Tesla's Q1 2024 Earnings Report: A 71% Drop In Net Income

Table of Contents

Analyzing the 71% Net Income Decline

The dramatic 71% plunge in Tesla's net income during Q1 2024 demands a thorough examination. Several interconnected factors contributed to this substantial decrease.

Factors Contributing to the Significant Drop

-

Aggressive Price Cuts: Tesla implemented multiple price reductions across its vehicle lineup to boost sales volume and maintain market share in the face of intensifying competition. While this strategy increased sales, it significantly compressed profit margins, directly impacting net income. The "price wars" in the EV sector played a major role in this decision.

-

Rising Competition: The EV market is rapidly expanding, with established automakers and new entrants launching competitive models. Increased competition from companies like BYD, Rivian, and Lucid, among others, has put pressure on Tesla's sales and pricing strategies. This increased competition is a key factor impacting profit margins.

-

Supply Chain Disruptions: Persistent supply chain challenges, including shortages of critical raw materials and logistical bottlenecks, continued to impact Tesla's production efficiency and increased operating costs. These disruptions are a global challenge for the automotive industry, and Tesla is not immune.

-

Increased Operating Expenses: Tesla's operating expenses, including research and development, sales and marketing, and general administration, rose significantly during Q1 2024. These increases further squeezed profitability and contributed to the lower net income. Balancing growth with cost control is crucial for maintaining a healthy profit margin.

-

Macroeconomic Factors: Global macroeconomic headwinds, such as inflation and rising interest rates, also played a role in impacting consumer demand and overall market sentiment, affecting Tesla's sales and profitability.

Comparison to Previous Quarters and Industry Benchmarks

Compared to Q4 2023, the net income drop is even more pronounced, showcasing a clear negative trend. Year-over-year comparison with Q1 2023 reveals a similar story. Analyzing Tesla’s performance against industry benchmarks like Rivian and Lucid shows that while all EV makers are experiencing challenges, Tesla's decline is exceptionally steep, raising concerns about its long-term profitability. The industry performance needs to be considered in the context of macroeconomic factors as well. Tesla's current market share, though still significant, is facing pressures from this increased competition.

Tesla's Q1 2024 Vehicle Deliveries and Production

While Tesla reported strong vehicle deliveries in Q1 2024, exceeding some analyst expectations, this growth wasn’t sufficient to offset the significant impact of decreased profit margins.

Production Figures and Sales Analysis

Tesla's production numbers for Q1 2024 were impressive, demonstrating the company's manufacturing capabilities. However, the sales volume, while strong, wasn't enough to compensate for the lower prices. The performance of individual models varied; the Model Y remained a strong performer, but sales of other models showed different levels of growth. Increased production of the Cybertruck is anticipated to positively impact future quarters, though its contribution to Q1 2024 was limited.

Global Market Share and Geographic Performance

Tesla's global market share in the EV sector remains substantial, but increasing competition is impacting its position in various regions. While US sales remain strong, the performance in China and Europe presents both opportunities and challenges. Understanding the regional sales dynamics is crucial for analyzing overall market penetration and future growth strategies. Further analysis of market share in specific geographic segments will inform long-term strategic decisions.

Future Outlook and Investor Sentiment

The Q1 2024 results have undoubtedly impacted investor sentiment, and Tesla's future outlook remains uncertain.

Tesla's Guidance for the Remaining Quarters of 2024

Tesla's guidance for the remaining quarters of 2024 is crucial to assess the company's ability to recover its profitability. While specific targets weren't overly optimistic, the company expressed confidence in its long-term growth potential. Analysis of the financial guidance, and the implied profitability projections, will help investors to evaluate the potential for future growth.

Investor Reaction and Stock Market Performance

The market reacted negatively to the Q1 2024 earnings report, with Tesla's stock price experiencing a significant drop. Investor confidence has been shaken, and analyst ratings have been revised downwards. This market reaction underscores the seriousness of the situation and the need for Tesla to address the issues contributing to the income decline. The impact on market capitalization reflects the broader concerns in the investor community.

Conclusion

Tesla's Q1 2024 earnings report revealed a substantial 71% drop in net income, primarily driven by aggressive price cuts, increased competition, supply chain issues, and higher operating expenses. While vehicle deliveries remained strong, the compressed profit margins overshadowed this positive development. The impact on investor confidence and the stock market highlights the seriousness of the situation. Analyzing the company's future guidance and market reaction is crucial for understanding the long-term implications for Tesla and the EV market. To stay informed about Tesla earnings, follow Tesla's Q2 2024 results and track the performance of Tesla stock to better understand the evolving landscape of the electric vehicle market. Understanding the dynamics of Tesla's performance is essential for understanding the future of the electric vehicle industry.

Featured Posts

-

The Closure Of Anchor Brewing Company Impact On The Craft Beer Industry

Apr 24, 2025

The Closure Of Anchor Brewing Company Impact On The Craft Beer Industry

Apr 24, 2025 -

From Whataburger Viral Video To Uil State The Story Of An Hisd Mariachi Group

Apr 24, 2025

From Whataburger Viral Video To Uil State The Story Of An Hisd Mariachi Group

Apr 24, 2025 -

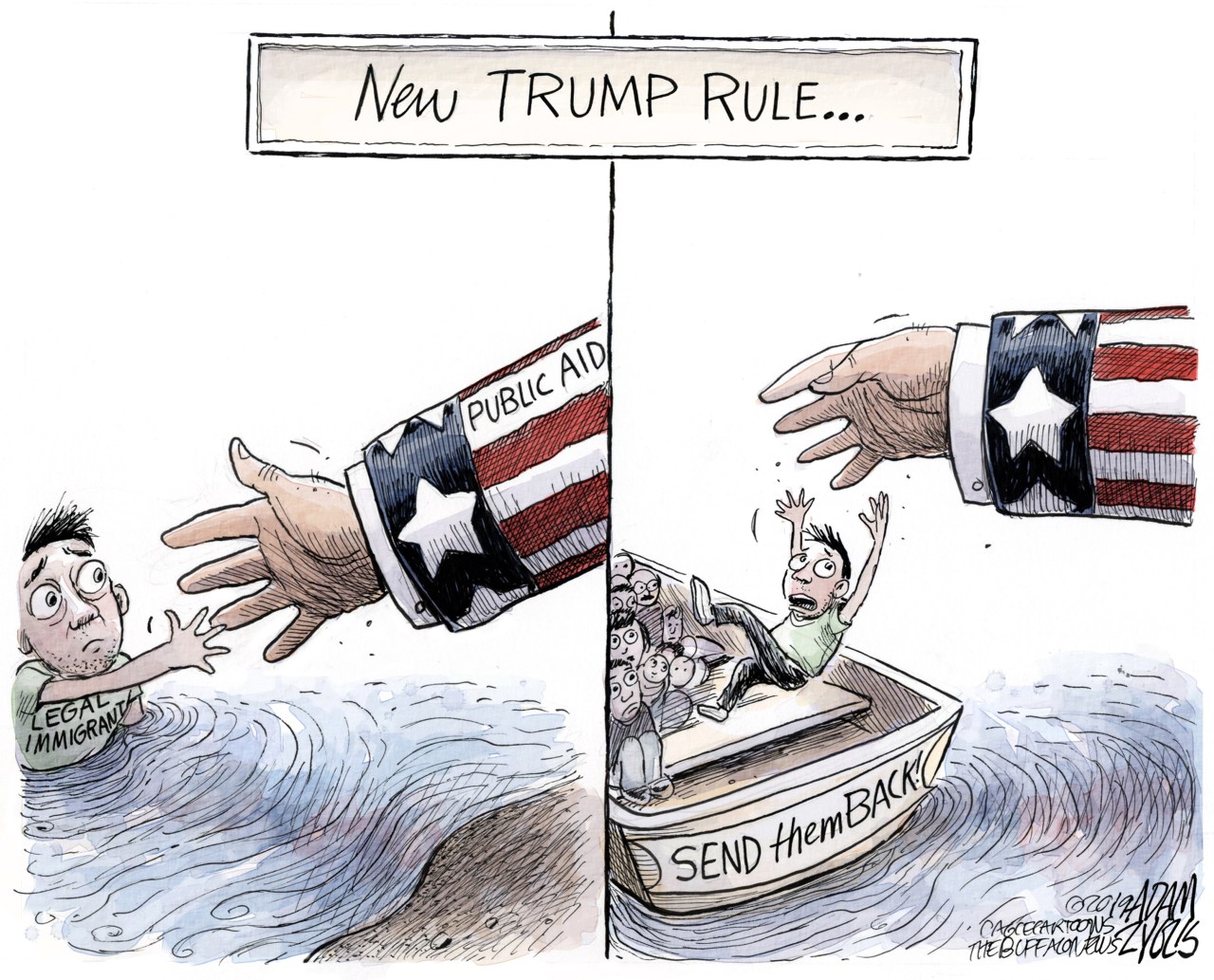

Immigration Crackdown Trump Administrations Policies Under Legal Scrutiny

Apr 24, 2025

Immigration Crackdown Trump Administrations Policies Under Legal Scrutiny

Apr 24, 2025 -

Trump Administration Immigration Crackdown Faces Legal Challenges

Apr 24, 2025

Trump Administration Immigration Crackdown Faces Legal Challenges

Apr 24, 2025 -

Bethesdas Oblivion Remastered Officially Released Today

Apr 24, 2025

Bethesdas Oblivion Remastered Officially Released Today

Apr 24, 2025

Latest Posts

-

Former Ufc Champ Aldo Back In Featherweight Division

May 12, 2025

Former Ufc Champ Aldo Back In Featherweight Division

May 12, 2025 -

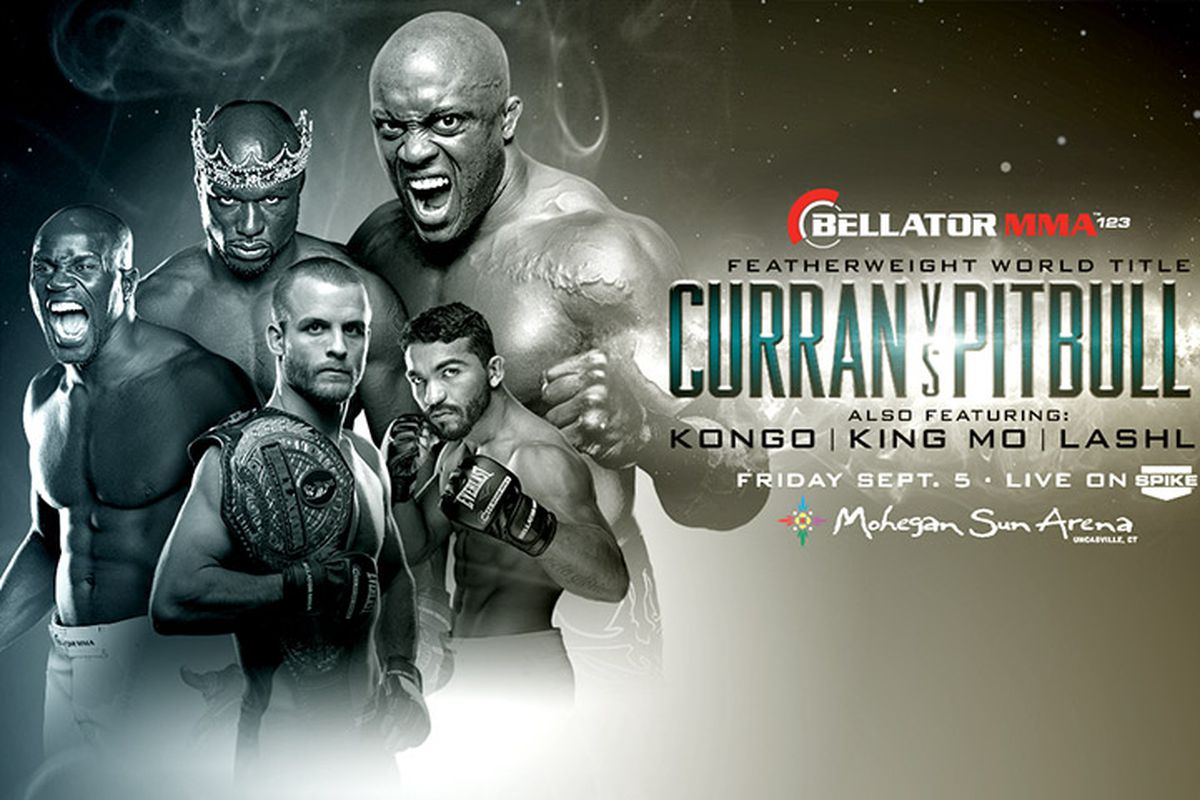

Freire Aldo Showdown Bellator Champions Next Fight Announced

May 12, 2025

Freire Aldo Showdown Bellator Champions Next Fight Announced

May 12, 2025 -

Ufcs Biggest Surprise Jeremy Stephens Unexpected Return

May 12, 2025

Ufcs Biggest Surprise Jeremy Stephens Unexpected Return

May 12, 2025 -

Freire Ready For Aldo Bellator Champion Eyes Next Challenge

May 12, 2025

Freire Ready For Aldo Bellator Champion Eyes Next Challenge

May 12, 2025 -

Shane Lowry And Rory Mc Ilroy To Play Zurich Classic

May 12, 2025

Shane Lowry And Rory Mc Ilroy To Play Zurich Classic

May 12, 2025