Tesla's Legal Maneuvers After Musk's Compensation Controversy

Table of Contents

The SEC Lawsuit and its Aftermath

The initial catalyst for much of the current legal turmoil was a 2018 tweet by Elon Musk stating his intention to take Tesla private at $420 per share. This tweet, ultimately deemed misleading by the Securities and Exchange Commission (SEC), resulted in a significant SEC lawsuit alleging securities fraud. The SEC argued that Musk's tweet artificially inflated Tesla's stock price and misled investors.

- Details on the settlement reached with the SEC: The case concluded with a settlement where Musk agreed to step down as Tesla's chairman, pay a $20 million fine, and accept oversight of his communications via a pre-approval process for certain tweets and public statements related to Tesla.

- Impact of the settlement on Musk's role at Tesla: While he retained his CEO position, the settlement significantly curtailed his ability to make spontaneous public statements about the company's financials and future plans. This has implications for transparency and investor relations.

- Ongoing implications of the SEC's oversight of Musk’s communications: The SEC continues to monitor Musk's communications closely, representing ongoing regulatory scrutiny and potential for future legal action should he violate the terms of the settlement. This creates a continuing challenge for Tesla's communication strategy.

- Subsequent legal actions related to the SEC case: Though the initial SEC case concluded, the episode set a precedent and has influenced discussions around social media regulation and corporate disclosure. The impact of the settlement ripples through other legal discussions, including arguments around the nature of securities fraud and the responsibilities of CEOs regarding public statements.

Shareholder Lawsuits and Allegations of Mismanagement

Beyond the SEC lawsuit, Tesla and Elon Musk have faced numerous shareholder lawsuits. These lawsuits allege various instances of mismanagement and misleading statements, often tying back to the controversial compensation package.

- Summary of the main allegations in these lawsuits: These lawsuits broadly claim that Musk's compensation plan, which grants him stock options contingent on reaching ambitious performance goals, lacked transparency and benefited Musk disproportionately at the expense of shareholders. Specific allegations include breaches of fiduciary duty and misleading statements regarding the company's performance and prospects.

- The status of these lawsuits (ongoing, settled, dismissed): The status of these shareholder lawsuits varies. Some have been dismissed, while others are ongoing and may take years to resolve.

- Potential financial implications for Tesla if these lawsuits are successful: If successful, these lawsuits could result in significant financial penalties for Tesla, potentially affecting its bottom line and stock price. This represents a high-stakes legal battle impacting investor confidence.

- The role of the compensation package in these lawsuits: The compensation package itself is a central element in many of these lawsuits, with plaintiffs arguing it represents unfair enrichment of Musk at the expense of ordinary shareholders. This highlights the ongoing debate about fair and transparent executive compensation.

Analyzing Tesla's Legal Strategies and Defenses

Tesla and Musk's legal team has employed several strategies to defend against the lawsuits.

- Examples of legal arguments used by Tesla's defense team: Tesla has argued that Musk’s actions were not fraudulent, that the compensation package was approved by a majority of shareholders, and that the company's overall performance justifies the executive compensation.

- Use of legal precedents and case law: The defense relies heavily on establishing legal precedent and using relevant case law to support their arguments.

- Potential outcomes and their implications for Tesla's future: The outcomes of these lawsuits will significantly impact Tesla's financial stability, reputation, and future corporate governance practices. Potential outcomes range from dismissal to significant financial penalties and changes in corporate structure.

- The role of Tesla's legal counsel in navigating these challenges: Tesla's legal counsel plays a critical role in mitigating risks and navigating the complexities of this ongoing legal landscape. The expertise of the legal team is vital to Tesla's ability to manage its exposure to financial and reputational risk.

The Impact on Tesla's Corporate Governance

The legal battles surrounding Musk's compensation have undeniably impacted Tesla's corporate governance.

- Changes in corporate governance structure (if any): While no major structural changes have been publicly announced directly in response to these lawsuits, the ongoing scrutiny has likely prompted internal reviews and potential adjustments to corporate governance protocols.

- Increased scrutiny from regulatory bodies: Tesla is under intense scrutiny not only from the SEC but also from other regulatory bodies concerned about its corporate governance practices and executive compensation policies.

- Impact on investor confidence: The legal challenges have undoubtedly impacted investor confidence, creating uncertainty and potentially affecting Tesla's ability to attract investment.

- Potential for future regulatory changes in executive compensation: The controversies surrounding Tesla and Musk's compensation could lead to broader regulatory changes in executive compensation practices, further impacting future corporate governance practices.

Conclusion

The legal maneuvers undertaken by Tesla in response to the controversies surrounding Elon Musk's compensation represent a significant chapter in the company's history. These legal battles have far-reaching implications for Tesla's future, encompassing potential financial repercussions, damage to its reputation, and changes to its corporate governance practices. The lawsuits serve as a case study on the complexities of executive compensation, its impact on corporate governance, and the scrutiny faced by high-profile companies. Understanding the complexities of Tesla's legal battles concerning the compensation controversy is critical for investors and anyone interested in the dynamics of corporate governance within the electric vehicle industry. Stay informed about the latest developments in this evolving legal saga by following our future updates on Tesla's legal maneuvers and their impact on its long-term success.

Featured Posts

-

Dodgers Bet On Conforto Following Hernandezs Success

May 18, 2025

Dodgers Bet On Conforto Following Hernandezs Success

May 18, 2025 -

Dam Square Car Explosion Driver Succumbs To Injuries Suicide Suspected

May 18, 2025

Dam Square Car Explosion Driver Succumbs To Injuries Suicide Suspected

May 18, 2025 -

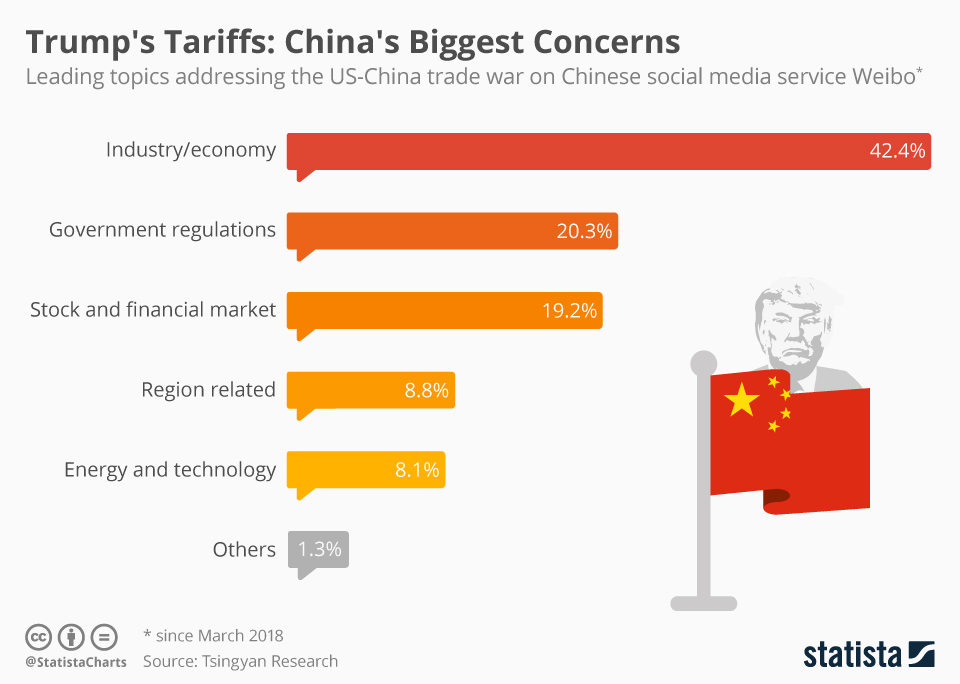

2025 Outlook Trumps 30 Tariffs On China Expected To Remain

May 18, 2025

2025 Outlook Trumps 30 Tariffs On China Expected To Remain

May 18, 2025 -

Where To Stream Damiano Davids Next Summer

May 18, 2025

Where To Stream Damiano Davids Next Summer

May 18, 2025 -

Kanye Wests Sex Trafficking Claims Against Kim Kardashian Fact Or Fiction

May 18, 2025

Kanye Wests Sex Trafficking Claims Against Kim Kardashian Fact Or Fiction

May 18, 2025

Latest Posts

-

Catch Spencer Brown At Audio Sf On May 2nd 2025

May 18, 2025

Catch Spencer Brown At Audio Sf On May 2nd 2025

May 18, 2025 -

Entertainment News Stay Updated On The Latest Movies Tv Shows And Music Releases

May 18, 2025

Entertainment News Stay Updated On The Latest Movies Tv Shows And Music Releases

May 18, 2025 -

Destino Ranchs Next Gen Media Infrastructure A Partnership Between Golden Triangle Ventures Lavish Entertainment And Viptio

May 18, 2025

Destino Ranchs Next Gen Media Infrastructure A Partnership Between Golden Triangle Ventures Lavish Entertainment And Viptio

May 18, 2025 -

Audio Sf Presents Spencer Brown Friday May 2nd 2025

May 18, 2025

Audio Sf Presents Spencer Brown Friday May 2nd 2025

May 18, 2025 -

Golden Triangle Ventures Lavish Entertainment And Viptio Partner To Launch Next Gen Omnichannel Media Infrastructure At Destino Ranch

May 18, 2025

Golden Triangle Ventures Lavish Entertainment And Viptio Partner To Launch Next Gen Omnichannel Media Infrastructure At Destino Ranch

May 18, 2025