SSE's Revised Spending Plan: £3 Billion Less Amidst Growth Concerns

Table of Contents

The Reasons Behind the £3 Billion Reduction in SSE's Spending Plan

The decision to cut £3 billion from SSE's investment plans stems from a confluence of factors, primarily driven by the challenging macroeconomic climate and evolving energy market dynamics.

Economic Headwinds and Inflationary Pressures

The UK, like much of the world, is grappling with significant inflationary pressures and rising interest rates. These economic headwinds have directly impacted SSE's investment calculus.

- Soaring Inflation: The UK's inflation rate has reached double digits, significantly increasing the cost of materials, labor, and other resources crucial for energy projects. This has made many previously viable projects financially unfeasible.

- Increased Interest Rates: Higher interest rates increase the cost of borrowing, making it more expensive for SSE to finance large-scale infrastructure projects. This has forced a reassessment of the return on investment for many planned initiatives.

- Recessionary Fears: The looming threat of a recession further dampens investor confidence and increases the perceived risk associated with large-scale energy investments. This uncertainty has prompted SSE to adopt a more cautious approach to spending.

For example, the increased cost of steel and other construction materials, coupled with higher labor costs, has significantly inflated the projected budgets for several of SSE's renewable energy projects.

Shifting Energy Market Dynamics and Renewable Energy Focus

The energy market itself is undergoing a period of rapid transformation. While the commitment to renewable energy remains strong, the path to achieving net-zero targets is becoming more complex.

- Supply Chain Disruptions: Global supply chain issues continue to impact the availability and cost of key components for renewable energy projects, impacting project timelines and budgets.

- Policy Uncertainty: Changes in government policy regarding renewable energy incentives and regulations can also impact investment decisions. This uncertainty necessitates a more flexible approach to long-term investment strategies.

- Prioritizing Renewable Energy: Despite the reduction, SSE remains committed to its renewable energy goals, but the revised plan reflects a prioritization of the most financially viable and strategically important projects within this sector. This may involve delaying or scaling back some less critical projects.

Investor Sentiment and Risk Mitigation

The revised spending plan also reflects a response to evolving investor sentiment and a proactive strategy for risk mitigation.

- Reduced Investor Confidence: Concerns about the economic outlook and the potential impact on energy sector profitability have led to a reduction in investor confidence. SSE's decision to cut spending is, in part, a response to these concerns.

- Risk Aversion: In a period of economic uncertainty, risk aversion is a natural response. Reducing spending allows SSE to strengthen its balance sheet and preserve financial flexibility in the face of potential future challenges.

- Executive Statements: SSE's leadership has publicly acknowledged the economic headwinds and emphasized the need for a more prudent approach to investment, highlighting the importance of financial stability in navigating the current market conditions.

Impact of the Revised Spending Plan on SSE's Operations and Future Growth

The £3 billion reduction in SSE's spending plan will have significant short-term and long-term implications for the company and the wider energy sector.

Short-Term Implications

- Project Delays: Some renewable energy projects may experience delays or be scaled back, potentially impacting the UK's overall renewable energy targets.

- Job Creation Impacts: The revised plan could lead to a slowdown in job creation within SSE and its supply chain.

- Short-Term Profitability: While the reduction in spending might improve short-term profitability, the long-term consequences on growth and market share need careful consideration.

Long-Term Implications

- Renewable Energy Targets: Achieving SSE's long-term renewable energy targets may be challenged, potentially requiring a reassessment of the timelines and strategies.

- UK Energy Transition: The impact on the UK's broader energy transition goals needs to be assessed; delays in renewable energy projects could hinder the country's progress toward net-zero emissions.

- Future Investment: The company's ability to resume a higher level of investment will depend on the future economic climate and investor confidence. A recovery in economic conditions will be crucial for unlocking future growth.

Analysis of SSE's Revised Spending Plan and Future Outlook

Understanding the implications of SSE's revised spending plan requires a broader perspective, considering competitive dynamics, expert opinions, and alternative strategies.

Competitive Analysis

SSE's response to the current economic climate can be compared to that of its competitors in the UK energy sector. While other companies may have adopted similar cost-cutting measures, the scale of SSE's reduction reflects the company's specific circumstances and strategic priorities.

Expert Opinions

Energy analysts and experts have offered a variety of opinions on SSE's revised plan. Some view the reduction as a necessary and prudent measure in the face of economic uncertainty, while others express concerns about the potential impact on long-term growth and the UK's energy transition goals. These varying perspectives highlight the complexity of the situation.

Potential Alternatives

While the £3 billion reduction may seem drastic, exploring alternative strategies is crucial. This could include focusing on securing more favorable financing terms, seeking government support for crucial projects, or prioritizing projects with quicker returns on investment.

Analyzing SSE's Revised £3 Billion Spending Plan: Looking Ahead

SSE's decision to slash its spending by £3 billion reflects a response to the challenging macroeconomic climate, shifting energy market dynamics, and evolving investor sentiment. The short-term implications may include project delays and reduced job creation, while the long-term effects could impact the achievement of renewable energy targets and the UK's energy transition goals. The success of this revised strategy hinges on future economic conditions and SSE's ability to adapt to the evolving energy landscape. Careful monitoring of SSE's progress and financial performance is crucial in assessing the overall impact of this significant investment adjustment. Stay informed on the latest developments regarding SSE's revised spending plan and its impact on the energy sector by subscribing to our newsletter.

Featured Posts

-

Roger Daltreys Deteriorating Health Facing Blindness And Deafness

May 23, 2025

Roger Daltreys Deteriorating Health Facing Blindness And Deafness

May 23, 2025 -

Grand Ole Oprys Centennial Celebration A London Spectacle

May 23, 2025

Grand Ole Oprys Centennial Celebration A London Spectacle

May 23, 2025 -

Sorteo Cb Gran Canaria Unicaja Conoce A Los Ganadores De Las 23 Entradas Dobles

May 23, 2025

Sorteo Cb Gran Canaria Unicaja Conoce A Los Ganadores De Las 23 Entradas Dobles

May 23, 2025 -

The Karate Kid Techniques Training And The Miyagi Do Philosophy

May 23, 2025

The Karate Kid Techniques Training And The Miyagi Do Philosophy

May 23, 2025 -

Ai Powered Podcast Creation From Repetitive Documents To Engaging Content

May 23, 2025

Ai Powered Podcast Creation From Repetitive Documents To Engaging Content

May 23, 2025

Latest Posts

-

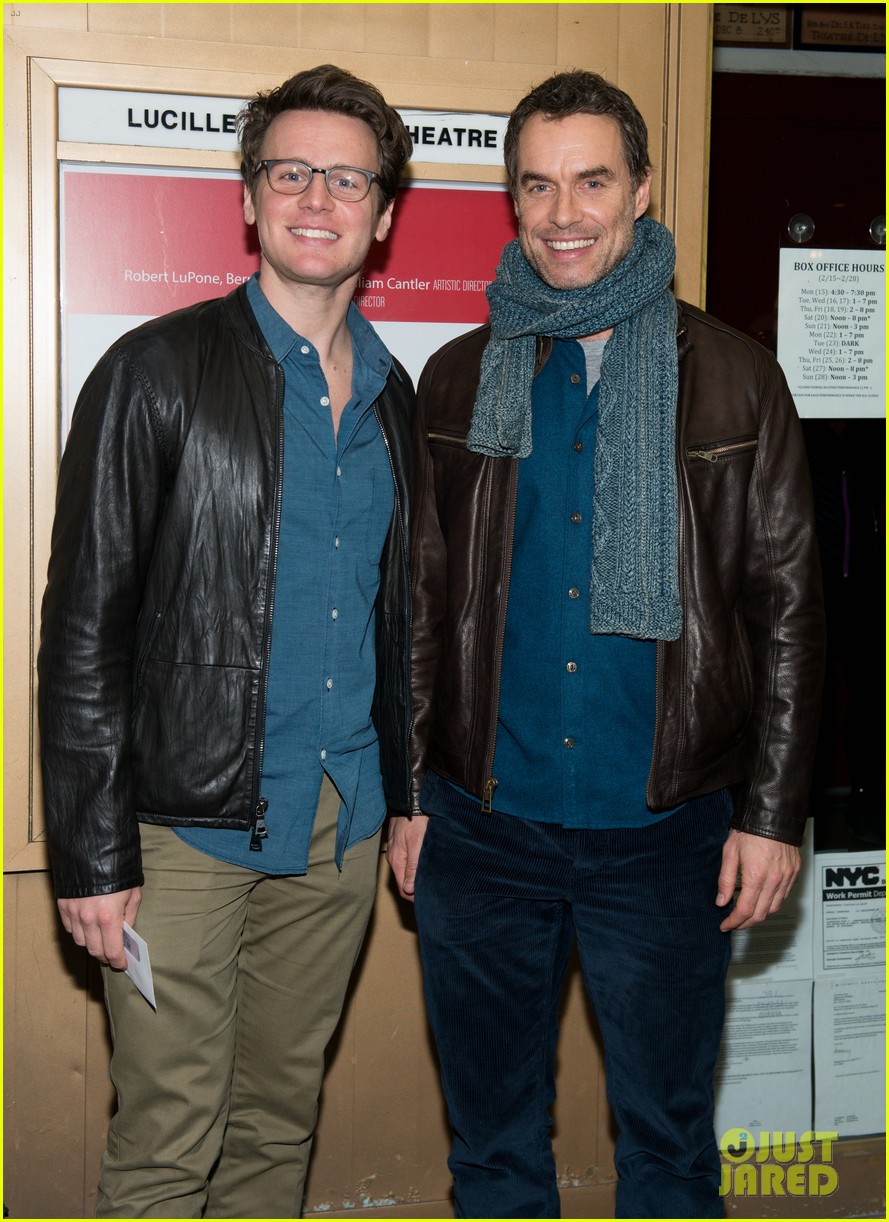

Jonathan Groffs Show Name Photos From The Opening Night Celebration

May 23, 2025

Jonathan Groffs Show Name Photos From The Opening Night Celebration

May 23, 2025 -

Jonathan Groffs Just In Time A Night Of Celebration With Lea Michele And Friends

May 23, 2025

Jonathan Groffs Just In Time A Night Of Celebration With Lea Michele And Friends

May 23, 2025 -

Broadways Just In Time Jonathan Groff Celebrates Opening Night With Star Studded Cast

May 23, 2025

Broadways Just In Time Jonathan Groff Celebrates Opening Night With Star Studded Cast

May 23, 2025 -

Jonathan Groffs Just In Time Opening Lea Michele Daniel Radcliffe And More Celebrate

May 23, 2025

Jonathan Groffs Just In Time Opening Lea Michele Daniel Radcliffe And More Celebrate

May 23, 2025 -

Jonathan Groffs Just In Time Photos From The Star Studded Broadway Premiere

May 23, 2025

Jonathan Groffs Just In Time Photos From The Star Studded Broadway Premiere

May 23, 2025