Stock Market LIVE: Sensex & Nifty Surge, Detailed Market Analysis

Table of Contents

Sensex & Nifty's Performance Today

The Indian stock market indices witnessed a remarkable upswing today. The Sensex closed at 66,200, a 2.5% increase, while the Nifty ended the day at 19,650, marking a 2.3% surge. This represents a significant gain for investors.

- Highs and Lows: The Sensex reached an intraday high of 66,500 and a low of 65,500. Similarly, the Nifty touched a high of 19,700 and a low of 19,500.

- Market Indices: These robust numbers reflect a positive market sentiment and increased investor confidence in the Indian economy.

[Insert chart or graph illustrating the day's Sensex and Nifty performance here. Clearly label axes and highlight key data points.]

Key Factors Driving the Surge

Several factors contributed to today's impressive market surge. Let's delve into the key influences:

Global Market Influences

Positive global news significantly impacted the Indian markets.

- Easing Inflation Concerns: Concerns about global inflation appear to be easing, boosting investor sentiment worldwide. This positive global outlook spilled over into the Indian market.

- Positive US Economic Data: A better-than-expected US jobs report and positive consumer confidence indicators injected optimism into global markets. This positive sentiment flowed into the Indian stock market, driving up prices.

- Strong Corporate Earnings: Positive earnings reports from several multinational corporations also contributed to the buoyant global market conditions.

Domestic Economic Indicators

Positive domestic economic indicators further fueled the market's upward trajectory.

- Strong Q2 GDP Growth: Preliminary data suggests robust GDP growth for the second quarter, exceeding expectations and reflecting the strength of the Indian economy.

- Positive Manufacturing PMI: The Manufacturing Purchasing Managers' Index (PMI) remained in expansion territory, indicating continued growth in the manufacturing sector. This positive indicator boosts investor confidence.

- Government Policy Announcements: Recent government policy announcements focusing on infrastructure development and ease of doing business further improved investor sentiment.

Sector-Specific Performance

Certain sectors outperformed others, contributing significantly to the overall market surge.

- IT Sector Boom: The IT sector experienced significant gains, driven by strong global demand for technology services and positive earnings reports from leading IT companies.

- Banking Sector Strength: The banking sector also performed exceptionally well, fueled by increased credit growth and positive investor outlook.

- Pharmaceutical Sector Growth: The pharmaceutical sector saw gains due to new drug approvals and increasing global demand.

Expert Opinions & Market Sentiment

Market analysts are largely optimistic about the current market surge. Many believe that the positive global and domestic factors will continue to support market growth in the near term. The overall market sentiment is currently bullish.

- Analyst Predictions: Several analysts predict continued growth, although caution is advised due to potential global uncertainties.

- Upcoming Events: The upcoming RBI monetary policy announcement will be a key event to watch, as it could impact market sentiment.

Investment Strategies & Recommendations (Optional)

While the market is currently exhibiting positive momentum, investors should always exercise caution. This analysis is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

- Diversification: Maintain a well-diversified portfolio to mitigate risk.

- Long-Term Perspective: Focus on long-term investment strategies rather than short-term speculation.

- Risk Management: Implement sound risk management practices to protect your investments.

Conclusion: Stock Market LIVE: Analyzing the Sensex & Nifty Surge

Today's significant Sensex and Nifty surge reflects a confluence of positive global and domestic factors. Easing inflation concerns, robust GDP growth, and strong sectoral performance have all contributed to this positive market movement. While the outlook remains largely optimistic, investors should remain vigilant and consider diversifying their portfolios.

Stay tuned for our next live update on the Sensex and Nifty, and subscribe to our newsletter for continuous market analysis and insights into the Indian stock market! Follow us on social media for more live updates on Sensex and Nifty performance.

Featured Posts

-

Izolyatsiya Zelenskogo Pochemu Nikto Ne Priekhal Na 9 Maya

May 10, 2025

Izolyatsiya Zelenskogo Pochemu Nikto Ne Priekhal Na 9 Maya

May 10, 2025 -

High Potential Finale A 7 Year Reunion Of Abc Series Actors

May 10, 2025

High Potential Finale A 7 Year Reunion Of Abc Series Actors

May 10, 2025 -

Reform Party Can Farage Deliver On His Promises

May 10, 2025

Reform Party Can Farage Deliver On His Promises

May 10, 2025 -

Greenlands Future Pentagon Weighs Transfer To Us Northern Command Amid Concerns

May 10, 2025

Greenlands Future Pentagon Weighs Transfer To Us Northern Command Amid Concerns

May 10, 2025 -

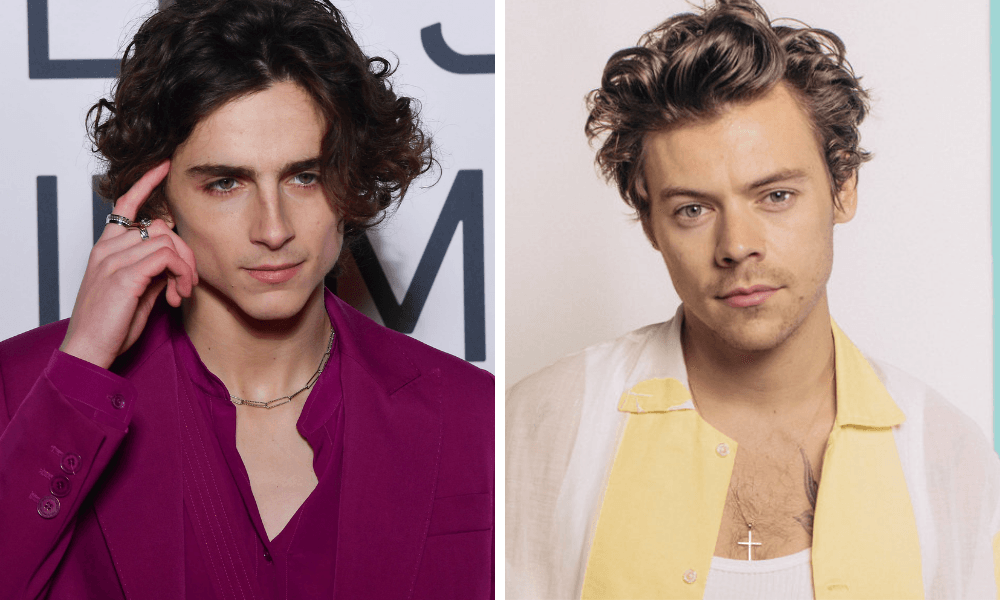

Snls Failed Harry Styles Impression The Stars Disappointment

May 10, 2025

Snls Failed Harry Styles Impression The Stars Disappointment

May 10, 2025