Strong Performance Of Emerging Market Equities Amid US Market Weakness

Table of Contents

Factors Driving the Strong Performance of Emerging Market Equities

Several factors contribute to the robust performance of emerging market equities despite the weakness in the US market. These include strong economic growth in certain regions, differing inflation and interest rate environments, currency fluctuations, and evolving geopolitical landscapes.

-

Robust Economic Growth: Several emerging markets, particularly in Asia, are experiencing significant economic growth. India, for example, is projected to maintain a high growth trajectory, fueled by its expanding middle class and robust domestic demand. Southeast Asian nations are also demonstrating impressive economic expansion, driven by factors such as technological advancements and increasing foreign investment. This positive economic outlook supports the growth of their equity markets.

-

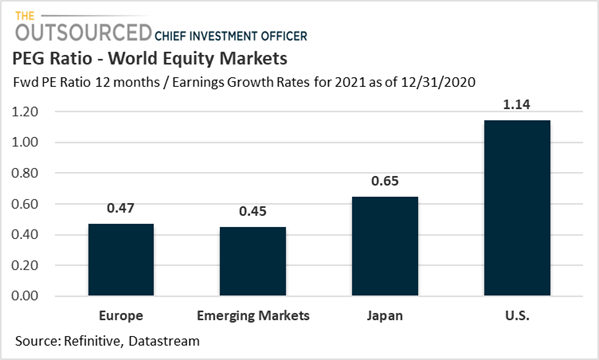

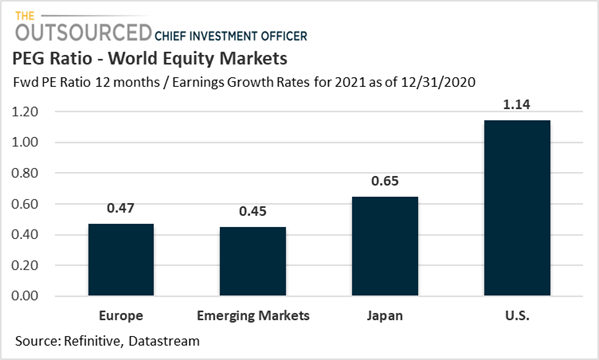

Inflation and Interest Rate Differentials: While developed markets like the US grapple with high inflation and aggressive interest rate hikes, some emerging markets have experienced more controlled inflation and, in some cases, lower interest rates. This difference creates attractive investment opportunities, as investors seek higher yields and returns in a less volatile environment.

-

Currency Fluctuations: Currency fluctuations play a crucial role in equity valuations. While some emerging market currencies may experience periods of weakness, others have strengthened relative to the US dollar, boosting the returns for foreign investors. This dynamic underscores the importance of careful currency risk management in emerging market investments.

-

Geopolitical Landscape: Geopolitical events, both positive and negative, impact emerging markets differently. While some may face challenges due to regional conflicts or political instability, others may benefit from shifting global alliances and increased trade opportunities. Analyzing the specific geopolitical risks and opportunities within each emerging market is crucial for informed investment decisions.

-

Improved Investor Sentiment: Growing confidence in the long-term growth prospects of several emerging markets has led to increased investment flows. Investors are increasingly recognizing the potential for high returns and are actively seeking diversification opportunities beyond developed markets.

Diversification Benefits of Investing in Emerging Markets

Diversification is a cornerstone of sound investment strategy, and emerging market equities offer significant diversification benefits.

-

Reduced Portfolio Risk: Emerging markets often exhibit low correlation with developed markets like the US. This means that when the US market experiences weakness, emerging market equities may perform independently, reducing overall portfolio risk.

-

Strategic Asset Allocation: Incorporating emerging market equities into a well-diversified portfolio can improve risk-adjusted returns. Strategic asset allocation helps investors balance risk and return based on their individual goals and risk tolerance. Emerging markets can play a vital role in optimizing a global investment portfolio.

Understanding the US Market Weakness

The current weakness in the US market stems from a confluence of factors, primarily related to macroeconomic conditions and investor sentiment.

-

US Economic Slowdown: Concerns about a potential economic slowdown in the US are contributing to market volatility. Rising inflation, supply chain disruptions, and geopolitical uncertainties are among the key factors weighing on investor confidence.

-

Inflation and Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes to combat inflation are impacting corporate profitability and increasing borrowing costs. This has led to decreased valuations for many US equities.

-

Recession Fears: The possibility of a recession is a significant driver of market uncertainty. Investors are closely monitoring economic indicators and assessing the likelihood and potential severity of a downturn.

-

Increased Market Volatility: The combination of economic uncertainty and rising interest rates has resulted in heightened market volatility, increasing the risk for investors.

Opportunities and Risks in Emerging Market Equities

Investing in emerging markets presents significant opportunities, but it's crucial to acknowledge the inherent risks involved.

-

Potential for High Returns: Emerging markets offer the potential for substantially higher returns compared to developed markets, driven by strong economic growth and increasing investor interest.

-

Importance of Due Diligence: Conducting thorough due diligence before investing in emerging markets is essential. Understanding the specific risks and opportunities associated with each market is vital for making informed decisions.

-

Long-Term Investment Horizon: Investing in emerging markets requires a long-term perspective. Short-term market fluctuations should be viewed as opportunities to adjust positions rather than reasons for panic selling.

-

Risk Management: Effective risk management through diversification and proper asset allocation is crucial for mitigating potential losses in emerging markets. Investors should carefully consider their risk tolerance before allocating funds to these markets.

Conclusion

The strong performance of emerging market equities amidst US market weakness highlights the importance of diversification in a dynamic global investment landscape. Factors such as robust economic growth in several emerging markets, differing inflation and interest rate environments, and currency fluctuations contribute to this trend. While emerging markets offer significant opportunities for high returns, they also involve inherent risks. Consider diversifying your portfolio with emerging market equities to potentially enhance returns and mitigate risks. However, remember to conduct thorough research and seek professional financial advice before making any investment decisions. The strong performance of emerging market equities presents a compelling case for investors to explore these markets, but careful consideration of the associated risks is paramount.

Featured Posts

-

Herros Hot Shooting 3 Point Contest Victory And Cavs Skills Challenge Win

Apr 24, 2025

Herros Hot Shooting 3 Point Contest Victory And Cavs Skills Challenge Win

Apr 24, 2025 -

Understanding The Value Of Middle Managers Benefits For Employees And The Organization

Apr 24, 2025

Understanding The Value Of Middle Managers Benefits For Employees And The Organization

Apr 24, 2025 -

All Star Weekend Draymond Green Moses Moody And Buddy Hield Confirmed

Apr 24, 2025

All Star Weekend Draymond Green Moses Moody And Buddy Hield Confirmed

Apr 24, 2025 -

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 24, 2025

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 24, 2025 -

Ella Travolta Kci Johna Travolte Odrasla U Prekrasnu Zenu

Apr 24, 2025

Ella Travolta Kci Johna Travolte Odrasla U Prekrasnu Zenu

Apr 24, 2025

Latest Posts

-

Dissecting Jessica Simpsons Alleged Snake Sperm Consumption

May 12, 2025

Dissecting Jessica Simpsons Alleged Snake Sperm Consumption

May 12, 2025 -

The Medias Response To Jessica Simpsons Snake Sperm Comments

May 12, 2025

The Medias Response To Jessica Simpsons Snake Sperm Comments

May 12, 2025 -

Reactions To Jessica Simpsons Statement About Snake Sperm

May 12, 2025

Reactions To Jessica Simpsons Statement About Snake Sperm

May 12, 2025 -

Did Jessica Simpson And Jeremy Renner Ever Flirt A Timeline

May 12, 2025

Did Jessica Simpson And Jeremy Renner Ever Flirt A Timeline

May 12, 2025 -

Jessica Simpson And Jeremy Renner Exploring Their Relationship History

May 12, 2025

Jessica Simpson And Jeremy Renner Exploring Their Relationship History

May 12, 2025