SSE's Response To Slowing Growth: A £3 Billion Spending Cut

Table of Contents

The Rationale Behind SSE's Cost-Cutting Measures

SSE's £3 billion spending cut is a direct response to the current economic climate. Slowing growth has reduced energy demand, impacting revenue projections and making large-scale investments riskier. The energy industry, already grappling with rising inflation and volatile energy prices, faces increased regulatory pressure to maintain affordability for consumers. This creates a squeeze on profit margins, forcing companies like SSE to reassess their spending priorities.

The decision reflects a multi-faceted challenge:

- Reduced energy demand: A slowing economy translates to lower energy consumption, impacting revenue streams for energy providers.

- Increased inflation and material costs: The rising cost of materials and labour significantly increases project budgets, making planned investments less viable.

- Pressure to maintain investor confidence and profitability: SSE, like all publicly traded companies, needs to demonstrate financial stability and a clear path to profitability to maintain investor confidence.

- Focus on operational efficiency and cost optimization: Streamlining operations and identifying areas for cost reduction are crucial for navigating the current economic headwinds.

Impact of the £3 Billion Spending Cut on SSE's Projects and Investments

The £3 billion reduction will inevitably impact SSE's investment portfolio. Specific areas affected include:

- Reduced investment in renewable energy infrastructure: Projects related to wind and solar power generation may face delays or cancellations, impacting SSE's renewable energy targets.

- Potential delays in grid modernization and network upgrades: Essential upgrades to the electricity grid, crucial for supporting the transition to renewable energy, may be postponed.

- Impact on job creation and regional economic development: Reduced investment may lead to fewer job opportunities and slower economic growth in regions where SSE operates.

- Review of existing projects to identify areas for cost savings: SSE will likely scrutinize existing projects to identify potential cost-saving measures without compromising safety and quality.

SSE's Strategic Response and Future Outlook

In response to the challenging economic climate, SSE is shifting its strategic priorities. This includes:

- Increased focus on operational efficiency and cost reduction initiatives: Improving internal processes and reducing operational expenses are critical for maintaining profitability.

- Exploration of new revenue streams and diversification opportunities: SSE is likely exploring new business models and diversifying its revenue sources to reduce reliance on traditional energy generation.

- Emphasis on sustainable and responsible energy practices: While some renewable energy projects might be delayed, SSE will likely maintain its commitment to sustainable energy practices.

- Potential partnerships and collaborations to mitigate financial risks: Collaborations and strategic partnerships might help share risks and leverage resources more effectively.

Market Reaction and Investor Sentiment

The announcement of SSE's £3 billion spending cut has garnered significant attention from investors and industry analysts. The initial market reaction was largely seen as cautious, with some analysts expressing concerns about the potential impact on long-term growth. However, others viewed the cost-cutting measures as a necessary step to navigate the current economic uncertainty and maintain financial stability. The long-term impact on SSE's stock price and investor confidence will depend on the company's success in implementing its revised strategy and navigating the challenging market conditions. This will also be measured against the actions of other energy companies responding to similar economic pressures.

Understanding the Implications of SSE's £3 Billion Spending Cut

SSE's £3 billion spending cut represents a significant strategic response to slowing economic growth and a volatile energy market. The decision, driven by reduced energy demand, rising inflation, and pressure to maintain profitability, will impact renewable energy projects, grid modernization, and potentially job creation. However, SSE's revised strategic focus on operational efficiency, diversification, and sustainable practices indicates a commitment to navigating these challenges and securing long-term success. To understand the full implications of this decision and SSE's future trajectory, stay informed about the evolving situation by following our updates on SSE's strategic response and the wider implications of its £3 billion spending cut.

Featured Posts

-

Best Outdoor Restaurants Manhattan Your Guide To Alfresco Dining

May 22, 2025

Best Outdoor Restaurants Manhattan Your Guide To Alfresco Dining

May 22, 2025 -

Addressing Tariff Barriers Switzerland And Chinas Collaborative Approach

May 22, 2025

Addressing Tariff Barriers Switzerland And Chinas Collaborative Approach

May 22, 2025 -

Vanja Mijatovic Promenila Ime Detalji O Promeni Imena

May 22, 2025

Vanja Mijatovic Promenila Ime Detalji O Promeni Imena

May 22, 2025 -

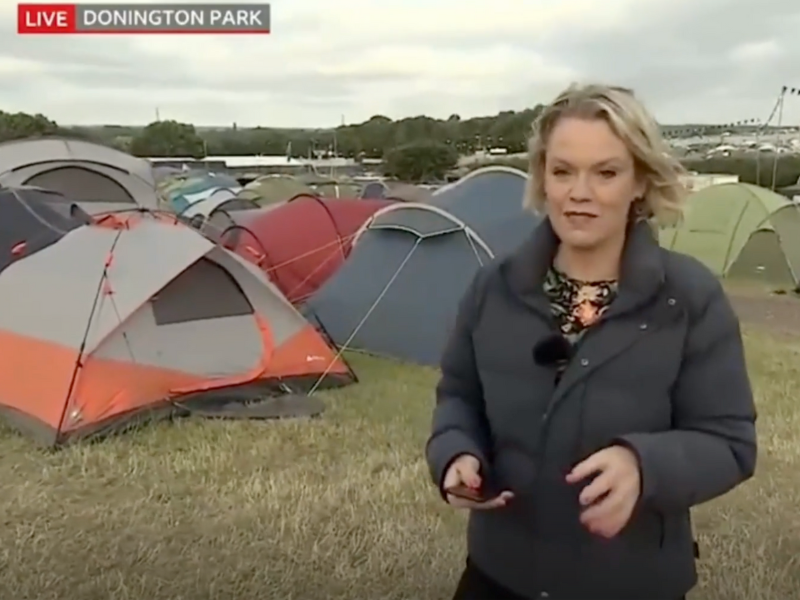

Unexpected Moment Guest Interrupts Bbc Breakfast Live

May 22, 2025

Unexpected Moment Guest Interrupts Bbc Breakfast Live

May 22, 2025 -

Gumballs Weird World A New Chapter

May 22, 2025

Gumballs Weird World A New Chapter

May 22, 2025

Latest Posts

-

Casper Residents Shocking Zebra Mussel Discovery Thousands Found On New Boat Lift

May 22, 2025

Casper Residents Shocking Zebra Mussel Discovery Thousands Found On New Boat Lift

May 22, 2025 -

Thousands Of Zebra Mussels Found On Casper Boat Lift

May 22, 2025

Thousands Of Zebra Mussels Found On Casper Boat Lift

May 22, 2025 -

Large Zebra Mussel Population Found On Casper Boat Lift A Case Study

May 22, 2025

Large Zebra Mussel Population Found On Casper Boat Lift A Case Study

May 22, 2025 -

Unexpected Zebra Mussel Discovery On Casper Boat Lift

May 22, 2025

Unexpected Zebra Mussel Discovery On Casper Boat Lift

May 22, 2025 -

Zebra Mussel Problem Casper Resident Discovers Large Infestation On Boat Lift

May 22, 2025

Zebra Mussel Problem Casper Resident Discovers Large Infestation On Boat Lift

May 22, 2025