Strong Parks And Streaming Performance Boost Disney's Profit Forecast

Table of Contents

Theme Park Revenue Exceeds Expectations

Disney's theme parks have been a significant contributor to the improved Disney Profit Forecast, exceeding expectations in both attendance and revenue.

Increased Attendance and Spending

Higher-than-anticipated visitor numbers at Disney theme parks globally are a major factor. This surge can be attributed to several key elements:

- Strong international tourism recovery: The rebound in global travel post-pandemic has significantly boosted international visitor numbers to Disney parks worldwide, contributing substantially to Disney park attendance.

- Successful new park additions: Recent expansions and new attractions have generated significant excitement and drawn large crowds, further increasing Disney theme park revenue.

- Increased per-capita spending: Visitors are spending more per visit on merchandise, food, and experiences, adding to the overall Disney World profit and Disneyland profit figures. This indicates a strong willingness to spend on premium experiences within the parks.

Pricing Strategies and Premium Offerings

Strategic pricing adjustments and the introduction of premium offerings have also played a crucial role.

- Successful Genie+ service rollout: The Genie+ service, offering expedited access to rides, has proven popular and generated additional revenue streams, contributing positively to Disney park pricing strategies.

- Higher ticket prices offset by increased demand: Despite higher ticket prices, demand remains strong, demonstrating the resilience of the Disney brand and its appeal to consumers.

- Luxury hotel package sales: Sales of luxury hotel packages and premium dining experiences have significantly boosted revenue, increasing the overall Disney revenue growth.

Streaming Growth Surpasses Projections

The performance of Disney's streaming services, particularly Disney+, has also significantly impacted the Disney Profit Forecast.

Subscriber Gains and Content Strategy

Disney+ has seen substantial subscriber growth, fueled by a combination of factors:

- Successful new series and movie launches: The release of highly anticipated series and films has attracted new subscribers and retained existing ones, driving Disney+ subscriber growth.

- Effective international marketing strategies: Targeted marketing campaigns in key international markets have expanded the subscriber base, contributing significantly to Disney streaming revenue.

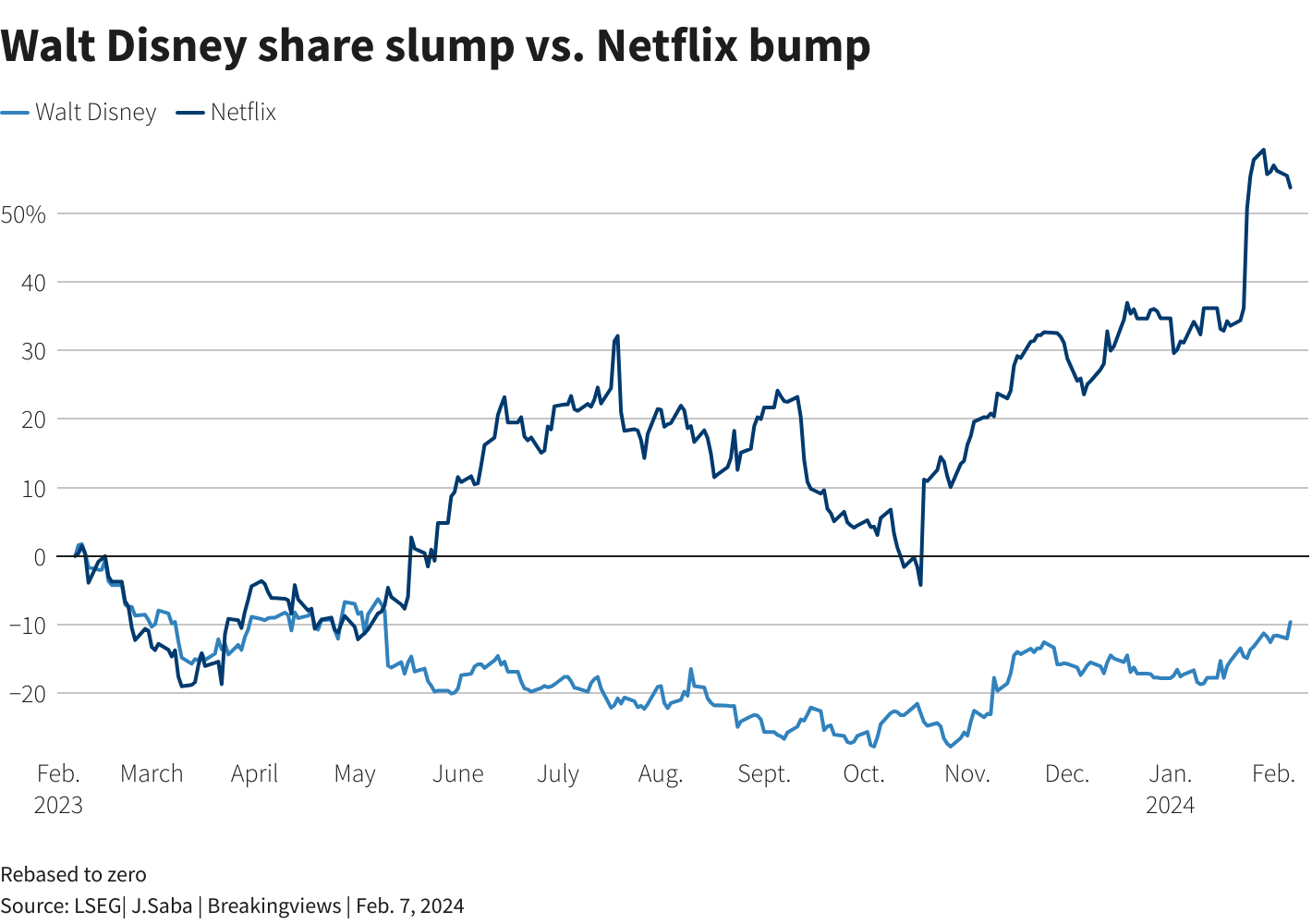

- Competitive pricing strategies compared to Netflix and other streaming services: Disney's pricing strategy has proven competitive in the crowded streaming market, attracting subscribers who are looking for value.

Improved Content ROI and Reduced Churn

Disney is demonstrating improved efficiency in its streaming operations:

- Data-driven content decisions: A data-driven approach to content creation is leading to more successful and cost-effective productions, improving Disney+ content ROI.

- Improved marketing targeting: More precise marketing efforts are reaching the target audience more effectively, reducing wasted ad spend and maximizing subscriber acquisition.

- Effective customer retention programs: Programs designed to retain subscribers have reduced churn, leading to increased subscriber lifetime value and contributing to Disney streaming profitability.

Overall Impact on the Disney Profit Forecast

The combined success of Disney's theme parks and streaming services has led to a significant upward revision in the company's financial outlook.

Revised Financial Projections and Market Response

The improved Disney Profit Forecast has resulted in:

- Specific numbers for the revised forecast: [Insert specific numbers from the financial report here, e.g., "The company revised its full-year earnings per share forecast upwards by 15%."]

- Stock market response to the news: [Describe the market reaction, e.g., "Disney's stock price saw a significant increase following the announcement of the revised forecast."]

- Analyst comments and predictions: [Include relevant analyst comments and predictions, e.g., "Analysts have expressed confidence in Disney's future prospects, citing the strong performance of its parks and streaming divisions."]

Future Outlook and Potential Challenges

While the future looks bright, potential challenges remain:

- Continued growth in streaming and parks: Sustaining the momentum in both streaming and theme park operations will be crucial for maintaining growth.

- Challenges related to inflation and economic uncertainty: Economic headwinds could impact consumer spending, posing a potential threat to future Disney revenue growth.

- Competition from other entertainment companies: The entertainment industry remains highly competitive, requiring Disney to constantly innovate and adapt to maintain its market leadership.

Conclusion:

The unexpectedly strong performance of Disney's theme parks and streaming services has significantly boosted the company's profit forecast, signaling a positive trajectory for the entertainment giant. The success can be attributed to strategic pricing, compelling content, and a robust recovery in international tourism. While challenges remain, Disney's current position indicates a bright outlook for the future. To stay updated on the latest developments affecting the Disney profit forecast, follow our blog for regular financial analysis and industry insights. Understanding the factors driving the Disney Profit Forecast is crucial for investors and industry observers alike.

Featured Posts

-

Coastal Erosion And Flooding The Impact Of Rising Sea Levels

May 10, 2025

Coastal Erosion And Flooding The Impact Of Rising Sea Levels

May 10, 2025 -

Sports Stadiums And Urban Redevelopment A Case Study Analysis

May 10, 2025

Sports Stadiums And Urban Redevelopment A Case Study Analysis

May 10, 2025 -

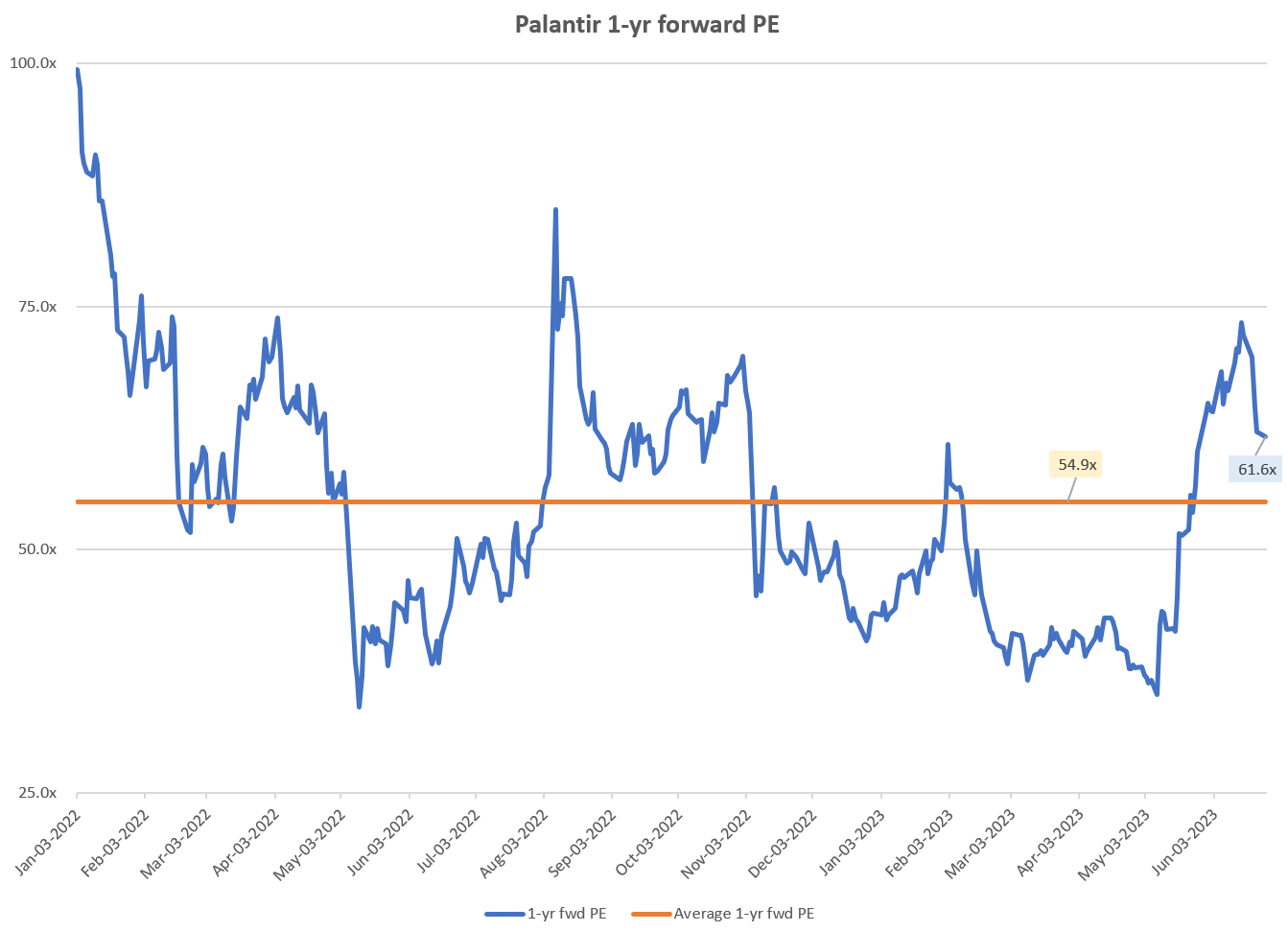

Should You Buy Palantir Stock Before May 5th A Pre Earnings Analysis

May 10, 2025

Should You Buy Palantir Stock Before May 5th A Pre Earnings Analysis

May 10, 2025 -

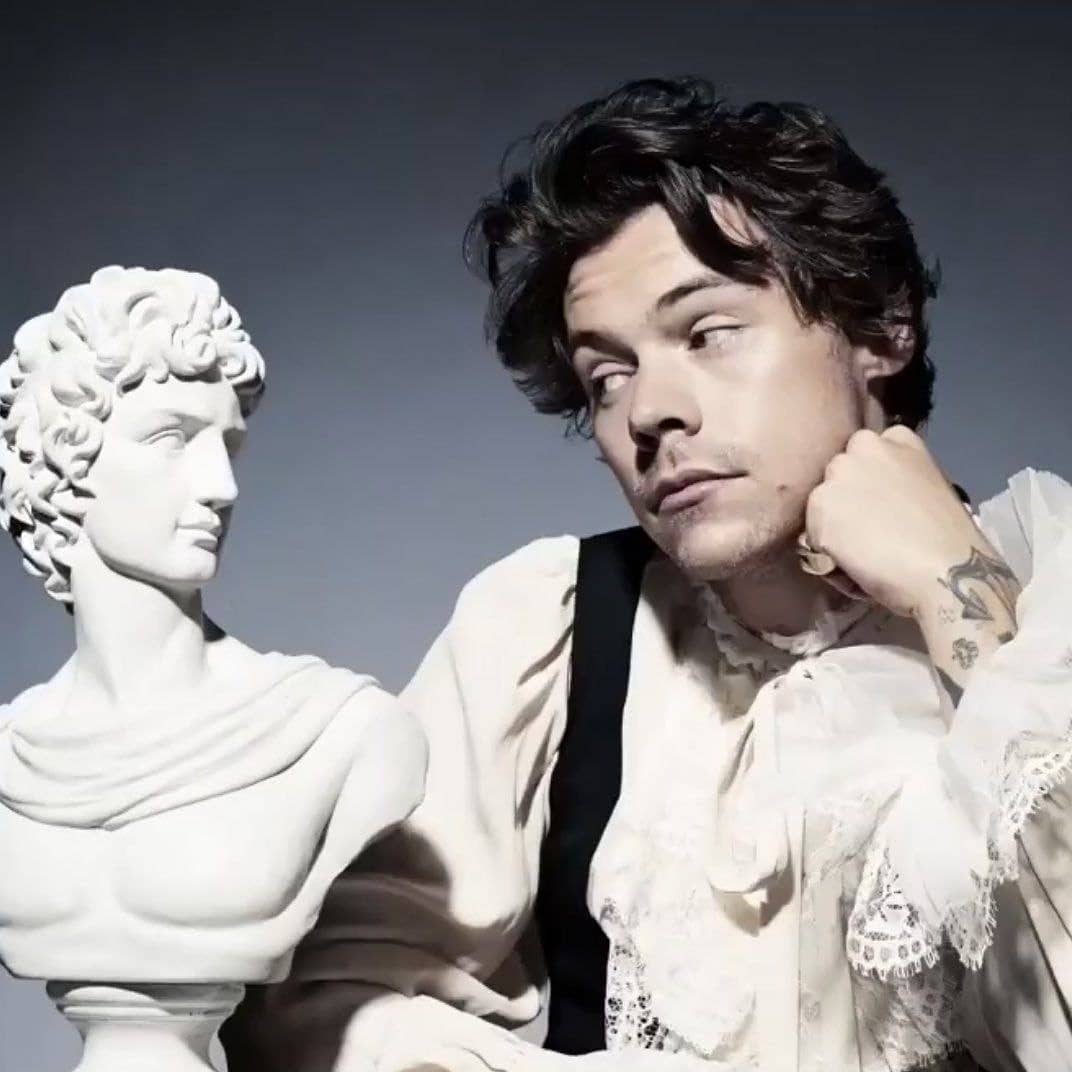

Harry Styles Snl Impression Backlash A Devastating Experience

May 10, 2025

Harry Styles Snl Impression Backlash A Devastating Experience

May 10, 2025 -

Assessing The Monkey Will Stephen Kings 2025 Adaptation Succeed Or Fail

May 10, 2025

Assessing The Monkey Will Stephen Kings 2025 Adaptation Succeed Or Fail

May 10, 2025