Stock Market News: 200-Point Sensex Gain, Nifty's Record High, UltraTech Slump

Table of Contents

Sensex's 200-Point Surge: A Detailed Look

The Sensex's impressive 200-point jump is a significant development in the Indian Stock Market. Opening at 65,200, the index closed at 65,400, representing a robust percentage increase. Several factors contributed to this positive performance.

- Positive Global Cues: Strong performance in global markets, particularly in the US and European indices, provided positive sentiment, encouraging foreign investment.

- Strong Domestic Investor Sentiment: Positive domestic economic indicators and easing inflation concerns boosted investor confidence.

- Positive Corporate Earnings Reports: Several leading companies released strong quarterly earnings, further strengthening market optimism. Strong results from IT and banking sectors played a key role.

- Government Policies: Continued government support for infrastructure development and positive economic reforms contributed to investor confidence.

Specific sectors that led the charge include IT, which saw a significant surge driven by strong global demand, and Banking, fueled by positive credit growth and improved asset quality. The FMCG sector also contributed to the overall positive trend.

Nifty's Record High: A New Milestone Achieved

The Nifty's achievement of a new all-time high is a momentous occasion for the Indian economy, signaling robust growth and investor confidence. This record high carries significant implications, potentially attracting further foreign investment and bolstering the overall economic outlook.

- Increased Foreign Institutional Investor (FII) Inflows: Significant FII inflows played a crucial role in driving the Nifty to record highs. This indicates growing international confidence in the Indian economy.

- Retail Investor Participation: Increased participation from retail investors also contributed significantly to the market's upward momentum.

- Robust Economic Growth Indicators: Positive macroeconomic indicators, including strong GDP growth and declining inflation, have created a favorable environment for the stock market.

- Positive Future Outlook: Experts predict continued positive growth, further bolstering the Nifty’s potential for future gains.

The factors contributing to the Nifty's record high largely overlap with those driving the Sensex's surge, highlighting a broad-based positive sentiment within the Indian Stock Market.

UltraTech Cement's Dip: Understanding the Contrasting Trend

While the broader market celebrated record highs, UltraTech Cement experienced a notable decline, presenting a contrasting trend that requires careful analysis. This dip highlights the sector-specific risks and volatility within the Indian Stock Market.

- Lower-than-expected Quarterly Results: UltraTech Cement's recent earnings report may have fallen short of market expectations, leading to profit-booking by investors.

- Concerns Regarding Future Demand: Concerns about a potential slowdown in the construction sector or reduced cement demand might have contributed to the decline.

- Impact of Global Economic Slowdown: Global economic uncertainties and rising input costs can also impact cement companies, influencing investor sentiment.

Understanding the specific reasons for UltraTech Cement's dip requires a detailed analysis of company-specific news and broader industry trends. This serves as a reminder that while the overall market may be positive, individual stocks can exhibit independent performance.

Market Volatility and Future Outlook

Despite the positive performance of the Sensex and Nifty, market volatility remains a key consideration for investors. Predicting future trends with certainty is impossible, but analyzing current conditions provides some insights.

- Short-term and long-term market predictions: While the short-term outlook appears positive, long-term predictions require considering various macroeconomic factors and geopolitical events.

- Advice for cautious investment strategies: Diversification is crucial to mitigate risk. Investors should carefully consider their risk tolerance and investment goals.

- Importance of Diversification: Diversifying your portfolio across different sectors and asset classes reduces exposure to individual stock volatility.

- Role of risk management: Implementing a robust risk management strategy is essential for navigating market fluctuations effectively.

Investing in the stock market inherently involves risk. It's crucial to conduct thorough research and seek professional advice before making any investment decisions.

Conclusion: Stay Updated on Stock Market News for Informed Decisions

Today's stock market performance showcased a mixed bag: a significant Sensex gain, a Nifty record high, and a notable UltraTech Cement dip. This highlights the dynamic nature of the Indian Stock Market and the importance of staying informed about daily Stock Market News. To make well-informed investment decisions, consistent monitoring of market trends, economic indicators, and company-specific news is essential. Regularly review Stock Market News and analysis to adapt your investment strategies effectively. Stay informed about the latest Stock Market News and make well-informed investment decisions. Follow us for daily updates on the Sensex, Nifty, and other key market indicators!

Featured Posts

-

The High Cost Of Childcare A Mans Experience With Babysitters And Daycare

May 09, 2025

The High Cost Of Childcare A Mans Experience With Babysitters And Daycare

May 09, 2025 -

Madeleine Mc Cann Case Polish Woman Julia Wandelt Arrested In Uk For False Claims

May 09, 2025

Madeleine Mc Cann Case Polish Woman Julia Wandelt Arrested In Uk For False Claims

May 09, 2025 -

Beyonce Tour Effect Cowboy Carter Streams Double

May 09, 2025

Beyonce Tour Effect Cowboy Carter Streams Double

May 09, 2025 -

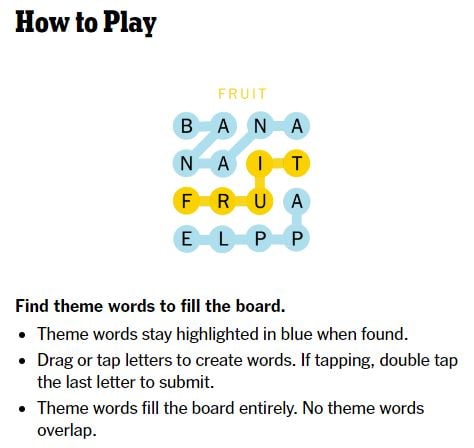

Nyt Strands Game 377 Solutions And Clues For March 15

May 09, 2025

Nyt Strands Game 377 Solutions And Clues For March 15

May 09, 2025 -

Taiwans Lai Issues Stark Warning On Totalitarianism In Ve Day Address

May 09, 2025

Taiwans Lai Issues Stark Warning On Totalitarianism In Ve Day Address

May 09, 2025