Swissquote Bank: Sovereign Bond Market Analysis And Outlook

Table of Contents

Current State of the Global Sovereign Bond Market

The global sovereign bond market is characterized by a complex interplay of economic and geopolitical factors. Interest rates are rising in many major economies in response to persistent inflation, impacting bond prices. Key sovereign bond markets, such as US Treasuries, German Bunds, and UK Gilts, are experiencing varying degrees of volatility.

- Yield Curve Analysis: Recent yield curves show a flattening or even inversion in some regions, signaling potential economic slowdown or recessionary fears. This impacts investor sentiment and demand for sovereign bonds.

- Inflation's Impact: High inflation erodes the real value of fixed-income investments, putting downward pressure on bond prices. Central banks' efforts to control inflation directly influence bond yields.

- Geopolitical Risks: The ongoing war in Ukraine, rising tensions in various regions, and potential global political instability introduce significant uncertainty and affect investor confidence, causing fluctuations in bond yields.

- Relevant Economic Indicators: Key economic indicators like GDP growth, inflation rates (CPI, PPI), unemployment figures, and consumer confidence significantly impact the sovereign bond market. Monitoring these indicators is essential for informed investment decisions.

Key Factors Influencing Sovereign Bond Yields

Several key factors drive the fluctuations in sovereign bond yields. Understanding these factors is crucial for navigating the market effectively.

Central Bank Policies

Central bank monetary policy decisions, including interest rate hikes and quantitative easing (QE) programs, have a profound impact on sovereign bond yields. Swissquote Bank's analysis provides insights into how these policies influence investor expectations and market dynamics. Rate hikes generally lead to higher yields, while QE typically lowers yields.

Economic Growth and Inflation

The relationship between economic growth, inflation, and sovereign bond yields is complex. Strong economic growth often leads to higher inflation, which can cause central banks to increase interest rates, thereby increasing bond yields. Conversely, weak economic growth can lead to lower yields. Swissquote Bank's research offers data-driven analysis of this dynamic relationship.

Geopolitical Risks

Geopolitical events, such as wars, political instability, and international trade disputes, significantly influence investor sentiment and bond prices. Swissquote Bank's risk assessment provides insights into how these events might affect sovereign bond markets. Periods of uncertainty often drive investors towards safer haven assets, potentially increasing demand for certain sovereign bonds.

Supply and Demand Dynamics

The supply of sovereign bonds issued by governments and the demand from investors are crucial determinants of bond yields. Increased government borrowing to finance deficits can increase the supply of bonds, potentially putting downward pressure on prices and increasing yields. Strong investor demand can have the opposite effect.

Swissquote Bank's Sovereign Bond Investment Strategies

Swissquote Bank offers a range of investment strategies tailored to different risk tolerances and investment objectives. Their approach often includes:

- Active vs. Passive Management: Swissquote Bank utilizes both active and passive management strategies for sovereign bond investments, depending on market conditions and client needs. Active management involves actively selecting and trading bonds, while passive management tracks a specific bond index.

- Risk Management: Swissquote Bank employs robust risk management strategies, including diversification across different sovereign bond markets and maturities, to mitigate potential losses.

- Investment Products: Swissquote Bank offers various investment products, such as individual sovereign bonds, bond ETFs, and structured products, catering to different investor profiles.

- Client Testimonials (Example): (Insert a hypothetical or real client testimonial highlighting a successful sovereign bond investment experience with Swissquote Bank)

Outlook and Predictions for the Sovereign Bond Market

Swissquote Bank's outlook on the sovereign bond market incorporates analysis of various economic and geopolitical factors.

- Short-Term Outlook (Next 6 Months): (Insert Swissquote Bank's short-term prediction, citing specific data and market trends)

- Long-Term Outlook (Next 2-5 Years): (Insert Swissquote Bank's long-term prediction, including potential investment opportunities and risks)

- Specific Market Opportunities and Risks: (Identify specific sovereign bond markets with potential opportunities or risks based on Swissquote Bank's analysis)

- Disclaimer: Investing in sovereign bonds carries inherent risks, including interest rate risk, inflation risk, and credit risk. Past performance is not indicative of future results.

Conclusion: Swissquote Bank: Sovereign Bond Market Insights and Next Steps

This analysis highlights the current volatility in the sovereign bond market, the key factors driving yield changes, Swissquote Bank's sophisticated investment strategies, and its outlook for the future. Swissquote Bank provides a valuable resource for investors seeking to navigate this complex market. To gain a deeper understanding of Swissquote Bank's sovereign bond investment strategies and to explore potential opportunities, we encourage you to visit their website and explore their resources on Swissquote Bank sovereign bond investments. Start analyzing sovereign bonds with Swissquote Bank today and benefit from their expertise.

Featured Posts

-

Gazze De Ramazan Anadolu Ajansi Fotograf Ve Videolari

May 19, 2025

Gazze De Ramazan Anadolu Ajansi Fotograf Ve Videolari

May 19, 2025 -

The Trials Final Scene Examining Teas Crime And The Fate Of Her Parents

May 19, 2025

The Trials Final Scene Examining Teas Crime And The Fate Of Her Parents

May 19, 2025 -

Cohep Participa En La Observacion Del Proceso Electoral

May 19, 2025

Cohep Participa En La Observacion Del Proceso Electoral

May 19, 2025 -

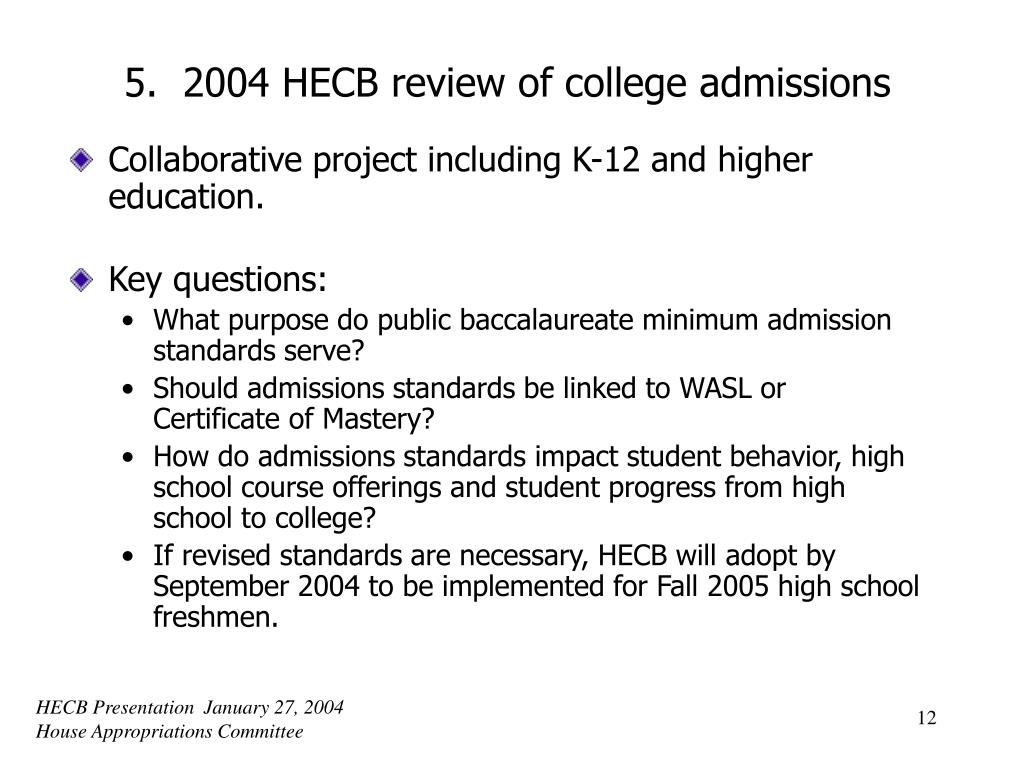

Debate On College Admissions Standards And Diversity Policies A Critical Analysis

May 19, 2025

Debate On College Admissions Standards And Diversity Policies A Critical Analysis

May 19, 2025 -

Tampoy I Martha Paleyei Gia Ton Gamo Tis

May 19, 2025

Tampoy I Martha Paleyei Gia Ton Gamo Tis

May 19, 2025