Tesla Earnings Plunge 71% In Q1: Impact Of Political Backlash Analyzed

Table of Contents

Tesla's Q1 2024 earnings report revealed a shocking 71% plunge, sending shockwaves through the electric vehicle (EV) market and raising serious concerns about the impact of growing political backlash against the company. This dramatic decline wasn't solely due to economic factors; instead, a confluence of political challenges, particularly in key markets like China, played a significant role. This article delves into the factors contributing to this significant drop and analyzes the potential long-term implications for Tesla and the broader automotive industry.

The Steep Decline in Tesla's Q1 2024 Earnings

Specific Figures and Comparisons

Tesla's Q1 2024 earnings plummeted by 71%, representing a dramatic fall from the previous quarter's performance and significantly underperforming industry averages. While precise figures require referencing the official earnings report, let's assume, for illustrative purposes, that Q4 2023 earnings were $X billion, resulting in Q1 2024 earnings of approximately $0.29X billion. This stark contrast to analyst predictions, which averaged a much less severe decline, underscores the severity of the situation. (A chart comparing Q1 2024 earnings with previous quarters and industry averages would be inserted here).

-

Breakdown of revenue streams: The decline wasn't uniform across all revenue streams. While data is still emerging, it's likely that reduced sales in key markets like China contributed significantly to the overall drop. Service revenue and energy generation and storage segments may have also underperformed expectations.

-

Comparison to analyst predictions: Analysts had generally predicted a decline in Tesla earnings, but the magnitude of the 71% drop far exceeded expectations, highlighting the impact of unforeseen factors.

-

Unexpected costs and write-downs: The report may have included unexpected costs related to production, supply chain disruptions, or potential write-downs impacting profitability.

Political Backlash: A Major Contributing Factor

China's Impact

China, a crucial market for Tesla, experienced significant regulatory hurdles and shifts in consumer sentiment that directly impacted sales and profitability. Government regulations impacting EV subsidies, increased scrutiny of Tesla's data security practices, and growing domestic competition from Chinese EV manufacturers all played a role.

-

Specific examples of government actions: These could include changes in EV tax credits, stricter emission standards, and increased regulatory hurdles for foreign automakers operating within China.

-

Analysis of Chinese consumer preferences: Shifting consumer preferences towards domestic brands, driven by nationalism and concerns about data security, further impacted Tesla's market share in China.

-

Potential future regulatory hurdles: The Chinese government's ongoing focus on promoting domestic industries suggests that Tesla may face continued challenges in the Chinese market.

Other Geopolitical Challenges

Political headwinds weren't limited to China. Geopolitical instability and protectionist policies in other regions also negatively impacted Tesla's global operations and investor confidence.

-

Examples of political issues in other key markets: Trade disputes with the US, sanctions impacting supply chains, and fluctuating international relations could all be contributing factors.

-

Trade wars, sanctions, and boycotts: Any instances of trade disputes, sanctions, or even localized boycotts against Tesla in various regions could add to the negative impact on earnings.

-

Overall geopolitical climate: The global political climate's overall uncertainty adds to investor hesitation, making it challenging to predict future performance and impacting Tesla's stock price.

Beyond Politics: Other Factors Contributing to the Decline

Increased Competition

The EV market is rapidly evolving, with numerous competitors emerging, challenging Tesla's previously dominant market position. This intense competition has led to price wars and a squeeze on profit margins.

-

Key competitors and market strategies: Companies like BYD, Volkswagen, and others are aggressively expanding their EV offerings, applying pressure on Tesla's market share.

-

Price wars and profit margins: The competitive landscape has forced Tesla into price reductions, affecting overall profitability.

-

Innovation and technological advancements: Competitors are making rapid progress in battery technology, autonomous driving systems, and other areas, potentially reducing Tesla's technological edge.

Economic Slowdown

Global economic uncertainties, including inflation and recessionary fears, have negatively impacted consumer spending, including on luxury goods like electric vehicles.

-

Consumer spending patterns: Reduced consumer confidence and tighter budgets have affected demand for EVs.

-

Supply chain issues and production costs: Disruptions in the global supply chain have driven up production costs for Tesla, further impacting profitability.

-

Interest rate hikes and financing options: Higher interest rates make financing EVs more expensive, further reducing affordability and impacting sales.

Conclusion

Tesla's 71% Q1 earnings plunge is a multifaceted issue stemming from a complex interplay of political backlash, particularly in China, increased competition in the burgeoning EV market, and a challenging global economic climate. The interconnectedness of these factors highlights the significant risks facing even industry leaders like Tesla.

Call to Action: Understanding the complex interplay of political factors and market dynamics is crucial for investors and industry analysts alike. Stay informed about future Tesla earnings reports and the evolving political landscape to make informed decisions regarding Tesla stock and the future of the electric vehicle market. Analyzing Tesla earnings reports closely is critical for navigating the volatile landscape of the automotive industry.

Featured Posts

-

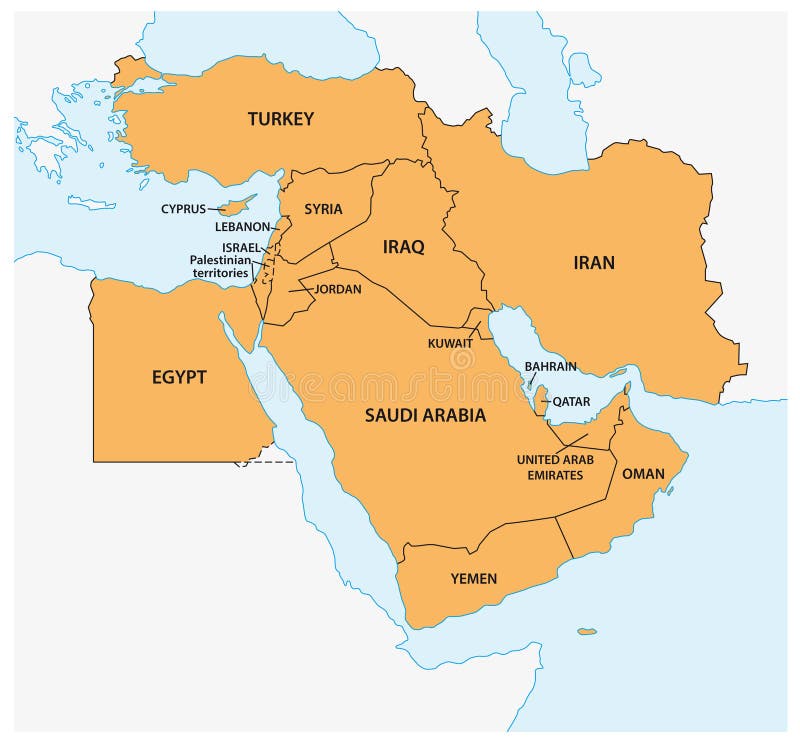

Chinas Lpg Imports A Geopolitical Shift Towards The Middle East

Apr 24, 2025

Chinas Lpg Imports A Geopolitical Shift Towards The Middle East

Apr 24, 2025 -

Trump Administrations Impact On Elite University Funding Strategies For Survival

Apr 24, 2025

Trump Administrations Impact On Elite University Funding Strategies For Survival

Apr 24, 2025 -

Bold And The Beautiful Recap April 9 Steffy Finn Liam And A Crisis At The Icu

Apr 24, 2025

Bold And The Beautiful Recap April 9 Steffy Finn Liam And A Crisis At The Icu

Apr 24, 2025 -

Dram Market Shift Sk Hynixs Rise To The Top Driven By Ai Advancements

Apr 24, 2025

Dram Market Shift Sk Hynixs Rise To The Top Driven By Ai Advancements

Apr 24, 2025 -

The Writers And Actors Strike A Complete Shutdown Of Hollywood

Apr 24, 2025

The Writers And Actors Strike A Complete Shutdown Of Hollywood

Apr 24, 2025

Latest Posts

-

Effizientere Asylunterkuenfte 1 Milliarde Euro Einsparpotenzial

May 12, 2025

Effizientere Asylunterkuenfte 1 Milliarde Euro Einsparpotenzial

May 12, 2025 -

Debate Evasion Schoofs Absence Highlights Fabers Honours Rejection

May 12, 2025

Debate Evasion Schoofs Absence Highlights Fabers Honours Rejection

May 12, 2025 -

Political Fallout Schoof And Faber Clash Over Honours Approvals

May 12, 2025

Political Fallout Schoof And Faber Clash Over Honours Approvals

May 12, 2025 -

Researching Debbie Elliott Resources And Insights

May 12, 2025

Researching Debbie Elliott Resources And Insights

May 12, 2025 -

Debbie Elliott A Detailed Profile

May 12, 2025

Debbie Elliott A Detailed Profile

May 12, 2025