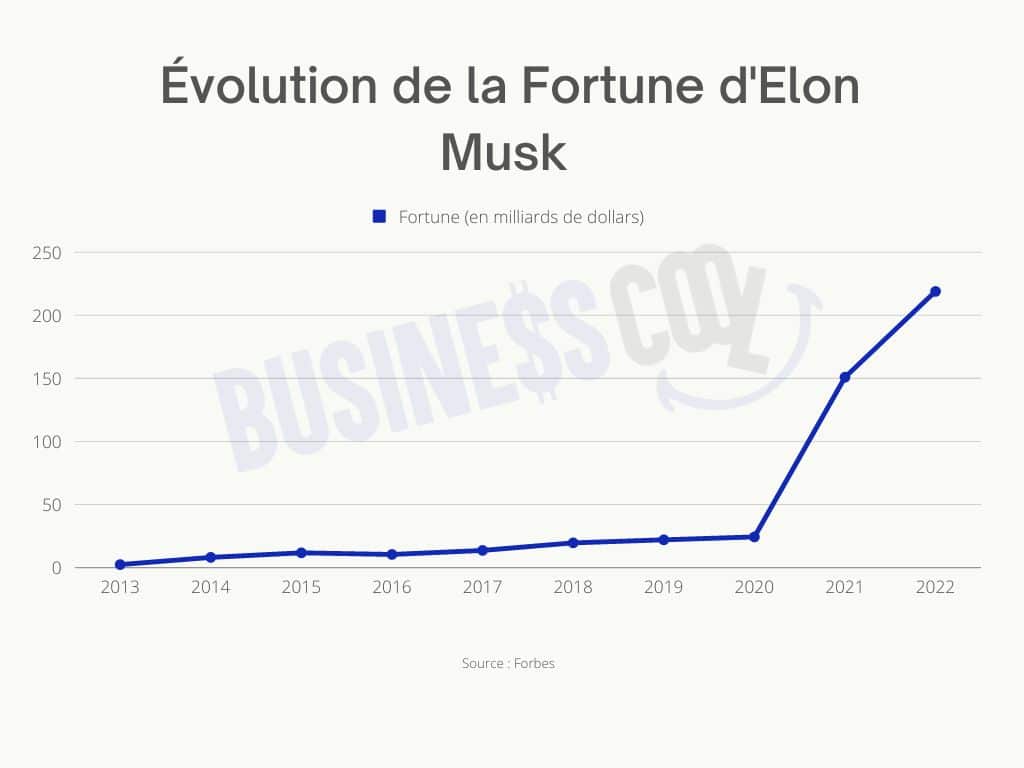

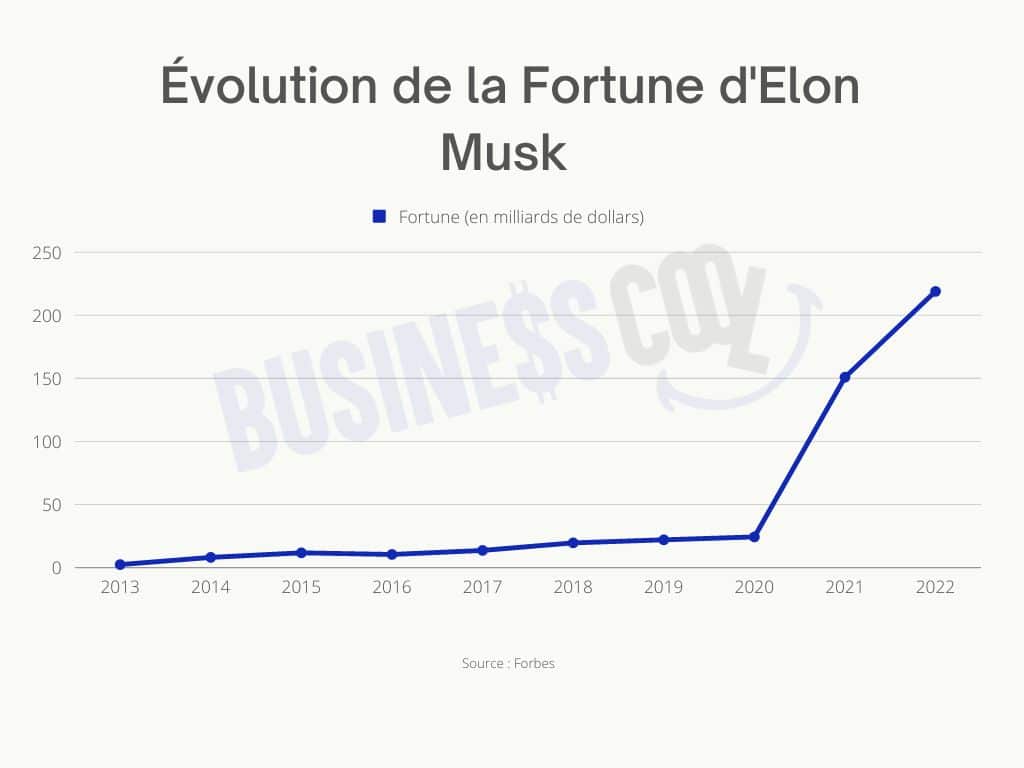

Tesla Stock Boost: Elon Musk's Fortune Explodes Following Dogecoin Step-Back

Table of Contents

The Dogecoin Dip and Tesla's Rise

The past few weeks have witnessed a fascinating inverse correlation: a decrease in Dogecoin's value coincided with a simultaneous rise in Tesla's stock price. This unexpected trend has captivated market analysts and investors alike.

- Percentage Changes: While specific percentages fluctuate daily, we've seen Dogecoin experience a [insert percentage]% drop in value over [insert timeframe], while Tesla's stock price saw a [insert percentage]% increase during the same period. [Insert links to reliable financial news sources confirming these figures].

- Key Dates & Events: The correlation became particularly noticeable around [insert specific dates or events that coincide with the changes]. This timing suggests a potential causal link between reduced Dogecoin promotion and increased investor confidence in Tesla.

The reduced focus on Dogecoin might be interpreted by investors as a sign that Musk is prioritizing Tesla's core business and long-term strategy. This could alleviate concerns about reputational risk associated with the inherent volatility of the cryptocurrency market. Investors might perceive a decreased likelihood of negative headlines dominated by Dogecoin price swings impacting Tesla's image and valuation.

Investor Sentiment and Market Speculation

Investor sentiment towards Tesla has demonstrably shifted following Musk's reduced engagement with Dogecoin.

- Social Media & News Analysis: A noticeable shift in social media sentiment is evident, with a decrease in discussions directly linking Tesla's performance to Dogecoin's price fluctuations. News articles are increasingly focusing on Tesla's operational performance and future prospects, rather than Musk's cryptocurrency activities. [Insert links to relevant social media analytics or news articles].

- Analyst Reports & Predictions: Several analysts have updated their Tesla price targets upward, citing improved investor confidence and a renewed focus on the company's fundamentals. [Insert links to analyst reports].

- Reduced Regulatory Scrutiny: The distancing from memecoins could also translate into less regulatory scrutiny, further boosting investor confidence. The less Tesla is associated with volatile cryptocurrencies, the less likely it is to attract unwanted attention from regulatory bodies.

Market speculation plays a crucial role. The perceived shift in Musk's priorities reduced uncertainty, which positively impacted investor sentiment. The decreased risk associated with less cryptocurrency-related news surrounding the company seems to have calmed investor anxieties, allowing a more rational evaluation of Tesla's intrinsic value.

Tesla's Fundamental Performance and Future Prospects

The Tesla stock boost isn't solely attributable to the Dogecoin factor. The company's underlying performance has also contributed significantly to the positive market response.

- Sales & Production Figures: Tesla has reported strong vehicle sales figures and increased production numbers in recent quarters. [Insert data and sources]. This demonstrates the company's continued market dominance in the electric vehicle sector.

- New Products & Advancements: Announcements of new product launches, technological advancements (e.g., battery technology improvements, autonomous driving updates), and expansion into new markets further fueled investor optimism. [Insert details and sources].

- Positive Financial Reports: Recent financial reports and earnings announcements have showcased Tesla’s strong financial health, bolstering investor confidence. [Insert relevant financial data and sources].

It's crucial to emphasize that the stock price increase is likely a multifaceted phenomenon. While the reduced focus on Dogecoin played a role, the inherent strength of Tesla's business model and its future growth prospects are equally, if not more, significant drivers.

Long-Term Implications for Tesla Investors

The recent Tesla stock boost presents both opportunities and challenges for long-term investors.

- Risks & Rewards: Investing in Tesla stock offers substantial potential rewards but carries inherent risks, including market volatility, competition, and dependence on Elon Musk's leadership.

- Market Conditions: Broader market conditions will undoubtedly influence Tesla's stock price. Economic downturns or shifts in investor sentiment toward the technology sector could impact Tesla's performance.

- Diversification Strategies: Investors should consider diversification to mitigate risk. Investing solely in Tesla, irrespective of its current performance, can be unwise.

Conclusion

The unexpected correlation between the Dogecoin downturn and Tesla's stock surge highlights the complex interplay of factors influencing stock market valuations. While the reduced focus on Dogecoin likely contributed to improved investor sentiment, Tesla's inherent strengths and positive operational performance are equally crucial in explaining the stock boost. This increase is likely a result of a combination of factors rather than a single cause-and-effect relationship.

Call to Action: While this Tesla stock boost is promising, thorough research and a comprehensive investment strategy remain crucial before investing in any stock, including Tesla. Stay informed about the latest news and market trends to make informed decisions about your Tesla stock investments. Understanding the risks involved in both Tesla and cryptocurrency investments is paramount before committing your capital. Remember to diversify your portfolio and seek professional financial advice when necessary.

Featured Posts

-

Wynne Evans Health Update A Nasty Illness And Showbiz Return

May 10, 2025

Wynne Evans Health Update A Nasty Illness And Showbiz Return

May 10, 2025 -

Report Uk Plans To Restrict Visas From Pakistan Nigeria And Sri Lanka

May 10, 2025

Report Uk Plans To Restrict Visas From Pakistan Nigeria And Sri Lanka

May 10, 2025 -

How To Watch And Enjoy Celebrity Antiques Road Trip

May 10, 2025

How To Watch And Enjoy Celebrity Antiques Road Trip

May 10, 2025 -

Trump Considers Limiting Legal Recourse For Detained Migrants

May 10, 2025

Trump Considers Limiting Legal Recourse For Detained Migrants

May 10, 2025 -

Wynne Evans Breaks Silence On Life After Strictly Come Dancing

May 10, 2025

Wynne Evans Breaks Silence On Life After Strictly Come Dancing

May 10, 2025