Succession Planning Among The Super Wealthy: A Rising Trend

Table of Contents

The Unique Challenges of Succession Planning for the Super Wealthy

Succession planning for the super wealthy extends far beyond simply drafting a will. It involves navigating a complex web of legal, financial, and familial considerations. These individuals often face challenges that are significantly different from those faced by individuals with more modest assets.

Global Asset Diversification

UHNWIs typically hold assets spread across multiple jurisdictions, encompassing real estate, private equity, art collections, and businesses in various countries. This global diversification presents significant challenges:

- Complex Tax Implications: Navigating international tax laws and optimizing tax efficiency across different jurisdictions requires specialized expertise. Each country has its own estate tax laws, inheritance laws, and gift tax rules which need careful consideration.

- Currency Fluctuations: The value of assets can fluctuate significantly due to currency exchange rate variations, requiring sophisticated hedging strategies.

- Regulatory Compliance: Adhering to various international regulations and reporting requirements adds layers of complexity.

Complex Family Structures

High-net-worth families often have complex structures, leading to increased challenges in succession planning:

- Blended Families: Dividing assets fairly and equitably among multiple spouses and children from previous marriages requires careful consideration and legal expertise.

- Multiple Inheritors: Determining how to divide substantial wealth among numerous beneficiaries while mitigating potential disputes can be a significant undertaking.

- Family Conflicts: Disagreements over inheritance can severely strain family relationships and lead to protracted legal battles, potentially diminishing the overall value of the estate.

Protecting Assets from Predatory Activities

The significant wealth of UHNWIs makes them vulnerable to various predatory activities:

- Fraud: Sophisticated fraud schemes target individuals with substantial assets, requiring robust security measures and due diligence.

- Litigation: Disputes over inheritance or business ownership can lead to costly and lengthy legal battles.

- Kidnapping and Extortion: In extreme cases, the sheer magnitude of wealth can attract criminal activity targeting the family's safety and security.

Philanthropic Goals

Many super-wealthy individuals have strong philanthropic inclinations, wanting their wealth to benefit causes they are passionate about. Integrating these philanthropic goals into their succession plan is crucial:

- Establishing Foundations: Creating family foundations allows for ongoing charitable giving and supports causes beyond the lifetime of the individual.

- Directed Giving: Specifying which charities or causes will receive donations after their death.

- Impact Investing: Investing in companies or projects with positive social or environmental impact.

Key Strategies Employed by the Super Wealthy for Effective Succession Planning

Effective succession planning for UHNWIs relies on a combination of strategies tailored to their unique circumstances:

Family Offices

Family offices are increasingly popular among UHNWIs, providing a centralized hub for managing various aspects of their wealth:

- Asset Management: Overseeing investments, real estate, and other assets.

- Family Governance: Establishing clear guidelines for family communication and decision-making, promoting harmony and collaboration.

- Wealth Preservation: Implementing strategies to protect wealth from various risks.

Trusts and Foundations

Trusts and foundations are powerful tools for wealth preservation, tax optimization, and philanthropic endeavors:

- Dynasty Trusts: These trusts can last for multiple generations, ensuring wealth continues to grow and remains protected from creditors and taxes.

- Grantor Retained Annuity Trusts (GRATs): These trusts can minimize gift and estate taxes.

- Charitable Remainder Trusts (CRTs): These trusts provide income to the grantor during their lifetime and distribute the remaining assets to a charity.

Investment Strategies for Long-Term Wealth Growth

Maintaining and growing wealth across generations requires a long-term investment strategy focused on:

- Diversification: Spread investments across different asset classes to mitigate risk.

- Alternative Investments: Explore opportunities in private equity, hedge funds, and real estate.

- Responsible Investing: Align investments with personal values and environmental, social, and governance (ESG) factors.

Education and Mentorship for Heirs

Preparing the next generation for the responsibility of managing significant wealth is essential:

- Financial Literacy Programs: Equipping heirs with the knowledge and skills to manage investments and finances.

- Mentorship Programs: Pairing heirs with experienced advisors and family members to provide guidance.

- Family Councils: Establishing regular meetings to discuss family matters, investments, and philanthropy.

The Role of Professionals in High-Net-Worth Succession Planning

Navigating the complexities of succession planning requires a team of experienced professionals:

Estate Planning Attorneys

Estate planning attorneys are crucial for:

- Drafting Wills and Trusts: Creating legally sound documents to ensure the efficient transfer of assets.

- Tax Planning: Optimizing estate plans to minimize tax liabilities.

- Probate Administration: Managing the legal processes involved in administering an estate after death.

Financial Advisors

Financial advisors play a vital role in:

- Wealth Management: Providing advice on investment strategies, portfolio diversification, and risk management.

- Financial Education: Educating heirs on financial management and investment principles.

- Asset Protection: Implementing strategies to protect assets from creditors and lawsuits.

Family Therapists/Counselors

Family therapists are invaluable in:

- Conflict Resolution: Mediating disputes and facilitating communication among family members.

- Family Dynamics: Addressing underlying family issues that may impact the succession planning process.

- Emotional Support: Providing emotional support during this often challenging transition.

Conclusion

Succession planning for the super wealthy presents unique and significant challenges requiring proactive and sophisticated strategies. From navigating complex global assets and intricate family structures to protecting against predatory activities, UHNWIs must employ a comprehensive approach. This includes leveraging the expertise of family offices, trusts, carefully tailored investment strategies, and robust educational programs for heirs. The involvement of a skilled team of estate planning attorneys, financial advisors, and family counselors is paramount to ensure a smooth and successful wealth transfer. Don't delay; consult with experienced professionals to develop a comprehensive and personalized wealth transfer strategy that protects your legacy and minimizes potential conflicts. Take the crucial step toward securing your family's future by proactively addressing your estate planning for the super wealthy needs and implementing effective high-net-worth succession strategies. Contact us today to learn more about our services and how we can help you navigate the complexities of succession planning.

Featured Posts

-

Vstup Ukrayini Do Nato Analiz Rizikiv Ta Naslidkiv Vidmovi

May 22, 2025

Vstup Ukrayini Do Nato Analiz Rizikiv Ta Naslidkiv Vidmovi

May 22, 2025 -

Controverse A Clisson Trop De Croix Autour Du Cou

May 22, 2025

Controverse A Clisson Trop De Croix Autour Du Cou

May 22, 2025 -

Quiz Histoire Gastronomie And Culture De Loire Atlantique A Quel Point Connaissez Vous Le Departement

May 22, 2025

Quiz Histoire Gastronomie And Culture De Loire Atlantique A Quel Point Connaissez Vous Le Departement

May 22, 2025 -

19 Indian Table Tennis Players Participate In Wtt Star Contender Chennai

May 22, 2025

19 Indian Table Tennis Players Participate In Wtt Star Contender Chennai

May 22, 2025 -

Addressing The Recent Allegations Against Blake Lively

May 22, 2025

Addressing The Recent Allegations Against Blake Lively

May 22, 2025

Latest Posts

-

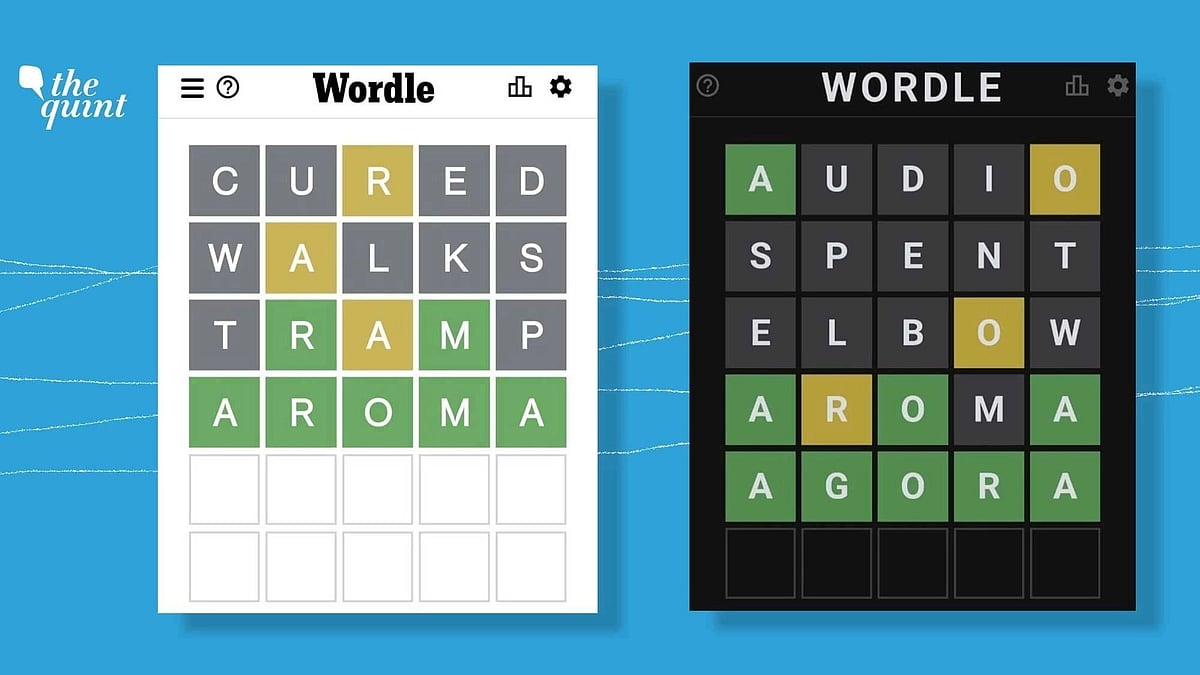

Wordle 608 March 26 Todays Nyt Wordle Answer And Hints

May 22, 2025

Wordle 608 March 26 Todays Nyt Wordle Answer And Hints

May 22, 2025 -

Wordle 1352 Hints And Clues For March 2nd

May 22, 2025

Wordle 1352 Hints And Clues For March 2nd

May 22, 2025 -

Solve Wordle 1384 April 3 2025 Hints Clues And The Answer

May 22, 2025

Solve Wordle 1384 April 3 2025 Hints Clues And The Answer

May 22, 2025 -

Nyt Wordle 1368 Hints Answer And Help For March 18

May 22, 2025

Nyt Wordle 1368 Hints Answer And Help For March 18

May 22, 2025 -

Wordle Hints Answer And Solution For March 18th 1368

May 22, 2025

Wordle Hints Answer And Solution For March 18th 1368

May 22, 2025