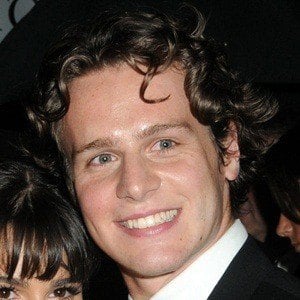

Jonathan Groff Could Little Shop Of Horrors Lead To A Historic Tony Win

May 23, 2025

Jonathan Groff Could Little Shop Of Horrors Lead To A Historic Tony Win

May 23, 2025 -

Jony Ives Ai Company Potential Open Ai Acquisition

May 23, 2025

Jony Ives Ai Company Potential Open Ai Acquisition

May 23, 2025 -

Vybz Kartel Breaks Silence Prison Family And Future Music Plans

May 23, 2025

Vybz Kartel Breaks Silence Prison Family And Future Music Plans

May 23, 2025 -

Stam Slams Ten Hags Expensive Man United Gamble Years Of Setback

May 23, 2025

Stam Slams Ten Hags Expensive Man United Gamble Years Of Setback

May 23, 2025

Latest Posts

-

Jonathan Groffs Just In Time Photos From The Star Studded Opening Night

May 23, 2025

Jonathan Groffs Just In Time Photos From The Star Studded Opening Night

May 23, 2025 -

Etoile A Spring Awakening Reunion For Gideon Glick And Jonathan Groff

May 23, 2025

Etoile A Spring Awakening Reunion For Gideon Glick And Jonathan Groff

May 23, 2025 -

Gideon Glick And Jonathan Groffs Etoile Reunion A Hilarious Spring Awakening Callback

May 23, 2025

Gideon Glick And Jonathan Groffs Etoile Reunion A Hilarious Spring Awakening Callback

May 23, 2025 -

Jonathan Groffs Show Name Photos From The Opening Night Celebration

May 23, 2025

Jonathan Groffs Show Name Photos From The Opening Night Celebration

May 23, 2025 -

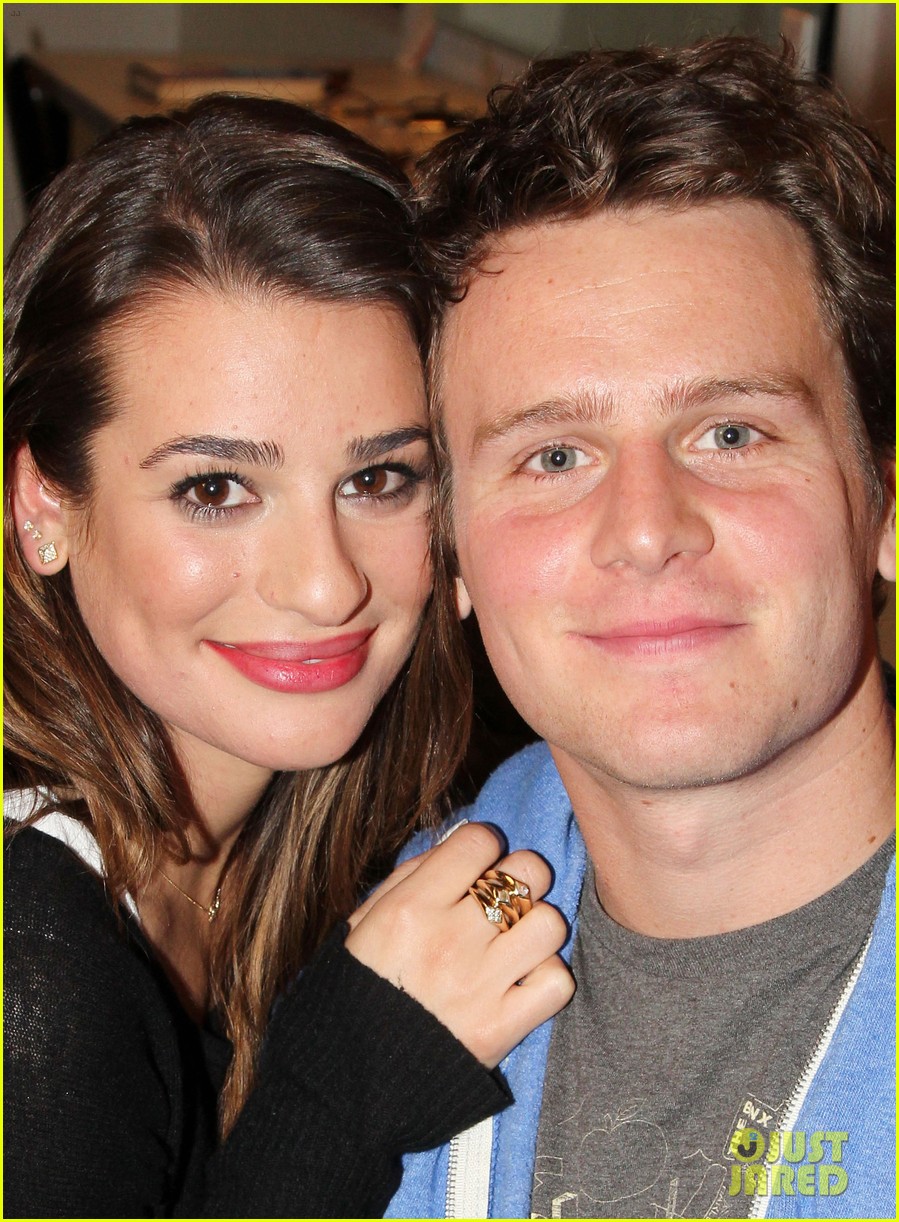

Jonathan Groffs Just In Time A Night Of Celebration With Lea Michele And Friends

May 23, 2025

Jonathan Groffs Just In Time A Night Of Celebration With Lea Michele And Friends

May 23, 2025