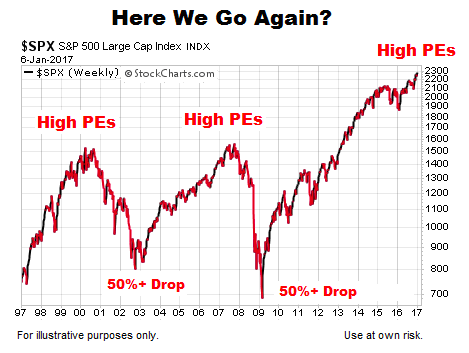

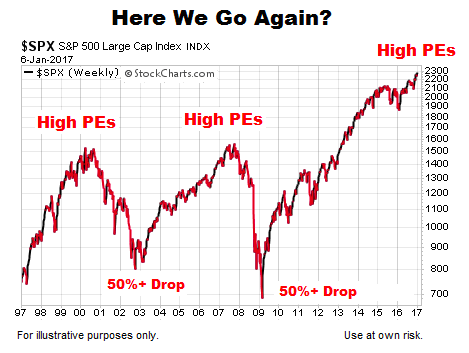

Stock Market Valuations: BofA Explains Why Investors Shouldn't Be Concerned

Table of Contents

BofA's Key Arguments Against Excessive Valuation Concerns

BofA's reassessment of current stock market valuations rests on several key pillars. By considering these factors, they present a more nuanced picture than the surface-level concern about high price-to-earnings ratios might suggest.

The Role of Interest Rates

Interest rates play a crucial role in determining stock valuations. BofA's analysis highlights the relationship between interest rates and discounted cash flow (DCF) models, which are widely used to assess the intrinsic value of a company. Higher interest rates generally lead to lower present values of future cash flows, thereby reducing valuations. However, BofA’s perspective incorporates the anticipated trajectory of interest rates.

- BofA's predicted interest rate trajectory: BofA anticipates a gradual increase in interest rates, followed by a potential plateau or even slight decline in the coming years. This prediction is based on their analysis of macroeconomic factors such as inflation and economic growth.

- Impact of interest rate changes on discounted cash flow models: Changes in interest rates directly impact the discount rate used in DCF models. A higher discount rate lowers the present value of future earnings, leading to a lower valuation. Conversely, lower rates increase valuations. BofA's analysis incorporates their interest rate projections to adjust these valuations.

- Examples of sectors more/less sensitive to interest rate fluctuations: Sectors like utilities and real estate are generally more sensitive to interest rate changes, while technology companies, with their longer-term growth prospects, might be less affected. BofA's research highlights these sector-specific sensitivities.

Earnings Growth Projections

BofA's forecasts for corporate earnings growth are central to their argument against excessive valuation concerns. They suggest that robust earnings growth can justify current valuations, even if they appear high based on historical averages.

- BofA's projected earnings growth for the next 1-3 years: BofA projects a healthy rate of earnings growth over the next few years, driven by factors such as continued economic expansion, technological innovation, and increasing consumer spending. Their projections vary across different sectors, reflecting industry-specific dynamics.

- Key industries expected to outperform/underperform: Specific industries, such as technology and healthcare, are expected to outperform others due to their growth potential and innovation drivers. BofA's analysis carefully distinguishes these trends.

- Comparison to historical earnings growth rates: While current valuations may appear elevated compared to historical averages, BofA argues that the projected earnings growth justifies these levels, offering a different perspective than a simple comparison to past metrics alone.

Accounting for Inflation

Inflation significantly impacts valuation metrics. BofA emphasizes the importance of adjusting these metrics to account for inflation to obtain a more accurate and realistic picture of stock market valuations.

- Specific valuation metrics used by BofA (e.g., P/E ratio, PEG ratio): BofA uses a range of valuation metrics, including the Price-to-Earnings (P/E) ratio and Price/Earnings to Growth (PEG) ratio, adjusting them for inflation.

- How inflation impacts each metric: Inflation erodes the purchasing power of future earnings. BofA's analysis demonstrates how inflation impacts the interpretation of these commonly used valuation metrics. Failing to account for inflation can lead to an overestimation of valuations.

- Examples illustrating the impact of inflation on valuation calculations: BofA provides concrete examples showing how inflation adjustments significantly alter the interpretation of valuation ratios, leading to a more accurate reflection of real returns.

Alternative Investment Strategies in a High-Valuation Environment

Even with BofA's reassuring perspective, investors should adopt strategies to navigate a market with potentially high valuations.

Focus on Quality and Growth

In a potentially overvalued market, selecting high-quality companies with sustainable growth potential is crucial. BofA recommends focusing on strong fundamentals.

- Specific criteria for identifying high-quality companies (e.g., strong balance sheets, consistent earnings growth): BofA suggests a set of criteria for identifying high-quality companies, including strong balance sheets, consistent earnings growth, and a history of successful innovation.

- Examples of sectors or industries with companies that fit this profile: They identify specific sectors and industries where such companies can be found.

- Strategies for mitigating risk in a high-valuation environment: BofA advocates for strategies such as value investing and focusing on companies with defensive characteristics to mitigate risks associated with higher valuations.

Diversification and Risk Management

Diversification across asset classes and sectors is paramount in any market environment, but it's especially important when valuations are high.

- Examples of diversified investment portfolios: BofA provides examples of diversified investment portfolios that include a mix of stocks, bonds, and other asset classes to reduce overall portfolio risk.

- Importance of asset allocation strategies: They stress the significance of having a well-defined asset allocation strategy aligned with individual risk tolerance and investment goals.

- Strategies for managing portfolio volatility: BofA outlines strategies for managing portfolio volatility, such as dollar-cost averaging and rebalancing, to help investors withstand market fluctuations.

Conclusion

While high stock market valuations might raise concerns, BofA's analysis suggests that investors shouldn't panic. Their assessment considers interest rate projections, anticipated earnings growth, and the impact of inflation on valuation metrics, pointing to a more nuanced picture than initially perceived. By focusing on high-quality companies and employing effective diversification strategies, investors can navigate the current market successfully.

Call to Action: Don't let anxieties about stock market valuations dictate your investment decisions. Learn more about BofA's in-depth analysis and adjust your investment strategy accordingly for a more informed approach to managing your portfolio in this market environment. Understand stock market valuations and take control of your financial future. Remember to consult with a financial advisor before making any significant investment decisions.

Featured Posts

-

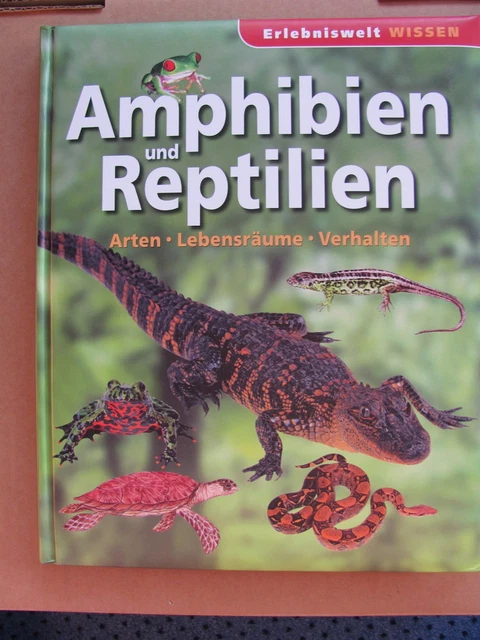

Amphibien Und Reptilien Thueringens Verbreitung Und Arten Im Neuen Atlas

Apr 27, 2025

Amphibien Und Reptilien Thueringens Verbreitung Und Arten Im Neuen Atlas

Apr 27, 2025 -

Bencic Returns To Wta Final In Abu Dhabi After Daughters Birth

Apr 27, 2025

Bencic Returns To Wta Final In Abu Dhabi After Daughters Birth

Apr 27, 2025 -

Dubai Return Svitolina Triumphs In First Round

Apr 27, 2025

Dubai Return Svitolina Triumphs In First Round

Apr 27, 2025 -

How Professional Help Transformed Ariana Grandes Hair And Tattoos

Apr 27, 2025

How Professional Help Transformed Ariana Grandes Hair And Tattoos

Apr 27, 2025 -

Juliette Binoche Appointed President Of The Cannes Jury For 2025

Apr 27, 2025

Juliette Binoche Appointed President Of The Cannes Jury For 2025

Apr 27, 2025

Latest Posts

-

Teslas Rise Lifts Us Stocks Tech Giants Power Market Growth

Apr 28, 2025

Teslas Rise Lifts Us Stocks Tech Giants Power Market Growth

Apr 28, 2025 -

Us Stock Market Rally Driven By Tech Giants Tesla

Apr 28, 2025

Us Stock Market Rally Driven By Tech Giants Tesla

Apr 28, 2025 -

Tesla And Tech Fuel Us Stock Market Surge

Apr 28, 2025

Tesla And Tech Fuel Us Stock Market Surge

Apr 28, 2025 -

Tech Giants Boost Us Stocks Tesla Leads The Charge

Apr 28, 2025

Tech Giants Boost Us Stocks Tesla Leads The Charge

Apr 28, 2025 -

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025