Tech's Top Seven: Analyzing A $2.5 Trillion Market Value Loss

Table of Contents

The Top Seven Tech Giants and Their Losses

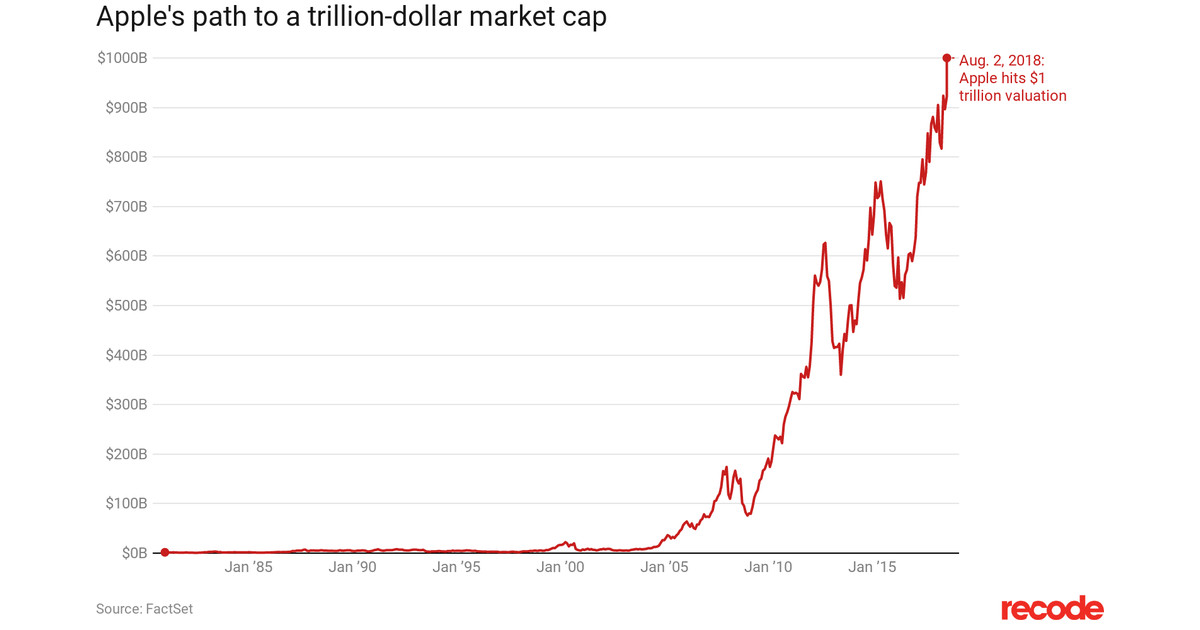

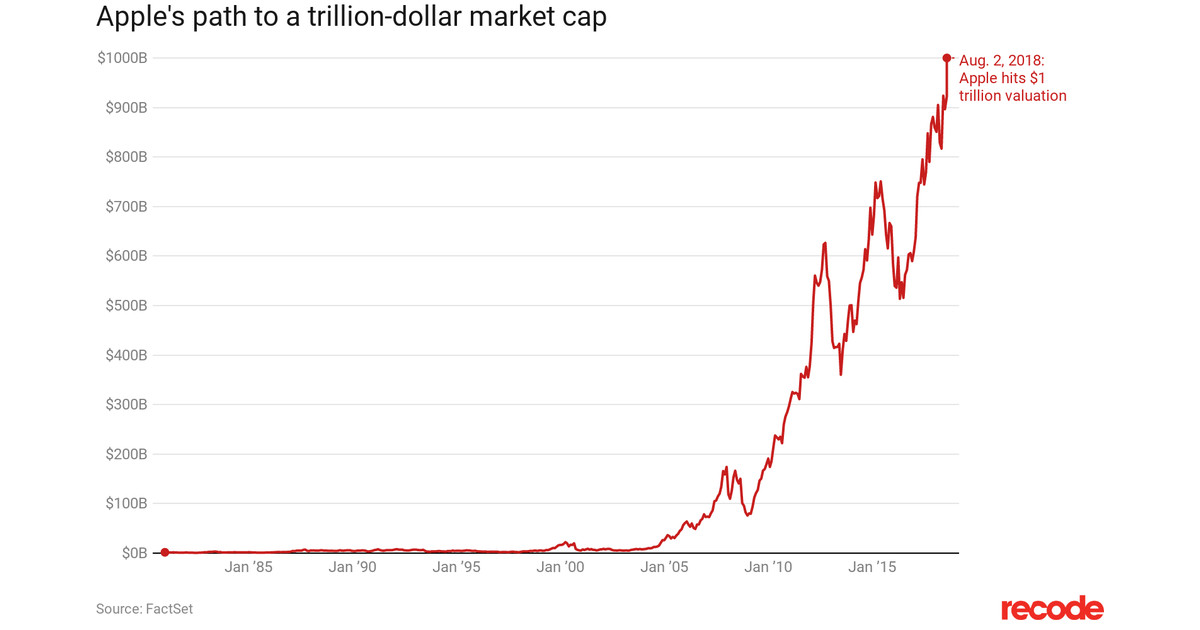

Seven leading tech companies—Apple, Microsoft, Alphabet (Google's parent company), Amazon, Meta (formerly Facebook), Nvidia, and Tesla—have been significantly impacted by this tech stock losses. Their combined market capitalization decline accounts for a substantial portion of the overall $2.5 trillion loss. While precise figures fluctuate daily, the following provides an approximate representation of the individual losses (as of October 26, 2023 - Note: These figures are estimates and subject to change. Always consult up-to-date financial news sources for the most accurate information.):

- Apple: Market cap loss (approx.): $[Insert approximate dollar amount], Percentage change: [Insert approximate percentage] - [Link to relevant financial news source]

- Microsoft: Market cap loss (approx.): $[Insert approximate dollar amount], Percentage change: [Insert approximate percentage] - [Link to relevant financial news source]

- Alphabet (Google): Market cap loss (approx.): $[Insert approximate dollar amount], Percentage change: [Insert approximate percentage] - [Link to relevant financial news source]

- Amazon: Market cap loss (approx.): $[Insert approximate dollar amount], Percentage change: [Insert approximate percentage] - [Link to relevant financial news source]

- Meta (Facebook): Market cap loss (approx.): $[Insert approximate dollar amount], Percentage change: [Insert approximate percentage] - [Link to relevant financial news source]

- Nvidia: Market cap loss (approx.): $[Insert approximate dollar amount], Percentage change: [Insert approximate percentage] - [Link to relevant financial news source]

- Tesla: Market cap loss (approx.): $[Insert approximate dollar amount], Percentage change: [Insert approximate percentage] - [Link to relevant financial news source]

Each company faced unique challenges. Apple battled supply chain disruptions impacting production and sales. Meta's ambitious metaverse investments yielded disappointing returns, impacting investor confidence. Other companies experienced slower-than-expected growth in specific sectors, contributing to the overall valuation decline.

Rising Interest Rates and Inflationary Pressures

Rising interest rates and persistent inflationary pressures have significantly impacted tech valuations. The Federal Reserve's aggressive interest rate hikes aim to curb inflation, but this has resulted in higher borrowing costs for businesses and reduced investor appetite for riskier assets, including many tech stocks.

- Impact on Venture Capital: Higher interest rates make it more expensive for venture capitalists to fund startups, leading to reduced investment in the tech sector.

- Corporate Borrowing Costs: Increased borrowing costs affect tech companies' ability to expand operations, invest in research and development, and acquire other businesses.

- Reduced Consumer Spending: Inflation erodes consumer purchasing power, leading to decreased spending on discretionary items like electronics and software, negatively impacting tech sales.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical instability, including the ongoing war in Ukraine and escalating trade tensions, has exacerbated existing supply chain vulnerabilities. These disruptions have hampered the production and distribution of essential tech components, impacting the entire industry.

- Chip Shortage: The global chip shortage continues to constrain production capacity for many tech devices and products.

- Trade Wars and Sanctions: Trade tensions and sanctions imposed on certain countries have disrupted the global supply chain, increasing costs and reducing the availability of crucial components.

- Logistics Bottlenecks: Global logistical challenges, including port congestion and transportation delays, further compound the supply chain disruptions.

Overvaluation and Investor Sentiment

The preceding tech boom led to overvaluation in certain sectors, creating a bubble that was bound to burst. As investor sentiment shifted towards caution, a market correction became inevitable.

- Market Bubbles and Corrections: Rapid growth often leads to inflated valuations, creating unsustainable market bubbles. Corrections are natural responses to overvaluation, restoring a more realistic equilibrium.

- Shifting Investor Sentiment: Investor confidence is highly sensitive to economic conditions and news. Negative news, such as rising interest rates or geopolitical instability, can trigger a rapid sell-off.

The Future of the Tech Sector: A Path to Recovery?

The future of the tech sector remains uncertain. A recovery is possible, but it hinges on several factors.

- Potential Catalysts for Growth: Innovation in areas like artificial intelligence, cloud computing, and renewable energy could fuel future growth. Increased consumer spending as inflation subsides could also contribute to a rebound.

- Persistent Challenges: Inflation, geopolitical uncertainty, and regulatory scrutiny will continue to pose challenges to the tech sector's recovery.

Investment Strategies in a Volatile Market

Navigating this turbulent market requires a thoughtful approach.

- Diversification: Spread investments across different asset classes and sectors to mitigate risk.

- Value Investing: Focus on undervalued companies with strong fundamentals.

- Long-Term Investment Horizon: Avoid short-term market fluctuations and maintain a long-term perspective.

- Risk Management: Implement strategies to manage and limit potential losses.

Regulatory Scrutiny and Antitrust Concerns

Growing regulatory scrutiny and antitrust concerns are impacting the growth and valuations of large tech companies.

- Antitrust Investigations and Lawsuits: Several tech giants face ongoing antitrust investigations and lawsuits, potentially leading to significant fines and changes in business practices.

- Data Privacy Regulations: Increased focus on data privacy and security is forcing tech companies to adapt their business models and invest in compliance measures.

Conclusion

The $2.5 trillion market value loss in the tech sector is a result of a confluence of factors: rising interest rates, inflation, geopolitical uncertainty, overvaluation, supply chain issues, and regulatory scrutiny. Understanding these forces is crucial for navigating the future of technology investments. Continue to research and monitor the tech market crash to make informed decisions. Stay informed about the evolving landscape of the tech sector and its impact on global markets. Learn more about mitigating tech stock losses and explore diverse investment strategies to navigate the tech industry downturn. This analysis of the $2.5 trillion market value loss serves as a starting point for a more in-depth understanding of this significant market event.

Featured Posts

-

Trauerbeflaggung An Deutschen Ministerien Papst Tod

Apr 29, 2025

Trauerbeflaggung An Deutschen Ministerien Papst Tod

Apr 29, 2025 -

Perplexity Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025

Perplexity Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025 -

36 Years Later Sons Conflict As Ohio Doctor Seeks Parole For Wifes Killing

Apr 29, 2025

36 Years Later Sons Conflict As Ohio Doctor Seeks Parole For Wifes Killing

Apr 29, 2025 -

Investing In Negeri Sembilans Emerging Data Center Market

Apr 29, 2025

Investing In Negeri Sembilans Emerging Data Center Market

Apr 29, 2025 -

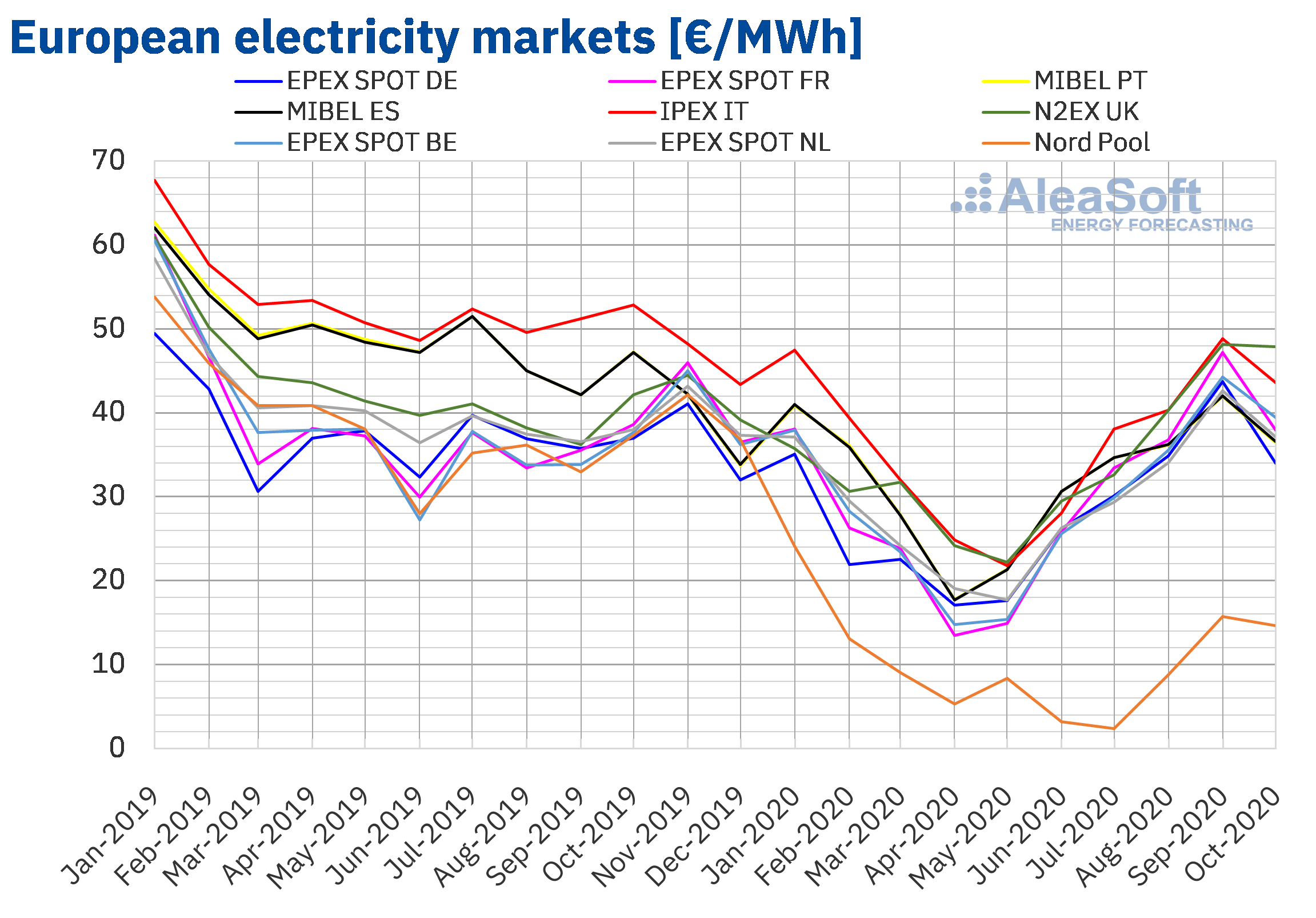

Negative European Electricity Prices A Solar Energy Success Story

Apr 29, 2025

Negative European Electricity Prices A Solar Energy Success Story

Apr 29, 2025

Latest Posts

-

David Rosenberg Critiques Bank Of Canadas Cautious Approach

Apr 29, 2025

David Rosenberg Critiques Bank Of Canadas Cautious Approach

Apr 29, 2025 -

Broadcoms Proposed V Mware Price Hike A 1050 Cost Surge For At And T

Apr 29, 2025

Broadcoms Proposed V Mware Price Hike A 1050 Cost Surge For At And T

Apr 29, 2025 -

Investigation Reveals Months Of Toxic Chemical Presence In Buildings After Ohio Derailment

Apr 29, 2025

Investigation Reveals Months Of Toxic Chemical Presence In Buildings After Ohio Derailment

Apr 29, 2025 -

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Contamination Of Buildings

Apr 29, 2025

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Contamination Of Buildings

Apr 29, 2025 -

Office365 Security Failure Costs Millions Federal Investigation Reveals Extent Of Damage

Apr 29, 2025

Office365 Security Failure Costs Millions Federal Investigation Reveals Extent Of Damage

Apr 29, 2025