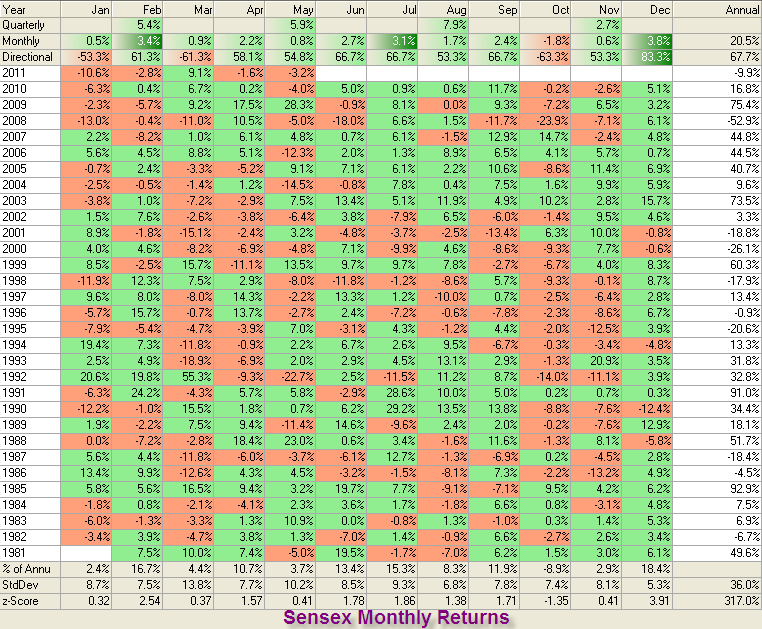

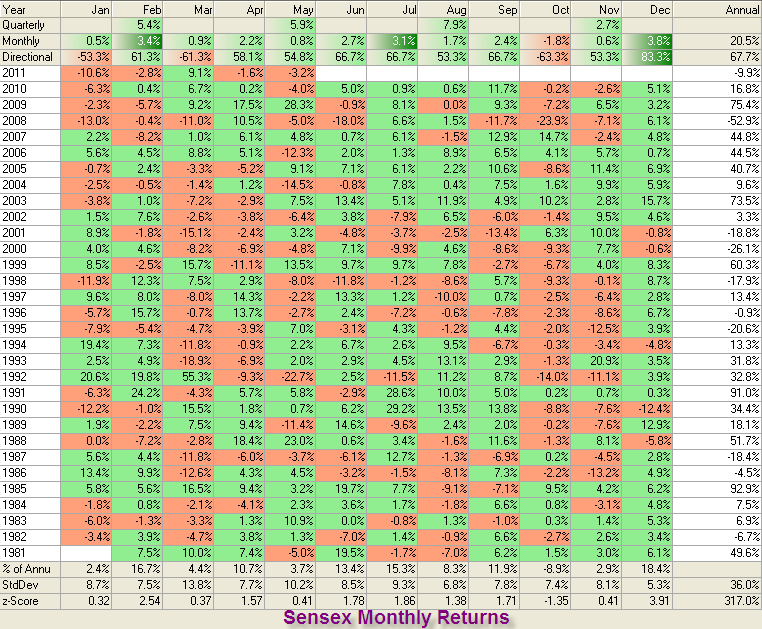

Stocks Climb 10%+ On BSE: Sensex's Significant Rise

Table of Contents

Key Drivers Behind the Sensex's 10%+ Surge

Several interconnected factors contributed to this remarkable increase in the Sensex. Let's analyze the key drivers that propelled the BSE to such significant heights.

Positive Global Market Sentiment

The global economic landscape played a crucial role in the Sensex's impressive performance. Positive global indicators created a ripple effect, boosting investor confidence in emerging markets like India.

- Improved US Economic Data: Stronger-than-expected economic data from the United States injected optimism into global markets, reducing fears of a recession and encouraging investment in riskier assets, including Indian stocks.

- Positive Global Investor Sentiment towards Emerging Markets: A general positive outlook towards emerging economies, fueled by factors like improving global growth forecasts, led to increased foreign investment flows into India.

- Strength of the Rupee against Major Currencies: The rupee's relative strength against major currencies like the US dollar made Indian assets more attractive to foreign investors, further boosting the Sensex.

- Global Index Performance: The positive performance of major global indices, such as the Dow Jones Industrial Average and the NASDAQ, created a positive spillover effect on the Indian market.

Strong Corporate Earnings

Robust corporate earnings from several Indian companies significantly bolstered investor confidence. Positive earnings surprises and strong growth projections fueled the market's upward trajectory.

- Significant Earnings Growth in Key Sectors: Companies across various sectors, particularly IT and Pharma, reported exceptionally strong earnings growth, exceeding market expectations. Examples include [insert specific company examples with ticker symbols and percentage growth].

- Positive Earnings Surprises: Several companies reported earnings that significantly surpassed analysts' predictions, leading to a surge in their stock prices and contributing to the overall market rally.

- Sectoral Performance: The IT sector saw particularly strong gains, driven by increased demand for technology services globally. Pharmaceutical companies also experienced significant growth due to [insert specific reasons].

Government Policies and Initiatives

Positive government policies and initiatives further contributed to the market's optimistic outlook. Regulatory changes and supportive measures instilled confidence among investors.

- Boosting Infrastructure Development: Government initiatives focused on improving infrastructure, such as [mention specific policy names], created a positive outlook for related sectors and the economy as a whole.

- Ease of Doing Business Reforms: Continued efforts to simplify regulations and improve the business environment boosted investor confidence in the long-term prospects of the Indian economy.

- Positive Regulatory Changes: Recent regulatory changes aimed at [mention specific examples, e.g., promoting foreign investment], further enhanced the appeal of the Indian market to investors.

Sector-Wise Performance Analysis: Which Stocks Led the Charge?

The Sensex's surge wasn't uniform across all sectors. Some sectors outperformed others, leading the charge in this significant market rally.

Top Performing Sectors

Several sectors experienced disproportionately large gains during this period. This analysis highlights the best performing sectors and their key drivers.

- Banking Sector: The banking sector witnessed substantial growth, fueled by [mention specific reasons, e.g., improving credit growth and positive interest rate environment]. Key performers included [mention specific bank names and their performance].

- FMCG Sector: The fast-moving consumer goods (FMCG) sector also saw significant gains, driven by [mention reasons, e.g., increasing consumer spending and strong brand performance]. Top performers in this sector included [mention specific company names and their performance].

- (Insert other top performing sectors and details) [Use charts/graphs if possible to visually represent sector-wise performance]

Stocks that Outperformed the Market

Beyond sectoral trends, individual stocks significantly outperformed the overall market. This section highlights some of these exceptional performers.

- [Stock Name 1]: Rose by [percentage]% due to [reason for performance]. [Link to relevant news article]

- [Stock Name 2]: Increased by [percentage]% driven by [reason for performance]. [Link to relevant news article]

- [Stock Name 3]: Showed a [percentage]% increase attributed to [reason for performance]. [Link to relevant news article]

Expert Opinions and Market Outlook: What Lies Ahead for the Sensex?

Analyzing expert opinions and current market sentiment is crucial for understanding the potential trajectory of the Sensex.

Analyst Predictions

Financial analysts offer diverse perspectives on the future direction of the Indian stock market.

- [Analyst Name 1]: Predicts [prediction about Sensex trajectory], citing [reasons for prediction].

- [Analyst Name 2]: Believes the Sensex will [prediction], highlighting [factors influencing their prediction].

- [Analyst Name 3]: Foresees potential challenges, including [potential risks].

Investor Sentiment and Strategy

Understanding investor behavior is key to navigating the market's future movements.

- Increased Risk Appetite: The current market surge suggests an increase in investor risk appetite, potentially leading to further gains.

- Strategic Investment: Investors may adopt strategies such as [mention strategies, e.g., sector rotation, value investing] to capitalize on market opportunities.

- Potential Threats: While the outlook is currently positive, investors should remain aware of potential risks, such as [mention potential risks, e.g., global economic slowdown, geopolitical uncertainty].

Conclusion: Navigating the Sensex's Significant Rise — What's Next?

The Sensex's dramatic 10%+ climb on the BSE is a result of a confluence of factors: positive global sentiment, strong corporate earnings, and supportive government policies. This significant rise presents both opportunities and challenges for investors. Understanding the underlying drivers, analyzing sector-specific performances, and staying informed about expert opinions are crucial for making informed investment decisions. The future trajectory of the Sensex remains subject to various internal and external factors. To navigate this dynamic market effectively, stay updated on market trends, continue researching, and consult with financial advisors. By closely monitoring the “Sensex's significant rise” and related market indicators, you can better position yourself for success in the Indian stock market.

Featured Posts

-

Indias Farm Sector To Thrive On Promising Monsoon Predictions Ind Ra Report

May 15, 2025

Indias Farm Sector To Thrive On Promising Monsoon Predictions Ind Ra Report

May 15, 2025 -

De Npo In Opstand Actie Gericht Op Frederieke Leeflang

May 15, 2025

De Npo In Opstand Actie Gericht Op Frederieke Leeflang

May 15, 2025 -

Itb Berlin Kuzey Kibris Gastronomisi Duenyaya Tanitildi

May 15, 2025

Itb Berlin Kuzey Kibris Gastronomisi Duenyaya Tanitildi

May 15, 2025 -

Verbetering Van De Aanpak Van Grensoverschrijdend Gedrag Binnen De Npo

May 15, 2025

Verbetering Van De Aanpak Van Grensoverschrijdend Gedrag Binnen De Npo

May 15, 2025 -

Kaysima Eyresi Ton Fthinoteron Pratirion Stin Kypro

May 15, 2025

Kaysima Eyresi Ton Fthinoteron Pratirion Stin Kypro

May 15, 2025

Latest Posts

-

Aanhoudende Klachten Over Angstcultuur Bij De Npo Onder Leiding Van Leeflang

May 15, 2025

Aanhoudende Klachten Over Angstcultuur Bij De Npo Onder Leiding Van Leeflang

May 15, 2025 -

Npo Medewerkers Melden Angstcultuur Onderzoek Naar Leeflangs Management Gewenst

May 15, 2025

Npo Medewerkers Melden Angstcultuur Onderzoek Naar Leeflangs Management Gewenst

May 15, 2025 -

Leeflangs Leiderschap Bij De Npo Klachten Over Angstcultuur Onder Medewerkers

May 15, 2025

Leeflangs Leiderschap Bij De Npo Klachten Over Angstcultuur Onder Medewerkers

May 15, 2025 -

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025 -

Nieuwe Stappen Tegen Grensoverschrijdend Gedrag Bij De Npo

May 15, 2025

Nieuwe Stappen Tegen Grensoverschrijdend Gedrag Bij De Npo

May 15, 2025