Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

BofA's Key Arguments for Moderate Stock Market Valuations

BofA's analysis of stock market valuations employs a multifaceted approach, incorporating several key valuation metrics. Their methodology includes traditional methods like price-to-earnings (P/E) ratios, but also incorporates more sophisticated models such as discounted cash flow (DCF) analysis, taking into account projected future earnings and the current interest rate environment. This comprehensive approach provides a nuanced picture of the current equity market.

BofA's main conclusions regarding current valuations include:

- BofA finds valuations to be in line with historical averages, adjusting for the current interest rate environment. This suggests that despite recent price increases, the market isn't significantly overpriced compared to past performance, considering the higher cost of borrowing.

- Strong corporate earnings growth is partially offsetting higher interest rates. While rising interest rates typically put downward pressure on stock valuations, BofA's analysis indicates that robust corporate earnings are mitigating this effect to some extent.

- Certain sectors show more attractive valuations than others. This highlights the importance of sector-specific analysis when assessing stock valuations and developing an investment strategy.

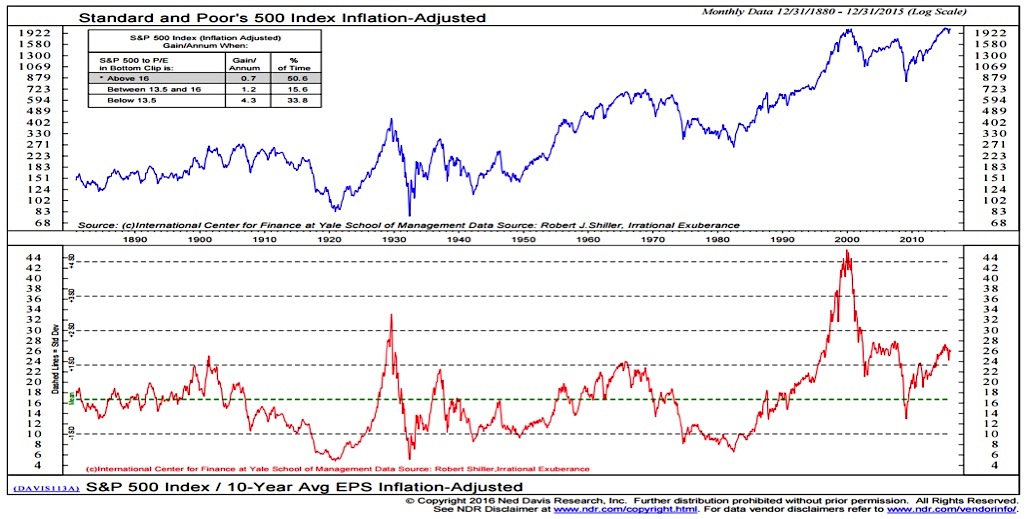

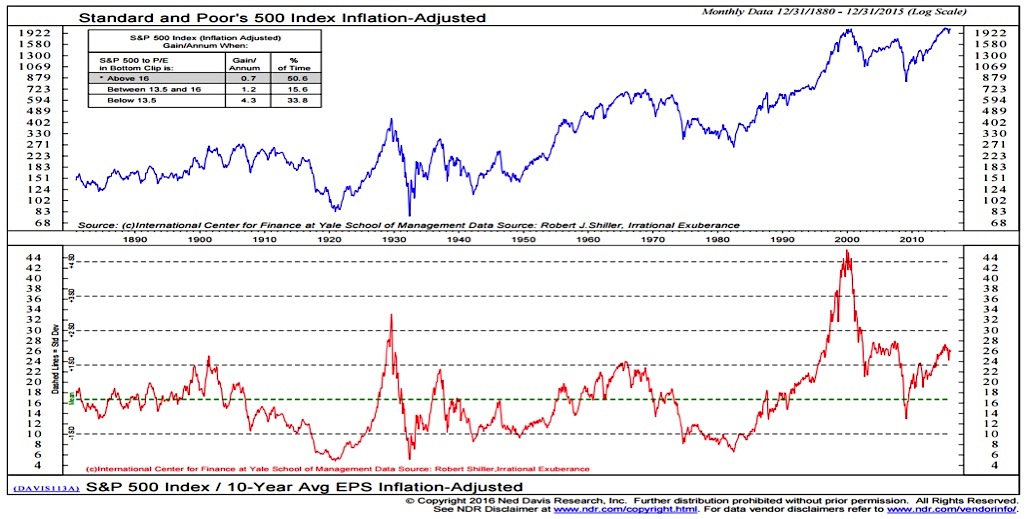

(Insert chart/graph here illustrating BofA's findings on P/E ratios compared to historical averages. Source: [Cite BofA report or relevant financial news source]).

Addressing Investor Concerns about Inflation and Interest Rates

The impact of inflation and rising interest rates on stock market valuations is a major concern for many investors. BofA's analysis directly addresses these anxieties.

BofA's counterarguments include:

- BofA's projections for inflation and its impact on corporate earnings. Their analysis suggests that while inflation remains a factor, its impact on corporate profitability is likely to be less severe than some anticipate. They consider factors like pricing power and cost-cutting measures employed by companies.

- Analysis of the relationship between interest rate hikes and equity market performance. BofA’s research explores the historical relationship between interest rate increases and equity market performance, suggesting that while rate hikes can cause short-term volatility, long-term growth isn't necessarily impeded.

- Mention of BofA's perspective on the Federal Reserve's actions and their effect on valuations. Their analysis considers the likely trajectory of Federal Reserve policy and its implications for stock valuations, providing a reasoned perspective on the central bank’s actions.

Sector-Specific Valuations and Investment Opportunities

BofA's assessment of stock valuations is not a blanket statement; it delves into sector-specific analysis. Their research identifies areas of relative undervaluation and overvaluation within the broader market analysis.

For example:

- Specific sectors deemed attractive based on BofA’s analysis. These may include sectors with strong growth prospects despite the current economic climate, or those showing resilience to inflationary pressures. (Example: Renewable energy, specific segments within healthcare).

- Reasons for their assessment of these sectors (e.g., growth potential, profitability). BofA's detailed reports explain the rationale behind their sector-specific recommendations, considering factors such as earnings growth, industry trends, and competitive landscapes.

- Cautionary notes about specific sectors. BofA's analysis isn't solely positive; it also highlights sectors that might be vulnerable to current economic headwinds or exhibiting signs of overvaluation. (Example: Certain technology sub-sectors).

Diversification Strategies Based on BofA's Insights

BofA's market analysis provides valuable insights for crafting a robust investment strategy. Investors can leverage this information to make informed decisions and manage risk effectively.

Actionable advice based on BofA's findings includes:

- Consider rebalancing your portfolio based on BofA's sector analysis. Adjust your asset allocation to reflect their assessment of undervalued and overvalued sectors, aiming for a more optimized portfolio.

- Explore investment options in undervalued sectors. Identify opportunities within sectors deemed attractive by BofA's research, considering their growth potential and risk profiles.

- The importance of a long-term investment horizon. Navigating market volatility requires a long-term perspective. BofA's analysis supports the importance of patience and a well-defined investment plan.

Conclusion

BofA's analysis suggests a more optimistic outlook on stock market valuations than might be perceived amidst current volatility. By considering their assessment of inflation, interest rates, and sector-specific stock valuations, investors can make more informed decisions. Their findings highlight the importance of diversification and a long-term investment strategy.

Call to Action: While market uncertainty persists, understanding current stock market valuations is crucial. Learn more about BofA's insights and develop a robust investment strategy based on their analysis to navigate the complexities of the current market. Stay informed about stock valuations and adjust your portfolio accordingly for optimal performance. Don't hesitate to consult with a financial advisor to tailor a strategy that aligns with your individual risk tolerance and financial goals.

Featured Posts

-

Patrick Schwarzenegger Cruises La In His Classic Bronco

May 06, 2025

Patrick Schwarzenegger Cruises La In His Classic Bronco

May 06, 2025 -

Watch Celtics Vs Pistons Live Free Stream Tv Channel Guide

May 06, 2025

Watch Celtics Vs Pistons Live Free Stream Tv Channel Guide

May 06, 2025 -

Canadas Economic Future Gary Mars Perspective On Western Development And Mark Carneys Role

May 06, 2025

Canadas Economic Future Gary Mars Perspective On Western Development And Mark Carneys Role

May 06, 2025 -

Putin On Ukraine No Need For Nuclear Weapons He Hopes

May 06, 2025

Putin On Ukraine No Need For Nuclear Weapons He Hopes

May 06, 2025 -

Patrik Svarceneger O Teretu Prezimena Arnolda Svarcenegera

May 06, 2025

Patrik Svarceneger O Teretu Prezimena Arnolda Svarcenegera

May 06, 2025

Latest Posts

-

Alina Voskresenskaya V Univer Molodye Podrobnosti Roli V Novom Sezone Tnt

May 06, 2025

Alina Voskresenskaya V Univer Molodye Podrobnosti Roli V Novom Sezone Tnt

May 06, 2025 -

Nitro Chem Europejski Lider W Produkcji I Dostawach Trotylu

May 06, 2025

Nitro Chem Europejski Lider W Produkcji I Dostawach Trotylu

May 06, 2025 -

Spak Kontrollon Banesen E Motrave Nikolli

May 06, 2025

Spak Kontrollon Banesen E Motrave Nikolli

May 06, 2025 -

Tnt And Max Saya 25 Years Of Service To Filipino Communities

May 06, 2025

Tnt And Max Saya 25 Years Of Service To Filipino Communities

May 06, 2025 -

Trotyl Polski Nitro Chem Wiodacy Producent W Europie

May 06, 2025

Trotyl Polski Nitro Chem Wiodacy Producent W Europie

May 06, 2025