Strengthened Capital Markets: Pakistan, Sri Lanka, And Bangladesh's New Agreement

Table of Contents

The Agreement's Core Provisions and Objectives

The core objective of this trilateral agreement is to foster deeper integration of the capital markets of Pakistan, Sri Lanka, and Bangladesh. This involves streamlining regulatory frameworks, enhancing investor protection, and creating mechanisms for increased cross-border investment. The agreement's key clauses focus on several critical aspects of regional financial cooperation:

-

Harmonization of Regulatory Standards: The agreement aims to harmonize and align the regulatory standards across the three countries, reducing inconsistencies and creating a more predictable and transparent investment environment. This will involve a significant effort to streamline processes and minimize compliance burdens for investors.

-

Establishment of a Joint Investment Platform: A crucial element is the creation of a joint investment platform, a centralized hub facilitating cross-border transactions, information sharing, and investor education. This platform will play a key role in promoting transparency and trust among investors.

-

Mechanisms for Dispute Resolution: Efficient and fair dispute resolution mechanisms are integral to the agreement, providing a framework for addressing conflicts between investors and regulators or between investors themselves. This will be critical for building confidence in the system.

-

Facilitation of Information Sharing: The agreement emphasizes the importance of readily accessible and transparent information sharing amongst participating regulatory bodies. This will enhance transparency and aid in the consistent application of regulatory standards.

-

Promotion of Regional Financial Products: The initiative promotes the development and cross-border trading of standardized regional financial products, deepening liquidity and creating more attractive investment opportunities within the region. This will help to develop more sophisticated financial markets.

Potential Economic Benefits for Pakistan, Sri Lanka, and Bangladesh

The anticipated economic benefits from this agreement are substantial and far-reaching, impacting several key areas of economic development for all three nations:

-

Increased Foreign Direct Investment (FDI): The enhanced regulatory clarity and investor protection provided by the agreement are projected to significantly increase FDI flows into Pakistan, Sri Lanka, and Bangladesh. This influx of capital will fuel economic growth and diversification.

-

Economic Diversification: The agreement is expected to promote economic diversification by encouraging investment in a wider range of sectors, fostering innovation and reducing over-reliance on specific industries. This will lead to greater resilience within each nation's economy.

-

Job Creation: The increased investment and economic activity resulting from the agreement are predicted to generate significant employment opportunities across various sectors, contributing to poverty reduction and improved living standards. Increased jobs will translate to more consumer spending, and stronger growth.

Specific Benefits by Nation:

-

Pakistan: Improved access to international capital markets can boost sectors like renewable energy, technology, and infrastructure development.

-

Sri Lanka: Attracting foreign investors will be crucial for the country's economic recovery and future growth, particularly in tourism and manufacturing.

-

Bangladesh: Enhanced infrastructure development, facilitated by increased FDI, will improve export capabilities and strengthen the country's position in the global market. Focus will be on improving infrastructure such as ports and roads to aid in this effort.

Challenges and Potential Hurdles to Implementation

Despite the considerable potential, several challenges could hinder the successful implementation of the agreement:

-

Political Instability: Political instability in any of the participating nations could undermine investor confidence and create uncertainty, making it difficult to achieve the agreement's objectives. Consistent political leadership is essential to implementation success.

-

Regulatory Challenges: Differences in regulatory approaches and enforcement capabilities may create obstacles to harmonization and lead to inconsistent application of rules. Overcoming these obstacles will require political will and strong cooperation.

-

Infrastructure Gaps: Inadequate infrastructure, including communication networks and financial payment systems, could limit cross-border investment flows and slow down the integration process. Significant investment in infrastructure will likely be required.

-

Capacity Building and Training: Building the necessary institutional capacity and providing training to relevant stakeholders are essential for ensuring effective implementation and monitoring of the agreement. This is a critical component of long-term success.

Comparative Analysis with Other Regional Capital Market Initiatives

This new agreement shares similarities with other successful regional capital market integration initiatives, such as the ASEAN Capital Markets Integration and the EU's single market. However, it also presents unique characteristics:

-

Scope and Depth: While ASEAN and EU initiatives encompass a larger number of countries, the focused nature of the Pakistan, Sri Lanka, and Bangladesh agreement allows for more streamlined implementation and targeted policy interventions.

-

Implementation: The success of the agreement will hinge on the effective harmonization of regulations and the establishment of efficient cross-border mechanisms, which may require more significant effort given the differing stages of economic and market development amongst the participating countries.

Conclusion: Unlocking the Potential of Strengthened Capital Markets

The new agreement between Pakistan, Sri Lanka, and Bangladesh represents a significant step towards fostering deeper regional cooperation and unlocking the substantial potential of strengthened capital markets within South Asia. The projected economic benefits, ranging from increased FDI and job creation to enhanced regional competitiveness, are considerable. However, addressing the challenges related to political stability, regulatory harmonization, and infrastructure development will be crucial for successful implementation. This agreement offers significant investment opportunities and promises to be a catalyst for South Asian economic development. Further research, open dialogue, and continued investment are needed to fully realize the potential of these strengthened capital markets and pave the way for a more prosperous and integrated South Asia. Let's work together to unlock the full potential of these strengthened capital markets.

Featured Posts

-

Municipales Dijon 2026 L Ambition Ecologiste

May 10, 2025

Municipales Dijon 2026 L Ambition Ecologiste

May 10, 2025 -

Oilers Draisaitl Injured Game Status Against Jets Uncertain

May 10, 2025

Oilers Draisaitl Injured Game Status Against Jets Uncertain

May 10, 2025 -

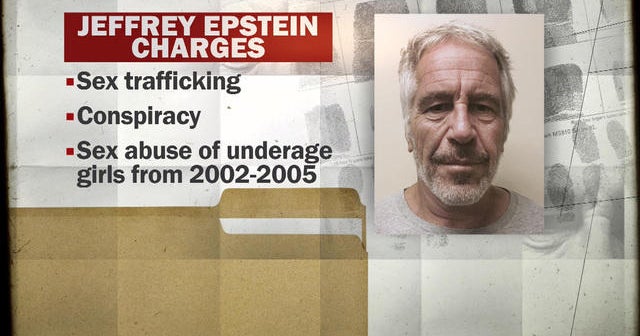

Understanding The Controversy Voting On The Release Of Jeffrey Epstein Documents

May 10, 2025

Understanding The Controversy Voting On The Release Of Jeffrey Epstein Documents

May 10, 2025 -

Should You Buy Palantir Stock In 2024 Investment Analysis And Risks

May 10, 2025

Should You Buy Palantir Stock In 2024 Investment Analysis And Risks

May 10, 2025 -

Trump Administration To Review Expedited Nuclear Power Plant Projects

May 10, 2025

Trump Administration To Review Expedited Nuclear Power Plant Projects

May 10, 2025