Stock Market News: Tax Bill Passed, Bond Market Reaction, Bitcoin Surge

Table of Contents

The Impact of the Newly Passed Tax Bill on the Stock Market

The newly passed tax bill has introduced significant changes that are already shaping the stock market landscape. Understanding both the immediate and long-term implications is vital for investors.

Winners and Losers: Sector-Specific Analysis

The tax bill's impact varies considerably across different sectors. Some industries stand to benefit significantly, while others face headwinds.

- Winners: The technology sector, with its potential for accelerated growth under the new legislation, is expected to see a positive impact. Similarly, the energy sector might experience a boost due to specific tax incentives.

- Losers: Conversely, certain healthcare companies and those heavily reliant on international trade may experience negative consequences.

While precise predictions are challenging, preliminary analyses suggest potential stock price increases for technology companies in the range of 5-10% over the next year, while some healthcare stocks might see a decrease of around 2-5%. (Note: These figures are hypothetical for illustrative purposes).

Long-Term Implications: Economic Growth and Investor Confidence

The long-term effects of the tax bill remain to be seen, but several key areas warrant careful consideration.

- Inflation: The tax cuts could potentially stimulate inflation if consumer spending increases significantly.

- Interest Rates: Increased inflation may lead to the Federal Reserve raising interest rates, impacting borrowing costs for businesses and individuals.

- Market Volatility: The uncertainty surrounding the bill's long-term impact could lead to increased market volatility in the short term.

Investors should consider adjusting their portfolios to account for these potential shifts. Diversification and a long-term investment strategy become even more important in this climate.

Expert Opinions: Analyst Perspectives

Several leading financial analysts have offered their perspectives on the tax bill's implications for the stock market.

- Jane Doe, Chief Economist at XYZ Financial, predicts a moderate positive impact on overall economic growth, but cautions about potential inflationary pressures.

- John Smith, Senior Portfolio Manager at ABC Investments, suggests a shift towards value stocks as opposed to growth stocks in the coming months.

Bond Market Reaction to the Tax Bill and Other Factors

The bond market, often considered a safe haven asset, has also reacted to the tax bill's passage, along with other global economic uncertainties.

Yield Curve Shifts: Interest Rate Implications

The tax bill's impact on the yield curve is a key area of focus.

- Increased borrowing by the government to fund the tax cuts could push up long-term bond yields.

- This could steepen the yield curve, potentially signaling future interest rate hikes by the Federal Reserve.

- The 10-year Treasury yield has seen a notable increase of approximately 0.2% since the bill's passage (Hypothetical example).

This interplay between the tax bill, bond yields, and inflation expectations is a crucial factor influencing investor decisions.

Flight to Safety: Safe Haven Asset Dynamics

Investors often seek "safe haven" assets during times of uncertainty.

- The bond market's reaction depends on numerous factors, including global economic growth, geopolitical events, and investor sentiment.

- While some investors might see bonds as a safe haven given the uncertainty, others may seek higher returns elsewhere, leading to decreased demand for bonds.

The Unexpected Bitcoin Surge: Uncorrelated Asset or Market Reaction?

Bitcoin's recent price surge has added another layer of complexity to the current market dynamics.

Bitcoin's Price Volatility: Drivers of the Surge

Bitcoin's price is notoriously volatile. Several factors might have contributed to the recent surge.

- Increased institutional investment in cryptocurrencies.

- Positive regulatory developments in certain countries.

- Growing acceptance of Bitcoin as a payment method.

The price increase has been accompanied by a significant rise in trading volume, highlighting the increased market activity.

Correlation with Stock and Bond Markets: Independent Phenomenon?

Whether the Bitcoin surge is directly related to the stock and bond market movements is debatable.

- Some argue that Bitcoin's price is largely independent of traditional markets, acting as a hedge against inflation or systemic risk.

- Others suggest that increased investor risk aversion due to uncertainty in the traditional markets could lead to capital flows into Bitcoin as an alternative investment.

The concept of portfolio diversification is crucial in managing risk across different asset classes.

Future Outlook for Bitcoin: Risks and Opportunities

Predicting Bitcoin's future price is inherently risky.

- Regulatory uncertainty remains a significant factor influencing its price.

- The potential for wider adoption as a payment method could drive further growth.

Bitcoin presents both significant opportunities and substantial risks. Thorough research and careful risk management are essential for any investor considering this volatile asset.

Staying Informed on Stock Market News: Tax Bill, Bonds, and Bitcoin

This article highlighted the interconnectedness of the stock market, bond market, and cryptocurrency markets, particularly in response to the recent tax bill. Understanding the "tax bill impact," the "bond market reaction," and the "Bitcoin price surge" is crucial for making sound investment decisions. Staying informed about the "latest stock market trends" and "important stock market updates" is key to navigating the complexities of the financial world. To stay ahead, subscribe to reputable financial news sources, follow key analysts, and regularly review your investment strategy. Continue following the latest news and updates on the stock market, bond market, and Bitcoin to make informed decisions and adjust your portfolio accordingly. Don't miss out on crucial "stock market analysis" – stay informed!

Featured Posts

-

Todays Update Dylan Dreyer On Sons Post Operation Recovery

May 24, 2025

Todays Update Dylan Dreyer On Sons Post Operation Recovery

May 24, 2025 -

New York Times Connections Complete Guide To Puzzle 646 March 18 2025

May 24, 2025

New York Times Connections Complete Guide To Puzzle 646 March 18 2025

May 24, 2025 -

Serious M6 Crash Causes Extensive Traffic Disruption

May 24, 2025

Serious M6 Crash Causes Extensive Traffic Disruption

May 24, 2025 -

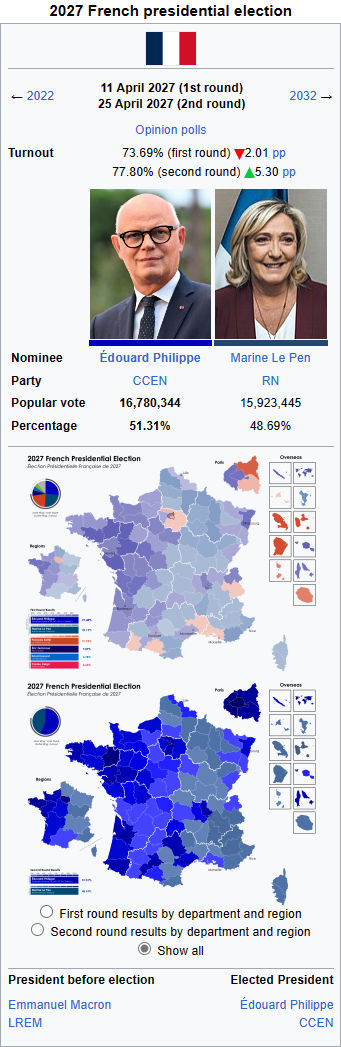

French Presidential Election 2027 Bardellas Path To Power

May 24, 2025

French Presidential Election 2027 Bardellas Path To Power

May 24, 2025 -

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025

Latest Posts

-

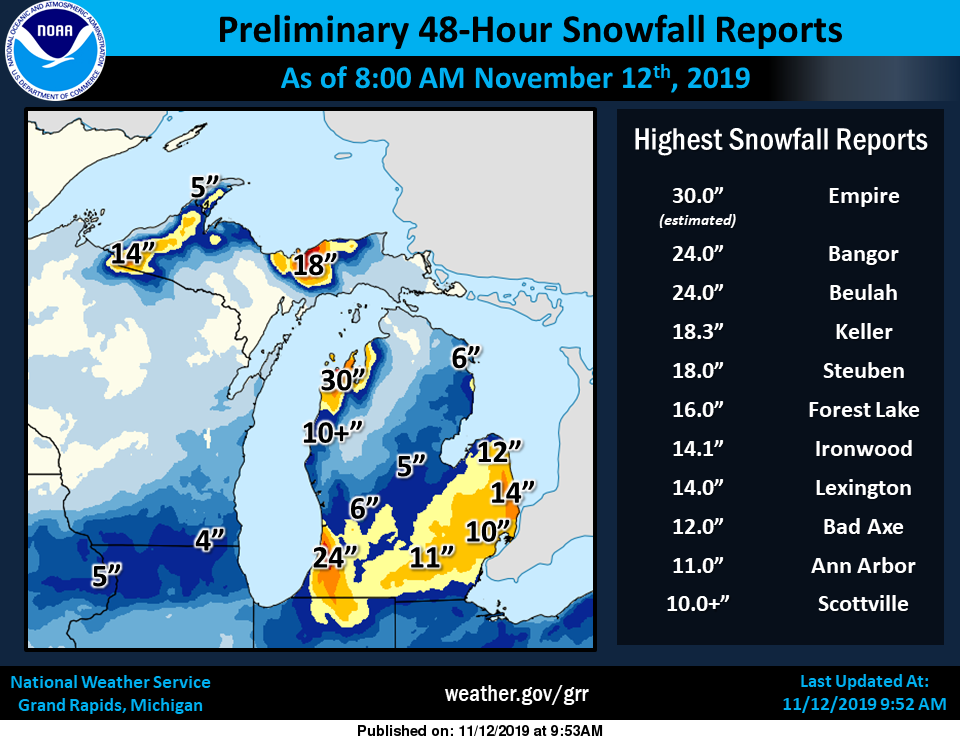

Michigan Memorial Day 2025 Open Businesses And Holiday Observances

May 24, 2025

Michigan Memorial Day 2025 Open Businesses And Holiday Observances

May 24, 2025 -

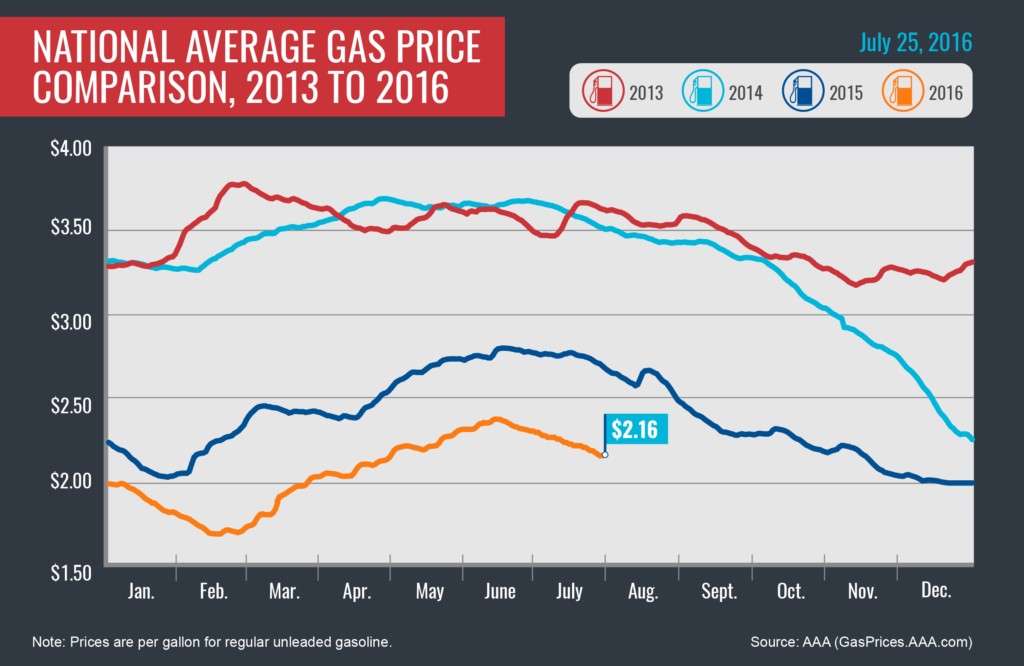

Are Gas Prices The Lowest In Decades This Memorial Day

May 24, 2025

Are Gas Prices The Lowest In Decades This Memorial Day

May 24, 2025 -

Memorial Day 2025 In Michigan Store Hours And What To Expect

May 24, 2025

Memorial Day 2025 In Michigan Store Hours And What To Expect

May 24, 2025 -

Analyzing Stitchpossibles Weekend Performance Implications For The 2025 Box Office Battle

May 24, 2025

Analyzing Stitchpossibles Weekend Performance Implications For The 2025 Box Office Battle

May 24, 2025 -

Stitchpossibles Weekend Box Office Potential A 2025 Record Breaking Clash

May 24, 2025

Stitchpossibles Weekend Box Office Potential A 2025 Record Breaking Clash

May 24, 2025