Tesla And Tech Drive US Stock Market Surge

Table of Contents

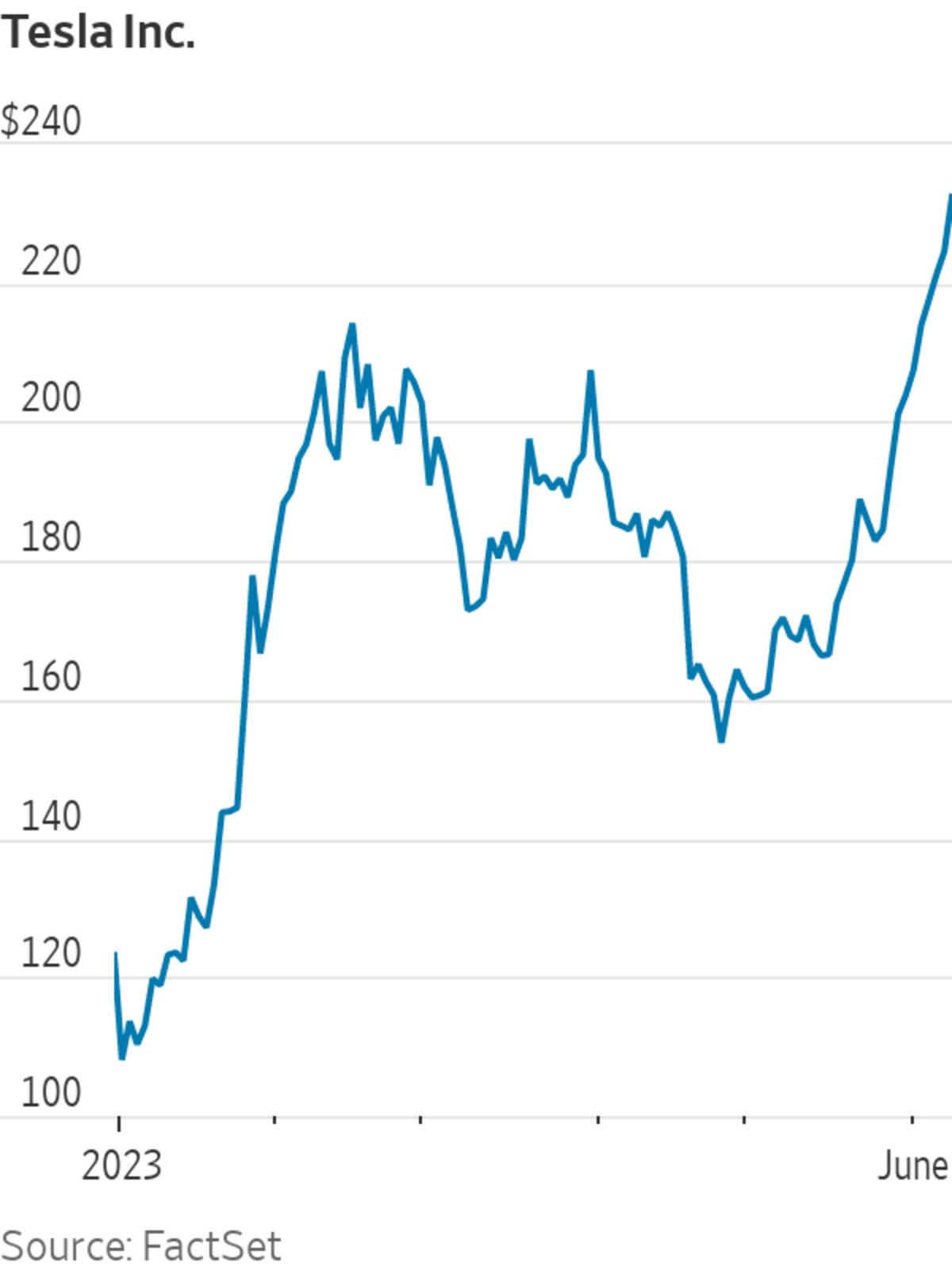

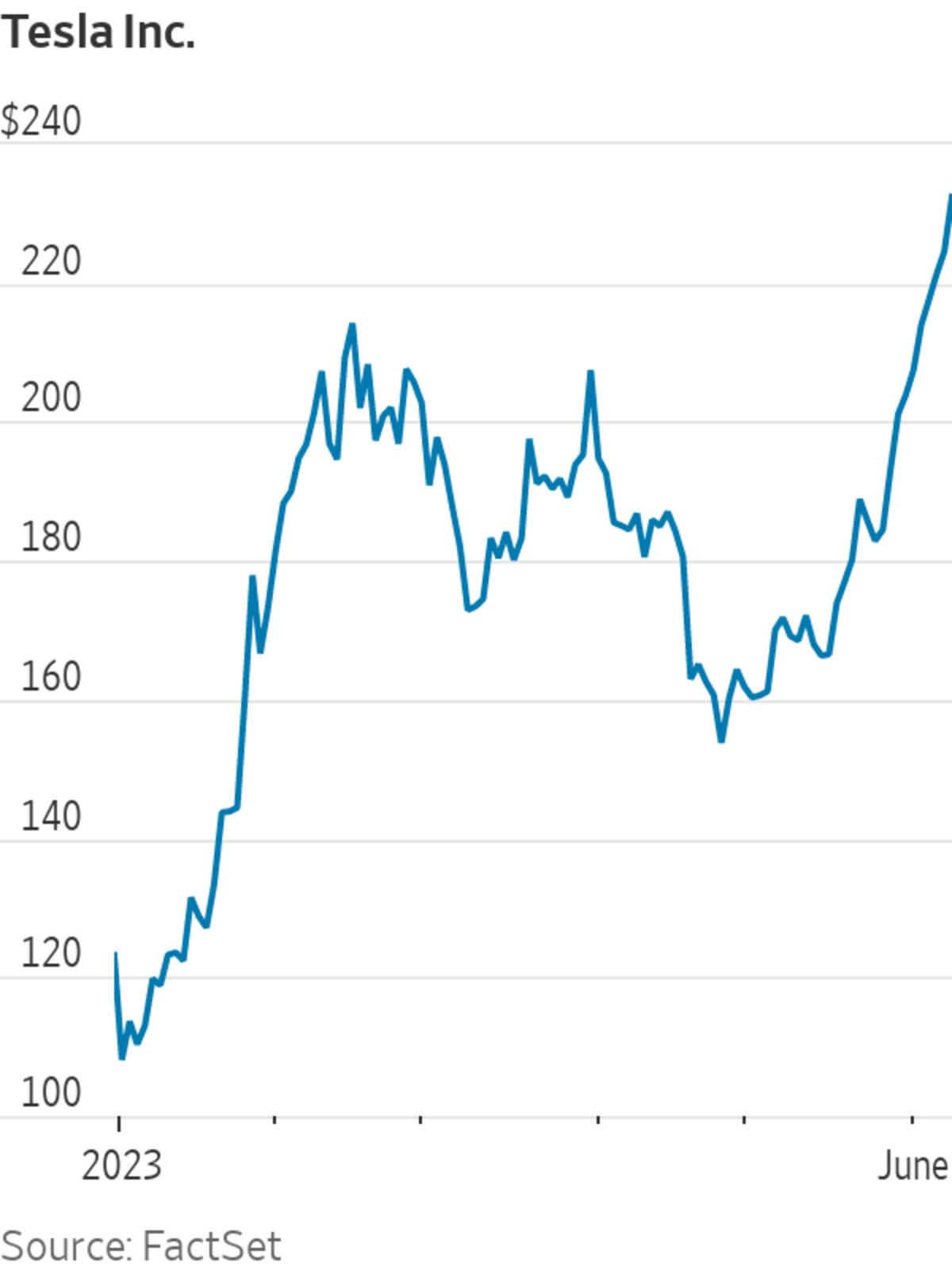

Tesla's Performance as a Catalyst

Tesla's remarkable financial performance and soaring stock price have acted as a powerful catalyst for the overall market surge. Several factors contribute to this phenomenal growth. The company's consistent delivery of record-breaking vehicle sales, coupled with innovative product launches like the highly anticipated Cybertruck and advancements in energy storage solutions, have significantly boosted investor confidence. Elon Musk's leadership, while often controversial, undeniably commands significant attention and influences investor sentiment, driving both enthusiasm and volatility.

- Record-breaking vehicle deliveries: Tesla consistently surpasses delivery targets, demonstrating strong consumer demand and market penetration.

- Successful product launches: The anticipation surrounding new vehicles and energy solutions keeps investors engaged and optimistic about future growth.

- Expansion into new markets and charging infrastructure: Tesla's global expansion strategy secures its position as a leading player in the burgeoning electric vehicle market.

- Positive investor outlook and analyst ratings: Favorable ratings and predictions from financial analysts reinforce the positive narrative surrounding Tesla's stock.

The Broader Tech Sector's Contribution

Tesla's success isn't an isolated phenomenon. The broader tech sector has also experienced substantial growth, strongly correlating with the overall market surge. Several key technological advancements and the success of leading tech companies have fueled this positive momentum.

- Growth in artificial intelligence (AI) and machine learning: Advancements in AI are driving innovation across various sectors, leading to increased investment and market capitalization.

- Increasing demand for cloud computing services: The growing reliance on cloud-based solutions benefits major cloud providers, contributing to their market dominance and overall market growth.

- Rise of the metaverse and related technologies: The burgeoning metaverse sector attracts significant investment and fuels growth in associated technologies, like virtual and augmented reality.

- Strong performance of semiconductor companies: The semiconductor industry, crucial to technological advancements, has shown strong performance, supporting the overall tech sector's growth.

Economic Factors Influencing the Surge

Macroeconomic factors have also played a crucial role in creating a favorable environment for the Tesla and tech-driven market surge. Several key economic indicators have contributed to this positive trend.

- Lower-than-expected inflation rates: Easing inflationary pressures have reduced concerns about interest rate hikes, creating a more positive investor sentiment.

- Positive consumer sentiment and spending: Strong consumer spending indicates a healthy economy, boosting demand for goods and services, including technological products.

- Government investment in green technologies and infrastructure: Government initiatives supporting green technologies and electric vehicles have provided a tailwind for companies like Tesla.

- Favorable regulatory environment for certain tech sectors: A supportive regulatory environment allows tech companies to flourish and expand their operations.

Risks and Future Outlook

While the current market surge is impressive, it's essential to acknowledge potential risks and challenges that could impact continued growth.

- Geopolitical tensions and their impact on global markets: Geopolitical instability can negatively impact investor confidence and disrupt global supply chains.

- Potential supply chain bottlenecks impacting production: Disruptions to supply chains can hinder production and affect the timely delivery of goods.

- Rising interest rates and their effect on investor sentiment: Increased interest rates can make borrowing more expensive, potentially dampening investment and economic growth.

- Competition within the electric vehicle and tech sectors: Intense competition from other companies can pressure profit margins and market share.

Conclusion: Understanding the Tesla and Tech Driven US Stock Market Surge and What it Means for Investors

The current US stock market surge is a complex phenomenon driven by a confluence of factors. Tesla's exceptional performance, fueled by strong sales, innovation, and expansion, has acted as a catalyst. Simultaneously, the broader tech sector's robust growth, driven by advancements in AI, cloud computing, and other technologies, has further amplified the upward trend. Favorable macroeconomic conditions have created a supportive environment for this growth. However, investors must remain aware of potential risks such as geopolitical uncertainty and supply chain challenges. Stay informed about future developments influencing the Tesla and tech driven US stock market surge and make sound investment decisions based on your own risk tolerance and thorough research.

Featured Posts

-

Understanding Ais Thought Processes A Surprisingly Simple Reality

Apr 29, 2025

Understanding Ais Thought Processes A Surprisingly Simple Reality

Apr 29, 2025 -

Microsoft Activision Deal Ftcs Appeal Explained

Apr 29, 2025

Microsoft Activision Deal Ftcs Appeal Explained

Apr 29, 2025 -

Halbmastbeflaggung In Deutschland Trauer Um Den Verstorbenen Papst

Apr 29, 2025

Halbmastbeflaggung In Deutschland Trauer Um Den Verstorbenen Papst

Apr 29, 2025 -

Inter Miami Cf Where To Watch Lionel Messi Play In Mls Schedule Live Streams And Betting

Apr 29, 2025

Inter Miami Cf Where To Watch Lionel Messi Play In Mls Schedule Live Streams And Betting

Apr 29, 2025 -

The Ny Times And The January 29th Dc Air Disaster What Was Omitted

Apr 29, 2025

The Ny Times And The January 29th Dc Air Disaster What Was Omitted

Apr 29, 2025

Latest Posts

-

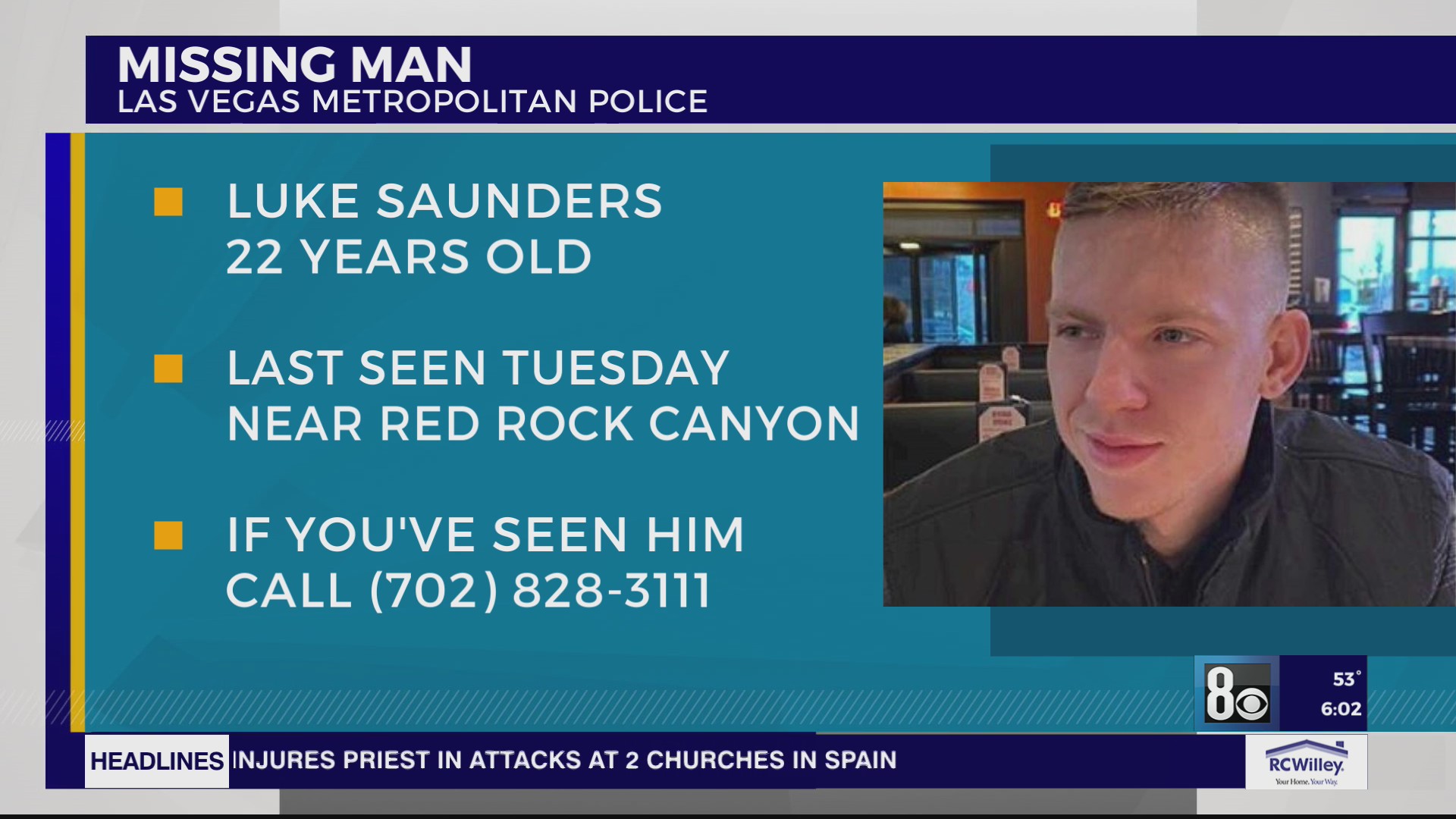

British Paralympian Sam Ruddock Missing In Las Vegas Urgent Search Underway

Apr 29, 2025

British Paralympian Sam Ruddock Missing In Las Vegas Urgent Search Underway

Apr 29, 2025 -

Missing British Paralympian Urgent Appeal For Information In Las Vegas

Apr 29, 2025

Missing British Paralympian Urgent Appeal For Information In Las Vegas

Apr 29, 2025 -

Concerns Grow Over Missing British Paralympian In Las Vegas

Apr 29, 2025

Concerns Grow Over Missing British Paralympian In Las Vegas

Apr 29, 2025 -

Midland Athlete Vanishes In Las Vegas Family And Friends Appeal For Information

Apr 29, 2025

Midland Athlete Vanishes In Las Vegas Family And Friends Appeal For Information

Apr 29, 2025 -

Search For Missing Midland Athlete Intensifies In Las Vegas

Apr 29, 2025

Search For Missing Midland Athlete Intensifies In Las Vegas

Apr 29, 2025