Student Loan Payments And Your Credit Score: What You Need To Know

Table of Contents

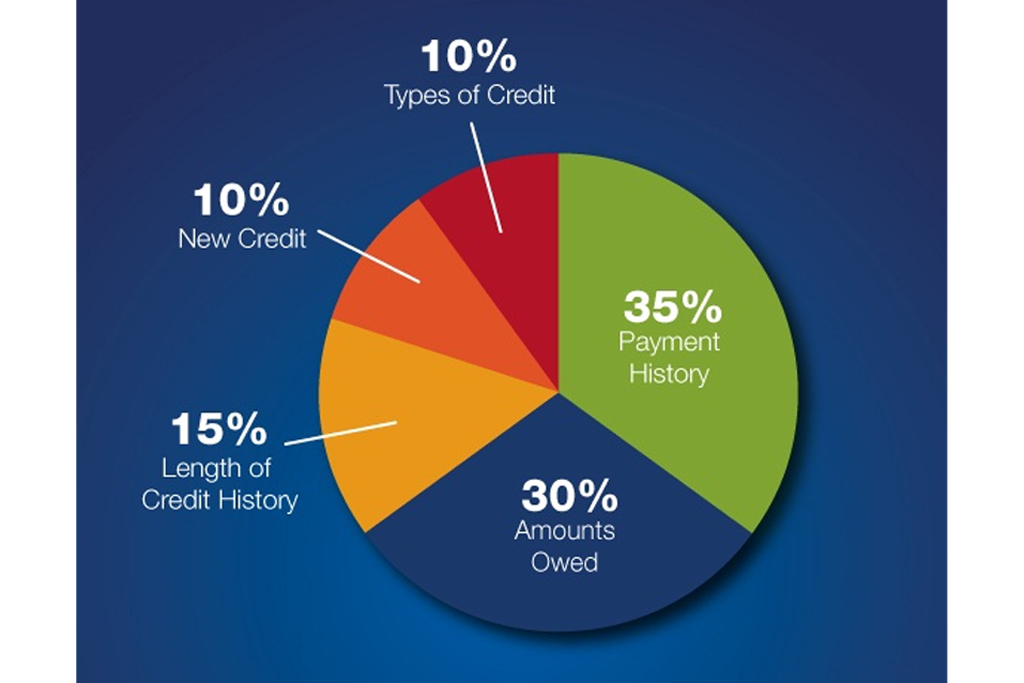

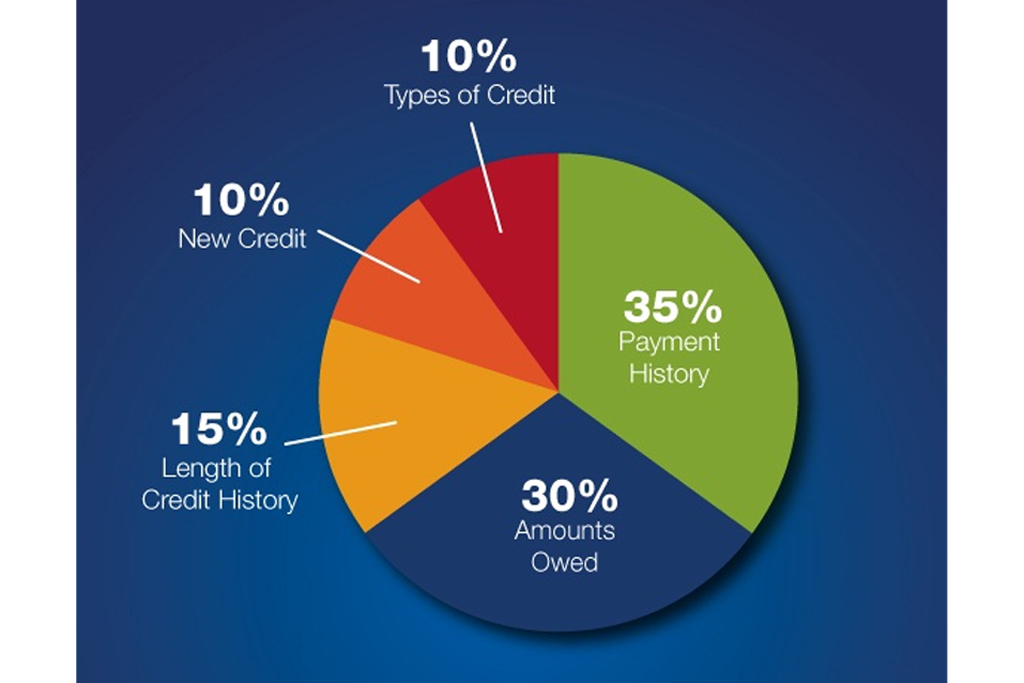

How Student Loan Payments Impact Your Credit Score

Your student loan payment history is a significant factor influencing your credit score. Credit scores, calculated by major credit bureaus like Equifax, Experian, and TransUnion, are numerical representations of your creditworthiness. Lenders use these scores to assess the risk associated with lending you money. The better your score, the better the interest rates and terms you'll qualify for on future loans, such as auto loans, mortgages, and credit cards.

-

On-time payments demonstrate responsible borrowing behavior: Consistently making on-time payments signals to credit bureaus that you are a reliable borrower, positively impacting your credit score. This responsible behavior builds your credit history, showing lenders you can manage debt effectively.

-

Consistent on-time payments contribute to a higher credit score: A higher credit score translates to lower interest rates on future loans, saving you substantial amounts of money over time. Aim for a high credit score to maximize your borrowing power and financial opportunities.

-

Late or missed payments significantly lower your credit score: Even a single late payment can negatively affect your credit score. The impact is more severe with multiple late or missed payments. These negative marks can remain on your credit report for seven years, hindering your ability to secure favorable loan terms in the future.

-

Defaulting on student loans has severe consequences: Defaulting on your student loans—failing to make payments for an extended period—has serious repercussions. This can lead to wage garnishment, tax refund offset, and damage to your credit score that can last for years, making it difficult to obtain loans or even rent an apartment.

Types of Student Loans and Their Credit Reporting

Understanding how different types of student loans are reported to credit bureaus is essential for effective credit management. There are two primary categories: federal and private student loans.

-

Federal student loans: These loans are offered by the federal government. They are generally reported to credit bureaus after you begin making payments. This means that the initial period of deferment or forbearance might not be reflected on your credit report.

-

Private student loans: These loans are offered by private lenders, such as banks and credit unions. Unlike federal loans, private student loans are often reported to credit bureaus from the outset, even before payments begin. This impacts your credit utilization ratio and overall credit score.

-

Understanding the reporting differences is crucial: Knowing when your student loans begin impacting your credit report helps you proactively monitor and manage your credit. This knowledge allows for better planning and strategic adjustments to your repayment strategy.

Strategies for Maintaining a Good Credit Score While Repaying Student Loans

Repaying student loans while maintaining a good credit score requires a strategic approach. Here are some practical tips:

-

Automate your payments: Setting up automatic payments ensures you never miss a payment, preventing negative marks on your credit report.

-

Explore income-driven repayment plans: If you're struggling to make your payments, consider income-driven repayment plans that adjust your monthly payments based on your income and family size. These plans can provide short-term relief while preventing default.

-

Contact your loan servicer if facing financial hardship: Don't hesitate to reach out to your loan servicer if you anticipate difficulty making payments. They may offer forbearance or other options to help you avoid default.

-

Monitor your credit report regularly: Regularly checking your credit report from AnnualCreditReport.com (the only authorized source for free annual credit reports) is crucial. This allows you to identify and dispute any errors promptly, protecting your credit score.

The Importance of Credit Monitoring for Student Loan Borrowers

Regularly monitoring your credit report is paramount, especially for student loan borrowers.

-

Free annual credit reports are essential: Take advantage of your right to obtain free annual credit reports from AnnualCreditReport.com. Review them thoroughly for accuracy.

-

Dispute any inaccuracies promptly: If you find any errors related to your student loans—incorrect payment history, incorrect loan amounts, etc.—dispute them immediately with the credit bureaus.

-

Early detection and correction of errors protect your credit score: Addressing errors promptly prevents them from negatively affecting your credit score and future financial opportunities.

Conclusion

Understanding the connection between student loan payments and your credit score is vital for long-term financial health. Consistent on-time payments are key to building a strong credit history, while missed payments can have serious consequences. By employing the strategies outlined above—from automating payments to actively monitoring your credit report—you can effectively manage your student loans and maintain a healthy credit score. Don't delay; take control of your student loan payments and secure your financial future. Start protecting your credit score today with responsible student loan management!

Featured Posts

-

Researching The New York Daily News May 2025 Back Issues

May 17, 2025

Researching The New York Daily News May 2025 Back Issues

May 17, 2025 -

Analyzing The Pistons And Knicks Key Differences This Season

May 17, 2025

Analyzing The Pistons And Knicks Key Differences This Season

May 17, 2025 -

Angel Reeses Sweet Message To Mom During Brothers Ncaa Win

May 17, 2025

Angel Reeses Sweet Message To Mom During Brothers Ncaa Win

May 17, 2025 -

Reebok X Angel Reese A Winning Collaboration

May 17, 2025

Reebok X Angel Reese A Winning Collaboration

May 17, 2025 -

Streaming Release Time Alexander Skarsgard In Murderbot

May 17, 2025

Streaming Release Time Alexander Skarsgard In Murderbot

May 17, 2025

Latest Posts

-

Find Andor Season 1 Episodes 1 3 Streaming On Hulu And You Tube

May 17, 2025

Find Andor Season 1 Episodes 1 3 Streaming On Hulu And You Tube

May 17, 2025 -

Andor Season 1 Episodes 1 3 Streaming Now On Hulu And You Tube

May 17, 2025

Andor Season 1 Episodes 1 3 Streaming Now On Hulu And You Tube

May 17, 2025 -

Andor The First Look Shows A Promising Future For Star Wars

May 17, 2025

Andor The First Look Shows A Promising Future For Star Wars

May 17, 2025 -

First Look At Andor A Major Star Wars Event Finally Revealed

May 17, 2025

First Look At Andor A Major Star Wars Event Finally Revealed

May 17, 2025 -

Andor First Look Delivers On Decades Of Star Wars Teases

May 17, 2025

Andor First Look Delivers On Decades Of Star Wars Teases

May 17, 2025