Swissquote Bank's Perspective On Recent Sovereign Bond Market Developments

Table of Contents

Rising Interest Rates and Their Impact on Sovereign Bond Yields

The global trend of rising interest rates is fundamentally reshaping the sovereign bond market. Central banks worldwide are aggressively tightening monetary policy to combat persistent inflation, leading to a significant increase in sovereign bond yields. This impact varies across different markets. For instance, US Treasury yields have seen substantial increases, reflecting the aggressive stance of the Federal Reserve. Similarly, German Bund yields and UK Gilt yields have also risen, though at potentially different paces depending on respective economic conditions and central bank actions.

- The inverse relationship between bond prices and interest rates: When interest rates rise, the yields on existing bonds become less attractive, causing their prices to fall. Conversely, when interest rates decline, bond prices generally rise.

- Economic conditions and bond yields: A country's economic health significantly influences its sovereign bond yields. Strong economic growth often leads to higher yields as investors demand a higher return for their investment. Conversely, weaker economies might see lower yields as investors seek safer havens.

- Central bank policies: Central banks play a crucial role in setting interest rates. Monetary policy decisions directly impact bond yields, influencing investor sentiment and market dynamics. Expansionary monetary policies tend to lower bond yields, while contractionary policies increase them. Keywords: interest rate risk, yield curve, monetary policy, bond yield, sovereign debt.

Inflation's Persistent Pressure on Sovereign Bond Markets

Persistent inflation poses a considerable challenge to sovereign bond markets. High inflation erodes the purchasing power of fixed-income investments, impacting the real return investors receive. Inflation expectations play a crucial role in shaping investor behavior. If investors anticipate continued high inflation, they may demand higher yields on sovereign bonds to compensate for the loss of purchasing power, driving bond prices down.

- Inflation and real yields: Real yield is the return on a bond after adjusting for inflation. High inflation reduces real yields, making sovereign bonds less attractive to inflation-conscious investors.

- Inflation-linked bonds as a hedging tool: Inflation-linked bonds (ILBs) offer a degree of protection against inflation, as their principal and coupon payments adjust with inflation rates. These bonds can be a valuable tool for diversifying portfolios and mitigating inflation risk.

- Central bank challenges: Central banks face the difficult task of managing inflation without triggering a significant economic downturn. Their actions significantly impact sovereign bond markets, creating both uncertainty and opportunities for investors. Keywords: inflation, inflation-linked bonds, real yield, purchasing power, bond valuation.

Geopolitical Risks and Their Influence on Sovereign Bond Demand

Geopolitical events, such as wars, political instability, and trade disputes, significantly impact sovereign bond markets. During times of heightened uncertainty, investors often seek the safety of sovereign bonds issued by countries perceived as politically and economically stable. This "flight to safety" phenomenon drives up demand for these bonds, pushing their prices higher and yields lower.

- Flight to safety: In times of geopolitical uncertainty, investors tend to move away from riskier assets and into perceived safe havens, such as US Treasuries, German Bunds, or Swiss government bonds.

- Impact of specific events: Major geopolitical events can cause significant shifts in investor sentiment and lead to dramatic fluctuations in sovereign bond yields. For example, the war in Ukraine has had a considerable impact on global bond markets.

- Credit ratings: Sovereign credit ratings play a crucial role in investor confidence. Higher credit ratings generally lead to lower yields as investors perceive lower risk. Keywords: geopolitical risk, safe haven assets, flight to safety, credit rating, sovereign credit risk.

Swissquote Bank's Strategic Recommendations for Navigating the Current Market

Given the current market conditions, Swissquote Bank recommends a cautious yet opportunistic approach to sovereign bond investments. Diversification is key to mitigating risk and capitalizing on potential opportunities. Investors should carefully consider their risk tolerance and investment goals when constructing their bond portfolios.

- Diversification strategies: Diversifying across different sovereign bond markets, maturities, and credit ratings is crucial to reducing overall portfolio risk.

- Bond type recommendations: The choice of specific bond types (e.g., government bonds, corporate bonds, inflation-linked bonds) should align with an investor's risk profile and investment horizon.

- Market timing: While precise market timing is difficult, investors should consider economic indicators and market sentiment when making investment decisions. Keywords: investment strategy, risk management, portfolio diversification, bond investment, Swissquote investment solutions.

A Measured Approach to Sovereign Bond Investments: Swissquote Bank's Perspective

Recent developments in the sovereign bond market highlight the importance of a well-informed and diversified investment strategy. Rising interest rates, persistent inflation, and geopolitical risks create a complex and dynamic environment. Swissquote Bank's analysis underscores the need for careful consideration of these factors when making investment decisions. Our recommendations emphasize diversification, risk management, and a thorough understanding of market dynamics. To learn more about Swissquote Bank's investment solutions and expert analysis on the sovereign bond market, please visit our website or contact our financial advisors. Keywords: sovereign bond analysis, Swissquote investment services, fixed income strategies.

Featured Posts

-

Apofaseis Tis Synodoy Toy Patriarxeioy Ierosolymon Olokliromeni Analysi

May 19, 2025

Apofaseis Tis Synodoy Toy Patriarxeioy Ierosolymon Olokliromeni Analysi

May 19, 2025 -

The Impact Of Governance On Londons Thriving Festival Culture

May 19, 2025

The Impact Of Governance On Londons Thriving Festival Culture

May 19, 2025 -

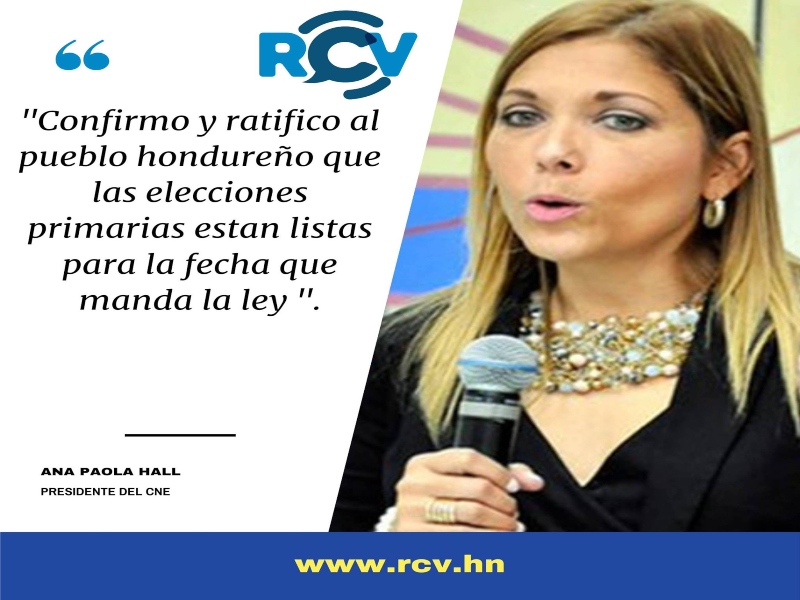

Ana Paola Hall Y La Declaratoria Un Gracias A La Ciudadania

May 19, 2025

Ana Paola Hall Y La Declaratoria Un Gracias A La Ciudadania

May 19, 2025 -

Postoje Li Sanse Za Popravak Marka Bosnjak Na Kladionicama

May 19, 2025

Postoje Li Sanse Za Popravak Marka Bosnjak Na Kladionicama

May 19, 2025 -

Tampoy Eksereynontas Tis Synepeies Ton Apokalypseon

May 19, 2025

Tampoy Eksereynontas Tis Synepeies Ton Apokalypseon

May 19, 2025