Tesla's Board Under Fire From State Treasurers For Musk's Focus

Table of Contents

State Treasurers' Concerns Regarding Tesla's Governance

State treasurers, responsible for managing massive public pension funds, are voicing serious concerns about Tesla's corporate governance. These funds, representing the retirement savings of countless public employees, have significant investments in Tesla, making the company's performance a matter of considerable public interest. The treasurers' anxieties center on the potential risks to Tesla's long-term value due to Musk's multiple, demanding commitments.

-

Concerns about potential risks to Tesla's long-term value: Musk's time and energy are spread thin across multiple ventures, potentially diverting critical attention away from Tesla's core operations and strategic planning. This raises questions about Tesla’s ability to maintain its innovative edge and competitive position in the rapidly evolving EV market.

-

Questions about the effectiveness of Tesla's board of directors: Critics question the board's ability to effectively oversee Musk and ensure his focus remains on Tesla's success. The board's apparent lack of assertive action in addressing this issue further fuels concerns about its effectiveness.

-

Calls for improved corporate governance at Tesla: The outcry is not merely about Musk's divided attention; it's a call for stronger corporate governance structures to mitigate the risks associated with a CEO presiding over such a diverse and demanding portfolio. Improved oversight mechanisms are deemed crucial to protect investor interests.

-

Specific state treasurers or groups involved: While specific names may vary, many state treasurers, particularly those managing large pension funds, have expressed increasing concern publicly or through behind-the-scenes engagement with Tesla's board.

These concerns are significantly impacting Tesla's stock price and investor confidence. Any perceived weakening in leadership or strategic focus can lead to volatility in the stock market, causing significant financial repercussions for both Tesla and its investors.

Musk's Diversified Portfolio and its Impact on Tesla

Musk's ambition extends far beyond Tesla. His involvement in SpaceX, the ambitious space exploration company, and X (formerly Twitter), the social media platform he acquired, demands a substantial portion of his time and mental energy. This raises valid questions about the time and attention he dedicates to Tesla.

-

Examples of Musk's time allocation seemingly shifting away from Tesla: Numerous instances, from public pronouncements to reported management shifts within Tesla, point to a potential shift in focus away from the company's core business. Analyzing his public appearances and statements reveals a clear distribution of his attention.

-

Analysis of how this impacts Tesla's product development, innovation, and overall strategy: The potential consequences are multifaceted. Delayed product launches, a decline in innovation, or even strategic missteps could result from this diluted focus. This poses a tangible threat to Tesla’s long-term competitiveness.

-

Mention any recent controversies or events reinforcing these concerns: Any recent controversies or events related to Tesla, SpaceX, or X that highlight Musk’s divided attention can be incorporated here to strengthen the argument.

The potential conflict of interest between Musk's various ventures also adds to the concern. Resources and talent could be diverted from Tesla to benefit other companies under his umbrella, potentially harming Tesla’s growth and profitability.

The Role and Response of Tesla's Board of Directors

Tesla's board of directors faces intense scrutiny for its perceived passivity in addressing the concerns surrounding Musk's divided attention. Their response (or lack thereof) is a key factor in assessing the effectiveness of Tesla's corporate governance.

-

Statements or actions taken by the Tesla board: Document any official statements, actions, or internal changes the board has implemented in response to the criticism.

-

Evaluation of the board's effectiveness in mitigating risks: Analyze whether the board's actions have adequately addressed the concerns and mitigated the risks associated with Musk's multiple commitments.

-

Discussion of potential board restructuring or changes in governance: Explore whether any board restructuring or changes in governance are under consideration or necessary to improve oversight and accountability.

The legal implications of the situation are also noteworthy. Shareholder lawsuits or regulatory investigations could arise if the board is perceived as failing in its fiduciary duty to protect Tesla's interests and shareholder value.

Potential Future Implications for Tesla and its Investors

The current situation carries significant long-term consequences for Tesla and its investors. The potential impact extends beyond short-term stock fluctuations, impacting the company’s trajectory and future prospects.

-

Impact on Tesla's stock price and investor sentiment: The ongoing controversy continues to impact investor sentiment, contributing to stock price volatility. Further escalation of the issue could lead to prolonged negative impact on investor confidence.

-

Potential changes in Tesla’s business strategy or leadership: To regain investor trust, Tesla might need significant changes in its business strategy or even its leadership structure.

-

Future regulatory scrutiny: Increased regulatory scrutiny is a real possibility, potentially leading to investigations and stricter regulations on corporate governance practices within the company.

Conclusion: Navigating the Storm: The Future of Tesla's Board and Musk's Focus

The concerns raised by state treasurers regarding Tesla's Board Under Fire highlight the critical importance of strong corporate governance, especially in companies with such a dominant and multifaceted CEO. The question of whether Musk can effectively balance his various commitments while ensuring Tesla's continued success remains central to the debate. Addressing concerns about Musk's Focus on Tesla and improving oversight mechanisms are crucial to restoring investor confidence and safeguarding the company's future. The need for transparency, accountability, and decisive action from Tesla's board is paramount. Staying informed about developments surrounding Tesla's corporate governance is essential for understanding the long-term implications for this influential company. Continue to monitor this situation closely for insights into the future of Tesla and the impact of Musk’s leadership style.

Featured Posts

-

Thlyl Ser Sbykt Dhhb 10 Jramat Fy Swq Alsaght 17 2 2025

Apr 23, 2025

Thlyl Ser Sbykt Dhhb 10 Jramat Fy Swq Alsaght 17 2 2025

Apr 23, 2025 -

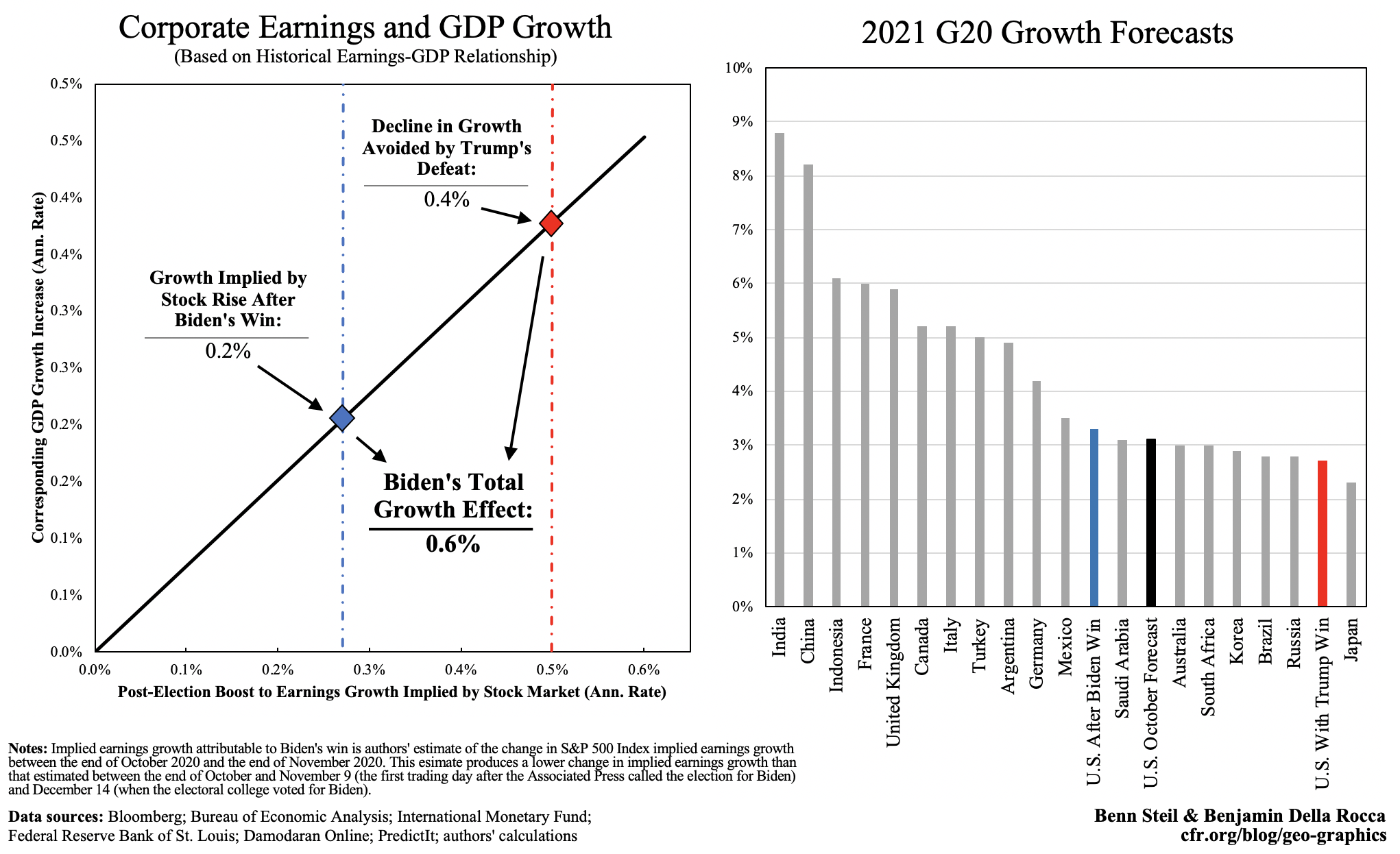

Economic Indicators Under Trump Fact Vs Perception

Apr 23, 2025

Economic Indicators Under Trump Fact Vs Perception

Apr 23, 2025 -

Emission Good Morning Business Du 24 Fevrier A Ecouter En Integralite

Apr 23, 2025

Emission Good Morning Business Du 24 Fevrier A Ecouter En Integralite

Apr 23, 2025 -

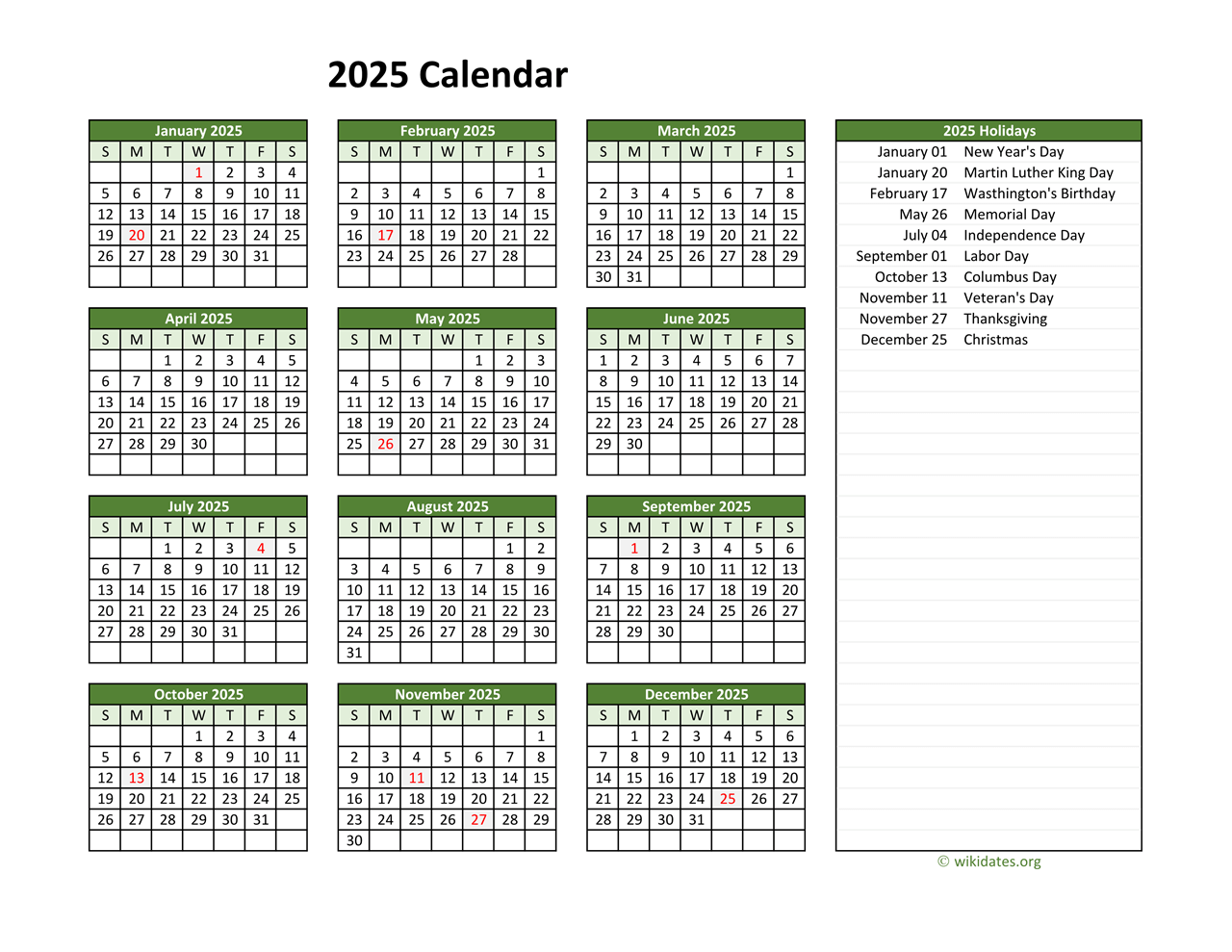

Us Holiday Calendar 2025 Federal State And Bank Holidays

Apr 23, 2025

Us Holiday Calendar 2025 Federal State And Bank Holidays

Apr 23, 2025 -

L Integrale De Bfm Bourse Marches Financiers Du 24 Fevrier 2024

Apr 23, 2025

L Integrale De Bfm Bourse Marches Financiers Du 24 Fevrier 2024

Apr 23, 2025