Taiwanese Investors' US Bond ETF Pullback: Reasons And Implications

Table of Contents

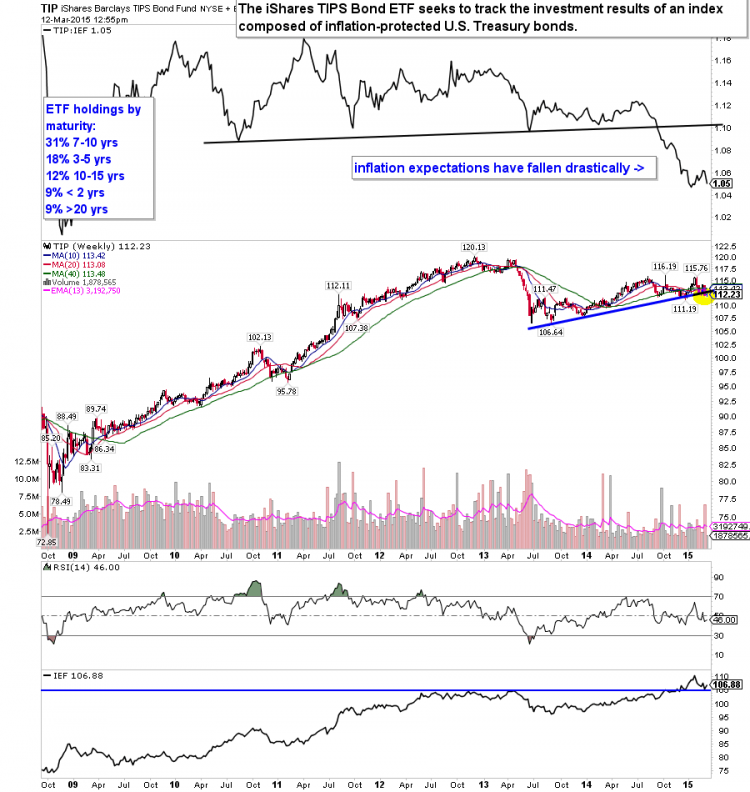

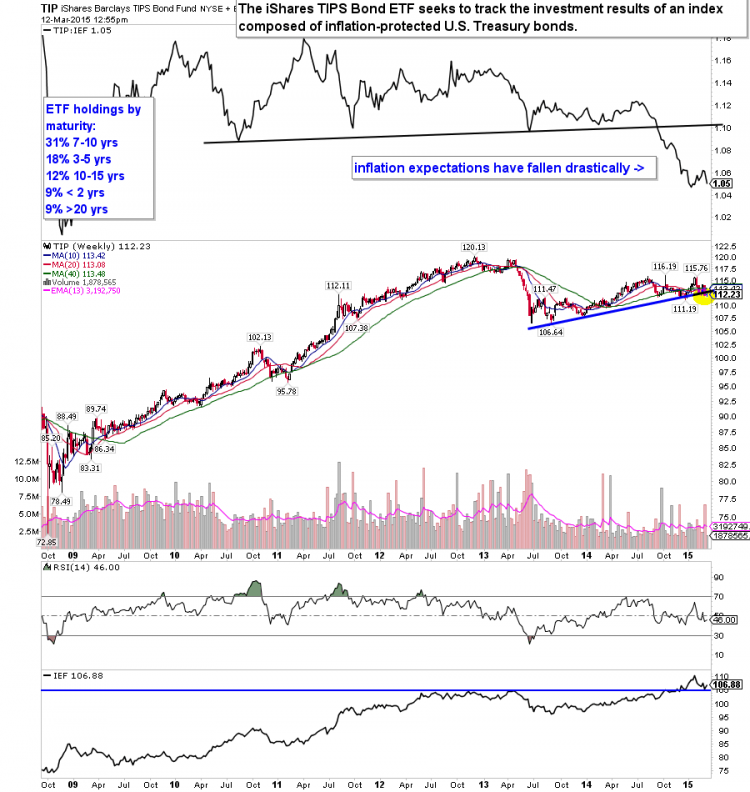

Rising US Interest Rates and Their Impact

The inverse relationship between bond prices and interest rates is a fundamental principle of finance. When the Federal Reserve (Fed) raises interest rates, as it has been doing to combat inflation, newly issued bonds offer higher yields. This makes existing bonds, including those held in US bond ETFs, less attractive. Consequently, the value of these ETFs falls, impacting Taiwanese investors who hold them.

- Impact on capital gains: The decline in ETF value directly translates to reduced capital gains for Taiwanese investors who planned to sell their holdings.

- Increased opportunity cost: Higher interest rates increase the opportunity cost of holding lower-yielding bonds, making alternative investments seem more appealing.

- Shifting investment strategies: Many investors are shifting their strategies, seeking higher yields elsewhere, potentially moving away from US bond ETFs and towards higher-yielding fixed-income instruments or other asset classes. This is a key aspect of the Taiwanese Investors' US Bond ETF Pullback.

Strengthening Taiwanese Dollar and Currency Risk

The appreciation of the Taiwanese dollar (TWD) against the US dollar (USD) further complicates matters for Taiwanese investors in US bond ETFs. When converting USD returns back to TWD, the stronger TWD diminishes the overall gains, eroding the attractiveness of these investments. Holding USD-denominated assets inherently involves currency risk.

- Hedging strategies: Some sophisticated investors employ hedging strategies to mitigate currency risk, but these strategies are not without their costs and complexities.

- Impact on portfolio performance: Currency fluctuations can significantly impact the overall performance of a portfolio heavily weighted in USD-denominated assets. This is a crucial factor in understanding the Taiwanese Investors' US Bond ETF Pullback.

- Diversification strategies: To mitigate currency risk, diversification into assets denominated in other currencies or assets less sensitive to exchange rate movements is becoming increasingly important.

Geopolitical Uncertainty and its Influence on Investment Decisions

Geopolitical uncertainty, particularly concerning US-China relations and broader global economic instability, plays a significant role in shaping investor sentiment. Increased uncertainty often leads to risk aversion, prompting investors to seek safer haven assets.

- Impact of trade wars and sanctions: Escalating trade tensions and sanctions can significantly undermine investor confidence in global markets, including the US bond market.

- Alternative investment destinations: Taiwanese investors are increasingly exploring alternative investment destinations perceived as less susceptible to geopolitical risks.

- Increased demand for safer haven assets: This heightened uncertainty fuels increased demand for assets considered safe havens, such as gold or government bonds issued by countries perceived as politically stable.

Attractiveness of Alternative Investment Opportunities

The appeal of alternative investments, both within Taiwan and globally, is another key driver of the Taiwanese Investors' US Bond ETF Pullback. Several factors are attracting investment away from US bond ETFs.

- Growth of the Taiwanese stock market: The robust growth of the Taiwanese stock market presents attractive domestic investment opportunities.

- Increased interest in emerging markets: Emerging markets offer potentially higher returns, albeit with increased risk, making them an attractive alternative for some investors.

- Rise of sustainable and responsible investing: The growing popularity of Environmental, Social, and Governance (ESG) investing is drawing funds away from traditional asset classes.

Conclusion

The Taiwanese Investors' US Bond ETF Pullback is a multifaceted phenomenon driven by a confluence of factors. Rising US interest rates, a strengthening TWD, geopolitical uncertainty, and the allure of alternative investment opportunities are all contributing to this shift. This trend has implications for both Taiwanese investors, who need to adjust their portfolio strategies and diversify to mitigate risks, and the US bond market, which may experience reduced demand and potential price impacts. Understanding the dynamics of the Taiwanese Investors' US Bond ETF Pullback is crucial for making informed investment decisions. Stay informed about the evolving landscape of this trend and consider seeking professional financial advice for managing your investments in US bond ETFs and other asset classes.

Featured Posts

-

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025 -

Darkseids Legion Attacks Dcs Superman July 2025 Solicits Revealed

May 08, 2025

Darkseids Legion Attacks Dcs Superman July 2025 Solicits Revealed

May 08, 2025 -

New Xrp Etfs From Pro Shares What Investors Need To Know

May 08, 2025

New Xrp Etfs From Pro Shares What Investors Need To Know

May 08, 2025 -

How To Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Guide

May 08, 2025

How To Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Guide

May 08, 2025 -

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025