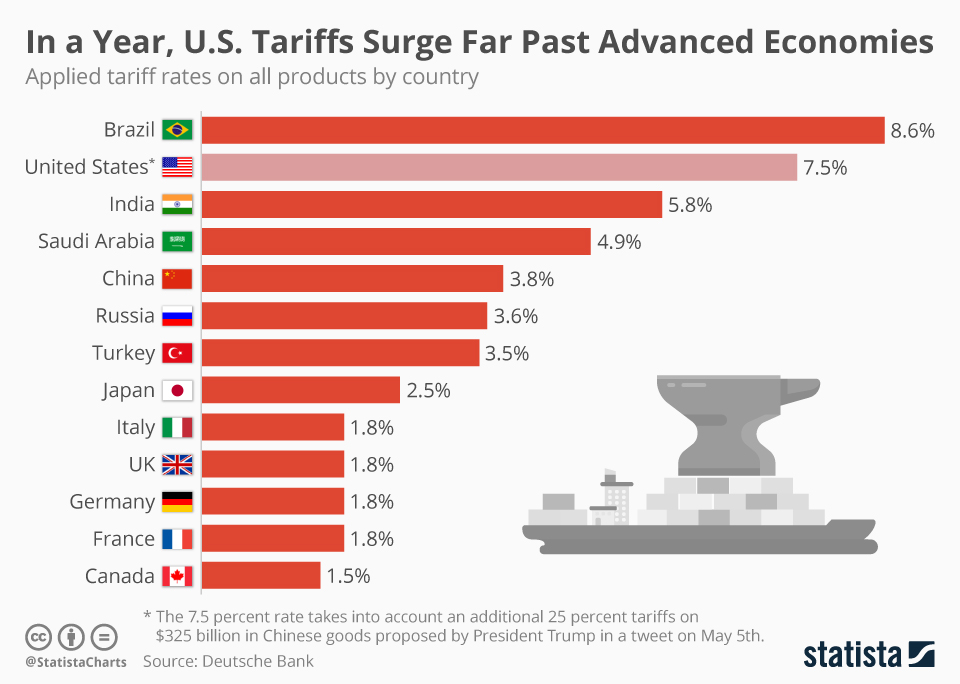

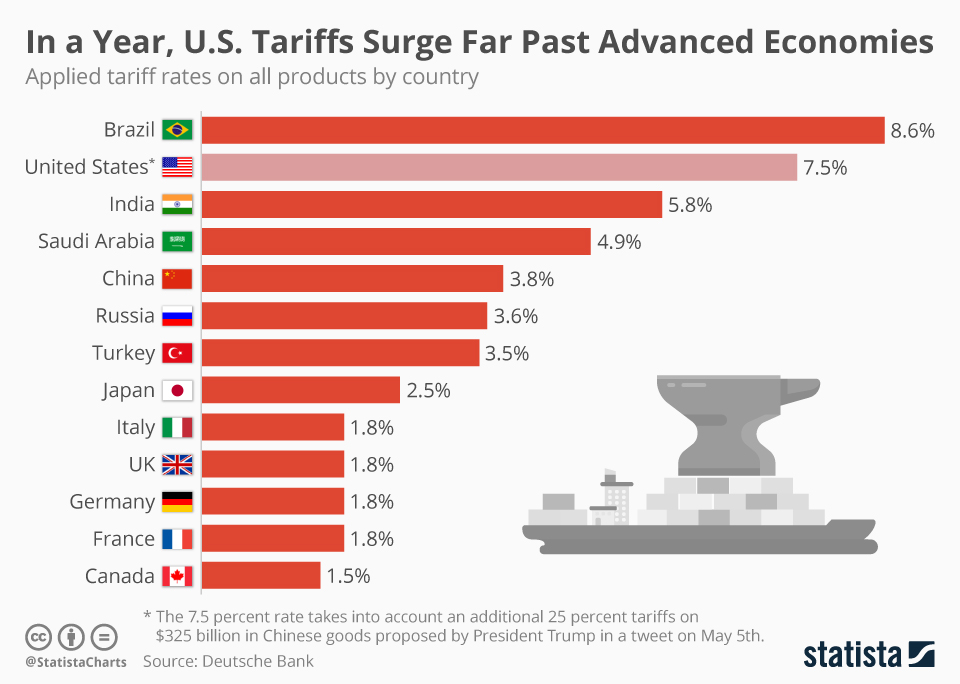

Stocks Under Pressure: Assessing The Impact Of 'Liberation Day' Tariffs

Table of Contents

Sector-Specific Impacts of 'Liberation Day' Tariffs

The "Liberation Day" tariffs have not impacted all sectors equally. The uneven distribution of tariff effects highlights the vulnerability of specific industries to trade disruptions. Understanding these sector-specific impacts is crucial for informed investment decisions.

Keywords: Tariff impact by sector, affected industries, import/export, supply chain disruption

-

Technology: The tech sector is facing increased costs for imported components, directly impacting profit margins for giants like Apple and Samsung. This has led to discussions of reshoring—bringing manufacturing back to domestic markets—and increased investment in domestic component production. The long-term effects remain uncertain, but potential supply chain disruptions could lead to higher prices for consumers.

-

Manufacturing: The manufacturing sector is significantly impacted, facing substantial price increases for both raw materials and finished goods. This reduced competitiveness is leading to job losses in some areas and increased pressure on companies to find alternative supply chains or absorb increased costs. Industries heavily reliant on imported materials are particularly vulnerable.

-

Consumer Goods: Consumers are already feeling the pinch, with higher prices for imported goods leading to decreased demand in some sectors. Companies are grappling with the decision to absorb increased costs or pass them on to consumers, potentially impacting sales figures and overall profitability. This shift could lead to a change in consumer behavior, with a potential shift towards domestically produced goods.

-

Agriculture: The agricultural sector faces disrupted trade relations, impacting export markets and reducing farm incomes. Depending on the specific agricultural products and trading partners affected, the effects vary. Government subsidies and support programs may play a vital role in mitigating the negative consequences for farmers.

Market Volatility and Investor Sentiment

The announcement of the "Liberation Day" tariffs immediately impacted investor sentiment, leading to a sharp decline in investor confidence. This uncertainty has resulted in increased market volatility and heightened concerns regarding future economic growth.

Keywords: Market reaction, investor confidence, stock market volatility, risk assessment, portfolio diversification

-

Sharp Decline in Confidence: The unexpected nature of the tariffs and the lack of clarity regarding their long-term implications have significantly shaken investor confidence.

-

Increased Market Volatility: As investors react to the uncertainty, market volatility has increased significantly, leading to larger price swings in various asset classes.

-

Flight to Safety: Investors are seeking refuge in traditionally safer assets, such as government bonds and gold, as a defensive measure against potential economic downturns.

-

Increased Hedging: Institutional investors are employing increased hedging strategies to mitigate potential losses from market fluctuations caused by the ongoing tariff situation.

Potential Investment Strategies in a Tariff-Affected Market

Navigating the current market requires a strategic approach. Investors need to adapt their strategies to mitigate risks and potentially capitalize on opportunities presented by this altered economic landscape.

Keywords: Investment strategies, risk management, portfolio adjustments, diversification, long-term investment, short-term trading

-

Diversification: Diversifying investments across different sectors and asset classes is crucial to reduce overall portfolio risk. This reduces exposure to any single sector heavily impacted by the tariffs.

-

Focus on Domestic Strength: Companies with strong domestic markets and reduced reliance on imports/exports are relatively better positioned. Investing in these businesses offers some protection against external trade disruptions.

-

Profitability Assessment: Careful evaluation of companies' ability to absorb increased costs and maintain profitability is essential. Analyze their pricing strategies and supply chain resilience.

-

Short-Term vs. Long-Term: Investors should consider both short-term trading opportunities—taking advantage of market fluctuations—and long-term investment strategies, focusing on companies with robust fundamentals and growth potential.

Conclusion

The implementation of "Liberation Day" tariffs has undoubtedly created significant pressure on stocks and introduced substantial uncertainty into the market. While certain sectors are more heavily impacted than others, understanding these effects and adapting investment strategies is crucial for navigating this turbulent period. By diversifying portfolios, carefully selecting investments, and closely monitoring market developments, investors can mitigate risks and potentially identify opportunities presented by this shifting economic environment. Stay informed about the ongoing impact of Liberation Day tariffs and adjust your investment strategy accordingly to weather this market challenge. Understanding the impact of Liberation Day tariffs on stock prices is key to successful investing during this period of global trade uncertainty.

Featured Posts

-

Arsenal Psg Macini Sifresiz Canli Izlemenin Yollari

May 08, 2025

Arsenal Psg Macini Sifresiz Canli Izlemenin Yollari

May 08, 2025 -

Is Jayson Tatum Underappreciated Colin Cowherd Weighs In Again

May 08, 2025

Is Jayson Tatum Underappreciated Colin Cowherd Weighs In Again

May 08, 2025 -

Revealed Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025

Revealed Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025 -

Seged Gi Eliminira Favoritite Od Pariz I Se Plasira Vo Chetvrtfinale Na L Sh

May 08, 2025

Seged Gi Eliminira Favoritite Od Pariz I Se Plasira Vo Chetvrtfinale Na L Sh

May 08, 2025 -

Cowherds Harsh Words For Tatum After Celtics Game 1 Loss

May 08, 2025

Cowherds Harsh Words For Tatum After Celtics Game 1 Loss

May 08, 2025