Tesla's Q1 2024 Financial Results: Deep Dive Into The 71% Net Income Decline

Table of Contents

Analyzing the 71% Net Income Decline: Key Factors

Several interconnected factors contributed to Tesla's significant drop in net income during Q1 2024. Let's break down the most impactful elements.

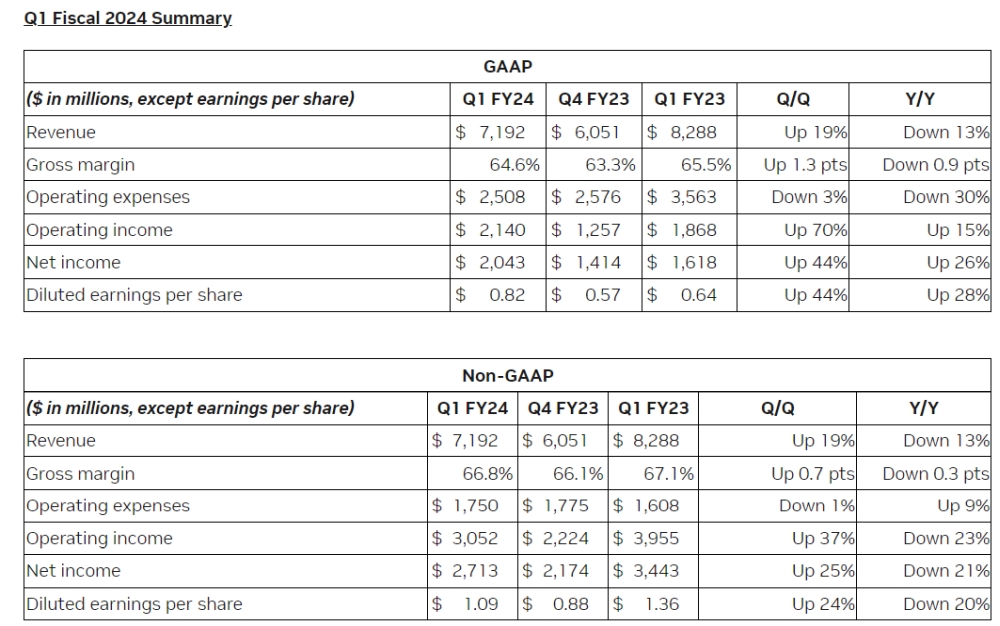

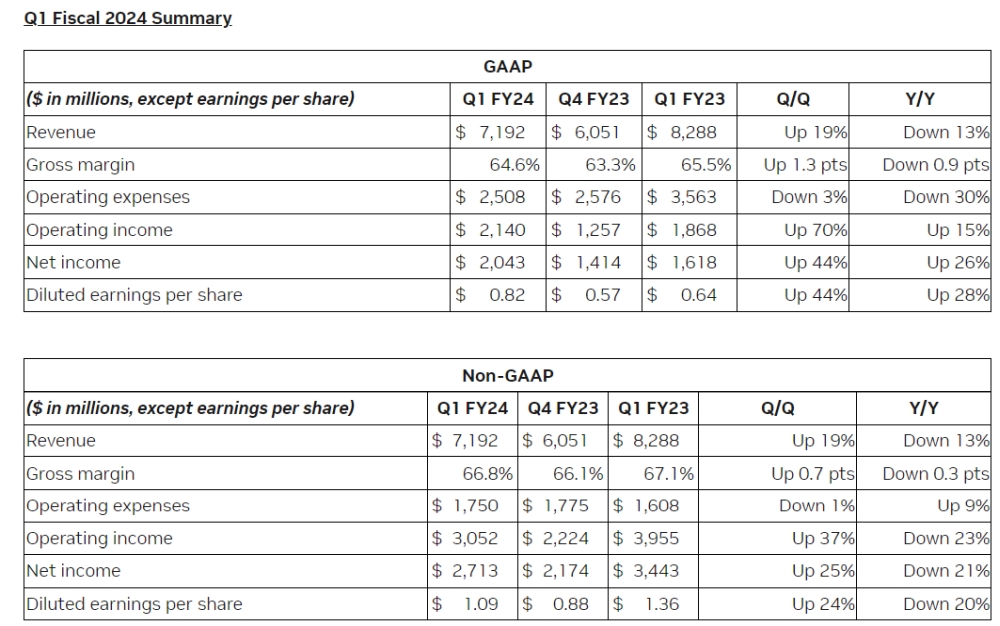

Price Reductions and Margins

Tesla's aggressive price cuts, implemented to boost sales volume and maintain market share, significantly impacted profitability. This strategy, while successful in increasing deliveries, squeezed profit margins.

- Gross profit margins: Experienced a notable contraction compared to Q1 2023, reflecting the lower selling prices. Specific data from the Q1 report should be cited here, once available (e.g., "Gross profit margin fell from X% to Y%").

- Operating margins: Similarly, operating margins were significantly compressed due to the price reductions and increased operational costs. Again, precise figures from the Q1 report are necessary for a complete analysis.

- Impact of price cuts: While increasing sales volume in a competitive EV market was a necessity, the resulting reduction in revenue per vehicle directly impacted the bottom line. This highlights the delicate balance Tesla faces between market share and profitability. Keywords: Tesla price cuts, Tesla profit margins, Tesla gross profit, Tesla operating income.

Increased Competition and Market Saturation

The EV market is rapidly evolving, with increased competition from established automakers and new entrants. This intensifying competition, coupled with market saturation, is impacting Tesla's sales volume and pricing power.

- Growing competition: Companies like BYD, Volkswagen, and others are aggressively expanding their EV offerings, putting pressure on Tesla's market dominance. Specific examples of competitor market share gains should be included.

- Market saturation: The increasing number of EVs on the market is leading to increased price sensitivity among consumers, further impacting Tesla's ability to maintain high profit margins.

- Tesla's market share: Analyzing the changes in Tesla's market share during Q1 2024 is crucial to understanding the impact of intensified competition. Keywords: Tesla competition, EV market share, electric vehicle market, Tesla sales volume.

Supply Chain Disruptions and Inflationary Pressures

Persisting supply chain disruptions and inflationary pressures continue to challenge Tesla's production and operational costs.

- Supply chain bottlenecks: Delays in sourcing raw materials and components have impacted production efficiency and increased expenses. Specific examples of these disruptions should be included.

- Inflationary impact: Increased costs of raw materials, energy, and labor have further squeezed profit margins. Quantifiable data on the impact of inflation on Tesla's costs would strengthen this analysis.

- Production costs: The combination of supply chain issues and inflation has led to a substantial increase in Tesla's production costs, directly impacting profitability. Keywords: Tesla supply chain, inflation impact, raw material costs, Tesla production costs.

Increased Investment in Research & Development and Expansion

Tesla's significant investments in research and development (R&D), new factories, and expansion projects are impacting short-term profitability but are crucial for long-term growth.

- R&D spending: Tesla's substantial investments in next-generation battery technology, autonomous driving capabilities, and other innovations are essential for maintaining its competitive edge.

- Factory expansion: The construction of new Gigafactories around the world represents a significant capital expenditure that will positively impact production capacity in the long term, but negatively impacts short-term profit.

- Long-term strategy: These investments, though impacting current net income, position Tesla for sustained growth and dominance in the evolving EV market. Keywords: Tesla R&D, Tesla investments, Tesla expansion, Tesla new factories.

Impact on Tesla Stock Price and Investor Sentiment

The announcement of Tesla's Q1 2024 earnings immediately impacted the stock price. The market reacted negatively, reflecting investor concerns about the company's profitability.

- Stock price reaction: A detailed analysis of the stock price fluctuation following the earnings release is crucial. Specific data points on percentage changes are needed.

- Investor sentiment: News outlets and analyst reports should be referenced to gauge investor sentiment and expectations for future performance.

- Market capitalization: The change in Tesla's market capitalization following the earnings report provides a clear picture of the market's overall reaction. Keywords: Tesla stock price, Tesla investor sentiment, Tesla market capitalization, Tesla stock forecast.

Tesla's Outlook and Future Strategies for Profitability

Tesla's management will likely outline strategies to address the net income decline and restore profitability.

- Cost-cutting measures: Identifying potential areas for cost optimization, such as streamlining production processes or negotiating better deals with suppliers, is vital.

- New product launches: Introducing new models or features can attract new customers and boost sales volume. Any upcoming product launches should be mentioned.

- Long-term outlook: Despite the current challenges, Tesla's long-term prospects in the booming EV market remain strong, provided they effectively address the immediate challenges. Keywords: Tesla future outlook, Tesla profit improvement, Tesla cost-cutting, Tesla new products.

Conclusion: Understanding Tesla's Q1 2024 Financial Performance and Looking Ahead

Tesla's Q1 2024 financial results revealed a significant decline in net income, primarily driven by price reductions, increased competition, supply chain disruptions, and substantial investments in R&D and expansion. This impacted the stock price and investor sentiment. However, Tesla's long-term outlook remains positive, contingent on successful implementation of strategies to improve profitability. What are your thoughts on Tesla's Q1 2024 earnings report and its future prospects? Share your analysis in the comments below! Stay tuned for our next deep dive into Tesla's financial performance and further analysis of Tesla Q1 2024 earnings.

Featured Posts

-

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025 -

Heats Herro Takes 3 Point Crown Cavaliers Clean Sweep Skills Challenge

Apr 24, 2025

Heats Herro Takes 3 Point Crown Cavaliers Clean Sweep Skills Challenge

Apr 24, 2025 -

Experts Warn Trump Cuts Exacerbate Tornado Season Dangers

Apr 24, 2025

Experts Warn Trump Cuts Exacerbate Tornado Season Dangers

Apr 24, 2025 -

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025 -

Transforming Repetitive Scatological Data An Ai Powered Podcast Solution

Apr 24, 2025

Transforming Repetitive Scatological Data An Ai Powered Podcast Solution

Apr 24, 2025

Latest Posts

-

Inside The Beach Homes Of Mtv Cribs Architecture And Design

May 12, 2025

Inside The Beach Homes Of Mtv Cribs Architecture And Design

May 12, 2025 -

The Most Impressive Mansions Featured On Mtv Cribs

May 12, 2025

The Most Impressive Mansions Featured On Mtv Cribs

May 12, 2025 -

Luxury Coastal Living A Look At Mtv Cribs Beach Properties

May 12, 2025

Luxury Coastal Living A Look At Mtv Cribs Beach Properties

May 12, 2025 -

Mtv Cribs Unveiling The Architecture And Design Of Celebrity Homes

May 12, 2025

Mtv Cribs Unveiling The Architecture And Design Of Celebrity Homes

May 12, 2025 -

Inside The Mansions Of Mtv Cribs A Look At Luxurious Living

May 12, 2025

Inside The Mansions Of Mtv Cribs A Look At Luxurious Living

May 12, 2025