Susquehanna Valley Storm Damage: Insurance Claims And Financial Assistance

Table of Contents

Understanding Your Insurance Policy After Susquehanna Valley Storm Damage

Following a disaster like the recent Susquehanna Valley storms, understanding your insurance policy is crucial for securing the financial resources you need for repairs and recovery. Knowing what's covered and how to file a claim efficiently can significantly impact your ability to rebuild.

Identifying Covered Damages

Homeowner's and renter's insurance policies typically cover various types of storm damage, but not all. Carefully reviewing your specific policy document is essential.

- Covered Damages:

- Wind damage to your roof, siding, or windows.

- Damage caused by falling trees (unless specifically excluded).

- Damage to your personal belongings from wind or hail.

- Uncovered Damages (Often):

- Flood damage (requires separate flood insurance).

- Damage caused by earthquakes (unless specifically covered).

- Damage from normal wear and tear.

Remember, the devil is in the details. Thoroughly read your policy to understand your specific coverage limits and exclusions. Don't hesitate to contact your insurance provider for clarification on any ambiguous points in your Susquehanna Valley storm damage policy.

Filing a Timely and Thorough Insurance Claim

Filing a claim promptly is critical. The longer you wait, the more difficult it might become to process your claim and receive the assistance you need.

- Immediate Action: Contact your insurance company immediately after the storm to report the damage.

- Documentation is Key: Gather comprehensive documentation to support your claim, including:

- High-quality photos and videos of the damage.

- Detailed descriptions of the damage.

- Receipts for any temporary repairs you've made.

- Expediting the Process: Be prepared to provide all necessary information promptly and follow up regularly to check on the status of your claim. Keep detailed records of all communication with your insurance provider.

- Potential Delays: Be aware that processing claims after a widespread disaster like the Susquehanna Valley storm damage can take time. Be patient but persistent.

Negotiating with Your Insurance Company

Insurance adjusters will assess the damage and determine the payout. You have the right to negotiate if you feel the settlement isn't fair.

- Understanding Your Rights: Familiarize yourself with your policy's terms and conditions regarding settlements.

- Effective Communication: Maintain clear and professional communication with your adjuster. Present your case calmly and logically, providing evidence to support your claims.

- Dispute Resolution: If you're unable to reach a satisfactory settlement, explore alternative dispute resolution methods, such as mediation. In some cases, legal counsel may be necessary.

Accessing Financial Assistance After Susquehanna Valley Storm Damage

Beyond your insurance coverage, several sources of financial aid can assist you in recovering from Susquehanna Valley storm damage.

FEMA Assistance

The Federal Emergency Management Agency (FEMA) offers various assistance programs for disaster survivors.

- Application Process: Visit the FEMA website () to apply for individual assistance.

- Eligibility Requirements: Eligibility varies based on the extent of damage and your financial situation.

- Types of Aid: FEMA may provide grants for temporary housing, home repairs, and other essential needs.

SBA Low-Interest Disaster Loans

The Small Business Administration (SBA) offers low-interest disaster loans to help small businesses and homeowners recover.

- Application Process: Apply through the SBA website ().

- Loan Terms: Loans typically have favorable repayment terms to help alleviate financial burden.

Red Cross and Other Charitable Organizations

Numerous charitable organizations provide vital support to disaster victims.

- American Red Cross: Offers emergency shelter, food, clothing, and other essential services. ()

- Salvation Army: Provides similar aid to the Red Cross. ()

- Local Charities: Many local charities offer specific assistance tailored to the needs of the Susquehanna Valley community.

State and Local Government Programs

Your state and local governments may have additional programs to assist with Susquehanna Valley storm damage recovery. Check your local government websites for details.

Conclusion: Rebuilding After Susquehanna Valley Storm Damage

Recovering from Susquehanna Valley storm damage requires a multifaceted approach. Filing a comprehensive insurance claim and exploring all available financial assistance options are crucial steps. Remember to act quickly, thoroughly document all damages, and persistently follow up on your claims. Don't delay; start your recovery journey today by exploring your insurance options and available financial assistance for Susquehanna Valley storm damage. Contact your local government or community organizations for further help and resources.

Featured Posts

-

Dennis Quaid Meg Ryan And James Caans Forgotten Western Neo Noir

May 22, 2025

Dennis Quaid Meg Ryan And James Caans Forgotten Western Neo Noir

May 22, 2025 -

Rock Icon Dead At 32 Fans Mourn The Loss

May 22, 2025

Rock Icon Dead At 32 Fans Mourn The Loss

May 22, 2025 -

Addressing The Recent Allegations Against Blake Lively

May 22, 2025

Addressing The Recent Allegations Against Blake Lively

May 22, 2025 -

Remont Pivdennogo Mostu Pidryadniki Vartist Ta Stroki

May 22, 2025

Remont Pivdennogo Mostu Pidryadniki Vartist Ta Stroki

May 22, 2025 -

Recent Surge In Gas Prices Southeast Wisconsin

May 22, 2025

Recent Surge In Gas Prices Southeast Wisconsin

May 22, 2025

Latest Posts

-

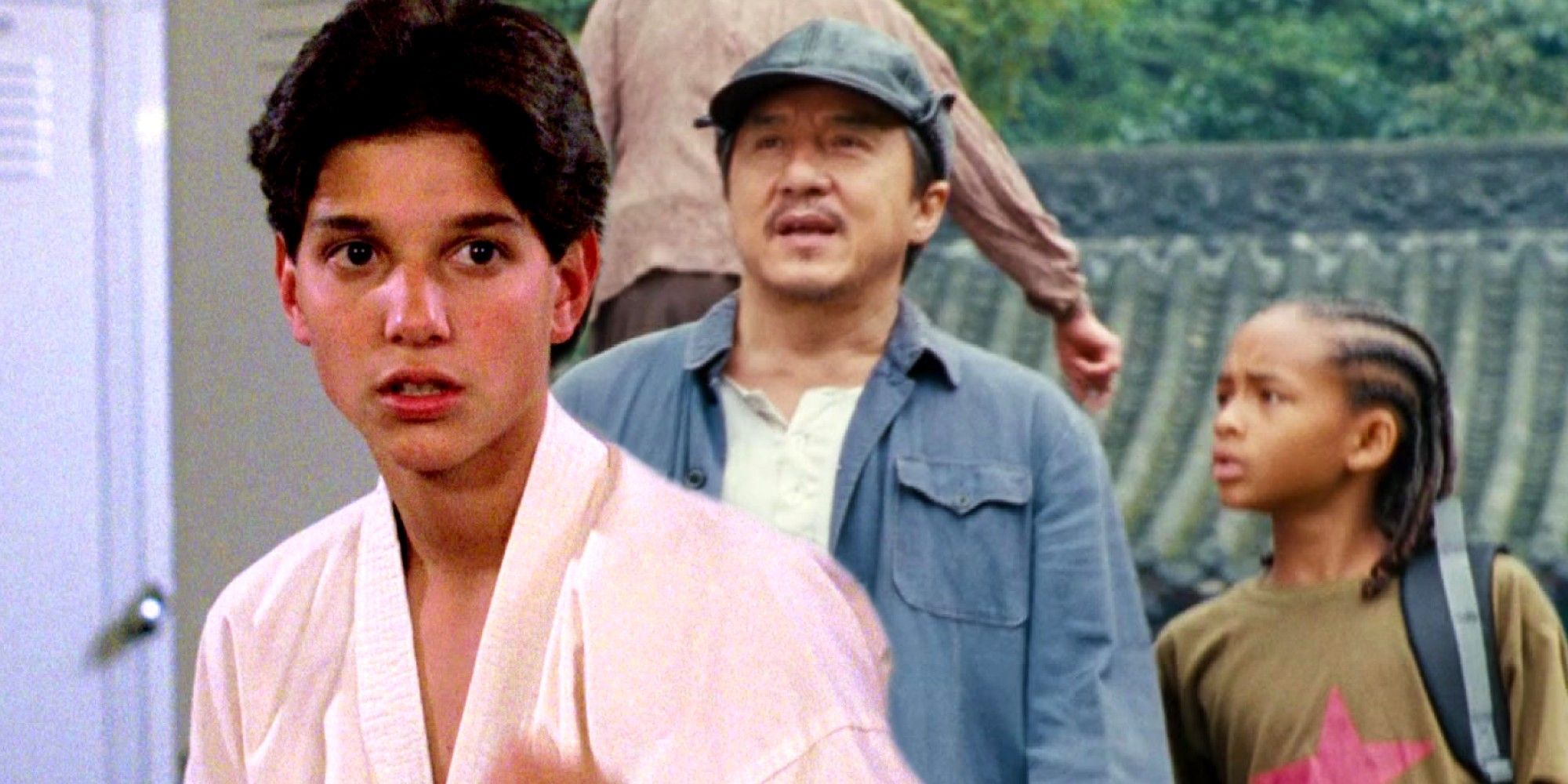

Cobra Kai Ep Hurwitz Reveals Original Series Pitch Trailer

May 23, 2025

Cobra Kai Ep Hurwitz Reveals Original Series Pitch Trailer

May 23, 2025 -

Is Ralph Macchio Reviving Another Famous Film After Karate Kid 6

May 23, 2025

Is Ralph Macchio Reviving Another Famous Film After Karate Kid 6

May 23, 2025 -

The Karate Kid Franchise A Comprehensive Look At Legend Of Miyagis Role

May 23, 2025

The Karate Kid Franchise A Comprehensive Look At Legend Of Miyagis Role

May 23, 2025 -

Karate Kid 6 And Beyond Ralph Macchios Film Choices

May 23, 2025

Karate Kid 6 And Beyond Ralph Macchios Film Choices

May 23, 2025 -

Connecting The Dots Karate Kid Legend Of Miyagi And The Franchises Continuity

May 23, 2025

Connecting The Dots Karate Kid Legend Of Miyagi And The Franchises Continuity

May 23, 2025