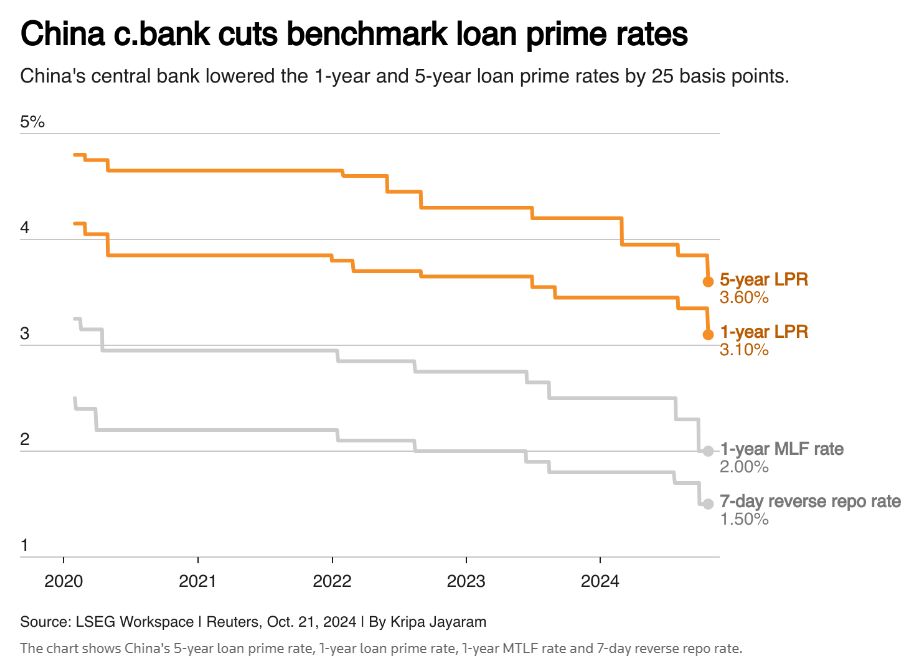

Tariff Response: China's Lowered Interest Rates And Stimulative Lending Policies

Table of Contents

The Rationale Behind Lowered Interest Rates

The decision to cut interest rates stems from a confluence of economic factors, primarily the slowdown in economic growth fueled by the ongoing trade war with the United States. The imposition of tariffs has dampened both domestic and international investment, impacting various sectors of the Chinese economy. Decreased interest rates are a key component of China's monetary policy designed to counteract these negative effects. The core aim is to stimulate economic activity and bolster growth.

- Decreased borrowing costs for businesses: Lower interest rates make it cheaper for businesses to borrow money, encouraging investment in expansion, new equipment, and job creation. This injection of capital aims to offset the contractionary effects of the tariffs.

- Increased consumer spending: Lower interest rates also translate to lower borrowing costs for personal loans, potentially leading to increased consumer spending and a boost in domestic demand. This helps to cushion the blow of reduced exports due to tariffs.

- Combating deflationary pressures: Reduced trade activity can lead to deflationary pressures. Lower interest rates can stimulate demand, preventing a decline in prices and ensuring price stability within the economy.

- Counteracting the negative impact of tariffs on domestic demand: By lowering borrowing costs and encouraging spending, the government aims to offset the decreased demand resulting from reduced exports and increased import costs caused by tariffs.

Stimulative Lending Policies: A Deeper Dive

Beyond interest rate cuts, China has implemented a range of stimulative lending policies. These measures form a crucial part of the country's fiscal policy, working in tandem with monetary policy to achieve its economic objectives. The government is actively directing lending towards specific sectors to bolster growth and mitigate the impact of the trade war.

- Targeted lending programs: Specific industries significantly affected by tariffs, such as manufacturing and agriculture, are targeted with preferential lending programs, making it easier for businesses within these sectors to access credit and maintain operations.

- Support for SMEs: Relaxation of lending requirements for small and medium-sized enterprises (SMEs) aims to support these vital contributors to the Chinese economy, which are often disproportionately affected by economic downturns.

- Infrastructure investment: Increased government spending on infrastructure projects—roads, bridges, railways—creates jobs, stimulates related industries, and provides a significant boost to overall economic activity. This is a classic Keynesian approach to counter cyclical downturns.

- Boosting liquidity: Measures to increase liquidity in the banking system ensure that banks have sufficient funds to lend, preventing a credit crunch and supporting the overall lending initiative.

Effectiveness and Potential Challenges

While the effectiveness of these measures is yet to be fully determined, several economic indicators offer a preliminary assessment. Monitoring GDP growth, inflation rates, and investment levels is crucial to gauge the success of the government's strategy. However, the approach is not without potential challenges and risks.

- Economic Indicator Analysis: Analyzing key economic indicators post-policy implementation is vital. While some early signs may show improvement, sustained observation is necessary for conclusive assessment.

- Increased Government Debt: Increased government spending and stimulative lending inevitably lead to higher government debt levels. This raises concerns about long-term fiscal sustainability and the potential for future economic instability.

- Inflationary Pressures: The increased money supply from stimulative lending carries the risk of inflationary pressures. Careful monitoring and potential adjustments to policy may be necessary to prevent runaway inflation.

- Global Implications: China's response to tariffs has significant global implications. Its economic slowdown, even partially mitigated, impacts global trade and supply chains, potentially influencing other countries' economic policies and strategies.

Comparison with Other Countries' Responses

China's response to the trade war differs from those of other nations facing similar challenges. While some countries have focused primarily on retaliatory tariffs or renegotiation of trade agreements, China has opted for a combination of monetary and fiscal stimulus.

- Comparison with US Response: The US response has primarily focused on tariffs and trade negotiations, with less emphasis on domestic economic stimulus.

- Comparison with Other Affected Countries: Other countries impacted by the trade dispute have adopted varying approaches, ranging from tariff adjustments to internal economic reforms.

- Effectiveness of Different Approaches: A comparative analysis of different policy approaches provides valuable insights into their effectiveness in navigating trade disputes and maintaining economic stability.

Conclusion

China's lowered interest rates and stimulative lending policies represent a significant attempt to mitigate the negative economic impacts of the ongoing trade war. While these measures aim to stimulate economic growth and counteract deflationary pressures, potential challenges exist, including increased debt levels and the risk of inflation. Further research into China’s economic policy response to tariffs is crucial for understanding the evolving global trade landscape. Continue to monitor China’s response to tariffs and the broader implications for the global economy. Stay informed about the latest developments in China's interest rates and stimulative lending policies to make informed decisions.

Featured Posts

-

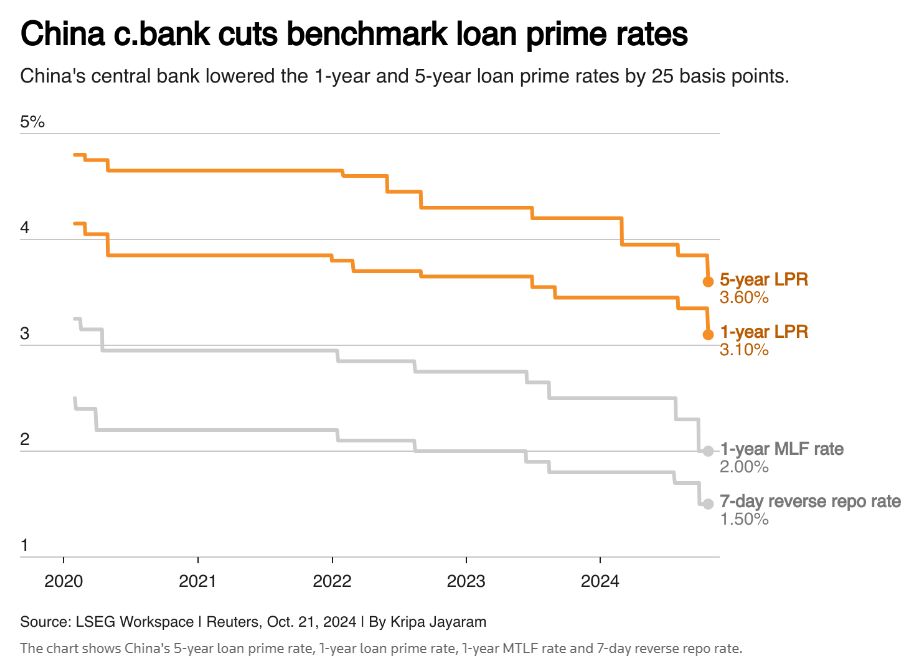

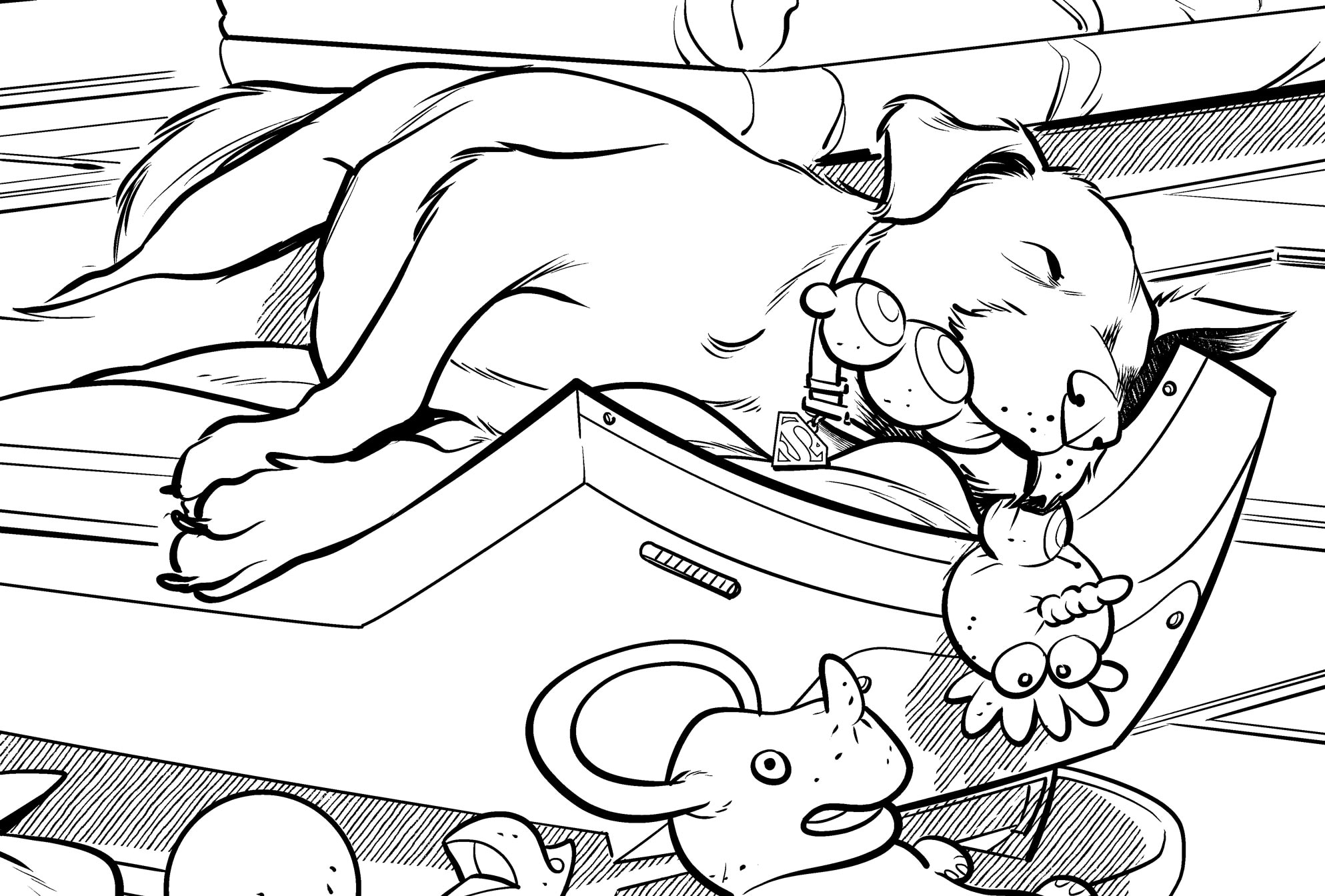

How Well Do You Know Nba Playoffs Triple Doubles Leaders

May 08, 2025

How Well Do You Know Nba Playoffs Triple Doubles Leaders

May 08, 2025 -

Will This Cryptocurrency Soar 185 Van Ecks Expert Prediction

May 08, 2025

Will This Cryptocurrency Soar 185 Van Ecks Expert Prediction

May 08, 2025 -

Psg Ve Nantes Berabere Kaldi Mac Oezeti Ve Analizi

May 08, 2025

Psg Ve Nantes Berabere Kaldi Mac Oezeti Ve Analizi

May 08, 2025 -

Thousands Affected Dwp Expands Home Visit Program For Benefits

May 08, 2025

Thousands Affected Dwp Expands Home Visit Program For Benefits

May 08, 2025 -

Review Krypto The Last Dog Of Krypton Is It Worth Watching

May 08, 2025

Review Krypto The Last Dog Of Krypton Is It Worth Watching

May 08, 2025