Strong Earnings Lift BSE Shares, Contributing To Indian Bourse Rally

Table of Contents

Robust Earnings Reports Drive BSE Share Prices Higher

Several blue-chip companies significantly exceeded analysts' expectations in their recent quarterly (Q) earnings reports, a key driver of the BSE's impressive performance. This outperformance wasn't an isolated incident; it represents a broader trend of strong corporate profitability.

-

Exceeded Expectations: Many leading companies reported revenue growth surpassing predictions, exceeding targets by considerable margins. For example, [Insert Company Name] saw a [Percentage]% increase in Q[Quarter] revenue compared to the same period last year, while [Insert Another Company Name] reported a [Percentage]% surge in net profit. These figures clearly demonstrate robust financial health.

-

Improved Profit Margins: Beyond revenue growth, many companies showcased improved profit margins, indicating increased efficiency and cost management. This is a crucial indicator of long-term sustainability and further strengthens investor confidence.

-

Increased Dividends: The announcement of increased dividends by several companies further incentivized investment in BSE shares. This demonstrates a commitment to shareholder returns and provides an attractive yield for investors.

-

Positive Earnings Revisions: The positive earnings surprised analysts, leading to upward revisions of earnings estimates for several sectors. This positive sentiment contributed significantly to the broader market rally and the increased value of BSE shares.

Increased Foreign Institutional Investor (FII) Interest in Indian Equities

The recent rally isn't solely attributable to domestic factors; a significant influx of foreign capital has played a crucial role. Increased Foreign Institutional Investor (FII) interest in Indian equities has fueled demand for BSE shares, pushing prices higher.

-

Positive Global Macroeconomic Factors: Positive global macroeconomic factors, such as [Mention specific factors, e.g., lower inflation in developed markets], have encouraged increased FII investment in emerging markets, with India being a prime beneficiary.

-

Strong Earnings Solidify Confidence: The robust earnings reports discussed earlier further solidified investor confidence in the Indian economy, making it an attractive destination for foreign investment. FIIs are increasingly viewing Indian equities as a stable and high-growth investment opportunity.

-

Capital Inflow Fuels Demand: This influx of foreign capital has directly translated into increased demand for BSE shares, putting upward pressure on prices and contributing to the overall market rally. Data from [Source] shows a [Percentage]% increase in FII investment in Indian equities during [Time Period].

-

Stable Political and Regulatory Environment: A stable political and regulatory environment also contributes to attracting FII investments. India's consistent economic reforms and investor-friendly policies are significant factors in this positive trend.

Sector-Specific Performance Contributing to BSE Rally

The BSE rally isn't uniform across all sectors; specific sectors have outperformed others, significantly boosting the BSE indices.

-

IT and Pharmaceuticals Lead the Way: Strong performance in sectors like IT and pharmaceuticals has been particularly noteworthy. The IT sector benefited from [Mention specific reasons, e.g., increased global demand for IT services], while the pharmaceutical sector experienced growth driven by [Mention specific factors, e.g., increased demand for generic drugs].

-

Positive Growth Projections Fuel Enthusiasm: Positive growth projections for these sectors, backed by robust financial results, have further fueled investor enthusiasm and driven investment in related BSE shares.

-

Broader Positive Trend: This sector-specific strength isn't limited to a few prominent companies; it indicates a broader positive trend across multiple companies within these sectors, strengthening the overall market rally.

-

Sectoral Analysis: [Include a brief analysis of other key sectors and their contribution to the overall BSE rally, supported by data and possibly charts/graphs].

The Role of the Nifty 50 in the Overall Market Strength

The Nifty 50 index, a key benchmark for the Indian stock market, mirrors the positive performance observed on the BSE. The strong correlation between these two indices underscores the widespread nature of the market rally.

-

Mirroring Positive Performance: The Nifty 50's performance closely tracks the BSE's, indicating that the positive trend isn't limited to a small segment of the market but rather represents a broader market strength.

-

Strong Correlation: The strong correlation between the Nifty 50 and BSE demonstrates that the rally is a fundamental market phenomenon and not simply driven by specific companies or sectors.

-

Nifty 50 Companies' Contribution: The performance of Nifty 50 companies, many of which are also listed on the BSE, has been a significant contributor to the overall market uptrend. Analyzing their individual performances provides valuable insight into the drivers of this rally.

Conclusion

The recent rally in the Indian stock market, prominently featured on the BSE, is largely due to a combination of strong corporate earnings, increased FII investment, and robust sectoral performance. This positive trend, evident in both the BSE and Nifty 50 indices, paints a picture of a healthy outlook for Indian equities. Understanding these market dynamics is crucial for investors looking to capitalize on opportunities in the Indian stock market.

Call to Action: Stay informed on the latest developments impacting BSE shares and the broader Indian Bourse. Monitoring strong earnings reports and their impact on BSE share prices is key to making informed investment decisions in this thriving market. Continue to research and analyze the performance of BSE shares to build a successful investment strategy within the Indian equity market.

Featured Posts

-

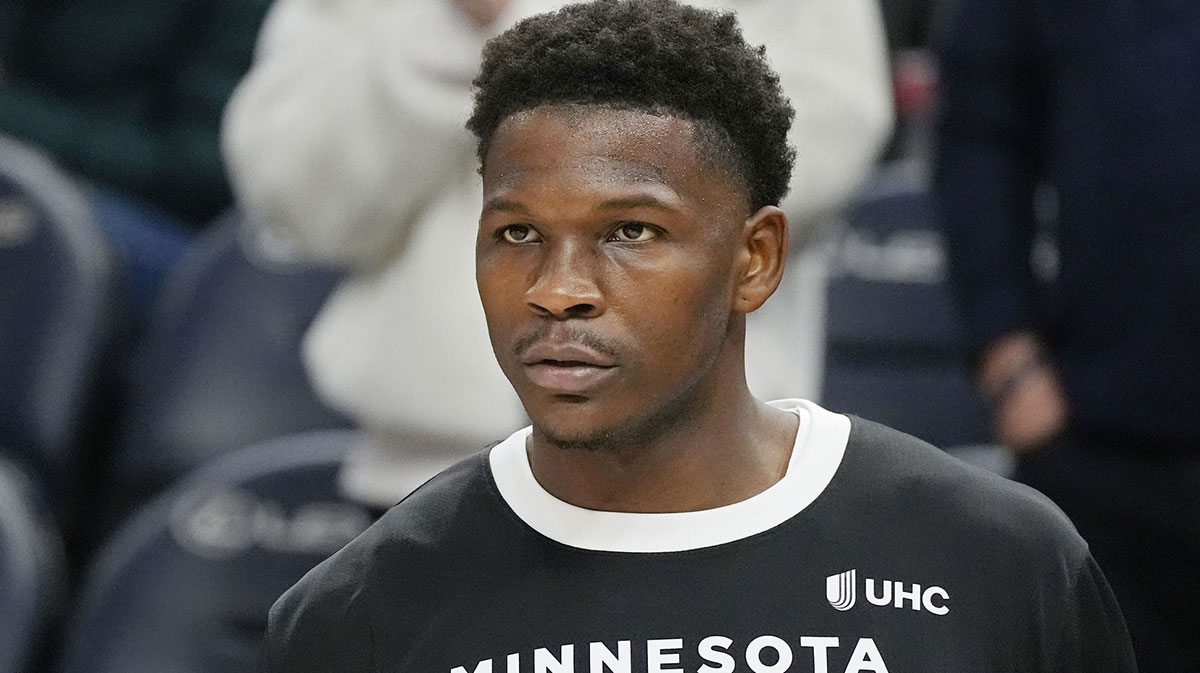

Anthony Edwards Injury Update Will He Play Against The Lakers

May 07, 2025

Anthony Edwards Injury Update Will He Play Against The Lakers

May 07, 2025 -

Insider Report Pittsburgh Steelers Considering Wide Receiver Trade

May 07, 2025

Insider Report Pittsburgh Steelers Considering Wide Receiver Trade

May 07, 2025 -

Upcoming 2025 Games Release Dates For Ps 5 Ps 4 Xbox Pc And Switch

May 07, 2025

Upcoming 2025 Games Release Dates For Ps 5 Ps 4 Xbox Pc And Switch

May 07, 2025 -

Warriors Beat Kings Kuminga Returns Curry And Kerr Celebrate Milestones

May 07, 2025

Warriors Beat Kings Kuminga Returns Curry And Kerr Celebrate Milestones

May 07, 2025 -

Brwtwkwl Laram Wimbratwr Tezyz Alsyaht Albrazylyt

May 07, 2025

Brwtwkwl Laram Wimbratwr Tezyz Alsyaht Albrazylyt

May 07, 2025

Latest Posts

-

160 Year Old Pierce County House To Become Park

May 08, 2025

160 Year Old Pierce County House To Become Park

May 08, 2025 -

Paramount S 7 Best Kept Streaming Secrets Movies

May 08, 2025

Paramount S 7 Best Kept Streaming Secrets Movies

May 08, 2025 -

The Best War Movie Saving Private Ryan Dethroned

May 08, 2025

The Best War Movie Saving Private Ryan Dethroned

May 08, 2025 -

Ranking Steven Spielbergs War Films 7 Must See Movies Saving Private Ryan Omitted

May 08, 2025

Ranking Steven Spielbergs War Films 7 Must See Movies Saving Private Ryan Omitted

May 08, 2025 -

Pierce Countys Historic Home Demolition And Park Conversion

May 08, 2025

Pierce Countys Historic Home Demolition And Park Conversion

May 08, 2025