Strong Reliance Earnings: Positive Impact On India's Large-Cap Stocks Predicted

Table of Contents

Reliance Industries' Stellar Performance: Key Drivers

Reliance Industries' robust performance is fueled by several key drivers, contributing significantly to the positive sentiment surrounding Indian large-cap stocks. The company's diverse portfolio, spanning telecom, retail, and energy, has shown remarkable growth across sectors.

-

Record-high Jio subscriber additions and increased ARPU: Jio Platforms, Reliance's telecom arm, continues to dominate the Indian market with record subscriber additions and a steady increase in Average Revenue Per User (ARPU). This reflects strong customer acquisition and retention strategies, leading to substantial revenue growth. Analysts predict continued ARPU growth driven by higher data consumption and premium offerings.

-

Expansion of Reliance Retail’s footprint and digital initiatives: Reliance Retail's aggressive expansion into new markets and its strategic investments in digital technologies have significantly boosted its performance. The integration of online and offline channels is enhancing customer experience and driving sales. The success of its e-commerce platform further solidifies its market position and contributes to overall Reliance earnings.

-

Positive outlook for the oil and gas sector: While subject to global commodity price fluctuations, the oil and gas sector within Reliance is showing signs of recovery. Increased refining margins and strategic investments in renewable energy sources are mitigating risks and ensuring long-term sustainability.

-

Successful divestments and strategic partnerships: Reliance's strategic divestments in certain sectors and the forging of key partnerships have injected capital and enhanced its operational efficiency. These moves demonstrate a proactive approach to capital management and value creation. Data shows these strategies have directly contributed to improved profitability and a stronger balance sheet.

Impact on the Broader Indian Stock Market

The strong Reliance earnings aren't confined to the company itself; they have a significant ripple effect on the broader Indian stock market, particularly impacting large-cap stocks. This influence stems from several factors:

-

Increased investor confidence in the Indian market: Reliance's stellar performance reinforces investor confidence in the overall strength and growth potential of the Indian economy. This positive sentiment spills over into other large-cap stocks, pushing up their valuations.

-

Positive spillover effects on related sectors: Reliance's success positively impacts related sectors, such as telecom (with its Jio Platforms), retail, and energy. This interconnectedness boosts the performance of companies operating in these sectors. For example, strong Reliance Retail performance can positively influence other retail giants' stock prices.

-

Potential for increased foreign investment: Strong Reliance earnings attract foreign institutional investors (FIIs), injecting further capital into the Indian stock market and increasing liquidity. This, in turn, fuels the growth of other large-cap companies.

-

Strengthening of the Indian Rupee: Positive market sentiment and increased foreign investment can contribute to a stronger Indian Rupee, benefiting Indian companies with significant international exposure. Experts believe a strong Rupee makes Indian assets more attractive to foreign investors.

Investment Strategies Based on Strong Reliance Earnings

The predicted positive impact of strong Reliance earnings offers several investment opportunities, though investors should proceed with caution.

-

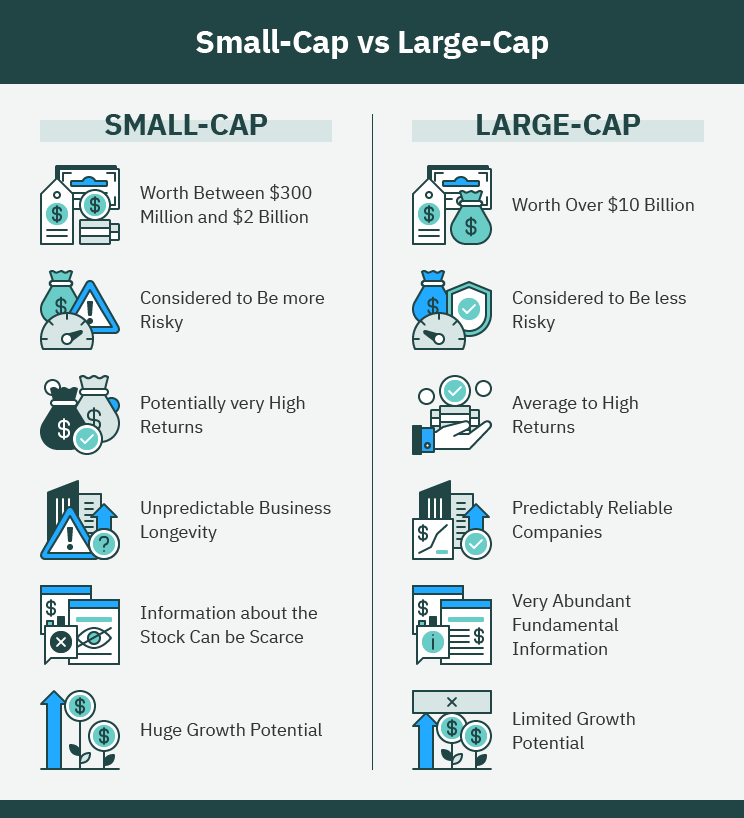

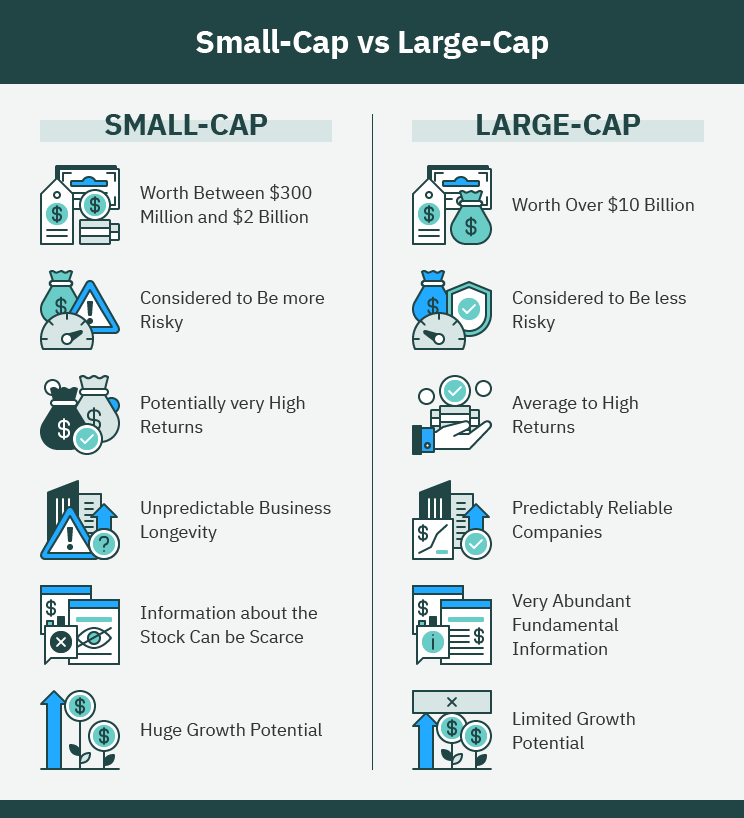

Diversification strategies for large-cap investments: Diversification is crucial. While Reliance's performance is positive, spreading investments across various large-cap stocks minimizes risk.

-

Analyzing Reliance-related stocks for potential growth: Investors can explore companies with strong business relationships with Reliance or those operating in sectors benefiting from Reliance's growth. Thorough due diligence is crucial before investing.

-

Understanding the market's reaction to earnings announcements: Studying historical market responses to Reliance earnings announcements can provide insights into potential future price movements.

-

Risk mitigation strategies in a volatile market: Implementing strategies like stop-loss orders and diversifying investments across asset classes helps minimize potential losses during market volatility.

Potential Risks and Challenges

While the outlook is positive, several factors could negatively impact the predicted positive effects of Reliance earnings on large-cap stocks:

-

Geopolitical risks impacting the global economy: Global events can impact investor sentiment and investment flows into the Indian market.

-

Regulatory changes in India: New regulations or policy changes could affect Reliance and other large-cap companies, potentially impacting their performance.

-

Competition within various sectors: Increased competition within sectors where Reliance operates could limit its growth and impact its future earnings.

-

Inflationary pressures: High inflation can erode purchasing power, affecting consumer spending and impacting the performance of several sectors, including retail.

Conclusion

Strong Reliance earnings are predicted to have a significant positive impact on India's large-cap stocks, boosting investor confidence and potentially leading to increased foreign investment. The interconnectedness of Reliance with other sectors further amplifies this effect. However, investors should remain aware of potential risks and diversify their portfolios accordingly. Analyzing the performance of Reliance Earnings and its influence on Large-Cap Stocks India is vital for investment success. Stay informed about future Reliance earnings announcements and their impact on Indian large-cap stocks for informed investment decisions. Carefully analyze the market trends and consult with financial advisors before making any significant investment related to Reliance earnings or Indian large-cap stocks.

Featured Posts

-

Trumps China Tariffs Higher Prices And Empty Shelves A Us Economic Analysis

Apr 29, 2025

Trumps China Tariffs Higher Prices And Empty Shelves A Us Economic Analysis

Apr 29, 2025 -

Apologies Offered For Prank Call To Browns Draft Pick Shedeur Sanders From Falcons Dcs Son

Apr 29, 2025

Apologies Offered For Prank Call To Browns Draft Pick Shedeur Sanders From Falcons Dcs Son

Apr 29, 2025 -

Anthony Edwards Injury Update Will He Play Lakers Vs Timberwolves

Apr 29, 2025

Anthony Edwards Injury Update Will He Play Lakers Vs Timberwolves

Apr 29, 2025 -

Akesos Disappointing Clinical Trial Results Lead To Stock Plunge

Apr 29, 2025

Akesos Disappointing Clinical Trial Results Lead To Stock Plunge

Apr 29, 2025 -

Vancouver Filipino Festival Nine Killed In Car Crash Incident

Apr 29, 2025

Vancouver Filipino Festival Nine Killed In Car Crash Incident

Apr 29, 2025

Latest Posts

-

One Plus 13 R And Pixel 9a Performance Camera And Value Compared

Apr 29, 2025

One Plus 13 R And Pixel 9a Performance Camera And Value Compared

Apr 29, 2025 -

Is The One Plus 13 R Worth It Comparing It To The Pixel 9a

Apr 29, 2025

Is The One Plus 13 R Worth It Comparing It To The Pixel 9a

Apr 29, 2025 -

Confronting Google Perplexitys Strategy In The Emerging Ai Search Market

Apr 29, 2025

Confronting Google Perplexitys Strategy In The Emerging Ai Search Market

Apr 29, 2025 -

Kuxius Solid State Power Bank Performance Price And Longevity Compared

Apr 29, 2025

Kuxius Solid State Power Bank Performance Price And Longevity Compared

Apr 29, 2025 -

One Plus 13 R Review A Practical Assessment

Apr 29, 2025

One Plus 13 R Review A Practical Assessment

Apr 29, 2025