Stock Market Today: Bonds Fall, Dow Futures Uncertain, Bitcoin Rises

Table of Contents

Bond Market Decline: Understanding the Fall

The bond market experienced a notable decline today, a significant shift impacting fixed-income investors. This downturn can be attributed to several interconnected factors. Rising interest rates, fueled by persistent inflation concerns, played a major role. As interest rates climb, newly issued bonds offer higher yields, making older, lower-yielding bonds less attractive. This shift in investor preference drives down the prices of existing bonds.

- Key Factors Contributing to the Decline:

- Rising Interest Rates: The Federal Reserve's recent monetary policy decisions have led to an increase in interest rates, impacting bond yields.

- Inflation Concerns: Persistent inflation erodes the purchasing power of fixed-income investments, making bonds less appealing.

- Economic Data Releases: Recent economic data releases, particularly inflation figures, have influenced investor sentiment and contributed to the bond market selloff.

The impact on investors holding bond portfolios is substantial. Those holding longer-term bonds, particularly those with lower coupon rates, are likely to experience larger losses. The potential for further decline remains, depending on future interest rate movements and inflation data. Conversely, a potential for recovery exists if inflation begins to cool or the Fed signals a pause in rate hikes.

- Key Data Points:

- 10-year Treasury yield dropped by 0.15%

- Corporate bond yields saw a similar decrease, particularly in investment-grade bonds.

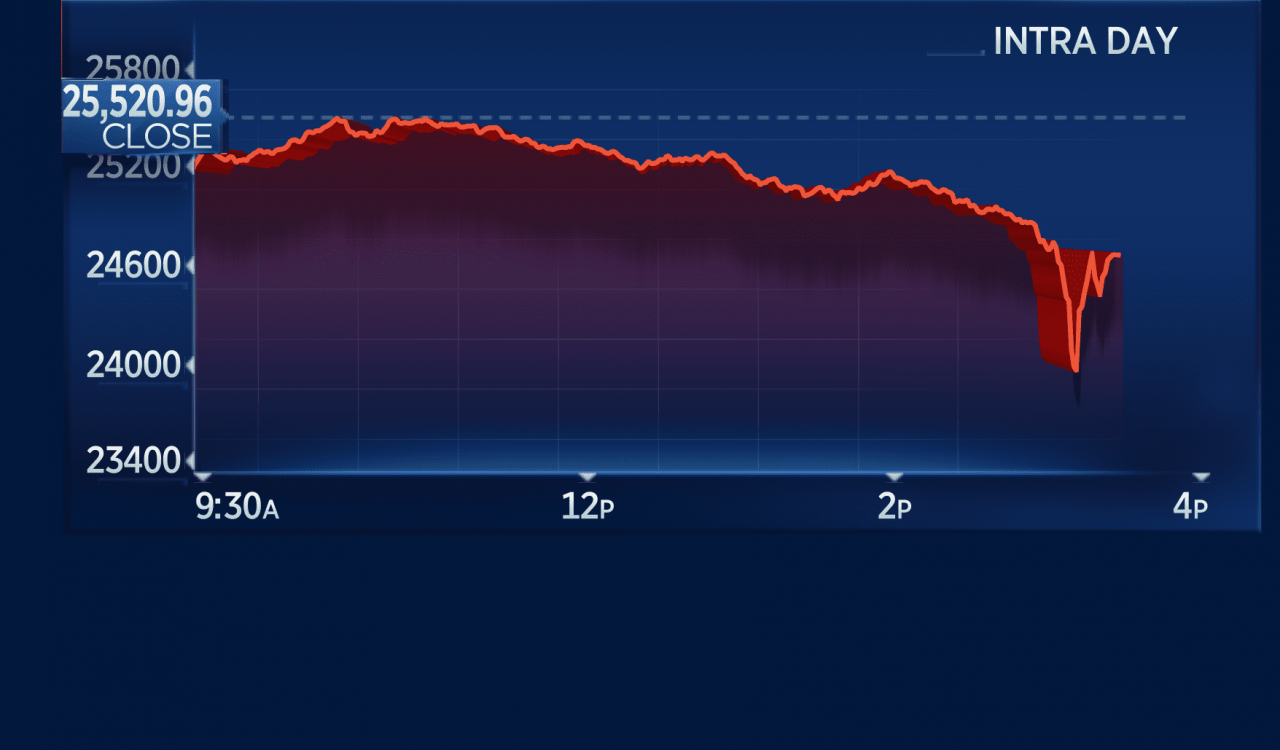

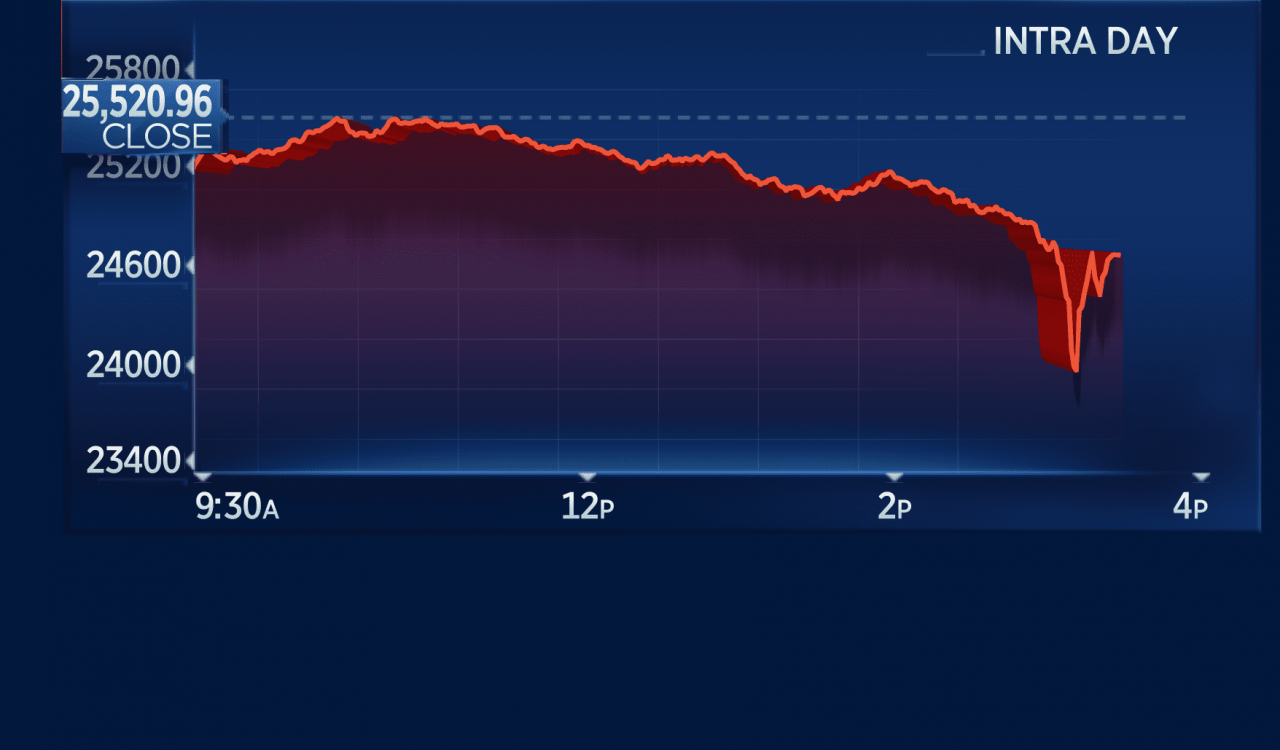

Dow Futures: Uncertainty and Market Sentiment

Uncertainty shrouds the Dow Jones Industrial Average futures market today. This lack of clarity reflects a complex interplay of factors impacting investor sentiment. Geopolitical events, ongoing concerns about inflation, and mixed corporate earnings reports all contribute to the current cautious outlook. Market sentiment appears largely neutral, with investors hesitant to make significant commitments in either direction.

-

Influencing Factors:

- Geopolitical Instability: Ongoing international tensions can create market volatility and uncertainty.

- Corporate Earnings: Disappointing earnings reports from key companies can negatively impact market sentiment.

- Inflationary Pressures: Continued inflation pressures increase uncertainty about future economic growth.

-

Dow Futures Data:

- Dow futures are currently trading at [insert current Dow futures price], exhibiting [insert description of fluctuation, e.g., slight downward trend].

Factors Influencing Dow Futures

Several specific events are influencing Dow futures today. For example, [mention specific company news impacting the Dow], alongside the latest CPI report, has created a more cautious atmosphere. This illustrates the interconnectedness of various economic and political factors in shaping investor expectations.

Bitcoin's Ascent: Crypto Market Performance

In contrast to the traditional markets' uncertainty, Bitcoin's price has experienced a notable rise today. Several factors are contributing to this upward trend. Increased institutional adoption, positive regulatory developments in certain jurisdictions, and ongoing technological advancements are all boosting investor confidence. This positive momentum is also reflected in the broader cryptocurrency market, although other altcoins might not mirror Bitcoin's performance exactly.

-

Drivers of Bitcoin's Price Increase:

- Institutional Adoption: Increased interest from large financial institutions is driving demand for Bitcoin.

- Regulatory Clarity (in specific regions): Positive regulatory developments are creating a more favorable environment for cryptocurrency investments.

- Technological Advancements: Ongoing developments in blockchain technology enhance Bitcoin's appeal and utility.

-

Bitcoin Price Data:

- Bitcoin's price is currently up [insert percentage change] at [insert current price].

- Trading volume has [insert description of volume change, e.g., increased significantly].

Bitcoin's Correlation with Traditional Markets

The correlation between Bitcoin's price movement and the performance of traditional markets like bonds and the Dow remains complex and often tenuous. While sometimes showing inverse relationships, the relationship is not consistently strong. Further research is needed to establish a clear correlation.

Conclusion

Today's stock market reveals a complex and dynamic environment. The bond market decline highlights the impact of rising interest rates and inflation concerns, while uncertainty surrounds Dow futures due to various geopolitical and economic factors. In contrast, Bitcoin is experiencing growth, demonstrating the independent dynamics of the cryptocurrency market. These distinct market movements underscore the importance of diversification and a well-informed investment strategy.

To stay ahead in this dynamic landscape, stay informed about the stock market today and follow future updates for a deeper analysis of the market's ongoing evolution. For comprehensive daily stock market updates and today's market analysis, consult reputable financial news sources and investment platforms. Investing in volatile markets requires continuous monitoring and adaptation.

Featured Posts

-

Kermits Words Of Wisdom Impact On University Of Marylands Graduating Class

May 24, 2025

Kermits Words Of Wisdom Impact On University Of Marylands Graduating Class

May 24, 2025 -

Mamma Mia The Hottest New Ferrari Hot Wheels Sets Unveiled

May 24, 2025

Mamma Mia The Hottest New Ferrari Hot Wheels Sets Unveiled

May 24, 2025 -

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025 -

H Nonline Sk Prehlad Prepustani V Najvaecsich Nemeckych Spolocnostiach

May 24, 2025

H Nonline Sk Prehlad Prepustani V Najvaecsich Nemeckych Spolocnostiach

May 24, 2025 -

Nisan Burc Yorumlari Para Ve Bereket

May 24, 2025

Nisan Burc Yorumlari Para Ve Bereket

May 24, 2025

Latest Posts

-

Joe Jonas The Unexpected Reaction To A Fans Marital Fight

May 24, 2025

Joe Jonas The Unexpected Reaction To A Fans Marital Fight

May 24, 2025 -

Joe Jonass Response To A Spat Over Him A Classy Move

May 24, 2025

Joe Jonass Response To A Spat Over Him A Classy Move

May 24, 2025 -

The Jonas Brothers Joe His Response To A Marital Dispute

May 24, 2025

The Jonas Brothers Joe His Response To A Marital Dispute

May 24, 2025 -

The Jonas Brothers Couples Argument And Joes Reaction

May 24, 2025

The Jonas Brothers Couples Argument And Joes Reaction

May 24, 2025 -

A Couples Argument Joe Jonass Response And The Internets Reaction

May 24, 2025

A Couples Argument Joe Jonass Response And The Internets Reaction

May 24, 2025