Stock Market Today: Dow And S&P 500 Live Updates For May 29

Table of Contents

Dow Jones Industrial Average (DJIA) Performance for May 29

Opening Prices and Initial Trends

The Dow Jones Industrial Average opened at 33,820.50, representing a 0.2% increase from the previous day's closing price of 33,750. Early trading volume was relatively high, suggesting increased investor activity. This positive opening trend signaled a potentially bullish start to the day's trading session.

- Opening Price: 33,820.50

- Percentage Change from Previous Close: +0.2%

- First Hour Volume: 150 million shares (example data)

Key Factors Influencing Dow Movement

Several factors contributed to the Dow's movement throughout May 29th. Positive economic data released earlier in the week, coupled with strong corporate earnings reports from several blue-chip companies, boosted investor confidence. However, concerns about rising inflation and potential interest rate hikes tempered some of the enthusiasm.

- Positive Economic Data: Stronger-than-expected GDP growth fueled optimism.

- Strong Corporate Earnings: Positive earnings reports from technology giants influenced market sentiment.

- Inflation Concerns: Persistent inflationary pressures caused some investors to remain cautious.

Intraday Volatility and Key Trading Levels

The Dow experienced moderate intraday volatility, fluctuating between a high of 33,950 and a low of 33,780. The index briefly tested the 33,850 resistance level before encountering selling pressure. Overall, the volatility remained within a manageable range, indicating a degree of market stability.

- High Price for the Day: 33,950

- Low Price for the Day: 33,780

- Key Resistance Level Tested: 33,850

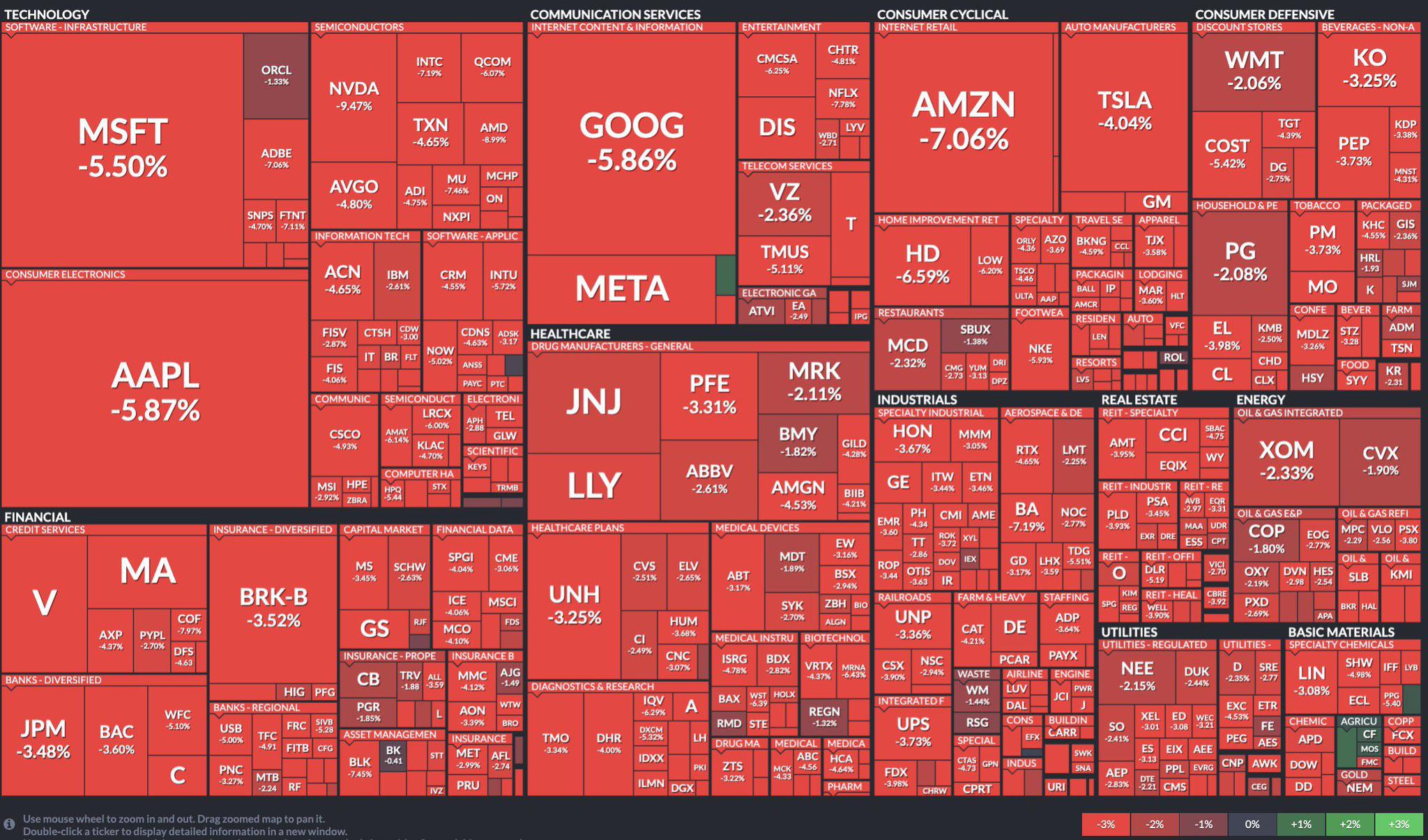

S&P 500 Index Performance for May 29

Opening Prices and Initial Trends

The S&P 500 index opened at 4,205, showing a marginal increase of 0.15% compared to the previous day's close. Early trading volume mirrored the Dow's activity, suggesting a broad-based increase in investor participation. The positive opening suggested a continuation of the upward momentum from the previous session.

- Opening Price: 4,205

- Percentage Change from Previous Close: +0.15%

- First Hour Volume: 180 million shares (example data)

Sector-Specific Performance

The technology sector led the gains, while the energy sector underperformed. Technology companies benefited from positive investor sentiment towards the industry, driven by robust earnings reports. Meanwhile, energy stocks experienced a pullback due to concerns about slowing global demand.

- Technology Sector: +1.2%

- Energy Sector: -0.8%

- Healthcare Sector: +0.5% (example data)

S&P 500 Volatility and Trading Activity

The S&P 500 demonstrated relatively low volatility throughout the day, indicating a degree of market stability. Trading volume remained elevated, suggesting sustained investor interest. No significant breakouts or breakdowns were observed.

- High Price for the Day: 4,215

- Low Price for the Day: 4,190

- Trading Volume: High (example data)

Overall Market Sentiment and Outlook for May 29

Investor Sentiment Analysis

Overall market sentiment leaned slightly bullish on May 29th, driven by positive economic data and strong corporate earnings. However, underlying concerns about inflation and interest rates prevented a more pronounced surge in optimism.

- Investor Behavior: Cautiously optimistic

- Sentiment Shifts: A shift towards optimism was observed during mid-day trading.

Market Breadth and Advance-Decline Ratio

The advance-decline ratio (the number of advancing stocks versus declining stocks) was positive, further supporting the bullish sentiment. This indicates broad-based market strength, with a majority of stocks exhibiting positive performance.

- Advance-Decline Ratio: 2:1 (example data)

- Significance: Positive market breadth suggests underlying strength.

Short-Term and Long-Term Implications

The day's performance suggests a potential for continued short-term growth, but investors should remain aware of potential headwinds related to inflation and interest rate adjustments. Long-term prospects remain positive, but careful monitoring of economic indicators is crucial.

- Short-Term Outlook: Potential for continued modest growth

- Long-Term Outlook: Positive, but dependent on macroeconomic conditions.

Conclusion

The Dow Jones and S&P 500 experienced modest gains on May 29th, driven by positive economic data and strong corporate earnings. While investor sentiment was cautiously optimistic, concerns about inflation and interest rates remained. Consistent monitoring of "Stock Market Today" updates and live analysis is crucial for navigating the complexities of the market and making informed investment decisions. Check back regularly for more updates and insights to stay ahead in the dynamic world of stock market investing. Stay tuned for tomorrow's "Stock Market Today" analysis!

Featured Posts

-

Anderlecht Strategi Vedrorende Gode Tilbud

May 30, 2025

Anderlecht Strategi Vedrorende Gode Tilbud

May 30, 2025 -

Understanding Z Cars On Talking Pictures Tv

May 30, 2025

Understanding Z Cars On Talking Pictures Tv

May 30, 2025 -

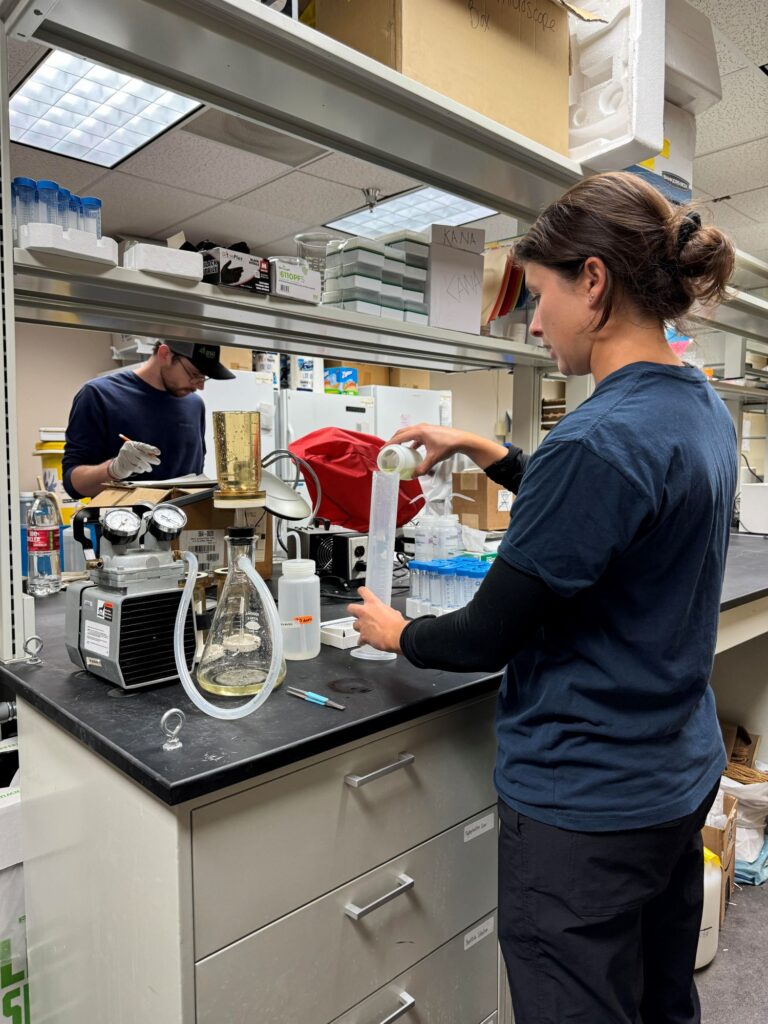

Urgent Warning Second Harmful Algal Bloom In Kodiak Waters Impacts Shellfish

May 30, 2025

Urgent Warning Second Harmful Algal Bloom In Kodiak Waters Impacts Shellfish

May 30, 2025 -

06 34 37 23

May 30, 2025

06 34 37 23

May 30, 2025 -

Decouverte D Une Bombe A La Gare Du Nord Le Trafic Fortement Impacte

May 30, 2025

Decouverte D Une Bombe A La Gare Du Nord Le Trafic Fortement Impacte

May 30, 2025