Stock Market Today: Dow Futures Fluctuate, China's Economic Support Amidst Tariff Tensions

Table of Contents

Dow Futures Fluctuation: A Detailed Look at Pre-Market Indicators

Understanding Dow Futures:

Dow futures are contracts obligating the buyer to purchase the Dow Jones Industrial Average at a predetermined price on a specific date. These futures serve as powerful pre-market indicators, offering a glimpse into the potential direction of the market before the opening bell. Monitoring Dow futures allows investors to gauge investor sentiment and anticipate potential market movements. Understanding their behavior is a key component of effective stock market analysis.

Factors Influencing Dow Futures Today:

Several factors contribute to the current volatility in Dow futures:

- Economic Data Releases: Recent economic data, such as inflation figures and employment reports, both domestically and internationally, can significantly impact investor confidence and influence futures trading. Unexpectedly strong or weak data often leads to sharp price movements.

- Corporate Earnings Reports: Upcoming or recently released corporate earnings reports, particularly from major companies within the Dow Jones index, can drive significant changes in futures prices. Positive earnings surprises generally lead to bullish sentiment, while negative surprises can trigger sell-offs.

- Geopolitical Uncertainty: Global events, including the ongoing US-China trade war and other geopolitical tensions, inject uncertainty into the market, affecting investor sentiment and causing significant fluctuations in Dow futures. This uncertainty is a major driver of market volatility.

[Insert relevant chart or graph visualizing Dow futures fluctuations here]

Interpreting the Signals:

The current performance of Dow futures suggests [insert interpretation based on current market data – e.g., a potential bearish opening due to negative economic indicators, or a sideways trend reflecting cautious investor sentiment]. This interpretation requires continuous monitoring and consideration of all influencing factors. Staying informed about real-time stock market updates is crucial for making accurate predictions.

China's Economic Support Measures and Their Global Impact

Analyzing China's Stimulus Packages:

The Chinese government has recently implemented several economic support measures aimed at stimulating growth and countering the effects of the trade war. These include:

- Increased Infrastructure Spending: Significant investments in infrastructure projects are designed to boost economic activity and create jobs.

- Tax Cuts for Businesses: Reductions in corporate taxes are intended to incentivize business investment and expansion.

- Monetary Policy Adjustments: Easing monetary policy, such as lowering interest rates, can encourage borrowing and spending.

Impact on Global Markets:

These measures have far-reaching implications for global markets:

- Increased Commodity Demand: Increased infrastructure spending in China can lead to higher demand for commodities such as steel, cement, and oil, impacting prices globally.

- Shifting Investment Flows: Investors might redirect capital towards China, potentially affecting investment flows in other markets.

- Interconnected Economies: The Chinese and US economies are deeply intertwined, making China's economic performance critical for global stability. Any significant shift in the Chinese economy directly impacts global market trends.

Effectiveness of the Measures:

While these stimulus packages aim to boost the Chinese economy, their effectiveness faces challenges, including:

- Debt Levels: China already has high levels of corporate and government debt, which could limit the impact of further borrowing.

- Trade War Uncertainty: The ongoing trade war continues to create uncertainty, potentially hindering the effectiveness of stimulus measures.

US-China Tariff Tensions: Ongoing Trade Disputes and Market Reactions

Review of Current Tariff Landscape:

The US-China trade war has been a significant source of market uncertainty. Tariffs imposed by both countries have disrupted supply chains, increased costs for businesses, and dampened investor confidence. While negotiations continue, the current state of affairs remains volatile and unpredictable.

Market Sensitivity to Trade Wars:

Ongoing trade tensions significantly impact investor confidence and market stability. Uncertainty about future trade policies leads to volatility, as investors adjust their portfolios based on perceived risk. This creates market instability and reduces long-term planning confidence. The "trade war impact" on stock markets worldwide is undeniable.

Potential Outcomes and their Market Implications:

Several scenarios are possible:

- Escalation: Further tariff increases could trigger a more significant market downturn and exacerbate global economic slowdown.

- De-escalation: A partial or complete rollback of tariffs could boost investor confidence and lead to market gains.

- Resolution: A negotiated settlement could lead to a period of market stability and growth, but this outcome remains uncertain. Each scenario presents unique challenges and opportunities impacting investment strategies and portfolio management.

Conclusion: Market Outlook and Investment Strategies for Navigating Volatility

In summary, today's stock market is characterized by fluctuating Dow futures, influenced by China's economic response to trade tensions and the ongoing US-China tariff dispute. This creates a climate of significant market uncertainty and geopolitical risk. Understanding these interconnected factors is vital for informed investment decisions.

To navigate this volatility, consider the following investment strategies:

- Portfolio Diversification: Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and geographic regions to reduce risk.

- Risk Management: Implement risk management strategies, such as stop-loss orders, to protect your portfolio from significant losses.

- Long-Term Perspective: Focus on your long-term investment goals and avoid making rash decisions based on short-term market fluctuations.

Regularly monitor stock market updates, economic indicators, and news regarding US-China trade relations. Stay informed about daily market analysis and today's market trends. Making informed investment decisions requires continuous monitoring and adapting your strategy to the evolving market landscape. By carefully considering these factors and implementing appropriate investment strategies, you can navigate the complexities of the stock market today and build a resilient portfolio. Continue to monitor stock market today updates for the latest analysis and insights.

Featured Posts

-

Strong Q Quarter Number Results For Abb Vie Abbv Higher Profit Guidance On The Back Of New Drug Success

Apr 26, 2025

Strong Q Quarter Number Results For Abb Vie Abbv Higher Profit Guidance On The Back Of New Drug Success

Apr 26, 2025 -

Months Long Persistence Of Toxic Chemicals After Ohio Train Derailment

Apr 26, 2025

Months Long Persistence Of Toxic Chemicals After Ohio Train Derailment

Apr 26, 2025 -

Florida Cnn Anchors Favorite Vacation Spot

Apr 26, 2025

Florida Cnn Anchors Favorite Vacation Spot

Apr 26, 2025 -

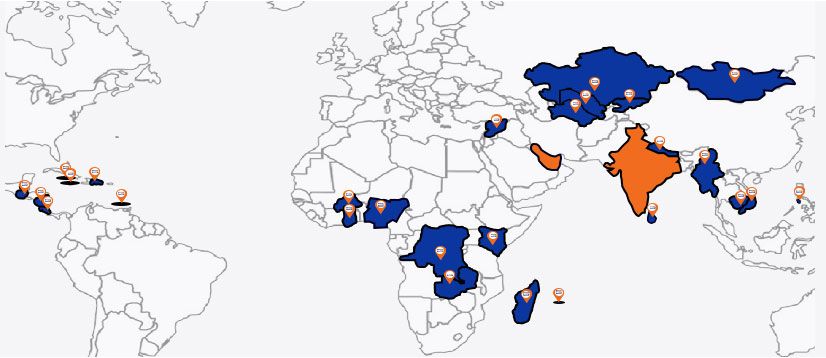

Identifying And Mapping Promising New Business Areas In The Country

Apr 26, 2025

Identifying And Mapping Promising New Business Areas In The Country

Apr 26, 2025 -

Discover The Countrys Top New Business Locations

Apr 26, 2025

Discover The Countrys Top New Business Locations

Apr 26, 2025

Latest Posts

-

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025 -

Controversy Erupts Hhs Appoints Vaccine Skeptic David Geier

Apr 27, 2025

Controversy Erupts Hhs Appoints Vaccine Skeptic David Geier

Apr 27, 2025 -

Hhss Choice Of David Geier Sparks Vaccine Debate

Apr 27, 2025

Hhss Choice Of David Geier Sparks Vaccine Debate

Apr 27, 2025 -

Vaccine Study Review Hhs Selects Vaccine Skeptic David Geier

Apr 27, 2025

Vaccine Study Review Hhs Selects Vaccine Skeptic David Geier

Apr 27, 2025 -

Hhs Hires Vaccine Skeptic David Geiers Role In Vaccine Study Analysis

Apr 27, 2025

Hhs Hires Vaccine Skeptic David Geiers Role In Vaccine Study Analysis

Apr 27, 2025