Stock Market Valuations: BofA's Argument Against Investor Worry

Table of Contents

Current stock market valuations are causing anxiety for many investors. Headlines scream about potential bubbles and impending corrections. However, Bank of America (BofA) offers a more nuanced perspective, arguing that the current valuations aren't as alarming as they might seem. This article explores BofA's key arguments and examines the factors supporting their relatively optimistic market outlook. We'll delve into their analysis of interest rates, corporate earnings growth, and potential risks, providing a clearer picture of the current stock market valuation landscape.

BofA's Key Arguments Against Elevated Valuations

BofA's core argument centers around a belief that current valuations, while seemingly high, are justifiable considering several key factors. They argue against knee-jerk reactions based solely on headline-grabbing metrics. Their analysis incorporates a detailed look at various valuation metrics and historical comparisons to support their position.

-

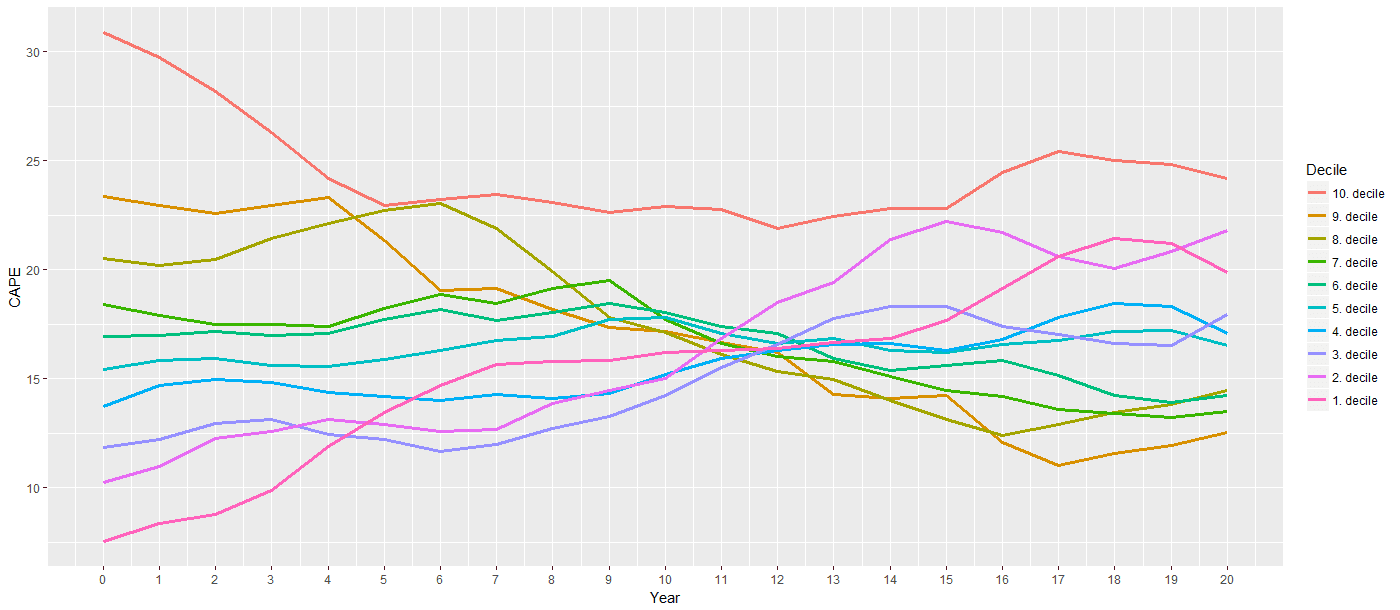

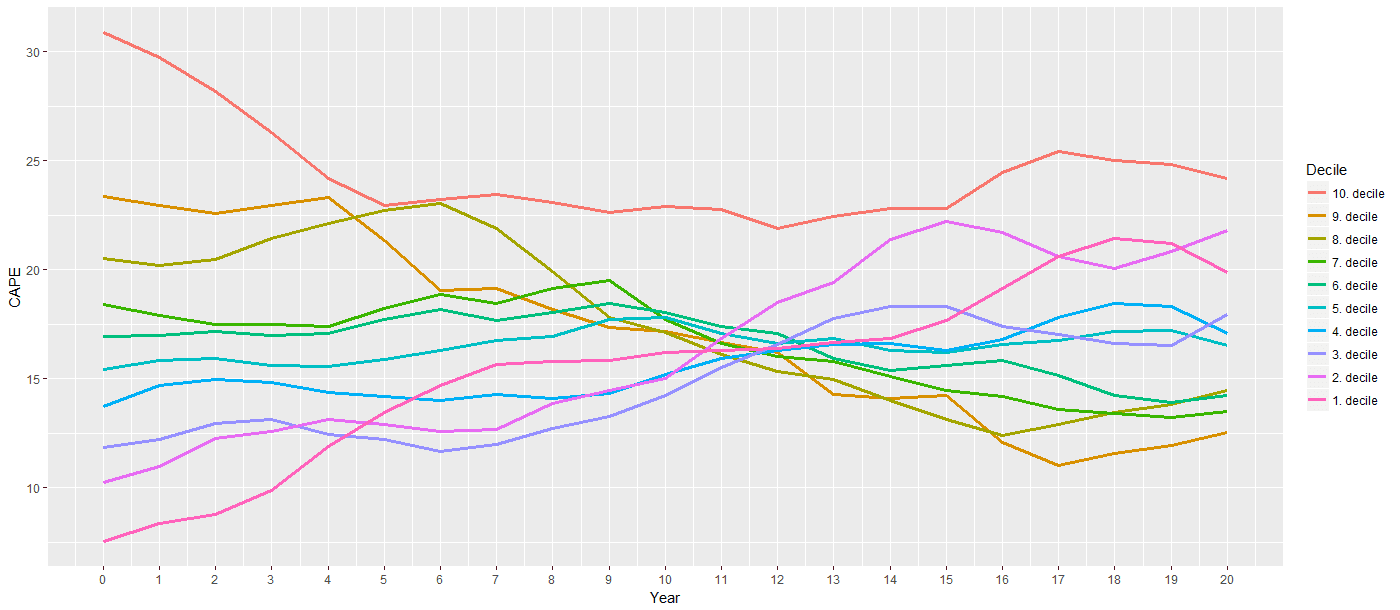

Specific Valuation Metrics: BofA utilizes a variety of metrics, including the price-to-earnings ratio (P/E ratio), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other forward-looking measures to assess market valuations. They don't rely on a single metric, acknowledging the limitations of each in isolation.

-

Historical Comparisons: BofA's analysis includes comparisons to past market cycles, highlighting periods with similar valuation levels and the subsequent market performance. This historical context helps to temper concerns about current valuations, showing that high valuations aren't necessarily indicative of an imminent crash.

-

Predictions for Future Market Performance: Based on their comprehensive valuation analysis, BofA projects continued, albeit potentially moderated, growth in the stock market. They acknowledge the possibility of short-term corrections but maintain a positive long-term outlook.

The Role of Interest Rates in BofA's Assessment

Interest rates play a crucial role in BofA's assessment of stock market valuations. The relationship between interest rates and stock valuations is generally inverse.

-

Inverse Relationship: Lower interest rates generally lead to higher stock valuations because borrowing costs for companies decrease, increasing profitability and making stocks more attractive relative to bonds.

-

BofA's Interest Rate Predictions: BofA's projections for interest rate movements are a key component of their valuation analysis. They anticipate a relatively stable, potentially slightly increasing, interest rate environment.

-

Impact on Valuation Analysis: BofA's relatively benign interest rate forecast supports their view that current stock valuations are sustainable. A sharp increase in interest rates would undoubtedly shift their outlook.

Considering Corporate Earnings Growth in Stock Market Valuations

BofA's valuation model explicitly incorporates projections for corporate earnings growth, a critical factor often overlooked in simplistic valuation analyses.

-

Projections for Future Corporate Earnings Growth: BofA projects continued, albeit potentially slower, corporate earnings growth. This is a key justification for their relatively optimistic stance.

-

Earnings Growth and Valuation Metrics: Strong earnings growth can offset seemingly high valuation metrics like the P/E ratio. If earnings grow faster than the price, the P/E ratio will eventually decrease, making the valuation appear more reasonable.

-

Justifying Higher Valuations: BofA argues that robust earnings growth can justify higher valuations, challenging the narrative that high valuations automatically signal overpricing.

Addressing Counterarguments and Potential Risks

While BofA maintains a relatively positive outlook, they acknowledge counterarguments and potential risks that could impact stock market valuations.

-

Inflation's Impact: Inflation is a major concern, potentially eroding corporate profits and impacting valuations. BofA acknowledges this risk but suggests their projections already incorporate reasonable inflation expectations.

-

Geopolitical Risks: Geopolitical events, such as international conflicts or trade wars, pose significant uncertainties and could negatively impact market performance. BofA’s analysis accounts for these, incorporating probabilities and potential impacts.

-

Recessionary Concerns: The potential for an economic recession is a valid concern. BofA addresses this risk by analyzing the likelihood of a recession and its potential impact on their valuation predictions.

Diversification as a Risk Mitigation Strategy

Even with a positive outlook, diversification remains crucial for managing risk.

-

Importance of Diversification: A diversified investment portfolio reduces the impact of any single asset's underperformance.

-

Asset Classes for Diversification: Consider diversifying across various asset classes including bonds, real estate, and alternative investments.

-

Seeking Professional Advice: Consult a qualified financial advisor for personalized advice tailored to your risk tolerance and financial goals.

Conclusion

BofA's analysis suggests that while stock market valuations appear high to some, they are not necessarily alarming. Their assessment incorporates a detailed examination of various valuation metrics, interest rate projections, corporate earnings growth, and potential risks. While acknowledging potential challenges, BofA maintains a relatively positive long-term outlook. Don't let worries about stock market valuations paralyze you. Conduct your own thorough research, understand the complexities of stock market valuations, and consider seeking professional financial advice before making any investment decisions. Learn more about interpreting stock market valuations and making informed investment decisions. Remember, responsible investing requires careful consideration of various factors and professional guidance.

Featured Posts

-

Jeanine Pirro Trumps Choice For Top Dc Prosecutor

May 10, 2025

Jeanine Pirro Trumps Choice For Top Dc Prosecutor

May 10, 2025 -

Is Leon Draisaitl Ready Key Injury Update For Edmonton Oilers Playoffs

May 10, 2025

Is Leon Draisaitl Ready Key Injury Update For Edmonton Oilers Playoffs

May 10, 2025 -

The Impact Of Figmas Ai On Adobe Word Press And Canva

May 10, 2025

The Impact Of Figmas Ai On Adobe Word Press And Canva

May 10, 2025 -

Snls Failed Harry Styles Impression His Heartbreaking Response

May 10, 2025

Snls Failed Harry Styles Impression His Heartbreaking Response

May 10, 2025 -

St Albert Dinner Theatre Fast Paced Farcical Fun

May 10, 2025

St Albert Dinner Theatre Fast Paced Farcical Fun

May 10, 2025