Stock Market Valuations: BofA's Reassuring Analysis For Investors

Table of Contents

BofA's Methodology and Key Assumptions

BofA's valuation analysis employs a rigorous approach, incorporating several key metrics and assumptions. Their methodology involves a comprehensive assessment of current market conditions and future economic forecasts to arrive at their conclusions regarding stock market valuations. The bank utilizes a multi-faceted approach, drawing upon various established valuation models.

- Specific valuation metrics used: BofA's analysis likely incorporates metrics such as the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, Price-to-Book (P/B) ratio, and Discounted Cash Flow (DCF) analysis. These metrics provide a diverse perspective on company valuations and overall market health.

- Time horizon of the analysis: The report likely considers both short-term and long-term scenarios, offering a nuanced perspective on stock market valuations over different timeframes. A longer time horizon allows for a more comprehensive assessment, factoring in potential economic shifts and market cycles.

- Economic scenarios considered: BofA's analysts likely considered various economic scenarios, ranging from optimistic growth to more pessimistic forecasts, to assess the robustness of their valuation conclusions under different conditions. This sensitivity analysis helps investors understand the potential range of outcomes.

BofA's Findings on Current Market Valuations

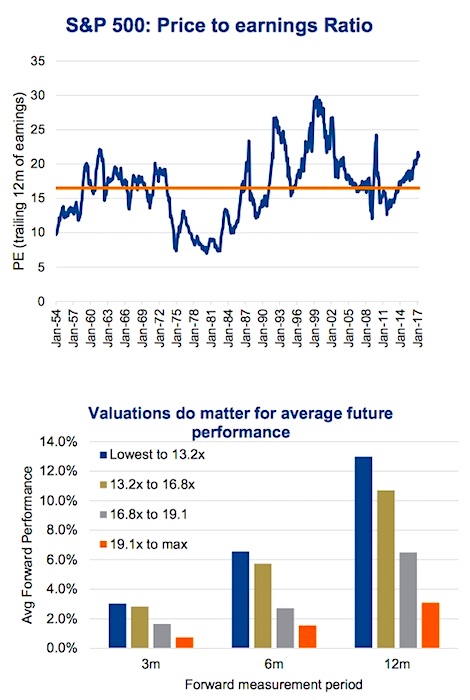

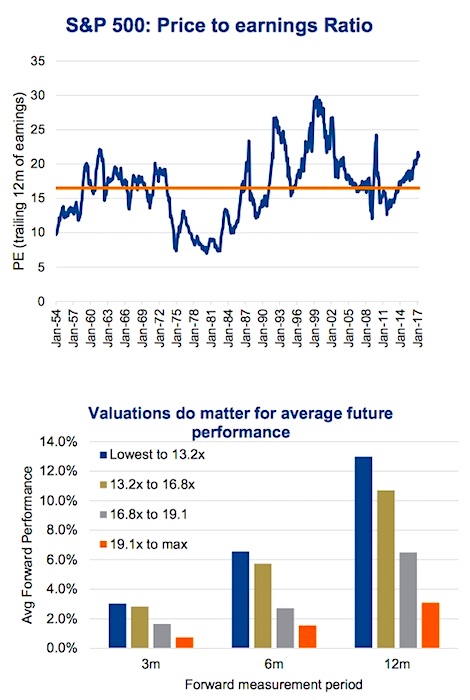

BofA's findings on current market valuations (the specific details will depend on the actual report) would typically present their assessment of whether the market is overvalued, undervalued, or fairly valued. Their conclusions would be supported by specific data points derived from their analysis. For example, a relatively high P/E ratio compared to historical averages might suggest a degree of overvaluation.

- Key valuation metrics and their results: For instance, "The P/E ratio is currently at 22, suggesting a slightly above-average valuation compared to historical averages of 18."

- Comparison to historical averages: The report would likely compare current valuation metrics to long-term historical averages to gauge whether current levels are unusually high or low. This provides crucial context for interpreting the current market landscape.

- Sector-specific findings: BofA might offer sector-specific insights, identifying sectors that appear relatively overvalued or undervalued compared to others. This granular analysis can help investors refine their investment strategies.

Implications for Investors Based on BofA's Analysis

The implications of BofA's analysis vary depending on investor profiles and risk tolerance. For example, long-term investors might view slightly overvalued markets as less concerning than short-term investors. Risk-averse investors might prefer a more conservative approach, while risk-tolerant investors may see opportunities for growth even in a potentially overvalued market.

- Investment strategies suggested: BofA's analysis might suggest strategies like sector rotation (moving investments from overvalued to undervalued sectors), diversification across asset classes, or a more cautious approach to equity investments.

- Sectors or asset classes BofA recommends: The report may highlight sectors or asset classes that appear more attractive based on their valuation analysis. This could provide valuable guidance for portfolio allocation.

- Risk management considerations: Understanding the potential risks associated with different investment strategies is crucial. BofA's analysis might emphasize risk management techniques such as diversification and stop-loss orders.

Counterarguments and Limitations of BofA's Analysis

It's essential to acknowledge potential limitations of any market analysis, including BofA's. While their analysis provides valuable insights, it's not a foolproof prediction of future market movements.

- Potential flaws in the methodology: For instance, assumptions about future economic growth or interest rates can significantly impact valuation results. Any limitations in the data used also need acknowledgement.

- Uncertainties or risks not fully accounted for: Unexpected geopolitical events, technological disruptions, or regulatory changes could significantly impact market valuations. These are inherent uncertainties difficult to predict accurately.

- Alternative perspectives on market valuation: Different valuation models and analytical approaches may lead to varying conclusions. Considering alternative viewpoints enhances the overall understanding.

Conclusion: Actionable Insights on Stock Market Valuations

BofA's analysis provides valuable insights into current stock market valuations, offering a nuanced perspective for investors. While the specific findings will vary depending on the report's date, the overall approach emphasizes the importance of considering multiple valuation metrics, historical averages, and potential economic scenarios. Understanding stock market valuations is crucial for informed investment decisions. Review BofA's comprehensive analysis and consult with a financial advisor to develop a personalized investment strategy based on your understanding of stock market valuations and your individual risk tolerance. Make informed choices about your portfolio today to optimize your financial planning.

Featured Posts

-

Regreso De Lewis Capaldi A Wwe Smack Down Despues De Sus Problemas De Salud

May 07, 2025

Regreso De Lewis Capaldi A Wwe Smack Down Despues De Sus Problemas De Salud

May 07, 2025 -

The Young And The Restless March 7 2024 Recap Diane Saves Claire Kyles Romantic Evening

May 07, 2025

The Young And The Restless March 7 2024 Recap Diane Saves Claire Kyles Romantic Evening

May 07, 2025 -

Chris Finchs Decisions The Key To The Timberwolves Future

May 07, 2025

Chris Finchs Decisions The Key To The Timberwolves Future

May 07, 2025 -

Le Verts Free Agency Will The Cavaliers Retain Him A Report

May 07, 2025

Le Verts Free Agency Will The Cavaliers Retain Him A Report

May 07, 2025 -

Ovechkins First Nhl Goal Goaltenders Unique Request To The Capitals Legend

May 07, 2025

Ovechkins First Nhl Goal Goaltenders Unique Request To The Capitals Legend

May 07, 2025

Latest Posts

-

The White Lotus Season 3 Did Ke Huy Quan Make A Surprise Appearance

May 07, 2025

The White Lotus Season 3 Did Ke Huy Quan Make A Surprise Appearance

May 07, 2025 -

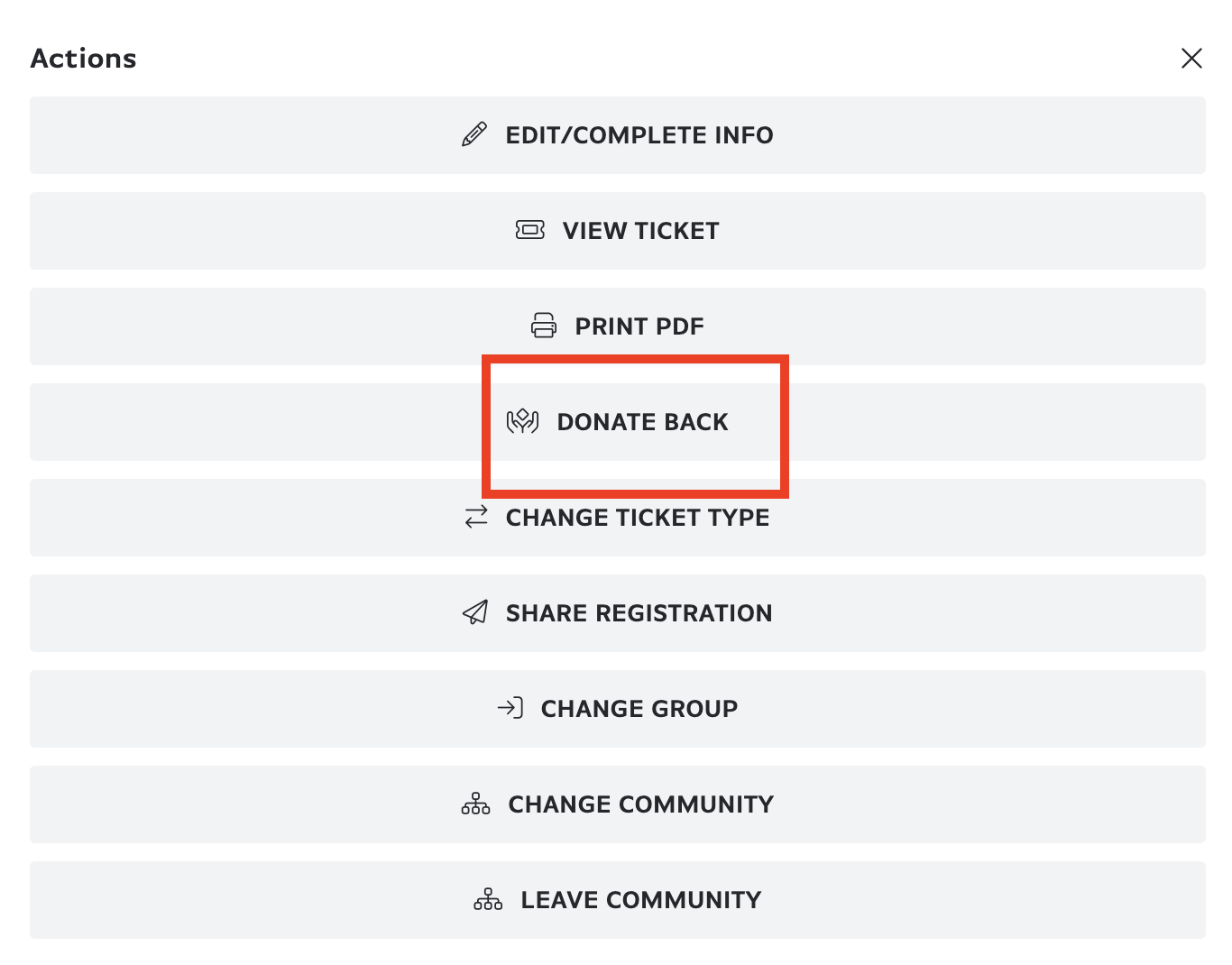

Cleveland Cavaliers Introduce Ticket Donation Program

May 07, 2025

Cleveland Cavaliers Introduce Ticket Donation Program

May 07, 2025 -

Ke Huy Quans The White Lotus Season 3 Cameo Fact Or Fiction

May 07, 2025

Ke Huy Quans The White Lotus Season 3 Cameo Fact Or Fiction

May 07, 2025 -

New Platform Lets Cavs Fans Donate Tickets

May 07, 2025

New Platform Lets Cavs Fans Donate Tickets

May 07, 2025 -

Is Ke Huy Quan In The White Lotus Season 3 Kenny Cameo Explained

May 07, 2025

Is Ke Huy Quan In The White Lotus Season 3 Kenny Cameo Explained

May 07, 2025